January 2025

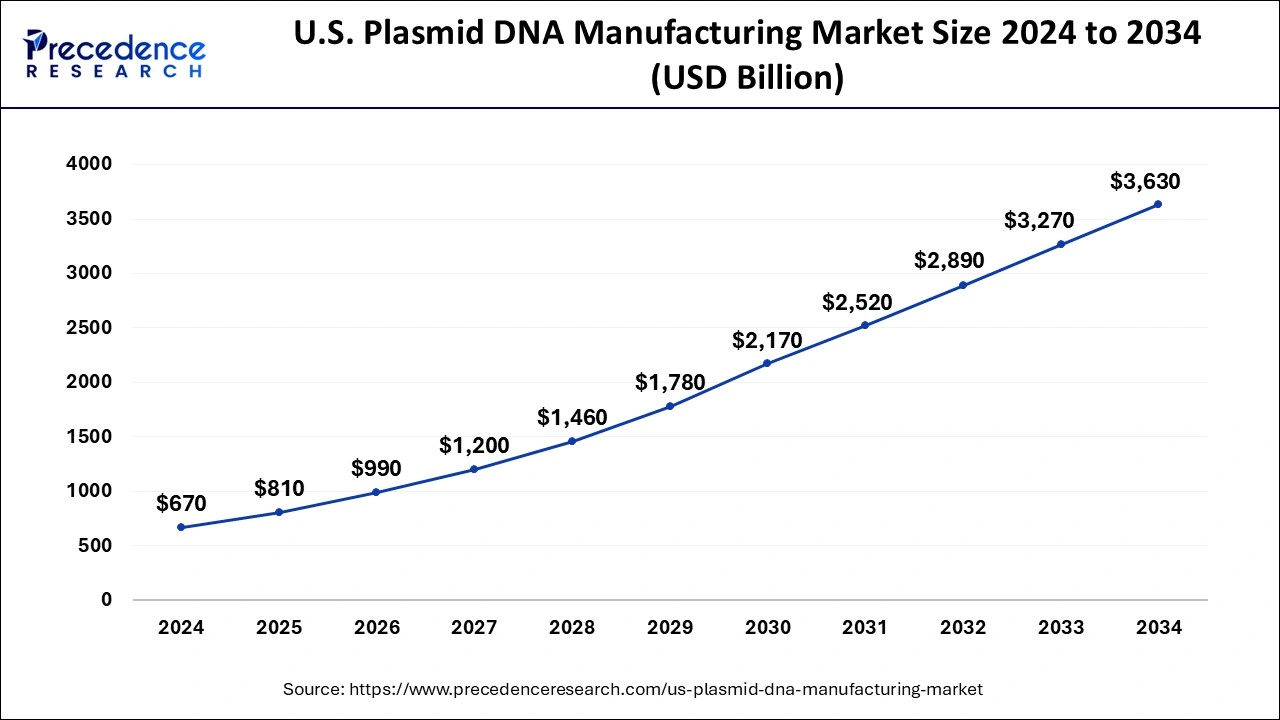

The U.S. plasmid DNA manufacturing market size is calculated at USD 810 million in 2025 and is forecasted to reach around USD 3,630 million by 2034, accelerating at a CAGR of 18.41% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. plasmid DNA manufacturing market size was estimated at USD 670 million in 2024 and is predicted to increase from USD 810 million in 2025 to approximately USD 3,630 million by 2034, expanding at a CAGR of 18.41% from 2025 to 2034.

The U.S. plasmid DNA manufacturing market revolves around the process of producing plasmid DNA molecules in large quantities for various applications, particularly in biotechnology and molecular biology. Plasmids are small, circular DNA molecules that exist separately from the chromosomal DNA in bacterial cells. They often carry genes that can be beneficial to the host organism or serve as a vector for the introduction of foreign genes.

Plasmid DNA manufacturing plays a crucial role in biotechnological and medical applications, including gene therapy, vaccine development, and the production of recombinant proteins for therapeutic use. The process is designed to ensure the production of high-quality, pure plasmid DNA suitable for research, clinical, or commercial purposes.

| Report Coverage | Details |

| Market Size in 2025 | USD 810 Million |

| Market Size by 2034 | USD 3,630 Million |

| Growth Rate from 2025 to 2034 | CAGR of 18.41% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Application, By Disease |

Growth in gene therapy development

Plasmid DNA is becoming more and more in demand as gene therapy advances. Producing lentivirus, AAV (adeno-associated virus), and other viral vector platforms need pDNA. Numerous life-threatening conditions, including heart disease, AIDS, cystic fibrosis, and age-related ailments, are also on the rise, along with several genetic abnormalities. For instance, the Centers for Disease Control and Prevention reported that in 2021, hypertension was a significant or contributing cause of 691,095 deaths in the United States. Over half of individuals (48.1%, 119.9 million) have hypertension if their systolic blood pressure is greater than 130 mmHg, their diastolic blood pressure is greater than 80 mmHg, or if they are taking medication for hypertension.

