List of Contents

U.S. Point of Care Infectious Disease Testing Market Size and Forecast 2025 to 2034

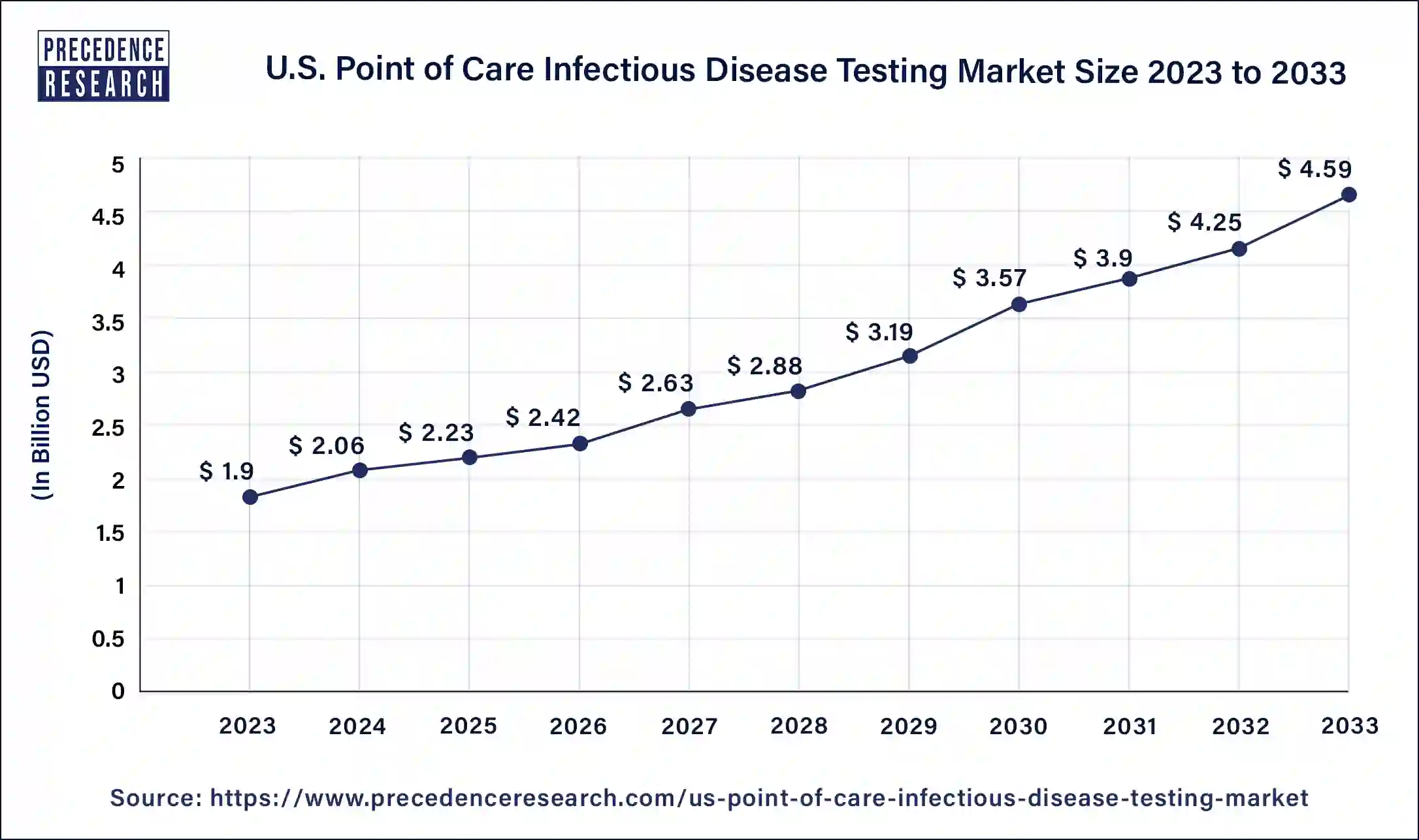

The U.S. point of care infectious disease testing market size is calculated at USD 2.06 billion in 2024 and is expected to reach around USD 4.93 billion by 2034. The market is expanding at a solid CAGR of 9.30% over the forecast period 2024 to 2033. The U.S. point of care infectious disease testing market is driven by the rising need for quick diagnosis to start therapy early.

U.S. Point of Care Infectious Disease Testing Market Key Takeaways

- By disease, the influenza/flu segment has held a major revenue share of 24.42% in 2024.

- By disease, the respiratory syncytial virus (RSV) segment is the second largest in the market in 2024.

