July 2024

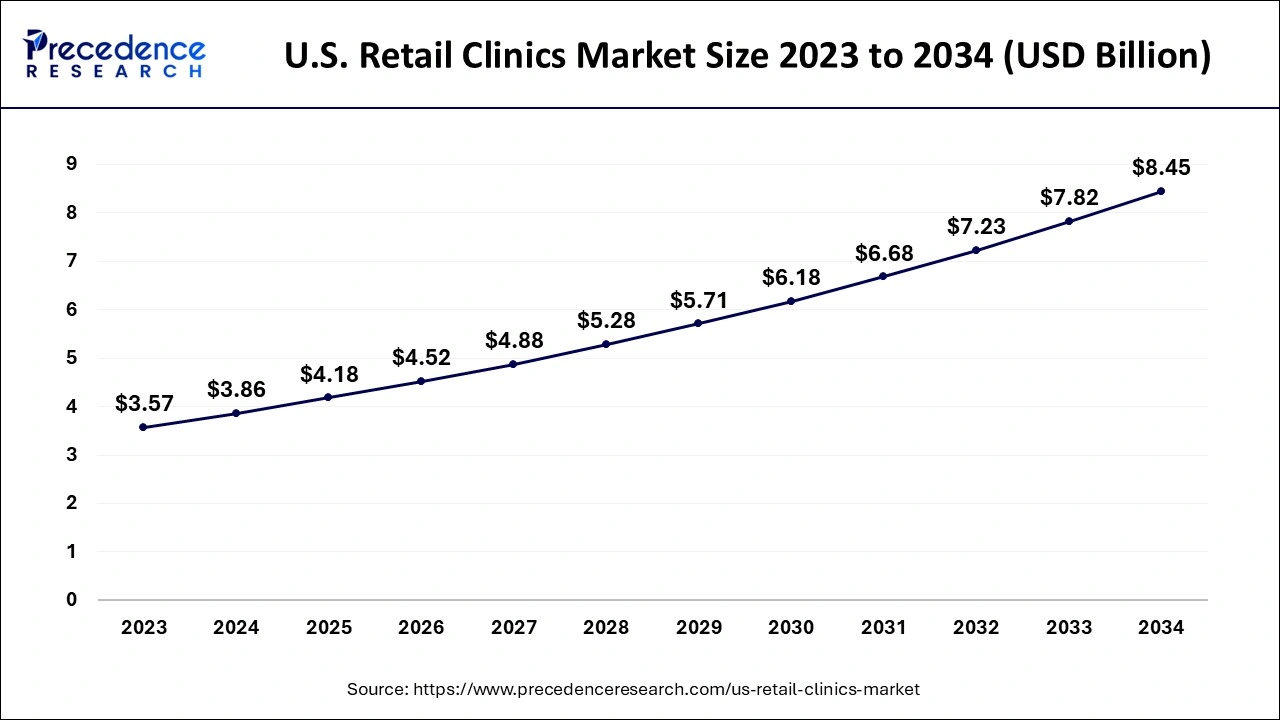

The U.S. retail clinics market size is evaluated at USD 3.86 billion in 2024, grew to USD 4.18 billion in 2025 and is projected to reach around USD 8.45 billion by 2034. The market is expanding at a CAGR of 8.15% between 2024 and 2034.

The U.S. retail clinics market size is calculated at USD 3.86 billion in 2024 and is projected to surpass around USD 8.45 billion by 2034, expanding at a CAGR of 8.15% from 2024 to 2034. The rapid evaluation of the healthcare industry in the United States and the demand for faster treatment providing healthcare solutions drive the growth of the U.S. retail clinic market.

Retail centers are emerging healthcare centers that are located in retail locations such as grocery stores, pharmacies, and department stores. These healthcare centers are specially designed for manageable or non-emergent health conditions. The clinics are well equipped with all the necessary medical devices and nursing facilities, and the physician’s assistants are certified to treat non-life-threatening conditions and injuries. These clinics are considered the most cost- and time-efficient alternative to the traditional type of healthcare setting.

How Can AI Impact the U.S. Retail Clinics Market?

The integration of AI into healthcare is revolutionizing the industry with greater precision in treatment, healthcare devices, or instruments and improves patient outcomes. Artificial Intelligence in retail clinics is significantly changing the area of healthcare. AI and automation are increasing the personalization and diagnostic accuracy in patients with the help of advanced data and machine learning algorithms. Further investment in technological advancements in healthcare is improving the quality and efficiency of healthcare services in retail clinics.

| Report Coverage | Details |

| Market Size by 2034 | USD 8.45 Billion |

| Market Size in 2024 | USD 3.86 Billion |

| Market Size in 2025 | USD 4.18 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.15% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Ownership, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Rising awareness about health in the population

The increasing awareness about the healthcare and healthcare facilities in the country and the rising spending culture on self-well-being are contributing to the expansion of the U.S. retail clinics market. Retail clinics are an efficient alternative to the traditional type of medical settings, which provide essential treatment for non-emergent type of conditions like flu, cold, sore throat, allergies, strains and sprains, minor cuts, scraps, rashes, and minor respiratory conditions. They also provide diagnostics and preventive care services, including blood samplings, health screenings, and vaccination in the different commercial spots.

Unavailability of emergency services

The unavailability of emergency healthcare facilities with specialists and the lack of awareness among people about ambulatory healthcare services are limiting the expansion of the U.S. retail clinic market.

The rising number of supermarkets and hypermarkets

The increasing number of supermarkets and hypermarkets in the United States is due to the rising consumer base for consumer goods. Supermarkets are the ideal place to be engaged throughout the year. There are several leading supermarket giants are investing in retail clinics to provide rapid and essential treatment to patients. There is a rising preference for adopting walk-in healthcare services that are more cost- and time-efficient. Additionally, the rising government intervention in the further launch of healthcare facilities and product advancements are observed in the recent years.

