January 2025

U.S. Nitrogenous Fertilizer Market (By Product: Urea, NPK Compound, Nitrates, Ammonium Phosphate, Others; By End-use: Agricultural use, Industrial use, Residential and consumer use) - Regional Outlook and Forecast 2025 to 2034

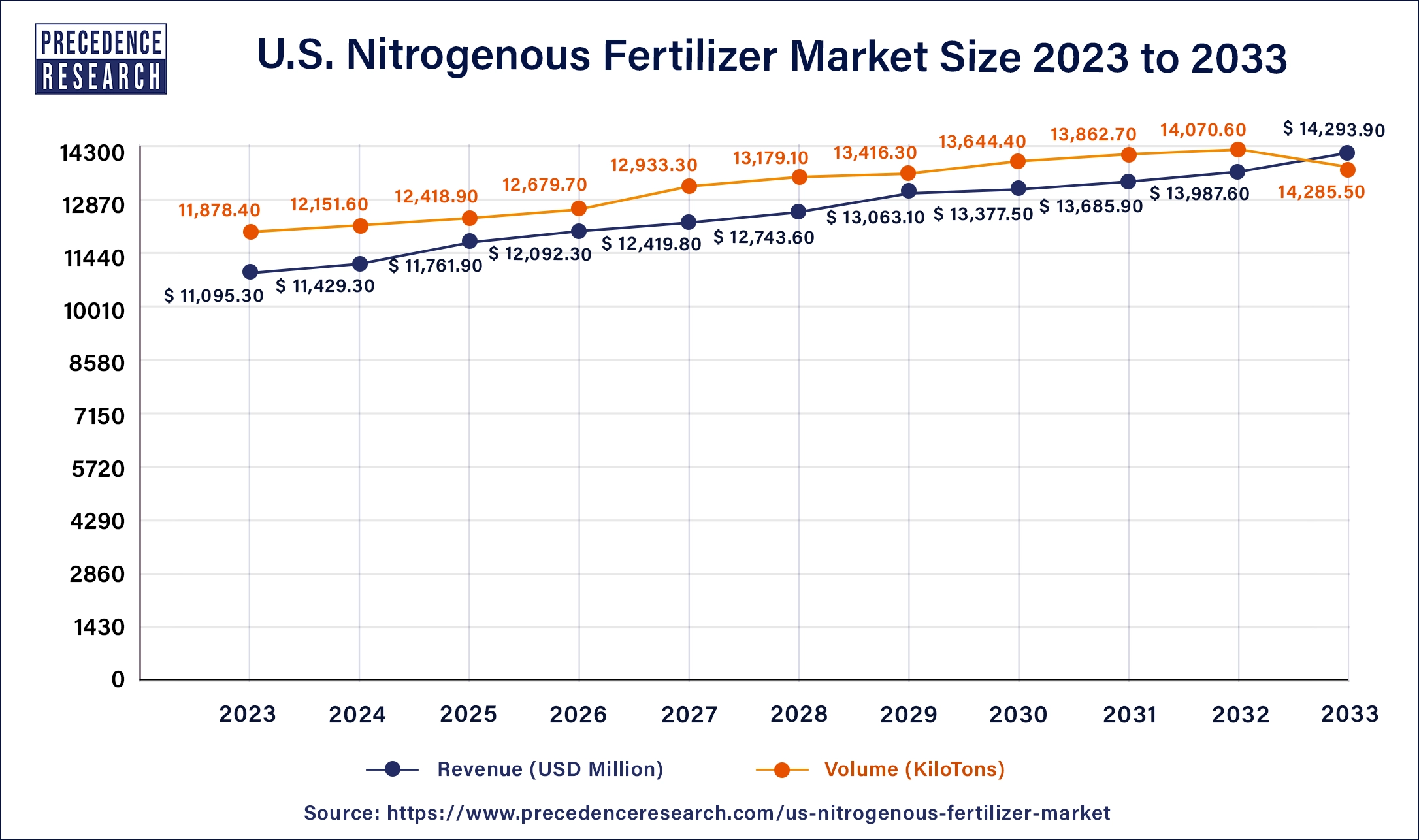

The U.S. nitrogenous fertilizer market size was valued at USD 1,1095.3 million in 2023 and is anticipated to reach around USD 1,4293.9 million by 2033, growing at a CAGR of 1.81% from 2024 to 2033. The increasing demand for nitrogen fertilizers in enhancing the quality of crops that driving the growth of the market.

The U.S. nitrogenous fertilizer market volume is calculated at 12,151.6 kilotons in 2024 and is expected to be worth around 14,285.5 kilotons by 2033, expanding at a CAGR of 2.52% from 2024 to 2033.

