March 2025

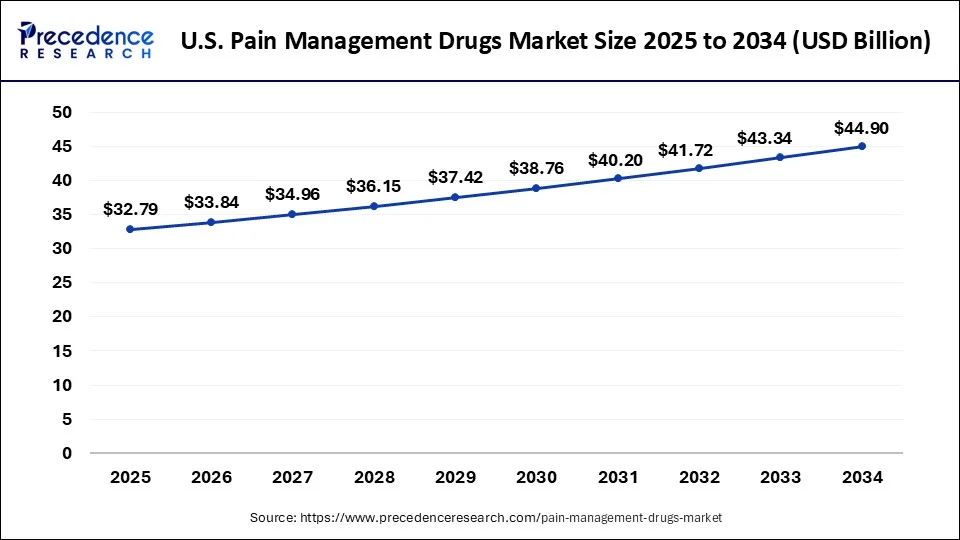

The U.S. pain management drugs market size accounted for USD 32.79 billion in 2025 and is forecasted to hit around USD 44.90 billion by 2034, representing a CAGR of 3.60% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. pain management drugs market size was calculated at USD 31.80 billion in 2024 and is predicted to increase from USD 32.79 billion in 2025 to approximately USD 44.90 billion by 2034, expanding at a CAGR of 3.60% from 2025 to 2034.

The U.S. pain management drugs market offers series of therapeutics in order to manage the pain caused by certain health concerns. Multiple sclerosis, stomach ulcers, osteoarthritis, chronic arthritis, diabetic neuropathy, fibromyalgia, and cancer are among the conditions that might be uncomfortable. Acute pain might last for a short while, whereas chronic pain lasts for a longer period.

Acute discomfort might be minor and subside quickly, or it can last for several weeks or months. Age-related bone and joint disorders, nerve damage, and even injuries can result in chronic pain. Many medications are used to treat pain arising from inflammation in reaction to pathogens or chemical agents (nociceptive pain), tissue injury, or damage to the nerves (neuropathic pain).

The number of Americans 65 and older grew around five times faster than the country as a whole during the 100 years between 1920 and 2020, according to the US Census Bureau. Senior citizens made up 55.8 million of the US population in 2020 or 16.8% of the overall population.

| Report Coverage | Details |

| Market Size in 2025 | USD 32.79 Billion |

| Market Size by 2034 | USD 44.90 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.60% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Class, Indication, and Distribution Channel |

Rising government and regulatory support

A favorable picture for the expansion of the U.S. pain management drugs market is being created by the implementation of numerous government programs and policies that encourage the discovery and approval of new pharmaceuticals. Accordingly, it is projected that the introduction of incentives and fast-track approvals for orphan drug development would propel market expansion by incentivizing pharmaceutical firms to engage in novel pain management medications.

The market is also growing significantly as a result of the adoption of government-funded healthcare programs and reimbursement guidelines, which have a direct impact on the availability and cost of painkillers. The industry is also being helped by the increasing number of initiatives being launched to improve access to painkillers, a recognition of the importance of pain treatment to public health. In addition, the increasing efforts to fund and award research on innovative pain management treatments, promoting creativity and advancement, are driving the U.S. pain management drugs market's expansion.

Side effects and stringent regulatory approval process

Many pain management drugs, especially opioids, can have side effects such as drowsiness, constipation, and nausea. Additionally, patients may develop tolerance over time, requiring higher doses for the same level of pain relief. These factors can limit the long-term effectiveness of certain medications.

