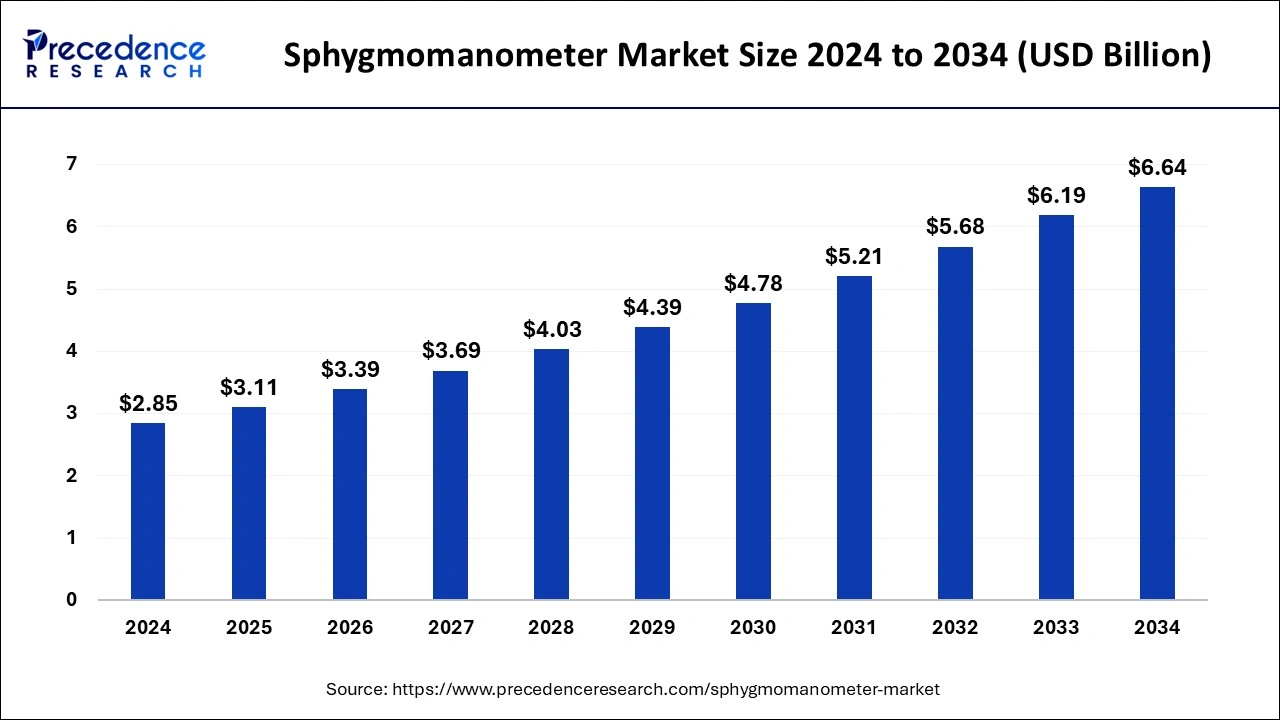

The global sphygmomanometer market size is calculated at USD 3.11 billion in 2025 and is forecasted to reach around USD 6.64 billion by 2034, accelerating at a CAGR of 8.83% from 2025 to 2034. The North America market size surpassed USD 1.00 billion in 2024 and is expanding at a CAGR of 8.86% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global sphygmomanometer market size accounted for USD 2.85 billion in 2024 and is expected to exceed around USD 6.64 billion by 2034, growing at a CAGR of 8.83% from 2025 to 2034. The demand for sphygmomanometers is increasing due to the rise in the number of hypertension cases in urban areas.

Technological adoption like Artificial Intelligence (AI) and Machine Learning (ML) in the healthcare industry is leading towards rapid revolutionization in recent years. The use of AI algorithms has increased the accuracy of medical tools which can provide on-point results in medical procedures. This has increased the reliance on technologies which certainly attracts more investments towards marking significant enhancements. The use of datasets is being implemented where these technologies provide personalized monitoring of the patients by analyzing their medical history. Additionally, the use of AI in real-time monitoring has enabled the monitoring of BP levels through wearable devices which enhances the accuracy of the medical procedures.

