March 2025

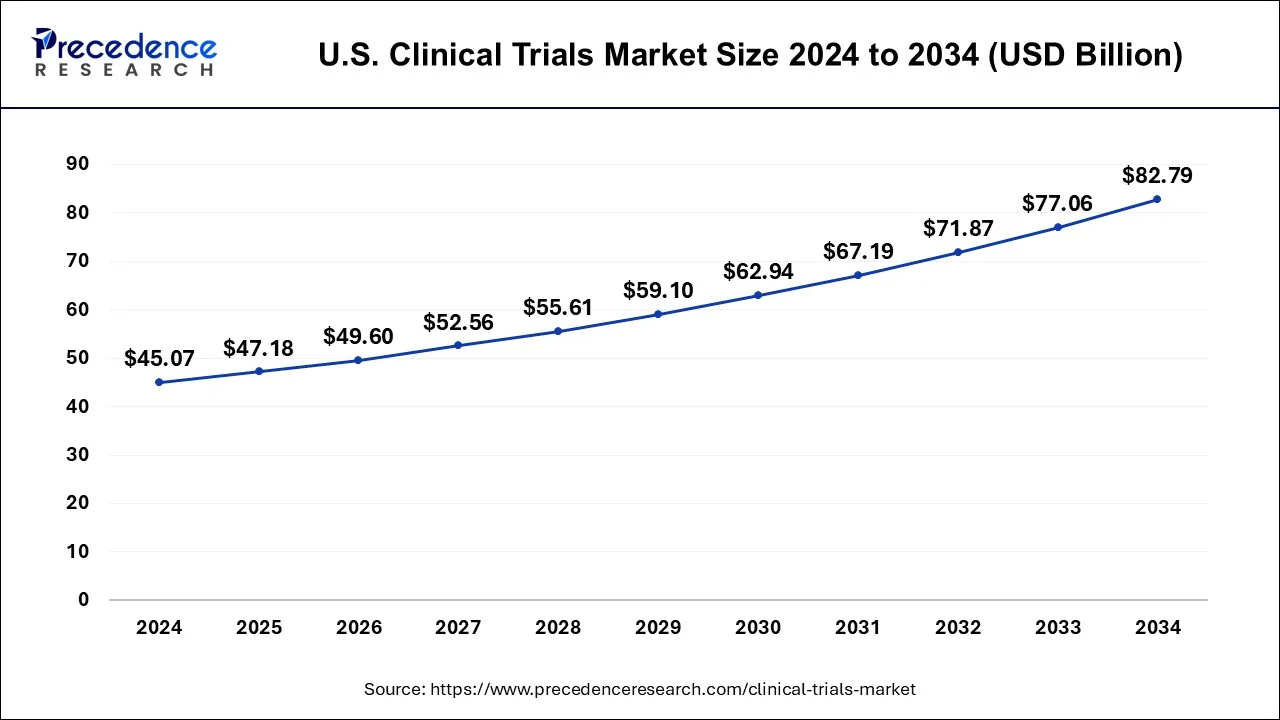

The U.S. clinical trials market size is calculated at USD 47.18 billion in 2025 and is forecasted to reach around USD 82.79 billion by 2034, accelerating at a CAGR of 6.40% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. clinical trials market size was estimated at USD 45.07 billion in 2024 and is predicted to increase from USD 47.18 billion in 2025 to approximately USD 82.79 billion by 2034, expanding at a CAGR of 6.40% from 2025 to 2034.

Clinical trials are a type of clinical research method that is guided by a specific protocol, which is carefully designed to resolve a specific patient care issue. Clinical studies are separated into five phases, each of which serves a specific purpose within the clinical trial. The clinical trials market is expanding due to factors such as the rising prevalence of chronic diseases, rising number of clinical trials in developing regions, increasing incidence of biologics, rapidly increasing demand for advanced treatments such as personalized medicines, viral disease outbreaks, rising cancer cases globally, rising geriatric population, and rising R&D expenditure.