Furthermore, the regulatory approval process for new pain management drugs can be lengthy and rigorous. Strict safety and efficacy requirements can delay the introduction of new medications to the market, impacting the ability of pharmaceutical companies to bring innovative solutions to patients. Thus, this is expected to be a major restraining factor for the U.S. pain management drugs market over the forecast period.

Growing technological advancements in pain management therapies

A promising future for the U.S. pain management drugs market appears to be provided by the quick technical progress in pain management, which has led to the creation of new and more potent medications, such as biologics and targeted therapies. Consequently, the market is expanding because of the increasing advancements in the effectiveness of therapies aimed at minimizing the negative effects of conventional painkillers.

Positive outlooks for the market's growth are also being created by the pharmaceutical industry's growing emphasis on research and development (R&D), which is producing new medications with improved profiles for pain management. It is also projected that the market will rise because of the growing acceptance of pharmacogenomics and customized medicine, which allow for more focused and efficient pain treatment techniques.

The opioids segment is expected to dominate the market over the forecast period. Opioids are a class of potent analgesic medications derived from opium or synthesized to mimic opiate effects. They work by binding to specific receptors in the central nervous system to alleviate pain. Opioids are available in various formulations, including oral tablets, injectables, patches, and sublingual formulations.

This versatility allows healthcare providers to choose the most appropriate route and formulation based on the patient's condition and needs. These are highly effective in providing potent pain relief, especially for moderate to severe pain, such as postoperative pain, cancer-related pain, and pain associated with certain medical conditions. Besides, the antidepressants segment is expected to grow at a rapid rate over the forecast period. Antidepressants, particularly certain classes like tricyclic antidepressants (TCAs) and selective serotonin and norepinephrine reuptake inhibitors (SNRIs), have found applications beyond mental health conditions.

They are increasingly prescribed for chronic pain, neuropathic pain, and certain types of musculoskeletal pain. They provide a non-opioid option for pain management, which can be beneficial in situations where opioid use may not be appropriate or when trying to avoid the potential risks associated with opioids. Thus, this is expected to drive the segment growth over the forecast period.

The arthritic pain segment is expected to capture the largest market share during the forecast period. The market for arthritic pain management includes a range of medications, including nonsteroidal anti-inflammatory drugs (NSAIDs), analgesics, disease-modifying antirheumatic drugs (DMARDs), and biologics. This diversity allows healthcare providers to tailor treatment plans based on the specific needs and characteristics of each patient.

In Addition, ongoing research and development efforts in the field of rheumatology lead to the introduction of novel drugs and treatment modalities. These advancements aim to improve the efficacy of pain management while minimizing side effects. On the other hand, the chronic back pain segment is expected to grow substantially during the projected period. Chronic back pain is a common health issue, affecting millions of people in the U.S. The persistent nature of this condition leads to a consistent demand for effective pain management medications.

For instance, according to the Health Policy Institute, back discomfort has been reported by about 65 million Americans in the past. About 16 million individuals, or 8% of the adult population, suffer from chronic or persistent back pain, which limits their ability to do several daily tasks. Thus, the aforementioned stats are expected to propel the segment growth over the forecast period.

The hospital pharmacy segment held the largest share of the U.S. pain management drugs market in 2024. The segment is observed to sustain the position throughout the forecast period. Hospital pharmacies are responsible for supplying pain management medications to patients admitted to hospitals for various reasons, including surgery, trauma, or acute medical conditions. Inpatient pain management often involves a combination of analgesics, opioids, and other medications tailored to individual patient needs.

Additionally, hospital pharmacies contribute to the implementation of multimodal pain management strategies. This involves combining different classes of medications, such as opioids, non-opioid analgesics, and adjuvant drugs, to achieve optimal pain control while minimizing side effects. Besides, the online pharmacy is expected to grow at the highest CAGR during the forecast period.

Online pharmacies offer a convenient way for consumers to access pain management medications without the need to visit a physical store. Patients can browse and purchase medications from the comfort of their homes. Moreover, these pharmacies often compete on pricing, offering discounts and promotions on pain management medications. This can be attractive to consumers seeking cost-effective options for managing their pain. Thus, driving the market growth.

By Drug Class

By Indication

By Distribution Channel

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

May 2024

February 2024

April 2025