January 2025

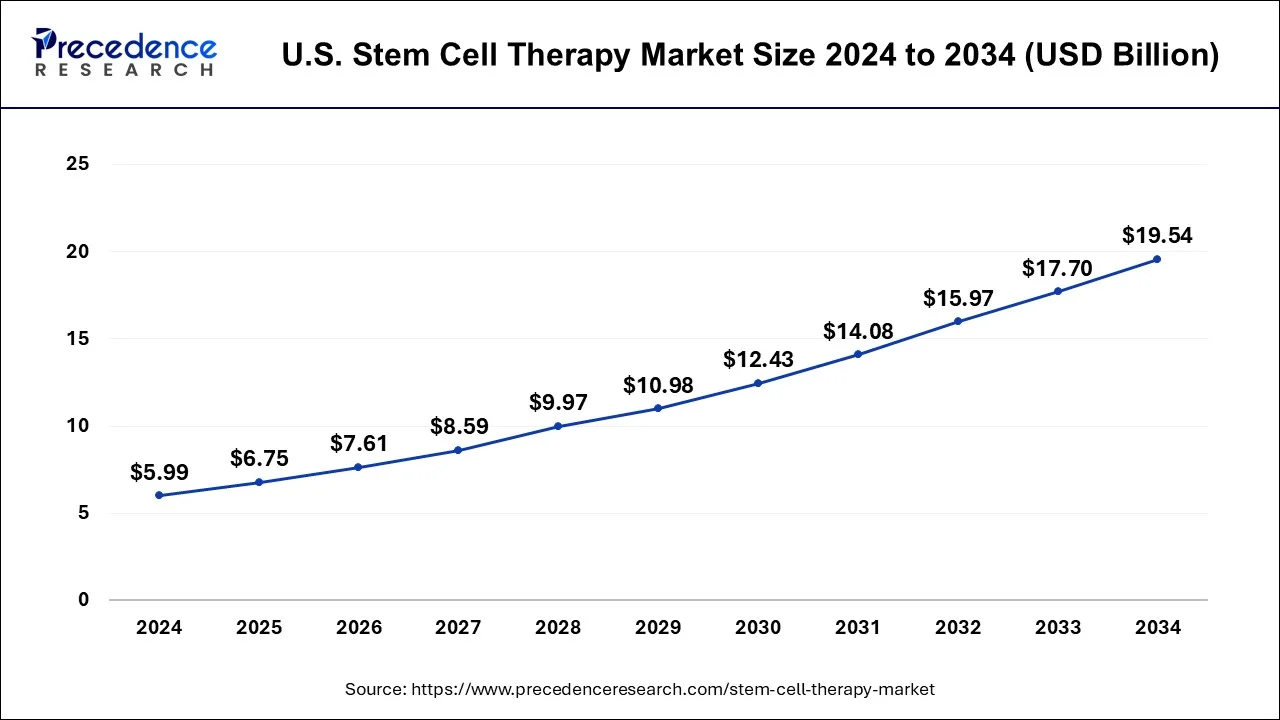

The U.S. stem cell therapy market size is calculated at USD 6.75 billion in 2025 and is forecasted to reach around USD 19.54 billion by 2034, accelerating at a CAGR of 12.55% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. stem cell therapy market size was estimated at USD 5.99 billion in 2024 and is predicted to increase from USD 6.75 billion in 2025 to approximately USD 19.54 billion by 2034, expanding at a CAGR of 12.55% from 2025 to 2034. The U.S. stem cell therapy market is driven by the increasing incidence of chronic illnesses, especially among the elderly population.

With the high frequency of illnesses like osteoarthritis and the potential for regenerative medicine solutions, musculoskeletal problems account for a large portion of the market. Stem cells have the potential to enhance wound healing and improve results from reconstructive surgery. Treatments for ailments such as multiple sclerosis, rheumatoid arthritis, and Crohn's disease are now in development.

The U.S. stem cell therapy market is observed to expand with multiple business activities along with fundings. Public and commercial funding aid new stem cell therapy research and development. Stem cell therapies are integrated with other technologies, such as 3D printing and artificial intelligence, for further breakthroughs. Customized stem cell therapies are more effective and have fewer negative effects for each patient. Stem cells are being modified using CRISPR and other technologies for therapeutic purposes.

The FDA declared that clinical studies for a novel Vertex type 1 diabetic stem cell therapy can begin in the US. The treatment is slated to begin clinical trials in the first half of 2023. It aims to prevent the requirement for immunosuppressive medications when replacing injured insulin-producing cells in a person with type 1 diabetes.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 12.55% |

| U.S. Market Size in 2025 | USD 6.75 Billion |

| U.S. Market Size by 2034 | USD 19.54 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Therapy Type, By Application, By Technology, and By End User |

Discovery of new stem cell sources

The variety of illnesses and ailments that can be treated with stem cell treatment is expanded by new sources of stem cells. This extension of therapeutic possibilities increases the market potential for stem cell therapies. The therapeutic qualities of various types of stem cells may differ. Researchers can now identify stem cell types with improved efficacy for medical applications due to identifying new sources, which improves patient outcomes and increases demand for these therapies.

Growth and accessibility benefits from new stem cell sources could facilitate the production of therapeutic stem cells in large quantities for broad clinical applications. This scalability helps to expand the U.S. stem cell therapy market and improves the commercial viability of stem cell therapies.