COVID-19 Impact

Clinical trial patients were restricted from visiting trial sites due to the disrupted transport system and population movement across the world. This leads to the negative impact of COVID-19 on the overall clinical trials market. No or fewer patients were recruited to carry out clinical trials to prevent infection by the virus, during COVID-19. However, the sector quickly experienced an increase in growth. This is due to an increase in clinical research activities and surging demand for effective and novel pharmaceuticals and vaccines. Favorable government support is aiding market growth; for instance, the WHO established "Solidarity," an international clinical trial to assess successful COVID-19 treatment. It involves comparing four treatment strategies to the standard of care in order to evaluate their efficiency against the coronavirus.

| Report Coverage | Details |

| Market Size in 2024 | USD 47.18 Billion |

| Market Size by 2034 | USD 82.79Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.40% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Phase, By Study Design, By Indication |

Drivers: Increased demand for clinical trial outsourcing

As the need for novel pharmaceuticals and enhanced medical technology rises, the demand for efficient, fast-paced, and trustworthy clinical trial programs also increases. Furthermore, the medicine development process is extremely risky for biotechnology and pharmaceutical companies, with substantially lower approval rates and associated high costs. As a result, it was concluded that outsourcing the clinical trials program to numerous contract research organizations (CRO) would save the pharmaceutical business time and money. Along with this, the spike in demand for clinical trial outsourcing is fueling the clinical trials market development throughout the forecast period.

Restraints: Expensive clinical trials procedures

The clinical trials market offers expensive services. Market labor expenses are a restraining factor for market expansion throughout the projection period. Patenting and contracting for clinical trials is a difficult procedure. As a result, labor costs in the clinical trials industry are high. Cost is a concern since it affects demand in a few markets. Clinical trial services should be cost-effective in most organizations. The high cost, on the other hand, boosts the overall operating costs of the industry. As a result, the high cost of clinical trials is limiting the clinical trials market's growth over the forecast period.

Opportunities: Technological advancements in predictive analytics and artificial intelligence

Several companies are already utilizing predictive analytics techniques such as artificial intelligence and machine learning to build models and provide suggestions. With the growing accessibility of health data to clinical trial investigators, predictive analytics tools can be utilized in clinical trial design to identify patient characteristics that are more likely to react to a particular treatment pattern, growing success rates, and lowering risk in large, multi-center clinical trials. As a result, the increasing usage of predictive analytics is opening up attractive prospects for market growth throughout the forecast period.

Based on the phase, the U.S Clinical Trials are segmented into Phases I, II, III, and IV. The largest revenue share of more than 53% was for Phase III. The factor contributing to this is that the phase is most crucial as it involves 300-3000 participants and has a longer treatment period. This makes the Phase most expensive. Following this, Phase II is considered the second most expensive phase. Efficacy studies are carried out in Phase II trials. This phase also finalized the dose. Increasing investment in R&D by industry and non-industry sponsors is expected to increase the market growth of Phase II trials. For instance, there are 43 therapeutics under Phase II for COVID-19.

Based on the study design, the U.S Clinical Trials are segmented into interventional and observational. The interventional segment acquired the largest revenue share and is expected to dominate the market over the forecast period. The direct impact of the treatment and preventive measures, that can be taken to treat a disease, are estimated by using interventional methods. The weakness and strengths of a clinical trial are identified with the help of interventional designs. Furthermore, the rising occurrence of emerging viral infections and continuous technological advancements in clinical trials are important reasons for interventional studies’ high revenue share.

Based on the indication, the U.S Clinical Trials are segmented into oncology, autoimmune, pain management, CNS conditions, obesity, cardiovascular, and diabetes. The largest share of the market is accounted by the oncology segment. The factor responsible for the growth is the growing cases of cancer. Thus, the largest amount is spent on oncology clinical trials. For instance, according to the report by US FDA, USD 38 billion and more is spent on the development of drugs for various cancer diseases by pharmaceutical companies. Cardiovascular illnesses are one of the diseases exhibiting a progressive increase in incidence globally.

Modern lifestyle changes are boosting the growth of CVD. These cardiovascular conditions can result in myocardial infarction, stroke, and heart attacks. According to the WHO (World Health Organization), strokes and heart attacks account for four of the five cardiovascular diseases (CVD)-related fatalities.

By Phase

By Study Design

By Indication

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

February 2025

January 2025