What is the U.S. Patient Engagement Solutions Market Size?

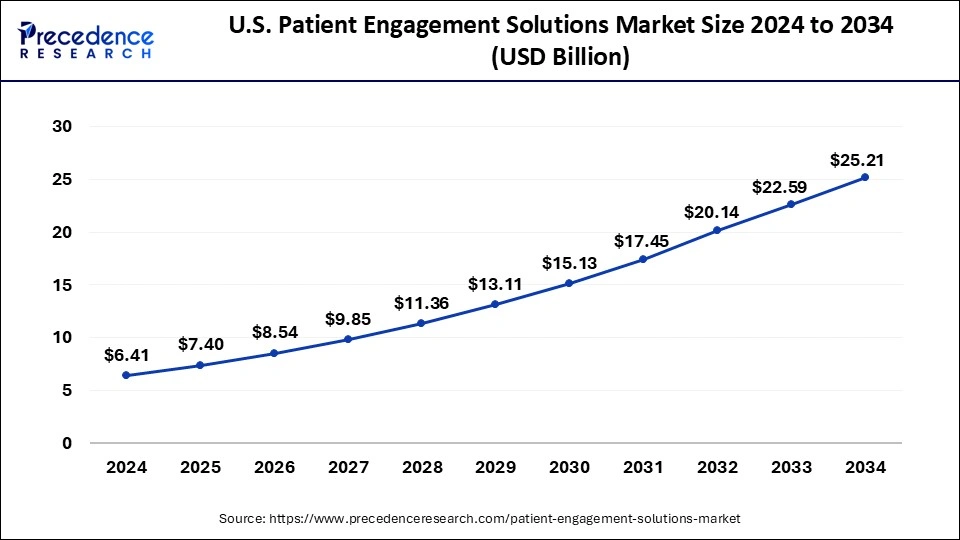

The U.S. patient engagement solutions market size accounted for USD 7.40 billion in 2025 and is predicted to increase from USD 8.54 billion in 2026 to approximately USD 25.21 billion by 2034, expanding at a CAGR of 14.68% from 2025 to 2034. The demand for value-based care models has increased in the U.S., driving the market. Increased demand for personalized healthcare experiences and the adoption of telehealth further contribute to the market growth.

Market Highlights

- By component, the software segment accounted for the biggest U.S. patient engagement solutions market share in 2024.

- By component, the services segment is expected to show considerable CAGR over the forecast period.

- By therapeutic area, the chronic diseases segment dominated the market in 2024.

- By therapeutic area, the fitness segment is projected to grow at a significant CAGR in the forecast period.

- By functionality, the communication segment held the largest market share in 2024.

- By functionality, the patient education segment is anticipated to expand at the highest CAGR during the assessment period.

- By application, the health management segment held the biggest market share in 2024.

- By application, the home healthcare management segment is projected to grow at the fastest CAGR during the forecast period.

- By end use, the providers segment held the major market share in 2024.

- By end use, the payers segment is anticipated to witness significant growth in the studied period.

- By delivery type, the web/cloud-based segment contributed the highest market share in 2024.

- By delivery type, the on-premise segment is expected to show considerable growth over the forecast period.

Strategic Overview of the U.S. Patient Engagement Solutions Industry

Patient engagement solutions create tailored effects on key areas such as harnessing digital health platforms, enhanced communication, leveraging data analytics, generating an educational resource platform, personalizing the patient experience, fostering community support, enabling shared decision-making (SDM), telehealth, remote monitoring, designing recognition and reward systems, and health outcomes.

The U.S. patient engagement solutions market is witnessing significant growth due to various factors like healthcare digitalization, the rising prevalence of chronic diseases, the search for remote healthcare services, and regulatory mandates for patient-centric care solutions. Government initiatives and regulatory support for patient-centric healthcare in the United States are leading to significant progress in key areas of engagement strategies, personalized medicine, regulatory changes, and digital health technologies.

By 2025, the United States will witness transformative growth in healthcare digitalization and indications of tools like AI and variable technologies in healthcare. The increased need for seamless communication, personalized care, and improved accessibility are major contributors to the adoption of digital-first patient engagement tools. The increased emphasis on improving personalized patient experiences is the major factor contributing to innovation and advancements in the U.S. patient engagement solutions market.

