February 2024

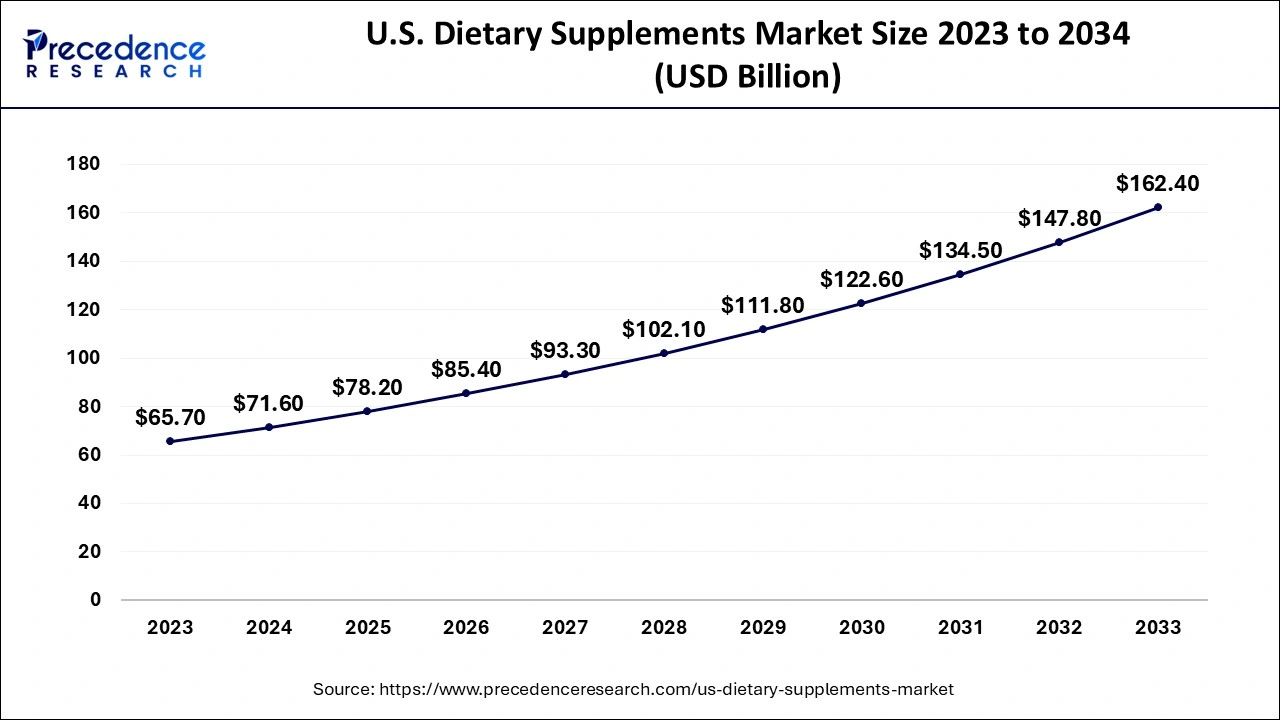

The U.S. dietary supplements market size is calculated at USD 71.60 billion in 2024, grew to USD 78.20 billion in 2025 and is predicted to be worth around USD 162.40 billion by 2033. The market is expanding at a CAGR of 9.47% between 2024 and 2033.

The U.S. dietary supplements market size accounted for USD 71.60 billion in 2024 and is projected to reach around USD 162.40 billion by 2033, growing at a CAGR of 9.47% from 2024 to 2033. The rising geriatric population in the country and the demand for preventive and nutrition supplements are driving the growth of the U.S. dietary supplements market.

Dietary supplements are an additional provision of nutrition in the human body. These are oral supplements that are different from traditional food. These products are added to the diet. The dietary supplements include minerals, vitamins, amino acids, herbs, and enzymes. Dietary supplements are of several types, including tablets, liquids, capsules, powders, soft gels, liquids, and gummies. The rising awareness about healthcare and the demand for energy supplements.

How Can AI Impact the U.S. Dietary Supplements Market?

The integration of artificial intelligence into the healthcare and pharmaceutical industry is improving the overall efficiency of the industry. AI is contributing significantly to the expansion of the dietary supplements industry.

| Report Coverage | Details |

| Market Size by 2033 | USD 162.40 Billion |

| Market Size in 2024 | USD 71.60 Billion |

| Market Size in 2025 | USD 78.20 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.47% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Ingredient, Form, Type, Function, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Benefits associated with dietary supplements

The rising awareness about healthcare in the country and the growing acceptance of dietary supplements in the population improve the immune system, gut health, and essential nutrition in the body. They enhance bone health, heart health, birth defects, anemia, and other health conditions.

