November 2024

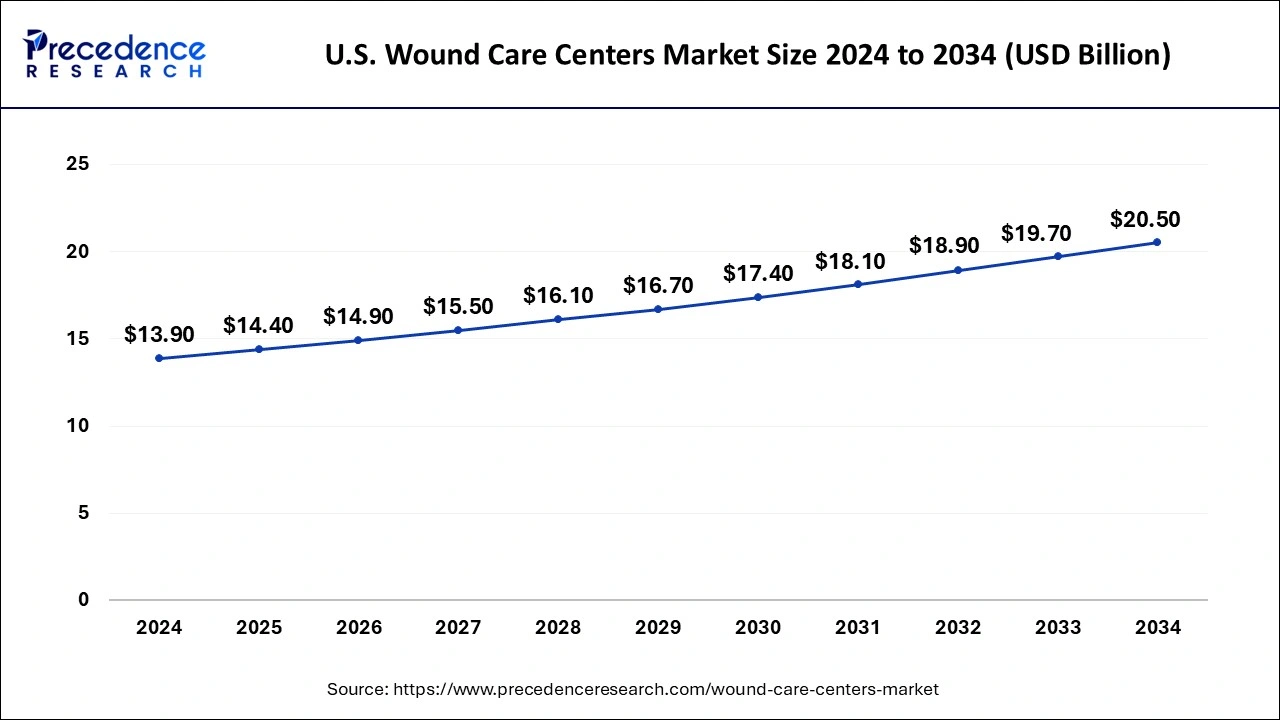

The U.S. wound care centers market size is calculated at USD 14.40 billion in 2025 and is forecasted to reach around USD 20.50 billion by 2034, accelerating at a CAGR of 3.96% from 2025 to 2034. The North America wound care centers market size surpassed USD 19.76 billion in 2024 and is expanding at a CAGR of 3.85% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. wound care centers market size was estimated at USD 13.90 billion in 2024 and is predicted to increase from USD 14.40 billion in 2025 to approximately USD 20.50 billion by 2034, expanding at a CAGR of 3.96% from 2025 to 2034.

Wound care centers, also known as wound healing centers or wound clinics, are specialized medical facilities that focus on the treatment and management of various types of wounds. These centers are staffed by healthcare professionals with expertise in wound care, including physicians, nurses, and other specialists. The primary goal of wound care centers is to facilitate the healing of chronic or non-healing wounds and to prevent complications.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 3.96% |

| U.S. Market Size in 2025 | USD 14.40 Billion |

| U.S. Market Size by 2034 | USD 20.50 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type and By Procedure |

Rising geriatric population

The number of people entering older age has increased, which has led to a change in the demographic landscape and an increase in the prevalence of chronic health disorders. Chronic wounds and pressure ulcers are more common in the elderly due to disorders including diabetes, peripheral vascular diseases, and decreased mobility.