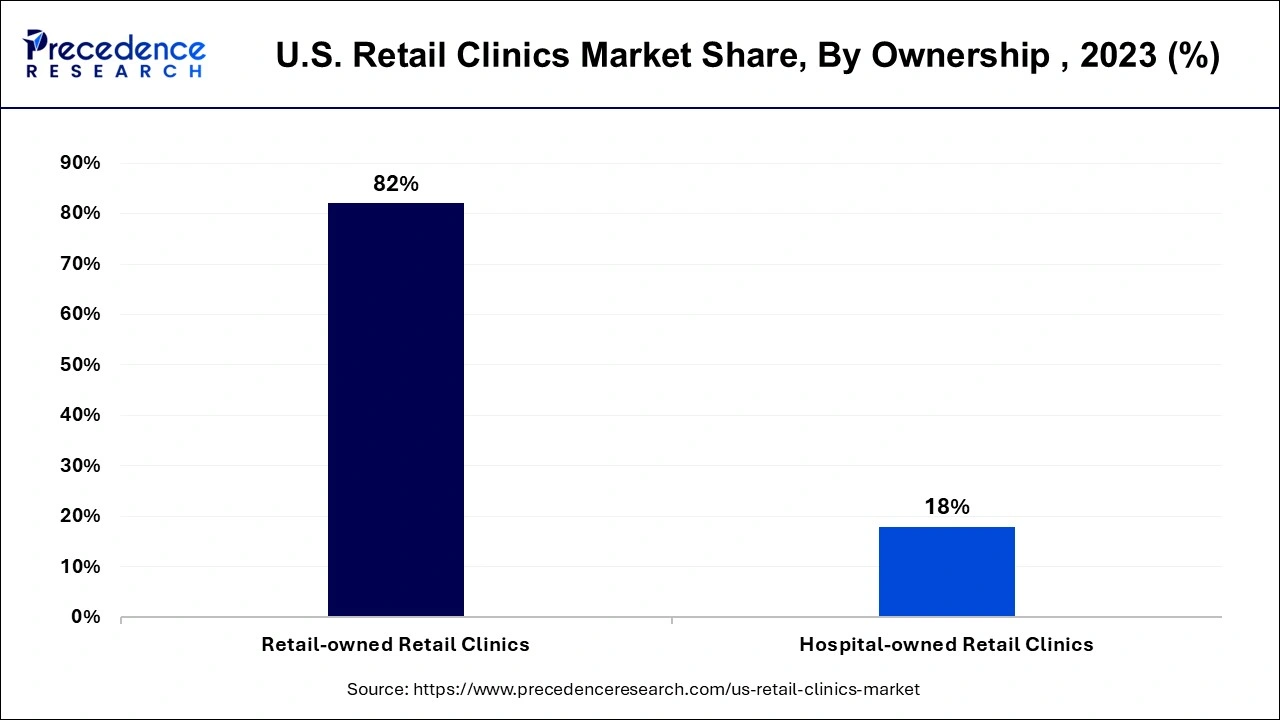

The retail-owned segment dominated the U.S. retail clinics market in 2023. The increasing presence of the retail clinics owned by the retail stores, which have the ability to provide efficient and non-emergent treatment to patients, drives the growth of the segment. Retail clinics are one of the emerging fields in healthcare settings and provide quality that is comparable to other settings. Several leading retailers are investing in retail clinics to provide healthcare and transport physicians or clinical providers to patients' homes. This is a cost-effective solution and is considered the best alternative to traditional healthcare settings, which collectively boosts the growth of the segment.

The hospital-owned segment is predicted to witness significant growth in the U.S. retail clinics market over the forecast period. The leading healthcare sector is heavily investing in retail clinics to provide effective treatment for patients and allow patients to be monitored at any location. Hospitals are gaining more momentum by partnering with or owning retail clinics; with the integration of retail clinics, they provide referrals to specialists or primary care physicians. The patient shows more trust in the brand name related to the retail clinics, which drives the growth of the segment.

The point-of-care segment led the U.S. retail clinics market in 2023. The rising acceptance of retail clinics for the different types of vaccination and several non-emergent diseases or conditions. Point-of-care centers provide essential treatment for patients. It offers several preventive and diagnostics services, including enabling healthcare checkups in workplaces and schools, and helps in providing blood sampling and physical exams.

The drug stores segment registered its dominance over the U.S. retail clinics market in 2023. The rising disposable income in the population drives the exceptional changes in the daily routine and lifestyle, which drives the adoption of over-the-counter drugs and supplements. This is driving the demand for drug stores that provide quick and efficient services.

The retail pharmacies segment is expected to witness substantial growth in the U.S. retail clinics market during the predicted period. The retail pharmacy landscape in the U.S. is evolving rapidly. This can be attributed to the increasing expenditure and overall health concerns.

The southeast region dominated the U.S. retail clinics market in 2023. The growth of the market is attributed to the rising prevalence of health conditions or emergency treatment in urban areas, which are majorly present in the southeast region of the United States. A large number of hospital-owned retail clinics are available in the region that have all the necessities of the healthcare settings. The rising preference for walk-in medical facilities due to the busy lifestyle and increasing healthcare spending is accelerating the growth of the region.

The western region expects significant growth in the U.S. retail clinics market during the forecast period. The rising preference for retail clinics as compared to the cost efficiency and the reduced time is driving the growth of the market in the particular region. Additionally, the rising awareness about retail clinics for the easy maintenance of health management in the population is accelerating the growth of the U.S. healthcare market across the region.

Segments Covered in the Report

By Ownership

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

February 2024

June 2024

July 2024