April 2025

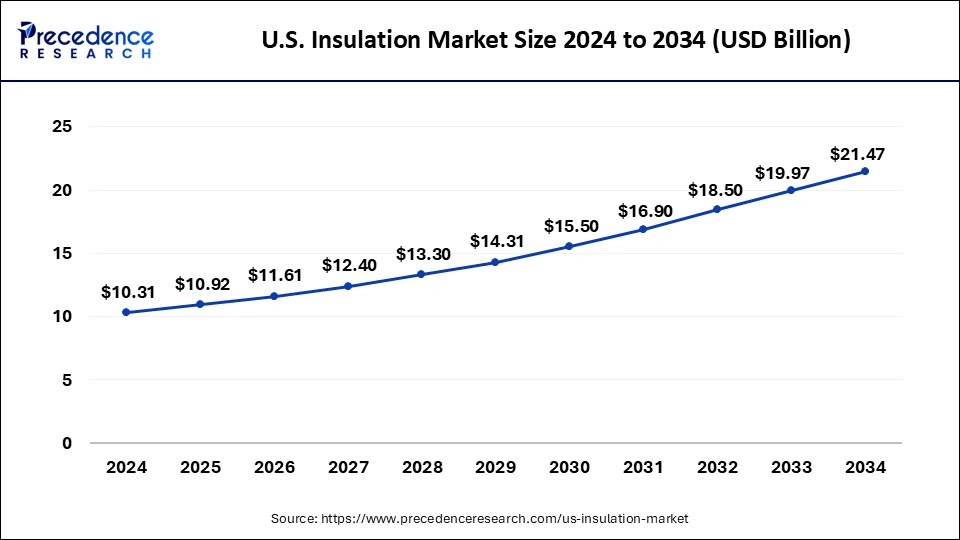

The U.S. insulation market size accounted for USD 10.92 billion in 2025 and is forecasted to hit around USD 21.47 billion by 2034, representing a CAGR of 7.80% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. insulation market size accounted for USD 10.31 billion in 2024 and is predicted to increase from USD 10.92 billion in 2025 to approximately USD 21.47 billion by 2034, expanding at a CAGR of 7.80% from 2025 to 2034.

The U.S. insulation market revolves around the development and distribution of materials that are used to cover gaps to reflect, absorb, or both to provide thermal or acoustic insulation. Such materials limit the flow of sound or heat from one location to another. Thermal insulation improves efficiency and reduces costs in residential and commercial building spaces by restricting heat transfer.

Numerous materials, such as plastic foam, mineral wool, glass wool, and others, are used to achieve insulation. Insulation is the process of keeping heat, electricity, and sound from moving into or out of a physical space. Installing insulating materials that function as an energy flow barrier is how it's done.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.80% |

| Market Size in 2025 | USD 10.92 Billion |

| Market Size by 2034 | USD 21.47 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Function, Function, and End User |

Green building initiatives

Green building practices are crucial for sustainability since common building materials use a lot of energy and resources. In this scenario, using green building materials is essential. Making construction materials accounts for 40% of emissions, which is a substantial contribution to pollution. The anticipated expansion of office and commercial buildings increases the amount of energy used.

In the U.S., the building industry is responsible for 60% of all energy usage. Green construction guidelines and sustainable insulation materials increase efficiency, which increases demand for insulation. Governments are pushing the development of eco-friendly insulating materials to lower production costs and solve health issues. Vendors reduce prices in response to rising raw material costs. The expansion of the U.S. insulation market will be fueled by green construction efforts.

Lack of skilled workforce

The lack of qualified workers is a major barrier to the expansion of the US insulation sector. Vendors struggle to locate experts who are educated about insulating materials and installation techniques, despite the increased demand for their services. Building insulation installation is a difficult, scientific process that involves choosing materials according to the building's size, type of structure, environmental considerations, and thermal characteristics. When selecting insulation, temperature is a crucial factor. There aren't many professionals on the market that can handle this complex procedure. For suppliers, finding and keeping such talent is difficult. Thus, the lack of a skilled workforce might be a major restraining factor for the U.S. insulation market’s growth during the forecast period.

Technological advancements

Constant improvements in technology and new developments in materials are supporting the market's expansion. The industry is also being helped by companies' growing preferences for eco-friendly and more effective alternatives, such as aerogels, which are lightweight and have excellent thermal insulation qualities. Additionally, improvements in manufacturing techniques are resulting in the creation of insulating materials with improved durability and fire resistance. These materials offer improved lifespan and safety, making them ideal for industrial applications. Apart from this, enhanced performance characteristics are also being facilitated by the use of nanotechnology in insulating materials.

A positive market outlook is also being provided by the introduction of smart insulation systems with sensors and monitoring features. Facility managers can minimize energy usage and rapidly fix insulation concerns due to these systems, which offer real-time data on insulation performance and energy efficiency. Additionally, intelligent insulation increases energy efficiency, lowers operating expenses, and boosts the general effectiveness of industrial structures.

The expanded polystyrene segment held the largest share of the U.S. insulation market in 2024 because of its strong thermal resistance, EPS is regarded as a useful insulator. It is frequently used to provide thermal insulation for floors, walls, and roofs in buildings, which lowers the amount of energy needed for heating and cooling. Furthermore, these insulating panels and boards are adaptable and simple to mold and shape to match a range of construction needs. They are often utilized in both new construction and retrofit projects for residential, commercial, and industrial structures.

The thermal segment is expected to capture the largest share in the U.S. insulation market during the forecast period. One major element affecting the thermal insulation market is the global building industry's expansion, which is being pushed by population increase and urbanization. The need for thermal insulation materials rises with the construction of more structures and infrastructure projects. Additionally, the utilization of thermal insulation to improve overall energy performance is encouraged by the focus on renewable energy sources and sustainable construction practices. Insulation supports the objectives of renewable energy by lowering the demand for continuous heating and cooling.

The foam segment dominated the U.S. insulation market in 2024. Foam insulation materials, such as rigid foam boards and spray foam, are known for their high insulating efficiency. They provide effective thermal insulation, helping to regulate indoor temperatures and reduce energy consumption for heating and cooling.

Moreover, the ongoing research and development efforts lead to technological advancements in foam insulation materials. Innovations include improved formulations, enhanced fire resistance, and developments in manufacturing processes, contributing to the overall performance and safety of foam insulation.

The construction segment is expected to continue its dominance in the U.S. insulation market with the largest market share over the forecast period. Increasing emphasis on energy efficiency in buildings is a major driver for the insulation market. Governments and regulatory bodies worldwide are implementing strict standards and codes to reduce energy consumption in buildings, promoting the use of insulation materials to achieve higher energy efficiency.

Additionally, government incentives, subsidies, and tax credits for energy-efficient construction practices encourage builders and developers to invest in insulation. Financial support from authorities promotes the adoption of insulation materials that contribute to long-term energy savings.

By Product

By Function

By Form

By End User

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

December 2024

March 2025