Unmet needs in chronic and degenerative disease

Many degenerative and chronic illnesses provide symptomatic alleviation or have insufficient therapy alternatives. Stem cell therapy presents hope for patients who have tried every other kind of treatment and want to address the underlying cause of their problems. The regulatory environment has changed to reflect improvements in the field, even though regulatory monitoring is still in place to guarantee the security and effectiveness of stem cell therapies. The development and commercialization of stem cell therapies are made more accessible by this regulatory clarity and support, which further propels market expansion.

With their unique ability to develop into numerous cell types, stem cells can heal damaged tissues. Their capacity to regenerate makes them appealing for the treatment of ailments where tissue destruction is a defining feature, like diabetes, Parkinson's disease, Alzheimer's disease, and spinal cord injuries.

Scientific and technological hurdles

There is still much to learn about the behavior and the uses of many types of stem cells, as stem cell research is still in its infancy. The research and approval of stem cell therapies are impeded by uncertainties around their efficacy, safety, and long-term impacts. Immune rejection is a common problem for stem cell therapies, in which the recipient's immune system assaults the transplanted cells because it perceives them as alien. Creating plans to reduce immunological rejection while maintaining the therapy's efficacy is still a significant challenge.

The regulatory environment surrounding stem cell therapy is intricate and dynamic. Stem cell therapies must pass costly, time-consuming clinical studies, regulatory approval processes, and safety evaluations.

Developing advanced technologies and delivery systems

Improved stem cell manipulation, growth, and differentiation are made possible by advanced technologies, which may result in more potent treatments for various illnesses. Advances in delivery technologies allow stem cells to be precisely targeted and released under controlled conditions, enhancing their therapeutic potential and reducing negative effects. By investing in state-of-the-art technologies and delivery methods, businesses can obtain a competitive advantage by providing superior products with enhanced patient experiences and outcomes. Thereby, such developments are observed to act as an opportunity for the U.S. stem cell therapy market.

Developing cost-effective manufacturing processes

Although expensive, stem cell therapies have not yet been widely used to treat various medical diseases. Streamlining and optimizing the manufacturing process can help organizations lower the cost of producing stem cell treatment. This could entail automation, scalability, and cell culture improvements, ultimately making these treatments more available and reasonably priced for patients.

The adult stem cells (ASCs) segment dominated the U.S. stem cell therapy market in 2024. In comparison to embryonic stem cells, adult stem cells (ASCs) have several benefits, including being more readily available, being simpler to remove from tissues like bone marrow and adipose tissue, and having a decreased chance of immunological rejection. Furthermore, improvements in science and technology have made it possible to create more effective techniques for isolating and culturing ASCs, which has increased their potential for therapeutic use. Patients and healthcare providers widely adopt ASC-based therapies due to their promising results in treating neurological disorders, cardiovascular diseases, and orthopedic injuries.

The allogenic segment dominated the U.S. stem cell therapy market in 2024. Using donor stem cells instead of the patient's own is known as allogenic stem cell treatment. Compared to autologous stem cell therapy, which involves removing the patient's cells for therapy, this method has many benefits, including shorter treatment times, more cells available for therapy, and possibly lower costs.

Allogenic stem cell therapy also gets around some of the drawbacks of autologous therapy, like how the patient's age and health state affect the quantity and quality of available stem cells. Furthermore, allogenic therapy makes it possible to produce standardized cell products that can go through stringent quality control procedures to guarantee treatment safety and uniformity.

The cell production segment dominated the U.S. stem cell therapy market in 2024. Advances have greatly improved the scalability and efficiency of manufacturing stem cells in cell production technologies, making it easier to supply the growing demand for these therapies. Furthermore, this sector is growing because regulatory frameworks now support cell production procedures more.

Furthermore, partnerships between universities, research centers, and biotech firms have sparked creativity in cell culture methods, leading to cutting-edge and more potent stem cell treatments.

The regenerative medicine segment dominated the U.S. stem cell therapy market in 2024. Since its primary goal is to use the body's innate capacity to repair and replace damaged organs and tissues, this method includes replacing or repairing damaged or diseased tissues utilizing stem cells, which can differentiate into various cell types. Techniques in regenerative medicine have promised for treating multiple illnesses, such as autoimmune diseases, neurological problems, orthopedic injuries, and cardiovascular ailments. A critical aspect of regenerative medicine that has gained popularity is stem cell therapy, which can offer individualized, minimally invasive treatments.

The hospitals segment dominated the U.S. stem cell therapy market in 2024. Hospitals often have well-established infrastructures with cutting-edge medical technology and facilities that enable them to provide various medical treatments, including stem cell therapy. Typically, it possesses extensive knowledge of regulatory compliance, guaranteeing adherence to stringent criteria and standards established by regulatory bodies. As a result, patients gain faith and confidence in the safety and effectiveness of stem cell treatments provided by hospitals.

Numerous healthcare facilities participate in stem cell therapy research and development initiatives, which result in advancements in treatment protocols and methodologies. This boosts their reputation and draws in patients looking for innovative treatments. Highly qualified medical workers, such as doctors and stem cell treatment researchers, are frequently employed by hospitals. Patients looking for cutting-edge treatment alternatives are drawn to this expertise.

By Product

By Therapy Type

By Application

By Technology

By End User

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

February 2025

November 2024