Side effects

The dietary supplements sometimes have side effects such as rashes, eyeburn, infection, and others, and the rising competition in the dietary supplements market is restraining the growth of the U.S. dietary supplements market.

Rising spending culture on healthcare

The increasing disposable income in the population of the United States the changing lifestyle preferences, and the spending culture on healthcare are driving the healthcare infrastructure and pharmaceutical industries. Additionally, the rising prevalence of chronic health conditions in the population is highly driving the demand for dietary supplements in the United States consumer market.

The vitamins segment held the largest share of the U.S. dietary supplements market in 2023. Vitamins are essential elements in dietary supplements and energy and weight management supplements. Vitamins are responsible for ensuring the proper functioning of the body. In energy and weight management, vitamins play an essential role in the functioning of metabolism. Vitamin B helps improve the body’s metabolism of carbohydrates, fats, and proteins used as stored energy in food.

The probiotics segment is expected to witness substantial growth in the U.S. dietary supplements market during the predicted period. Probiotics are the elements of the substance that are used to improve and protect the immune system of the mother and the developing baby. They are microorganisms that have a number of health benefits when consumed in proper proportion. It maintains good gut health, reduces the risk of infection severity, increases immune cells, and enhances recovery time.

The tablet segment accounted for the largest share of the U.S. dietary supplements market in 2023. The tablet form of dietary supplements is increasing in consumption by the population of the United States due to their affordability, efficient usage, and high availability in every pharmacy and healthcare center. These supplements are easily transportable. Tablet supplements provide an accurate dosage and economical, reliable options for daily dietary supplement consumption.

The liquid form segment expected to witness significant growth in the U.S. dietary supplements market during the anticipated period. Liquid dietary supplements are nutraceuticals that come in liquid form and can be taken in small cups, droppers, or shot glasses. The liquid dietary supplements are mostly water, liposome, and alcohol-based. The liquid dietary supplement has quicker assimilation and absorption than the other types of dietary supplements.