If left untreated, these wounds can result in life-threatening consequences and extended hospital admissions. Consequently, there is a demand for healthcare institutions to offer efficient wound care options to handle these ailments. To improve healing results and improve the quality of life for the elderly, this demographic trend has increased demand for sophisticated wound care products, such as specialized dressings, negative pressure wound treatment, and wound care devices.

Additionally, the percentage of this age group in the overall population is expected to increase from 17% to 23%. Thus, the aforementioned statistics are expected to propel the U.S. wound care centers market over the forecast period.

The expensive nature of sophisticated wound care products and wound therapies

The amount spent on wound treatment in the U.S. surpasses USD 45–55 billion. Most patients also need to have their dressings changed often. Conventional NPWT devices have an initial purchase price of between USD 20,000 and USD 30,000. The disposables or consumables, including dressings and canisters, that are utilized in conjunction with NPWT devices also incur additional expenditures for end users.

Furthermore, the cost of treating traumatic injuries is high due to the necessity of several treatments, long-term rehabilitation, expensive equipment, and material-intensive surgical and non-surgical wound care. As a result, in high-income nations, the entire cost of healthcare for each burn sufferer exceeds USD 85,000, as the price of therapy has increased. Thus, the expensive nature of wound care products and wound therapies are expected to be a major restraining factor for the U.S. wound care centers market growth over the forecast period.

Increasing business activities

The increasing partnership is expected to offer a lucrative opportunity for the U.S. wound care centers market during the forecast period. Such business activities support research initiatives by facilitating the sharing of data and insights among healthcare institutions. Business activities can play crucial role in managing research data, supporting clinical trials, and fostering innovation in the healthcare sector.

The U.S. wound care centers market is segmented into hospitals and clinics. The hospitals segment held the largest share of the market in 2023 and the segment is expected to dominate the market over the forecast period due to industrialized nations' expanding patient pools and well-established healthcare infrastructure.

Furthermore, it is anticipated that the market for wound care centers will continue to rise in the future due to the increasing number of hospital employees and professional caregivers. Makeshift estimates that there are about 5.7 million workers in hospitals in the United States. The increase is also ascribed to patients' strong preferences brought on by an increase in hospital-acquired illnesses (HAI). The Centers for Disease Control (CDC) estimates that each year, 1.7 million people are infected with HAIs. Every year in the United States, more than 99,000 people pass away from HAIs as opposed to wounds from radiation, car crashes, and other causes.

Based on the procedure, the U.S. wound care centers market is bifurcated into Debridement, negative pressure wound therapy, compression therapy, hyperbaric oxygen therapy, specialized dressings, and infection control.

The hyperbaric oxygen therapy segment led the market with a 34% market share in 2024. Hyperbaric oxygen therapy involves breathing pure oxygen in a pressurized room or chamber. This increased pressure allows for higher levels of oxygen to dissolve in the bloodstream, promoting improved oxygen delivery to tissues. Oxygen is crucial for wound healing. In most areas of the United States, hyperbaric oxygen therapy has received regulatory approval for specific wound care applications. Clinical guidelines and recommendations from healthcare authorities may support the use of HBOT in certain cases.

The specialized dressings segment is expected to grow at the fastest rate during the forecast period due to the increased development of innovative and effective treatments, such as biological skin products, skin replacements, and other complicated dressing items. Growth in this market is anticipated to be aided by the rising number of skin replacement surgeries brought on by burn cases and the rising number of burn sufferers.

Skin replacements promote rapid wound healing, decrease the need for a vascularized wound bed, enhance the dermal portion of the healed wound, reduce variables that impede the healing process, and prevent scarring thereafter. It is projected that these reasons would raise the demand in care facilities for skin replacements.

By Type

By Procedure

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

September 2024

May 2024

January 2024