Artificial Intelligence (AI) Integration and its Impact on the U.S. Patient Engagement Solutions Market

Artificial Intelligence is becoming an innovative and transforming tool for the U.S. patient engagement solutions market. The increase in the adoption of digitalization in U.S. healthcare is a significant driver for the implementation of AI in the sector. The ability of AI to provide predictive analytics, enhance patient experiences, and improve patient engagement platforms makes them popular for integration. AI algorithms can analyze a broad amount of patient data to provide predictions of health risks and personalized treatment plans. The growing need to improve patient satisfaction, reduce healthcare costs, and enhance patient health outcomes is leveraging AI with patient engagement solutions.

The United States is witnessing an increased surge in remote healthcare services, driving demand for remote monitoring solutions. Healthcare providers, along with key vendors, are focusing on providing tailored patient engagement solutions for remote monitoring and health outcomes, making an essential stage for AI integration with the solutions. Healthcare providers and key market vendors have increased their focus on direct communication tools through mobile apps and AI-driven diagnostics to improve the effectiveness of treatment and health outcomes.

- In February 2025, Smart Meter, a pioneering force in remote patient monitoring (RPM) technology, announced the launch of patient engagement with SmartHealth Solutions, a game-changing suite of AI-powered tools and applications, at the HIMSS 2025 National Conference in Las Vegas.

U.S. Patient Engagement Solutions Market Growth Factors

- Increase prevalence of chronic diseases: The prevalence of chronic diseases has increased, driving demand for ongoing care and management solutions. Healthcare professionals are fueling the adoption of patient engagement solutions to provide remote monitoring and improved healthcare outcomes.

- Health care digitalization: The United States is a hub for early adoption of cutting-edge and digital technologies. The high adoption of digitalization in healthcare is driving the patient engagement solutions market.

- Growth of telehealth: The adoption of telehealth has increased due to a growing search for remote healthcare services and advances in technologies, leading to the utilization of patient engagement solutions.

- Increase demand for patient-centric care: The demand for patient-centric care has increased in U.S. healthcare infrastructure. Healthcare providers are focusing on prioritizing patient engagement and empowerment, driving a favorable impact on market growth.

- Focus on advancements in patient engagement tools: Key market players and healthcare providers are continuously focusing on advancing patient engagement tools to improve patient experience and health outcomes, which are the major factors shaping the growth of the market in the United States.

Market Outlook

- Market Growth Overview: The U.S. patient engagement solutions market is expected to grow significantly between 2025 and 2034, driven by government initiatives and regulations, the rising burden of chronic diseases, and an ageing population that increasingly requires access to healthcare services.

- Sustainability Trends: Sustainability trends involve a shift from volume-based care, reduced resource consumption and waste, and enhanced chronic care management and prevention.

- Major Investors: Major investors in the market include The Vanguard Group, Inc., BlackRock, Inc., State Street Corporation, and PE and VC firms.

- Startup Economy: The startup economy is focused on chronic disease management platforms, virtual care and telemedicine, and AI and conversational platforms.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.40 Billion |

| Market Size in 2026 | USD 8.54 Billion |

| Market Size by 2034 | USD 25.21 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.68% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Therapeutic Area, Functionality, Application, End use, Delivery Type |

Market Dynamics

Drivers

Government and regulatory initiatives

The increased prevalence of chronic diseases in the United States has attracted the government's focus, leading to the promotion of mandate regulations for patient-centric healthcare. The U.S. government is supporting the adoption of digital health technologies and remote health solutions, enabling personalized and effective care. The adoption of tailored patient engagement solutions has witnessed transforming growth in the country due to regulatory and government support for the adoption of favorable policies.

Government and non-government organizations are providing funds for the implementation of digital health systems, with improved reimbursement policies expected to increase the demand for the U.S. patient engagement solutions market during the upcoming years. Furthermore, the Health Insurance Portability and Accountability Act emphasizes patient privacy, security, and an increasing adoption of secure patient engagement solutions in the US healthcare infrastructure.

Restraint

Security and privacy concerns

The concerns of security and privacy are the major restraints for the U.S. patient engagement solutions market. Patient engagement solutions handle sensitive patient data, and ensuring the security and privacy of this data is essential. The increased utilization of digital technologies in healthcare infrastructure is a driving force, and healthcare professionals are more concerned about the security and privacy of their sensitive data. These concerns are influencing the slow adoption and cost increase of patient engagement solutions. Additionally, complaints with regulations like HIPAA further cause challenges for the adoption of these solutions in healthcare. The need for solutions providers to prioritize data security and privacy is emerging in the market.

