September 2024

US Smart Healthcare Market (By Product Type: RFID Kanban Systems, RFID Smart Cabinets, Electronic Health Records (EHR), Telemedicine, mHealth, Smart Pills, Smart Syringes) - Regional Outlook and Forecast 2025 to 2034

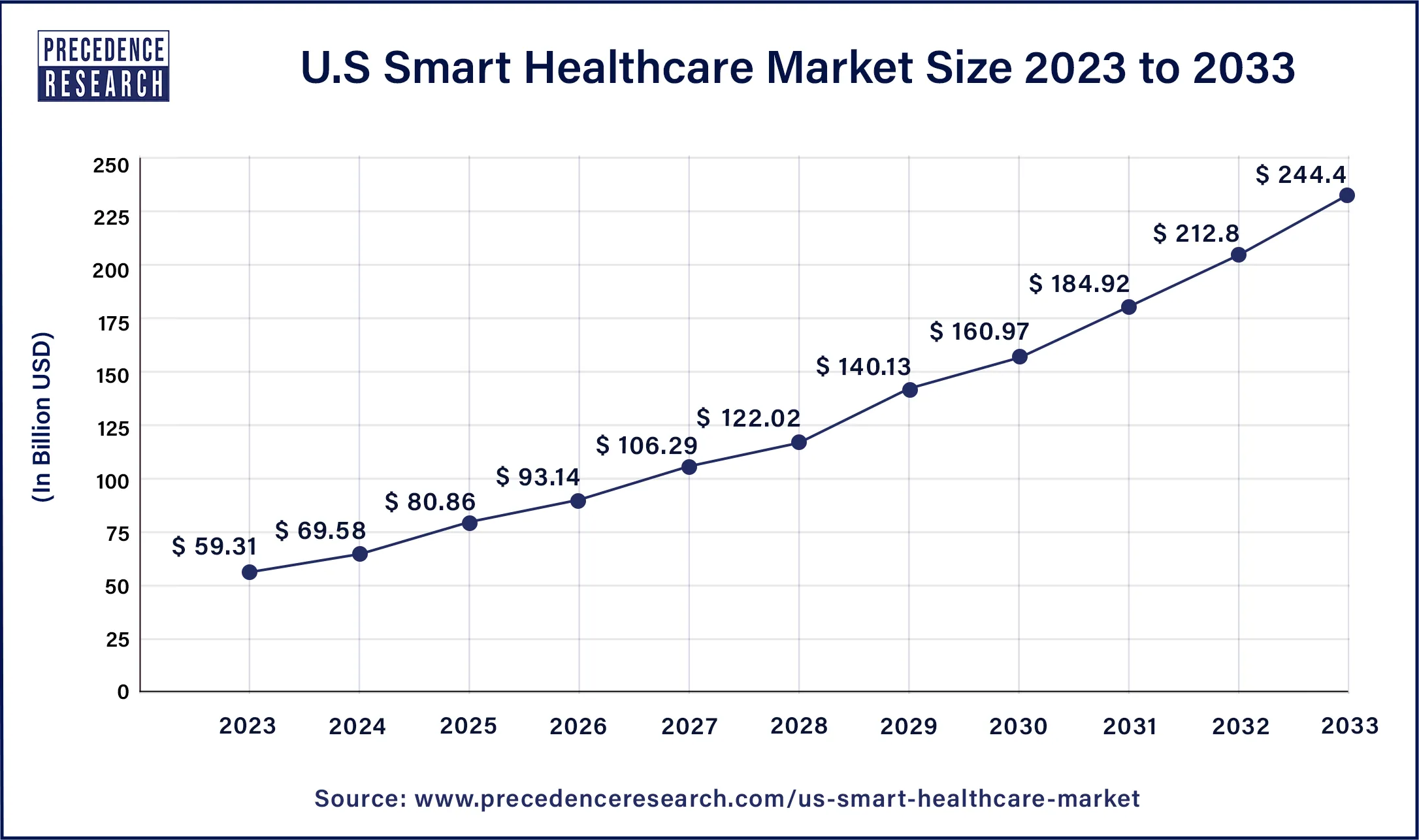

The US smart healthcare market size surpassed USD 59.31 billion in 2023 and is projected to reach USD 244.4 billion by 2033, representing a CAGR of 14.98% from 2024 to 2033. The US smart healthcare market is driven by the growing need for RPM, or remote patient monitoring.

US Smart Healthcare Market Overview

The U.S. smart healthcare market offers devices and solutions to manage chronic diseases, wearable technology and sensors gather real-time health data (heart rate, blood pressure, etc.), enabling earlier intervention and better results. Chatbots and technology-based treatment platforms provide accessible and reasonably priced mental health services. Healthcare systems are being worked on to become more interoperable so that providers may more readily share patient data.