Rather than just reducing symptoms like other therapies do, gene therapy using viral vectors offers patients with genetic illnesses and other life-threatening disorders a full cure. Numerous clinical trials on plasmid DNA production and viral vectors are underway, highlighting the potential of gene therapy to meet critical medical requirements. Thus, this is expected to drive the growth of the U.S. plasmid DNA manufacturing market in the upcoming years.

High cost and regulatory challenge

The production of plasmid DNA, especially at large scales, can be costly. The need for sophisticated bioprocessing facilities, skilled personnel, and quality control measures contributes to the high production costs, which can be a restraint for some companies. Additionally, the regulatory environment for gene therapies and DNA-based products can be complex. Meeting regulatory requirements and obtaining approvals for new products may pose challenges, delaying the introduction of plasmid DNA-based therapies to the market. Thus, hampering the U.S. plasmid DNA manufacturing market over the forecast period.

Growing collaboration

The growing collaboration is expected to offer a lucrative opportunity for the U.S. plasmid DNA manufacturing market during the forecast period. For instance, in May 2023, Forge Biologics, a pioneer in the production of genetic medicines, and Labcorp, a preeminent international life sciences enterprise, partnered on the development and production of gene therapy.

Adeno-associated virus (AAV) mediated gene therapy programs will now have more accessibility to services due to this strategic collaboration, which will also provide manufacturing capabilities, drug development services, and coordinated scientific expertise to gene therapy clients across the industry.

The viral vectors segment held the largest share of the U.S. plasmid DNA manufacturing market owing to the growing gene therapy applications. Both plasmid DNA and viral vectors are crucial components in gene therapy. Plasmid DNA can be used to carry therapeutic genes, but viral vectors, such as adenoviruses, lentiviruses, and adeno-associated viruses (AAVs), are often employed as carriers to efficiently deliver genes into target cells. The development and manufacturing of plasmid DNA and viral vectors are interconnected in the gene therapy field.

Besides, the Plasmid DNA segment is expected to grow at a significant rate over the forecast period. Plasmid DNA is employed in the development of DNA vaccines. These vaccines use the genetic material of a pathogen, typically a virus or bacterium, to stimulate an immune response. The Plasmid DNA manufacturing market plays a vital role in providing the necessary plasmids for the production of DNA vaccines. Thereby, driving the segment growth.

The gene therapy segment held the largest share of the U.S. plasmid DNA manufacturing market in 2024. Plasmid DNA serves as a vector for delivering therapeutic genes into target cells. In gene therapy, plasmid vectors are designed to carry specific therapeutic genes that can correct, replace, or introduce new genetic information into the patient's cells. In addition, plasmid DNA is used in conjunction with gene editing technologies such as CRISPR-Cas9 to facilitate precise modifications of the genome.

Plasmids can carry the necessary components for gene editing and serve as a delivery vehicle to introduce these components into target cells. The DNA vaccines are expected to grow at the highest CAGR during the forecast period. DNA vaccines, including their plasmid vectors, can be developed and manufactured relatively quickly compared to traditional vaccines. The plasmid DNA manufacturing market's ability to provide scalable and efficient processes contributes to the rapid development of DNA vaccines in response to emerging infectious diseases.

The cancer segment held the largest share of the U.S. plasmid DNA manufacturing market in 2024. The segment growth is attributed to the increasing prevalence of cancer in the U.S. For instance, according to the National Institute of Health, it is anticipated that there will be 609,820 cancer deaths and 1,958,310 new cancer cases in the US in 2023. After two decades of reduction, the incidence of prostate cancer rose by 3% yearly from 2014 to 2019, representing an additional 99,000 new cases; otherwise, however, men's incidence trends were more positive than women's.

The infectious disease is expected to grow at a rapid rate over the forecast period. The plasmid DNA manufacturing market plays a crucial role in the development and production of various technologies and products related to infectious diseases. Plasmid DNA is utilized in different applications, including the development of vaccines, diagnostics, and therapeutic interventions. Thereby, driving the segment growth.

By Product

By Application

By Disease

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

December 2024