Opportunity

Increased adoption of telehealth

The increase in the surge of patients for remote healthcare services is driving the adoption of telehealth in the United States. Telehealth provides remote healthcare consultation and monitoring, which offers convenience, affordability, and accessibility to healthcare services. Telehealth further provides flexible and personalized healthcare services to the patient, enabling them to improve patient satisfaction and outcomes.

Telehealth is becoming an essential tool for encouraging patients to participate in their healthcare journey. The increased focus of healthcare professionals on enhancing the patient experience and health outcomes is driving demand for telehealth in healthcare. The ability of health solutions to reach numerous patient populations from rural or remote areas makes them ideal for the increased trend of remote healthcare services. The growth of telehealth is anticipated to increase in U.S. healthcare infrastructure to improve patient outcomes and overall patient experience.

Segments Insights

Component Insights

The software segment accounted for the biggest U.S. patient engagement solutions market share in 2024. The segment growth is accounted for by increased demand for patient-centric care and personalized patient engagements. Software is the prior tool used in various industries like home healthcare management and healthcare management. The rising adoption of digitalization in the healthcare sector is driving demand for patient engagement software solutions. Additionally, the ongoing surge in the integration of software with existing systems and other healthcare IT infrastructures is improving the software adoption rate.

- In July 2024, IBM collaborated with Cerner for the utilization of AI in improving patient engagements. Cerner implemented AI technologies into its EHRs to give healthcare providers actionable insights to improve the quality of care and patient engagement.

The services segment is expected to show considerable growth over the forecast period with an increased need for implementation, training, and support. The services segment empowers patient participation, helps with better communications, and provides adherence to treatment plans. The increased demand for customized solutions and the complexity of patient engagement solutions drive the adoption of services such as implementation, interoperability, training, and consulting to make the healthcare journey. Additionally, the increased demand for managed services to outsource management and maintain patient engagement solutions is driving the demand for the services segment.

Therapeutic Area Insights

The chronic diseases segment dominated the U.S. patient engagement solutions market in 2024. The increased incidence of chronic diseases such as cancer, diabetes, and cardiovascular disease in the U.S. is driving the need for continuous health monitoring and management solutions. Healthcare providers are seeking patient engagement solutions to monitor patients' health remotely to reduce hospitalizations and improve outcomes. Patient engagement solutions enable personalized care to provide patient-centric treatment plans. The growing adoption of daily health and remote monitoring services is driving demand for patient engagement solutions.

The fitness segment is projected to grow significantly in the forecast period. The increased demand for fitness-focused solutions and a focus on preventive care to prevent chronic diseases and promote a healthy lifestyle has taken over the trend in the United States. The adoption of mobile health apps for fitness tracking, such as step count, calorie intake, and sleep patterns, is trending in the country. Integration of patient engagement solutions with variable devices like smartwatches, trackers, and mobiles is leveraging segment growth in the market.

Functionality Insights

The communication segment held the largest U.S. patient engagement solutions market share in 2024 due to an increase in demand for enhanced communication capability. Patient engagement solutions enable tailored communication plans. Healthcare organizations are adapting communication functionalities to make it easier for treatment plans, decision-making capabilities, appointment scheduling, and medication reminders and to enhance the patient experience. The increase in the search for remote patient monitoring is the major factor driving the need for communication solutions in the healthcare sector; the segment is witnessing growth driven by an increase in the need for efficient, effective, and personalized communications between healthcare providers and patients.

However, the patient education segment is anticipated to expand at the highest CAGR during the assessment period. The patient education segment driving the growth of the U.S. dot S dot patient engagement solutions market is driven by increased demand for informed patients and better healthcare outcomes. The increased prevalence of chronic diseases, spending on healthcare, and driving patients' search for accessibility and clear information about conditions, diagnostics, treatments, and Wellness strategies. The increased need for patient financial assistance, increasing competitive pressure, and mechanistic proliferation in specialty and chronic diseases are driving demand for higher standard value demonstrations. Key vendors are showing determination and providing digital tools and other applications to provide tailored patient education facilities.