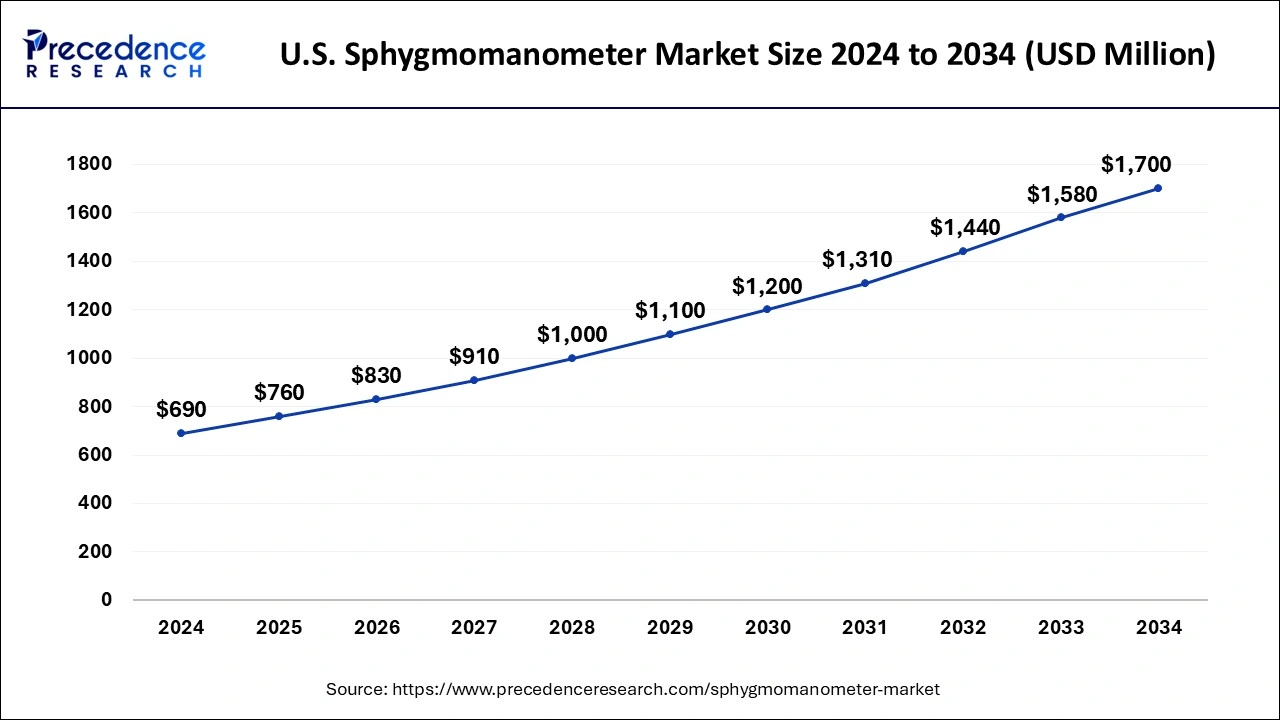

The U.S. sphygmomanometer market size was exhibited at USD 690 million in 2024 and is projected to be worth around USD 1,700 million by 2034, growing at a CAGR of 9.44% from 2025 to 2034.