- By end-user, the hospitals segment dominated market with the largest revenue share of 38.56% in 2024.

What is the Role of AI in the US Point of Care Infectious Disease Testing Market?

Artificial intelligence (AI) based POCT offers significant benefit over traditional methods including improved workflow efficiency, higher accuracy, and faster results. In diagnostics, AI algorithms can analyze medical images like CT scans, X-rays, and MRIs, identifying subtle anomalies that may be missed by the human eye. This aids in the early detection of diseases like cancer and allows timely interventions to improve patient outcomes.

AI based models has ability to analyze vast clinical and experimental datasets may allow precise disease diagnosis, treatment prognosis, and the prediction or development of new anti-microbial compounds. AI in healthcare benefits include support mental health, assists in improving surgery, leads to better data driven decision within the healthcare system, helps in prevention and control of many diseases, and helps in prediction of many risks and diseases.

Market Overview

Since infections can spread from person to person and throughout populations, pathogenic microbes pose a threat to public health and the economy and cause infectious diseases. Effective diagnostic tools are required to deliver precise and timely assistance for case identification, transmission disruption, and proper treatment administration. Point of care (POC) tests function as a personal "radar" and deliver actionable data close to the patient.

Point of care tests (POCT) detect a range of biomarkers associated with infectious disorders, such as viral particles, nucleic acids, proteins, and antibodies. These include compact molecular diagnostic systems, lateral flow assays, microfluidics, plasmonic technologies, and paper-based assays, among others. POCTs provide the cornerstone of infectious illness diagnosis and therapy that is "patient centralized."

Point-of-care testing (POCT) has become increasingly popular due to changes in health management models, advances in interdisciplinary technologies, and growing public awareness of disease prevention. Numerous affordable, lightweight, and quick POCT devices have been developed to support patient prognostic improvement, disease control, and health management.

U.S. Point of Care Infectious Disease Testing Market Data and Statistics

- In May 2023, Sensible Diagnostics created a tiny, inexpensive sample-to-answer device to complete PCR in ten minutes. The company plans to introduce its system with affordable test cartridges in early 2024, first concentrating on point-of-care testing for infectious diseases.

- According to the World Health Organization, by the end of 2022, an estimated 39.0 million people were HIV positive.

U.S. Point of Care Infectious Disease Testing Market Growth Factors

- Growing awareness among people for point of care testing.

- Technological innovations in point-of-care testing devices.

- Increasing prevalence of infectious diseases.

- Focus on rapid diagnostics in hospitals and clinics.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 2.06 Billion |

| Market Size in 2025 | USD 2.23 Billion |

| Market Size by 2034 | USD 4.93 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.12% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Disease and End-user |

Market Dynamics

Driver

Latest trends of consumer-centric services coupled with high demand for portable and rapid testing devices

Consumer-centric services prioritize patient's wants and preferences and place greater emphasis on user experience, convenience, and accessibility. This translates into an increasing need for testing solutions in infectious disease testing that are simple to use, yield fast findings, and can be carried out outside of conventional healthcare facilities like clinics and hospitals.

Numerous point-of-care testing devices that address these needs have been developed due to the growth of consumer-centric services. Because these devices are frequently small, lightweight, and easy to use, people can conduct tests independently or with little help from medical experts. This accessibility facilitates early diagnosis and treatment of infectious diseases and gives people more control over their healthcare. This drives the growth of the U.S. point of care infectious disease testing market.

Restraint

Limitations associated with point of care testing

The former frequently show lower sensitivity and specificity when comparing point-of-care testing to laboratory-based assays. This indicates that false-positive and false-negative test findings are more frequent, which might result in incorrect diagnosis and treatment. The reduced accuracy of POCT can be a significant problem in the case of infectious diseases, where precise diagnosis is essential for patient treatment and public health. The operator's proficiency and expertise can impact the accuracy of point-of-care tests.

Errors and incorrect diagnoses can be caused by improper procedures or unskilled people interpreting the results. Although it might be resource-intensive, ensuring healthcare providers using POCT devices have the necessary training and proficiency is crucial.

Opportunity

Need for better and regular monitoring systems in near-patient settings

Infectious disease prevalence remains a concern for world health. Epidemics of HIV/AIDS, hepatitis, influenza, and sexually transmitted infections (STIs) in the United States underscore the need for prompt and efficient diagnostic services. New point-of-care test instruments that provide quick and precise findings are the product of technological breakthroughs.