- In May 2024, IQVIA launched its excellence web series to understand market forces and strategies for shaping a patient-centric approach to healthcare, making patient engagement and support programs business critical.

Application Insights

The health management segment held the biggest U.S. patient engagement solutions market share in 2024. The increased chronic disease prevalence is driving the need for effective management and personalized care plans in the U.S. The health management segment refers to improved health monitoring and patient-centric care. The health management application, including chronic disease management programs, wellness applications, and medication adherence applications, is driving the segment's growth. Additionally, the growing adoption of digital health technologies like electronic health records (EHRs), daily health, and mobile health applications is contributing to segment growth.

- In January 2025, Cotiviti, a leader in data-driven healthcare solutions, introduced its Engagement Hub to improve health plans by detecting care gaps and gaining a holistic view of members across quality measures. This hub enables the deployment of targeted outreach to improve member care and achieve performance benchmarks.

However, the home healthcare management segment is projected to grow at the fastest CAGR during the forecast period. The adoption of home healthcare solutions has increased in the U.S., a country facing high challenges of chronic disease incidence, especially among the elderly population, driving demand for convenience and cost-effective remote healthcare solutions. The rising surge of patients for remote healthcare services is driving demand for home healthcare services for disease management and activity monitoring.

End-Use Insights

The providers segment held the major U.S. patient engagement solutions market share in 2024. Healthcare providers are the primary adopters of patient engagement solutions. Patient engagement solutions enable improved routine care processes, patient-centered care, and personalized care. To handle the highest number of patients and offer point-of-care services, healthcare providers are highly preferring patient engagement solutions. The ability of the solutions to provide complex healthcare decisions, information access, data analytics, and patient-centric care makes them popular among providers.

The payers segment is anticipated to witness significant growth in the studied period. The increased need for payers to provide improved patient outcomes, enhanced customer satisfaction, and cost-effective solutions is driving the adoption of patient engagement solutions. The shift over to value-based care modules to provide high-quality healthcare and cost-effective solutions enhanced the popularity of patient engagement solutions. The payer-driven patient engagement initiatives, like support for the adoption of telehealth, online patient portals, and personalized health content, are enabling the essential adoption of patient engagement solutions.

Delivery Type Insights

The web/cloud-based segment contributed the highest U.S. patient engagement solutions market share in 2024 due to factors like increased adoption of telehealth services and a surge in patient-care models. Web/cloud-based patient engagement solutions are scalable, accessible, and cost-effective solutions. The increased chronic disease prevalence is driving demand for personalized medicines. Web/cloud-based solutions enhance patient engagement according to patient history data analytics and adherence. The increased demand for remote patient monitoring solutions fuels the adoption of web/cloud-based solutions.

- In January 2025, Huma collaborated with Pfizer Inc. for the introduction of the Huma Cloud Platform for Hemophilia in the United States. According to the partnership, Huma's FDA Class 2 510k cleared Remote Patient Monitoring (RPM) solution was integrated to provide personalized, data-driven support that enhances patient engagement, adherence to therapy, and communication with healthcare providers.

The on-premise segment is expected to show considerable growth over the forecast period. The segment growth is anticipated due to increased concerns about data privacy and compliance with regulatory requirements. The on-premises segment involves hosted and managed on-site software, which provides overall control over data security. On-premises services are customized as they provide specific needs of healthcare providers with greater flexibility and control access. Total access to the information contained within the premises, emerging segment popularity in the U.S. healthcare infrastructure

U.S. Patient Engagement Solutions Market Value Chain Analysis

- Research, Development, and Solution Design

This initial stage involves understanding healthcare provider and patient needs, designing software solutions, and developing the underlying technology.

Key Players: Cerner Corporation, Epic Systems Corporation, Allscripts Healthcare Solutions, GetWell and Lumeon. - Software Development and System Integration

This stage focuses on coding the solutions, ensuring interoperability with existing electronic health records (EHR) systems and other clinical platforms, and rigorous testing.

Key Players: Epic, Oracle Health, Amazon Web Services (AWS) and Microsoft Azure. - Sales, Marketing, and Distribution

This stage involves marketing the solutions to healthcare providers (hospitals, clinics, integrated delivery networks), managing sales cycles, and negotiating contracts.