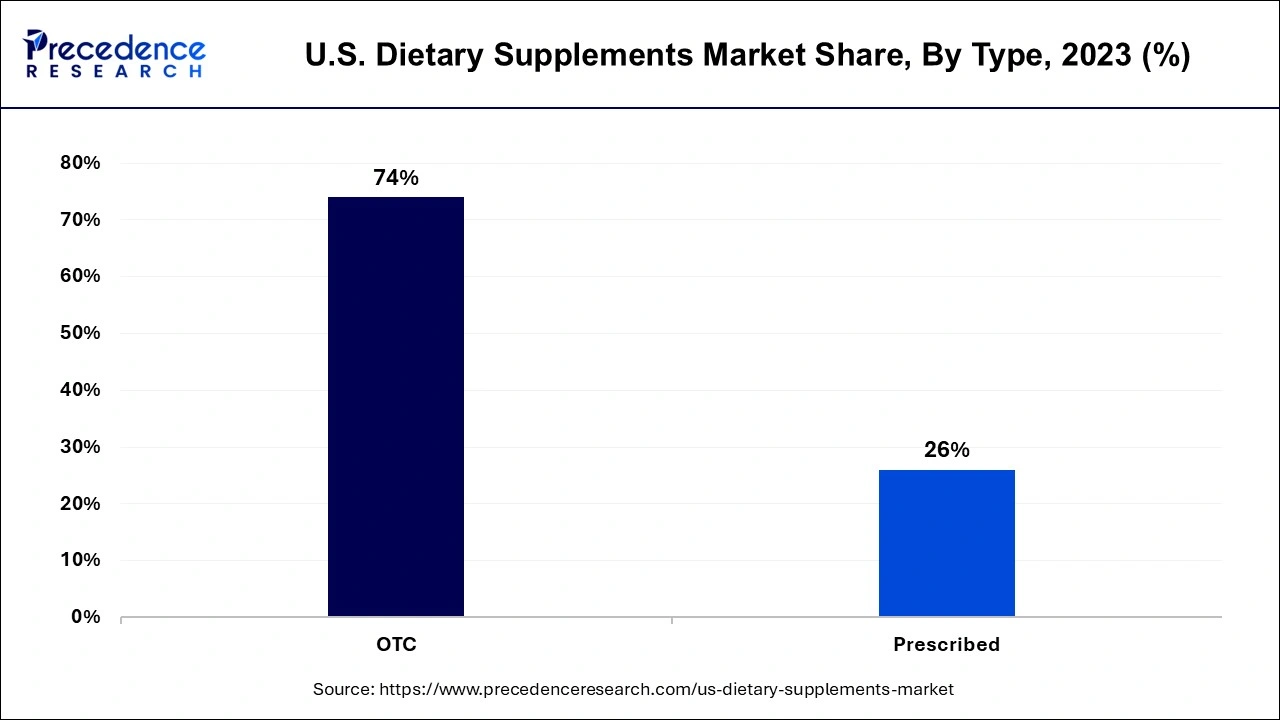

The OTC segment led the U.S. dietary supplements market in 2023. The rising consumption of dietary supplements among the population is driving the demand for over-the-counter dietary supplements. The increasing awareness about daily nutrition and maintaining energy levels is driving the demand for counter-dietary supplements.

The prescribed segment expects significant growth in the U.S. dietary supplements market during the forecast period. There is an increasing inclination towards healthcare professionals for regular diagnosis and checkups and the acceptance of prescribed dietary supplements due to the greater assurance of medicines by physicians. The prescribed dietary supplement provides the product authenticity and reduced risk.

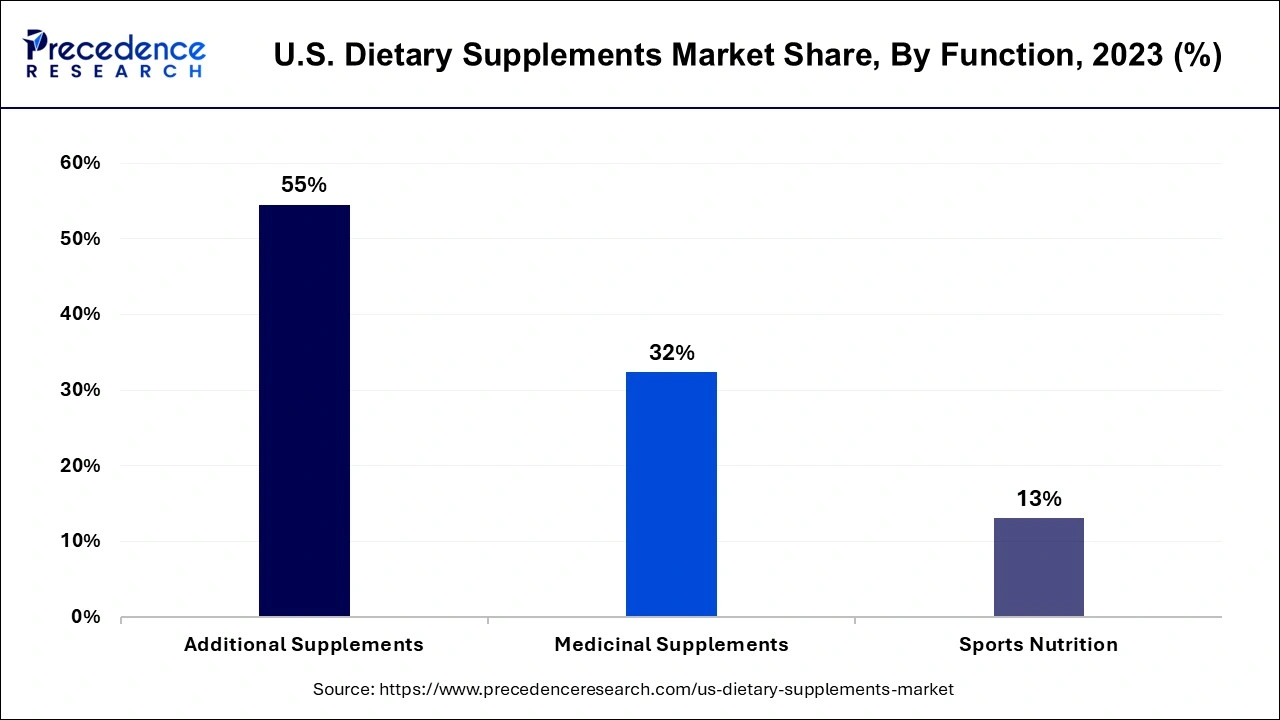

The additional supplements segment is projected to see the fastest growth in the U.S. dietary supplements market during the forecast period. The increasing prevalence of chronic and lifestyle diseases in the United States population is driving the demand for the additional supplements segment. Vitamins, minerals, and fats are some types of additional supplements that are essential for the human body; in some cases, it is not fulfilled by the routine diet, which drives the demand for the additional supplements segment.