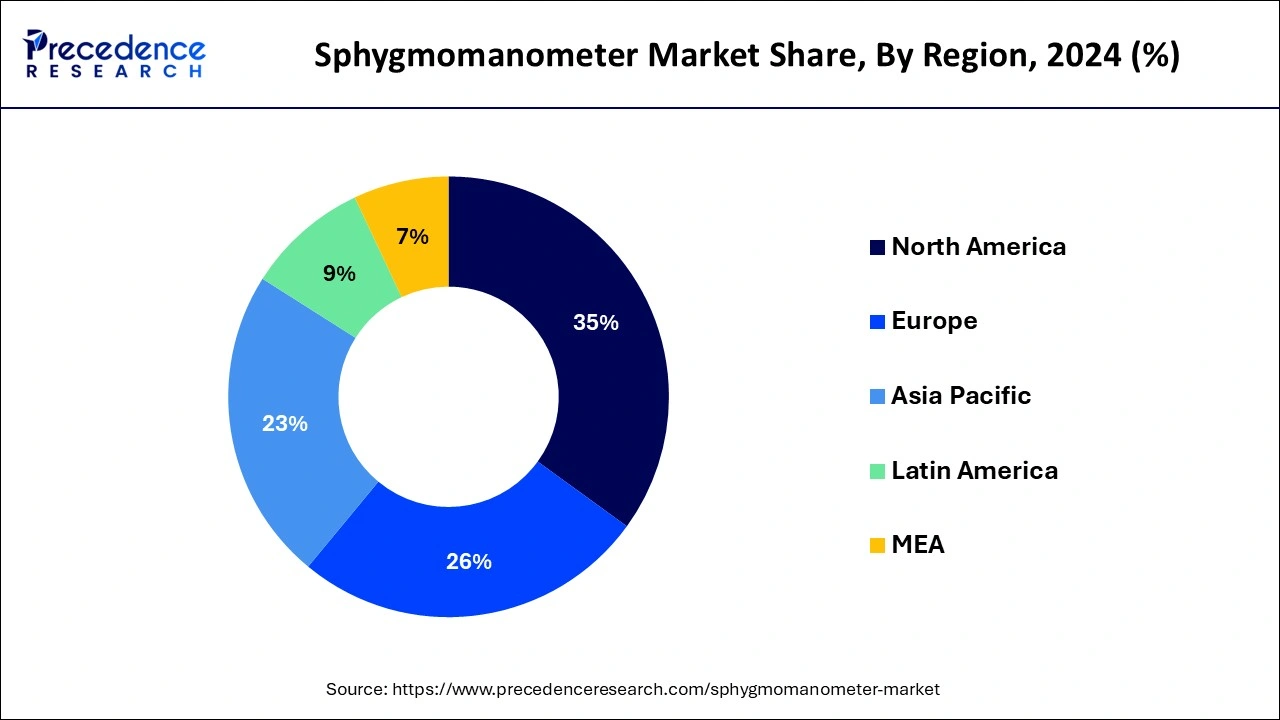

Because of its highly regulated and established healthcare system, North America held the greatest revenue share of more than 34.34% in 2023. Increasing investments in the development of accurate and effective BP monitors is projected to contribute to the growth of the blood pressure monitoring device business in the future years. Furthermore, new product releases and technology improvements are projected to fuel market expansion. For example, Hillrom announced the commercial debut of the Welch Allyn Spot Vital Signs 4400 in February 2020, which is an easy-to-use next-generation vital signs equipment designed to enhance hypertension identification in ambulatory and emergency department settings.

Asia-Pacific, on the other hand, is predicted to rise rapidly throughout the forecast period due to the availability of unexplored potential, rising hypertension prevalence and rising awareness levels. Rapidly improved healthcare facilities, as well as an increase in the number of misdiagnosed driving regional market expansion. Government attempts to raise public awareness, as well as a fast rising target disease population base, are all contributing to the lucrative growth of the BP monitoring devices market in this area.

For example, in May 2018, the Indian Council of Medical Research (ICMR) launched the "May Measurement Month 2018" campaign in partnership with the Public Health Foundation of India to raise awareness about blood pressure, which is the main cause of mortality and morbidity in India.

A sphygmomanometer refers to a device which measures blood pressure by detecting the force of the blood in the heart. For individuals with heart problems, it is critical to monitor blood pressure with a sphygmomanometer. A single device may measure many metrics, including pulse rate and heartbeat rate, in addition to blood pressure. Sphygmomanometers are cheap, long-lasting, lightweight, and portable. The rising prevalence of chronic disorders such as hypertension and ischemic heart disease is propelling the industry forward.