These gadgets are becoming more affordable, portable, and user-friendly, making them appropriate for usage in various near-patient environments, including community health centers, clinics, and emergency rooms. This opens an opportunity for the growth of the U.S. point of care infectious disease testing market.

Disease Insights

The influenza/flu segment underwent notable growth in the market during 2024.

- In April 2025, the launch of the Metrix COVID/Flu Test the second assay on the Metrix Molecular Platform for use at the point of care and in the home was announced by SEKISUI Diagnostics, a global medical diagnostics manufacturer. The Metrix COVID/Flu Test is a molecular test intended for the qualitative detection and differentiation of RNA from SARS-CoV-2, Influenza-A and Influenza-B from anterior nares swab samples.

(Source: SEKISUI Diagnostics launches Metrix COVID/Flu Test for use at the point-of-care and home)

The respiratory syncytial virus (RSV) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- In May 2025, the launch of a new rapid diagnostic testing tool to detect respiratory syncytial virus (RSV) in professional healthcare settings was announced by SEKISUI Diagnostics, a global medical diagnostics manufacturer. The OSOM RSV Test is a rapid immunochromatographic assay for the qualitative detection of RSV nucleoprotein antigen in anterior nasal swab specimens from patients with signs and symptoms of respiratory infections in just 15 minutes.

(Source:SEKISUI Diagnostics Announces Launch of the OSOM RSV Test)

U.S Point of Care Infectious Disease Testing Market Revenue (USD Mn), By Disease, 2022 to 2024

| By Disease | 2022 | 2023 | 2024 |

| Pneumonia or Streptococcus-associated infections | 290.44 | 314.52 | 341.46 |

| Respiratory syncytial virus (RSV) POC | 381.36 | 410.21 | 442.37 |

| TB and drug-resistant TB POC | 217.92 | 234.64 | 253.29 |

| Influenza/Flu POC | 426.64 | 465.85 | 509.89 |

| HIV POC | 143.98 | 155.6 | 168.59 |

| Others (Clostridium difficile POC, HBV POC, etc.) | 308.49 | 327.81 | 349.15 |

End-user Insights

The hospitals segment enjoyed a prominent position in the market during 2024 and is set to experience the fastest rate of the market growth from 2025 to 2034.

- In June 2025, next-generation CMAT Advantage to Accelerate Chronic Disease Detection and Transform Point of Care Diagnostics was launched by Brina Medical (US) LLC.

U.S Point of Care Infectious Disease Testing Market Revenue (USD Mn), By End User 2022-2024

| By End User | 2022 | 2023 | 2024 |

| Hospitals | 678.53 | 735.96 | 800.29 |

| Clinics | 320.34 | 344.82 | 372.12 |

| Home | 155.83 | 166.98 | 179.37 |

| Assisted Living Healthcare Facilities | 177.95 | 192.77 | 209.36 |

| Laboratories | 287.26 | 310.44 | 336.35 |

| Others (Ambulatory Surgical Centers, etc.) | 148.94 | 157.65 | 167.24 |

U.S. Point of Care Infectious Disease Testing Market Companies

- Beckton Dickinson

- Roche

- Biomerieux

- Siemens

- Bio-rad

- Chembio Diagnostic Systems

- Quidel Corporation

- Abbott

Recent Developments

- In July 2025, to expand INDICAID portfolio, Phase Scientific, a fastest growing biotech company known for its science driven innovation and commitment to improve healthcare outcomes announced that it has entered into an exclusive U.S. distribution agreement with Lumos Diagnostics for FebriDx, a rapid point of care (POC) test that aids in the diagnosis of bacterial acute respiratory infection and differentiation from non-bacterial etiology in approximately 10 minutes using a single drop of blood.

(Source: PHASE Scientific Launches FebriDx in U.S. to Expand INDICAID Portfolio) - In December 2024, a molecular diagnostic test for the H5N1 virus was launched by Amid reports of the first severe human case of bird flu in the U.S. According to the clinical testing giant, its H5 test can be used to help check potential human exposure, as the virus has begun to spread through outbreaks at poultry farms and dairy herds across the country as well as among wild bird populations.

(Source: Labcorp launches bird flu test amid first severe case in the US)

Segments Covered in the Report

By Disease

- Pneumonia Or Streptococcus Associated Infections

- Respiratory Syncytial Virus (RSV)

- TB and Drug Resistant TB POC

- Influenza/Flu POC

- HIV POC

- Others

By End-user

- Hospitals

- Clinics

- Home

- Assisted Living Healthcare Facilities

- Laboratories

- Others

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client