The energy & weight management segment is led the U.S. dietary supplements market in 2023. The rising concern about health and maintaining energy in the body is boosting the demand for energy and weight management supplements. These supplements help in losing weight and are used in fat metabolism, which is efficiently used to lose extra fats in the body. Active elements that are present in the supplements help get rid of extra fats. Energy and weight management supplements mostly consist of ingredients that contain large amounts of minerals, caffeine, fiber, and other plants.

The prenatal health supplements segment is predicted to witness significant growth in the U.S. dietary supplements market over the forecast period. Pregnancy is one of the most important and crucial parts of a woman's life, and it needs to be managed efficiently during pregnancy; there is a shortage of vitamins and minerals in the body. With the use of proper physician-recommended prenatal health supplements, the shortage of vitamins and minerals may be fulfilled. The folic acid supplement is one of the most important supplements during pregnancy, which prevents birth defects known as neural tube defects, consisting of spina bifida.

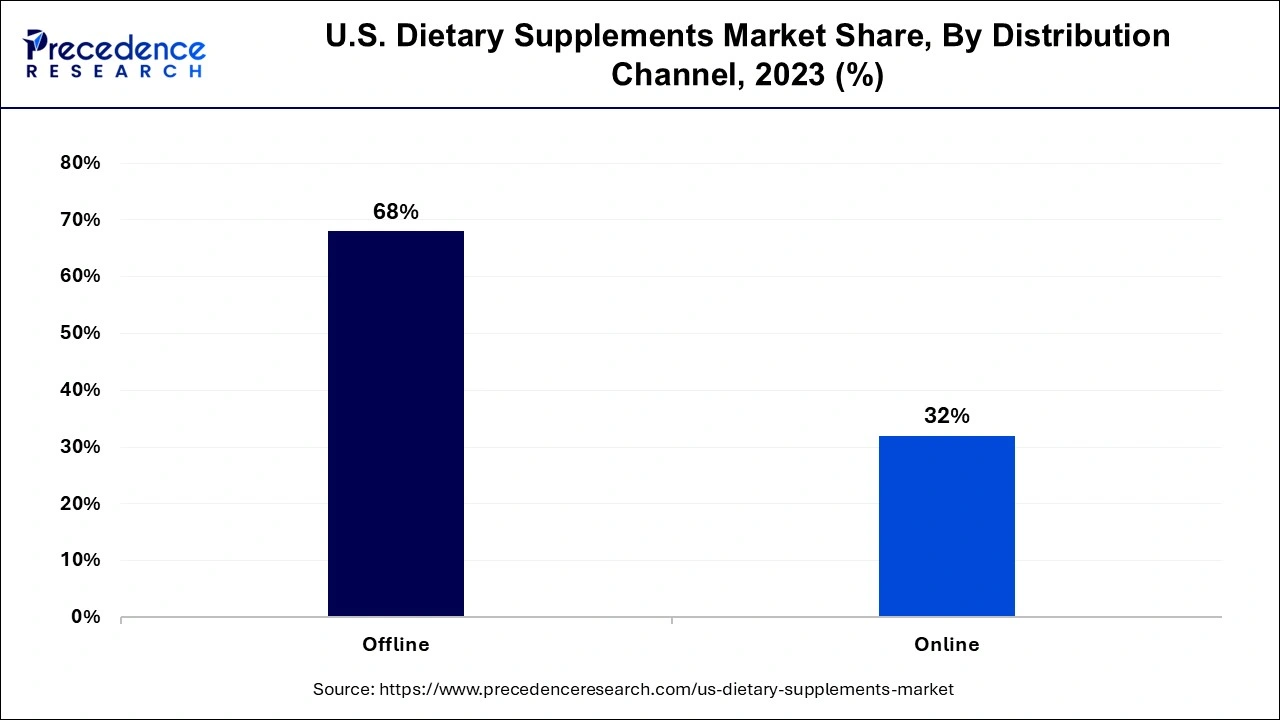

The offline segment dominated the U.S. dietary supplements market in 2023. The offline sales channel further includes sub-segments such as pharmacies, supermarkets and hypermarkets, practitioners, specialty stores, and others. The population has a rising preference for buying medicines from nearby pharmacies or specialty stores due to the greater availability. The pharmacies that are present in the pharmacies and specialty stores help recommend personalized medicines or supplements according to the consumer's age, condition, and gender.