Robotic, less intrusive operations are becoming more popular because they improve patient outcomes and hasten recovery. Technologies are being employed to promote disease prevention and early diagnosis. The proliferation of venture capital investment in smart healthcare fuels new product development and innovation.

US Smart Healthcare Market Data and Statistics

Drivers

Rapid innovation in AI, IoT, and wearables

AI algorithms can analyze massive quantities of patient data to enable early disease identification and individualized treatment regimens. Real-time surveillance and intervention are made possible by IoT devices and wearables, which continuously monitor health indicators and vital signs. The spread of user-friendly IoT wearables and gadgets motivates people to manage their health actively, encouraging wellness practices and preventive care, while promoting the growth of the U.S. smart healthcare market. AI-driven automation frees healthcare workers to concentrate more on patient care by streamlining administrative duties like booking appointments and maintaining medical records.

Consumer preference for convenience and accessibility

The desire for healthcare services that are always open to the public and unrestricted by traditional appointment scheduling is growing. With telemedicine and online monitoring tools provided by smart healthcare technologies, patients can receive medical care from the comfort of their homes. It can facilitate underprivileged people's access to healthcare services, such as those living in remote areas and those with restricted mobility. All patients can receive high-quality care because of telemedicine, mobile medical clinics, and remote diagnostic techniques that eliminate geographic barriers.

Restraints

Lack of interoperability

Often, healthcare data is kept in separate systems that are unable to communicate with one another efficiently. Because of this fragmentation, it is difficult for healthcare professionals to obtain complete patient data, resulting in inefficiencies and service gaps.

The seamless flow of information between various healthcare organizations, including hospitals, clinics, and labs, must be improved by incompatible data formats and standards. This affects patient outcomes and satisfaction by impeding provider collaboration and care coordination. Thereby, the lack of interoperability causes a major restraint for the US smart healthcare market.

Healthcare equity and access gaps

Only some have access to the high-speed internet or smartphones essential for smart healthcare solutions, particularly in remote or underprivileged locations. Access disparities are made worse by differences in digital and health literacy. Some populations might not be able to fully utilize or abuse smart healthcare devices because they lack the necessary knowledge or abilities. Disparities in the quality of care might result from healthcare providers' deliberate or unconscious bias or discrimination. Given that the acceptability of smart healthcare solutions depends on public confidence in the healthcare system, this may impact their uptake and efficacy.

Opportunities

Personalized public health interventions

Healthcare professionals can adjust their tactics to each patient's unique needs by considering genetic predispositions, lifestyle decisions, and environmental factors using personalized interventions. This focused approach may result in better patient satisfaction and more successful outcomes. Enabling people to participate actively in their health care promotes higher patient engagement. By receiving tailored advice and comments, patients are more likely to follow their treatment regimens and make better decisions.

Wearable technology and data analytics can be used to tailor therapies to emphasize preventive rather than reactive healthcare. Through the early detection and treatment of health disorders, before they worsen, this move can help save healthcare expenses.

Growing focus on mental health

The need for mental health services and solutions is rising as people become more aware of how crucial mental health is to overall well-being. Adopting smart healthcare solutions in this area is made more accessible by legislative initiatives to increase access to and affordability of mental health services and insurance coverage expansions for such services. Thereby, the rising emphasis on mental wellness is observed to create potential opportunities for the U.S. smart healthcare market.

Stress, anxiety, sadness, and other mental health issues are becoming more common, primarily because of cultural shifts, financial strains, and international emergencies like the COVID-19 pandemic. The increased prevalence of mental health issues increases the need for creative remedies.

The telemedicine segment dominated the U.S. smart healthcare market in 2023. Patients can obtain medical services remotely using telemedicine, eliminating the requirement for in-person consultations. Its popularity has been greatly influenced by its convenience, particularly in rural areas with limited access to healthcare institutions. Telemedicine has expanded due to the widespread use of cell phones, high-speed internet, and advanced communication technology. Remote healthcare delivery has become smoother with the availability of video calls, chat platforms, and smartphone apps allowing patients to consult with healthcare providers.

The mHealth segment is the fastest growing in the US smart healthcare market during the forecast period. With mobile health technologies, people may easily access healthcare services, keep an eye on their health, get advice, and access medical records from anywhere. Because mHealth solutions eliminate the need for costly medical procedures, hospital stays, and in-person consultations, they present affordable alternatives to traditional healthcare services.

Creating creative mHealth solutions for various healthcare requirements, including remote patient monitoring, telemedicine, and medication adherence, has been made possible by advancements in mobile technology, such as smartphones, wearables, and the Internet of Things devices.

By Product Type

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

December 2024

June 2024

May 2024