U.S. Nitrogenous Fertilizer Market Overview

Nitrogenous fertilizers are one of the types of fertilizers that are used in the agriculture industry that is used in enhancing the growth of the crops and unlocking the yield production. It is a nitrogen rich substance which is either meat in the form of liquid or solid. Nitrogen is one of the common and most important parts in the production of crops and all types of plants, it helps in producing energy in the plant cell. There are two types of the nitrogenous fertilizers organic or natural, and synthetic or chemical. Nitrogen fertilizers come in the ammonia (NH3), nitrate (NO3), ammonium (NH4), or urea (CH4N20). The rising demand for the high-quality crops and increasing demand for the agricultural production is driving the growth of the U.S. nitrogenous fertilizers market.

| Report Coverage | Details |

| U.S. Nitrogenous Fertilizer Market Size in 2024 | USD 11,429.3 Million |

| U.S. Nitrogenous Fertilizer Market Size by 2033 | USD 14,293.9 Million |

| U.S. Nitrogenous Fertilizer Market Growth Rate | CAGR of 1.81% from 2024 to 2033 |

| U.S. Nitrogenous Fertilizer Market Volume in 2024 | 12151.6 Kilotons |

| U.S. Nitrogenous Fertilizer Market Volume by 2033 | 14285.5 Kilotons |

| Quantitative Units | Revenue in USD Million/Billions, Volume in Tons, CAGR from 2024 to 2033 |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product and End-Use |

Driver: Rising demand for the high-quality crops

The increasing population of the country results in the higher demand for the quality and quantity production of crops. The higher dependencies on the agriculture for handling the rising demand for the food in the United States due to the rising population is driving the demand for the nitrogenous fertilizers for improving the crop production. Nitrogenous fertilizers are used to improve the nutritional quality of crops and it is used in enhancing the production capacity in agriculture.

The rising awareness about the nutritional food supply in the population drives the increased demand for safe, nutritious food that further drives the use of nitrogenous fertilizers in agriculture. Nitrogen fertilizers are used for restoration and maintenance of nutrition in soil which is necessary for high-quality crop production and growth in agriculture. Thus, the rising population and beneficial properties of nitrogenous fertilizers are collectivity driving the growth of the market.

Restraint: Environmental Impacts

The excessive use of nitrogenous fertilizers in the hazardous effects on the ecosystem drives the various impacts on the inhabited animals, and on environment is restraints the adoption of nitrogenous fertilizers and results in the restraining the growth of the U.S. nitrogenous fertilizers market.

Opportunity: Advancements in the nitrogenous fertilizers

Nitrogen fertilizers is gaining popularity in the agriculture industry due to its potential benefits to the crops and it is highly utilized by the farmers for higher quality and quantity of production yields. But the excessive use of nitrogenous products is leaving negative impacts on the environment and ecosystem and causing health hazards in the animals. There is increasing investment in the research activities for finding the advancement in the nitrogen-based fertilizers with the lower impact on ecosystem, such as amino acid biosynthesis, carbon metabolism, and targeted engineered genetics are driving the growth opportunity in the U.S. nitrogenous fertilizers market.

The urea segment dominated the market with the largest share in 2023. The growth of the segment is attributed to the rising usage of urea in the agriculture sector for efficient crop management. Urea is a crystalline solid which is highly soluble in water. Urea used in agriculture is an organic compound with highly concentrated nitrogen. Urea had properties like water solubility, neutral pH and high nitrogen content which makes them the best choice for the various food processing and agricultural practices.

The urea is comparatively less expensive than the other nitrogen contained compound which makes them popular choice in agricultural application. Urea is used as a fertilizer, yeast nutrient, food processing aid, and animal feed additives. Majorly it is used as the fertilizers in agriculture, it used to provide the necessary nutrients to the crops for enhancing quality and quantity of crop yields.

The NPK compound segment held the second largest share in 2023. NPK compound is the combination of three different nutrients nitrogen (N), potassium (K), and phosphorus (P). NPK fertilizers are considered as the complete fertilizers though it provides all the essential nutrients for the plant growth. NOP compound is found in all three physical states (gas, solid, and liquid). With the three nutrients, NPK compound also contains zinc and iron to enhance the growth of plants. Thus, the rising adoption of the NPK compounds by regional farmers to promote crop production drives the growth of the NPK compounds in the U.S. nitrogenous fertilizers market.

The agricultural use segment dominated the market in 2023. The rising adoption of nitrogenous fertilizers in agriculture due to beneficial properties is driving the demand for the nitrogenous fertilizers in agriculture. Nitrogenous fertilizers are found in solid and liquid physical states. Nitrogenous fertilizers are rich in nitrogen substances that are essential for plant growth and help in increasing quality of crops. Nitrogen produces energy in the plant cell and helps to promote the health of crops and productivity.

The rising investment in the promotion of agricultural activities in the United States and the increasing farmland for production of high-quality crop yields in the region due to the continues rising population and the demand for the high-quality food supplies that contributing in the demand for the nitrogenous fertilizers in the agriculture segment.

The industrial use segment is observed to grow at a notable rate in the U.S. nitrogenous fertilizers market. Government policies and subsidies aimed at supporting the agricultural sector indirectly boost the industrial use segment. These policies often include incentives for the use of fertilizers to increase crop production. Advances in precision agriculture technologies allow for more efficient and targeted application of nitrogenous fertilizers. This not only improves crop yields but also reduces environmental impact, making the use of these fertilizers more appealing for industrial applications.

Segments Covered in the Report

By Product

By End-Use

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024