Key Players: GetWell, Allscripts, and Well Health. - Implementation, Training, and Support

This crucial stage ensures the solutions are successfully deployed within healthcare organizations, and both providers and patients are effectively trained on their use.

Key Players: Lumeon, GetWell, Accenture, and Deloitte.

U.S. Patient Engagement Solutions Market Companies

- Athenahealth: Athenahealth contributes to the patient engagement market by integrating patient communication tools and services within its cloud-based electronic health record (EHR) and practice management software.

- Cerner Corporation (Oracle Health): Now operating as Oracle Health, Cerner is a major player providing extensive patient engagement solutions integrated within its clinical and financial health systems.

- IBM: IBM contributes to the market through its Watson Health segment (though much of it was divested, some technology remains influential), focusing on AI and data analytics to personalize patient engagement strategies and identify at-risk populations.

- Epic Systems Corporation: As one of the largest EHR vendors in the U.S., Epic dominates a significant portion of the market with its MyChart patient portal, providing a seamless and highly integrated platform for patient-provider communication, health data access, and care management.

- Allscripts Healthcare, LLC: Now part of Raccoon.ai, Allscripts contributes through a range of patient engagement solutions that complement its EHR offerings, focusing on consumer experience, population health management, and driving patient activation for improved outcomes.

- McKesson Corporation: While largely a distribution and supply chain company, McKesson contributes to the healthcare IT landscape through various technology solutions that indirectly support patient engagement efforts by optimizing provider operations and data management.

- ResMed: Primarily a leader in connected health devices for sleep apnea, ResMed contributes by leveraging its digital platforms to engage patients in managing their specific chronic conditions. Their technology focuses on remote monitoring and coaching, creating a niche in device-based patient engagement.

- Nuance Communications, Inc.: Acquired by Microsoft, Nuance contributes advanced conversational AI and voice recognition technology used in patient engagement solutions for automated patient interaction, virtual assistants, and streamlining clinical workflows.

- Koninklijke Philips N.V.: Philips contributes to the market through its health technology portfolio, focusing on connected care solutions for remote patient monitoring and personal health management. Their approach integrates devices and platforms to engage patients in managing chronic conditions outside the hospital setting.

- Klara Technologies, Inc.: Klara is a modern, software-focused company that contributes by providing a robust, simple-to-use patient communication platform that replaces multiple communication channels (like phone calls and faxes) with secure, centralized messaging.

- CPSI, Ltd.: CPSI primarily serves community and rural healthcare organizations with its EHR and associated services. They contribute by providing cost-effective patient engagement tools to these specific market segments, helping smaller facilities manage patient interactions efficiently.

Leaders' Announcements

- In February 2025, Paul Brient, chief product officer at Athenahealth, announced the Patient Digital Engagement Index (PDEI), which was launched in 2023 and is a novel tool that provides activity measurements and tracking of patients.

- In February 2025, Casey Pittock, CEO of Smart Meter, announced AI-driven applications integration with companies' cellular-enabled health monitoring devices to offer easier patient engagement in the company's care while providing healthcare professionals with crucial data for improved decision-making.

Recent Developments

- In March 2025, Health Catalyst, Inc. announced the acquisition of Upfront Healthcare Services, Inc. in a deal valued at USD 86 million, with an additional earnout potential of USD 33.4 million to enhance its patient engagement capabilities.

- In February 2025, athenahealth announced findings from new research using de-identified data from more than 6,300 practices and over 50 million patients, which shows healthcare practices with higher patient digital engagement experience enhanced financial performance and saw a reduction in time spent on after-hours documentation.

- In September 2024, AiCure, a leading AI and advanced data analytics company that monitors patient behavior and enables remote patient engagement in clinical trials, launched its patient engagement platform, H.Code, at the 14th Annual DPHARM conference.

Segments Covered in the Report

By Component

- Software

- Standalone

- Integrated

- Services

- Consulting

- Implementation and Training

- Support and Maintenance

- Others

- Hardware

By Therapeutic Area

- Chronic Diseases

- Fitness

- Women's Health

- Mental Health

- Others

By Functionality

- Communication

- Health Tracking and Insights

- Billing and Payments

- Administrative

- Patient Education

- Others

By Application

- Social Management

- Health Management

- Home Healthcare Management

- Financial Health Management

By End Use

- Payers

- Providers

- Individual Users

By Delivery Type

- Web/Cloud-based

- On-premise

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting