May 2025

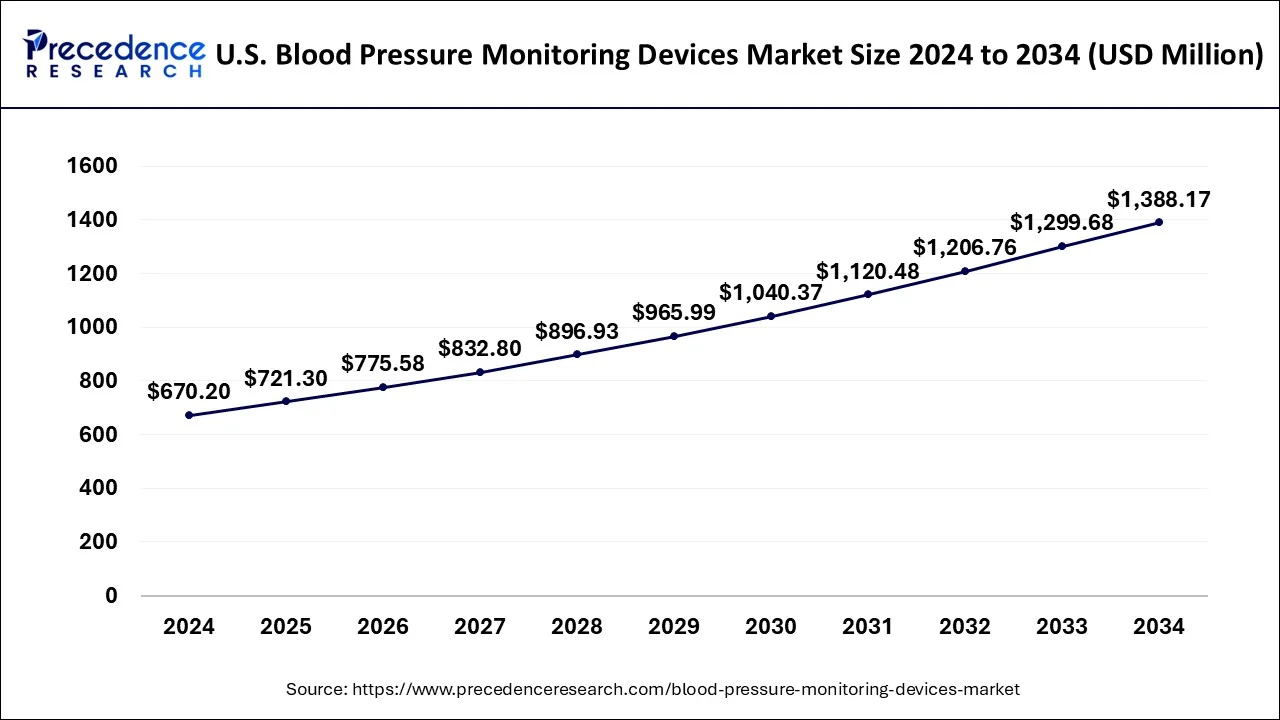

The U.S. blood pressure monitoring devices market size is calculated at USD 670.20 million in 2025 and is forecasted to reach around USD 1388.17 million by 2034, accelerating at a CAGR of 7.64% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. blood pressure monitoring devices market size was valued at USD 670.20 million in 2024 and is anticipated to reach around USD 1388.17 million by 2034, expanding at a double-digit CAGR of 7.64% from 2025 to 2034.

The U.S. blood pressure monitoring devices market revolves around the development and distribution of monitoring devices that are generally to measure pulse inside the arteries using blood pressure as a parameter. To test, treat, and keep an eye on hypertension, blood pressure monitoring devices are essential. Pulse monitoring devices are incredibly accurate and assist physicians or other professionals in ensuring effective care. These incredibly accurate devices assist medical professionals in providing patients with efficient care.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.64% |

| U.S. Market Size in 2024 | USD 670.20 Million |

| U.S. Market Size by 2034 | USD 1,388.17 Million |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product and By End User |

Rising older population and awareness about hypertension

The likelihood of hypertension seems to rise with age. Older people are more likely to have high blood pressure because of hormonal fluctuations and altered blood vessel flexibility. As a result, the need for blood pressure monitoring devices is being driven by the demographic trend toward an older population. Elderly people's blood pressure is being monitored and managed by healthcare practitioners more often with the prescription of these devices. Further boosting the U.S. blood pressure monitoring devices market’s expansion is the fact that a large number of senior citizens find home blood pressure monitoring to be more convenient.