The sphygmomanometer is made up of a rubber cup wrapped around the arm, a bulb to inate the cup, a valve to release the pressure, and a measuring device to measure the pressure of the cup. An oscillometric measuring method is used by a digital or electronic sphygmomanometer. It is simple to use, battery-powered, automated, and devoid of mercury. Manual, automated, wrist, upper arm, neonatal, and paediatrics sphygmomanometers are examples of digital sphygmomanometers. Wrist and automated digital sphygmomanometers are the most regularly utilised.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.11 Billion |

| Market Size by 2034 | USD 6.64 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.83% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Operation, Configuration, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Lack of skilled professionals in the rural areas

The healthcare sector has been gaining significant popularity due to the rising technological adoption in developed regions. There are still some concerns which could hamper the market growth in these regions. The lack of skilled professionals can restrict the technological adoption which can remain underutilized. Also, despite the increased frequency of the disorders, the expensive cost of these devices may impede the growth of the worldwide aneroid sphygmomanometer market.

Rise in the aging population

The rising number of elderly people is a crucial factor which leads to increasing risk towards health conditions, therefore it helps the growth of the healthcare industry. The sphygmomanometer market is anticipated to grow effectively where the aging population are opting for healthcare services at remote locations. This possesses significant opportunities in the market which is also supported by the governments and other healthcare organizations to manage chronic disease cases throughout the country. Additionally, the growth of the medical tourism sector will also help in attracting significant demand in the upcoming years.

Increasing number of healthcare professionals

The manual segment led the global market. Healthcare providers all over the world prefer manual sphygmomanometers due to their more accurate and better adjustability. As attention to healthcare has gone up globally among both governments and consumers in emerging economies, demand for sphygmomanometers has grown substantially. Manual machines do not require electricity or batteries to operate, allowing them to be used even in regions without power.

The electric segment is predicted to witness significant growth in the market over the forecast period. Despite electric sphygmomanometers being available in the market as a technology for decades now, they are often not as trusted by manual devices. However, with innovations in both sensors and biotechnology, electric sphygmomanometers are becoming a lot more accurate. These factors are expected to further expand growth potential in the next few years.

The portable segment led the global market and is projected to expand rapidly in the market in the coming years. Portable sphygmomanometers are widely popular for their mobility and ease of storage. They are also lightweight and allow for precise tracking. Other types of configurations, such as desk mounted or floor standing, have their uses in operation theatres, however, the portable sector dominates the market and is expected to maintain its position in the next few years.

Due to its increasing demand in 2023, the aneroid BP monitors/sphygmomanometers segment has held the highest market share at more than 42.0%. Technological developments, together with new product introductions, are projected to increase global demand for sphygmomanometers. Demand for digital sphygmomanometers is predicted to grow at a rapid pace due to benefits such as accuracy and convenience of use.

Furthermore, continual technical advancements in the consumer healthcare segment, such as innovations in wearable technology, applications, and mobiles, the falling average selling price for retailers and manufacturers, and increased penetration in the professional market, are driving company expansion. Microlife WatchBP home A, QardioArm, LifeSource Sophisticated one-step auto inflate blood pressure monitor, and Omron healthcare's iHealth blood pressure monitor are examples of technologically advanced digital BP monitors on the market.

Blood pressure cuffs are predicted to expand at a substantial rate throughout the forecast period, owing to increased use of blood pressure monitors and the rising prevalence of high blood pressure. These cuffs are available in a variety of sizes depending on the patient. There are two sorts of cuffs on the market: disposable and reusable. The disposable category, in particular, is expected to rise at a rapid CAGR due to rising use of eco-friendly goods and growing worry over hospital-based cross-contamination occurrences.

The end-use categories examined in the blood pressure monitoring devices market include hospitals and clinics, ambulatory surgery centres, and home healthcare. Due to the availability of a broad patient pool, hospitals and clinics accounted for the biggest revenue share as of 2023. The desire for cost-effective, quick, and accurate diagnostic tools for better health outcomes is driving the use of blood pressure monitoring devices.

Over the projection period, home healthcare is expected to grow at a healthy CAGR of roughly 12.6%. The cost-effectiveness of this alternative option for BP monitoring, along with the availability of smart wearables that allow mobility, is projected to fuel expansion. As a result, the trend toward independent living is likely to push the home healthcare industry. Ambulatory blood pressure monitoring (ABMP) is a method of measuring out-of-office blood pressure measurements at defined time intervals during a 24-hour period. ABPM provides a more accurate technique of predicting long-term cardiovascular disease outcomes.

Recent Developments

By Product

By Operation

By Configuration

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client