The online segment is predicted to witness significant growth in the U.S. dietary supplements market over the forecast period. The rising penetration of e-commerce and the rapid expansion of telehealth and online delivery of medicines. The rising geriatric population and busy lifestyle are driving the demand for medicines to be delivered to their doorstep and are driving the sales of dietary supplements from the online sales channel.

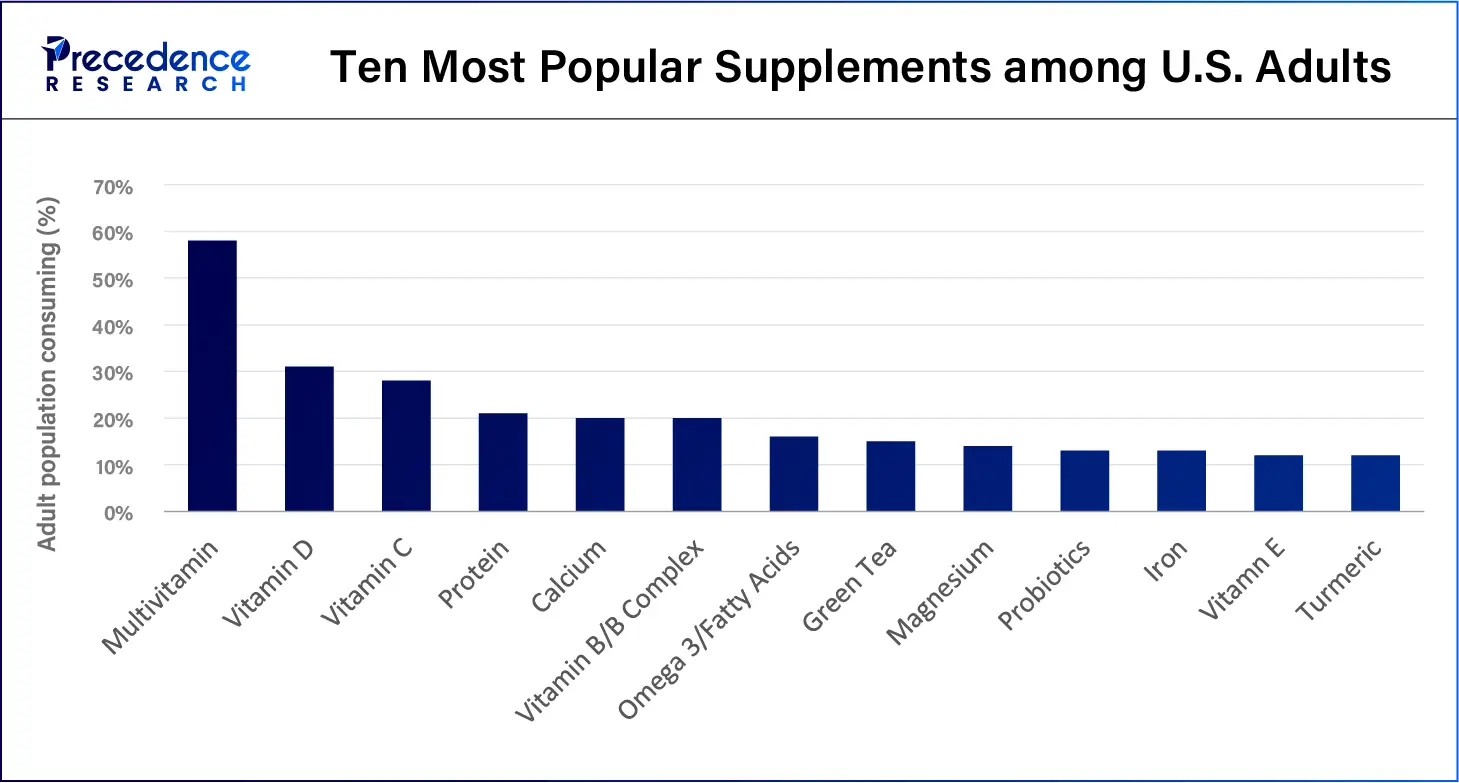

The adult segment dominated the U.S. dietary supplements market in 2023. The rising consumption of dietary supplements by adult users is due to the rising demand for energy and an improved immune system in the body. There are a number of leading players manufacturing dietary supplements for adults. Dietary supplements help improve and maintain their health and provide the necessary nutrients such as vitamins, minerals, and other nutrients that are missing from their routine diet. It improves the heart, bone, vision health, and others.

U.S. Dietary Supplements Market Trends

Segments Covered in the Report

By Ingredient

By Form

By Type

By Function

By Application

By Distribution Channel

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2024

March 2025

August 2024

March 2025