Additionally, people are more likely to routinely check their blood pressure as they become more aware of the dangers of hypertension and how it affects their general health. Investing in personal blood pressure monitoring devices is encouraged by the focus on early identification and preventative healthcare. Furthermore, a greater number of prescriptions are being written as a result of healthcare professionals actively teaching patients about the advantages of monitoring. Device sales are fueled by this increased knowledge and health consciousness, which also improves health outcomes by enabling early intervention and lifestyle changes in reaction to rising blood pressure readings.

The presence of high undiagnosed population

The greatest contributor to the burden of illnesses and the main cause of heart attacks is hypertension. A sizable segment of the populace received insufficient care or no diagnosis at all. As a result, they have a higher chance of morbidity and death from diseases like stroke and other CVDs that are associated with hypertension.

Healthcare professionals (HCPs) are encouraged to identify people who may have undetected hypertension as part of this effort. The new hypertension threshold, established by the American Heart Association (AHA) and the American College of Cardiology (ACC), is 130/80 mm Hg. It was 140/80 mm Hg before. Over 103 million Americans now have high blood pressure as a result of the reclassification. As a result, the large number of undiagnosed people poses a barrier to the expansion of the blood pressure monitoring device industry in the United States.

Rising demand for ambulatory blood pressure monitoring systems

Ambulatory blood pressure monitors are becoming more and more in demand, mainly for the diagnosis of white coats and disguised hypertension. Ambulatory blood pressure monitors are small, wrist- or arm-based devices with features that make them easier to use and more accessible. Ambulatory BP monitoring technologies allow for noninvasive blood pressure measurement. When people engage in regular activities, their blood pressure may be monitored by the use of ambulatory blood pressure monitors.

These gadgets keep an eye on how well blood pressure meds are working. The diagnosis of arterial hypertension is done at home and medical institutions like clinics using ambulatory blood pressure monitors. Advanced ambulatory blood pressure monitors are available from several companies. Thus, throughout the projected period, the U.S. blood pressure monitoring devices market will rise due to the rising demand for ambulatory BP monitoring systems.

The sphygmomanometer segment held the largest share of the U.S. blood pressure monitoring devices market in 2024 due to its accuracy and reliability. Sphygmomanometers are known for their accuracy in measuring blood pressure. This accuracy is crucial for making informed clinical decisions and diagnosing conditions such as hypertension. This remains a staple in clinical settings such as hospitals, clinics, and healthcare offices. They provide accurate blood pressure measurements and are often used by medical professionals to assess patients' cardiovascular health.

Besides, the ambulatory blood pressure monitor segment is expected to grow at the fastest CAGR during the forecast period. Ambulatory blood pressure monitor devices offer the advantage of continuous blood pressure monitoring, providing a more comprehensive and accurate picture of a patient's blood pressure variations throughout the day and night. This helps in identifying patterns and abnormalities that may go unnoticed with intermittent measurements.

Additionally, ABPM devices are designed to be portable and non-intrusive, allowing patients to go about their daily activities while the device records blood pressure readings at regular intervals. This ambulatory nature improves patient compliance and provides a more natural representation of their blood pressure.

The hospitals segment held the largest market share in 2024 and is expected to capture the largest market share during the forecast period. The large patient pool size is the reason for the high share. Increasingly, quick, accurate, and affordable diagnostic tools are needed to improve patient outcomes, which is why blood pressure monitoring devices are being used.

The home healthcare segment is expected to grow at the fastest rate over the projected period in the U.S. blood pressure monitoring devices market. home blood pressure monitoring devices offer convenience and accessibility, allowing individuals to monitor their blood pressure without the need for frequent visits to healthcare facilities. This is particularly beneficial for elderly individuals and those with mobility issues. Thereby, driving the segment expansion.

By Product

By End User

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

May 2024

September 2024

April 2025