Wound Care Market Size and Forecast 2025 to 2034

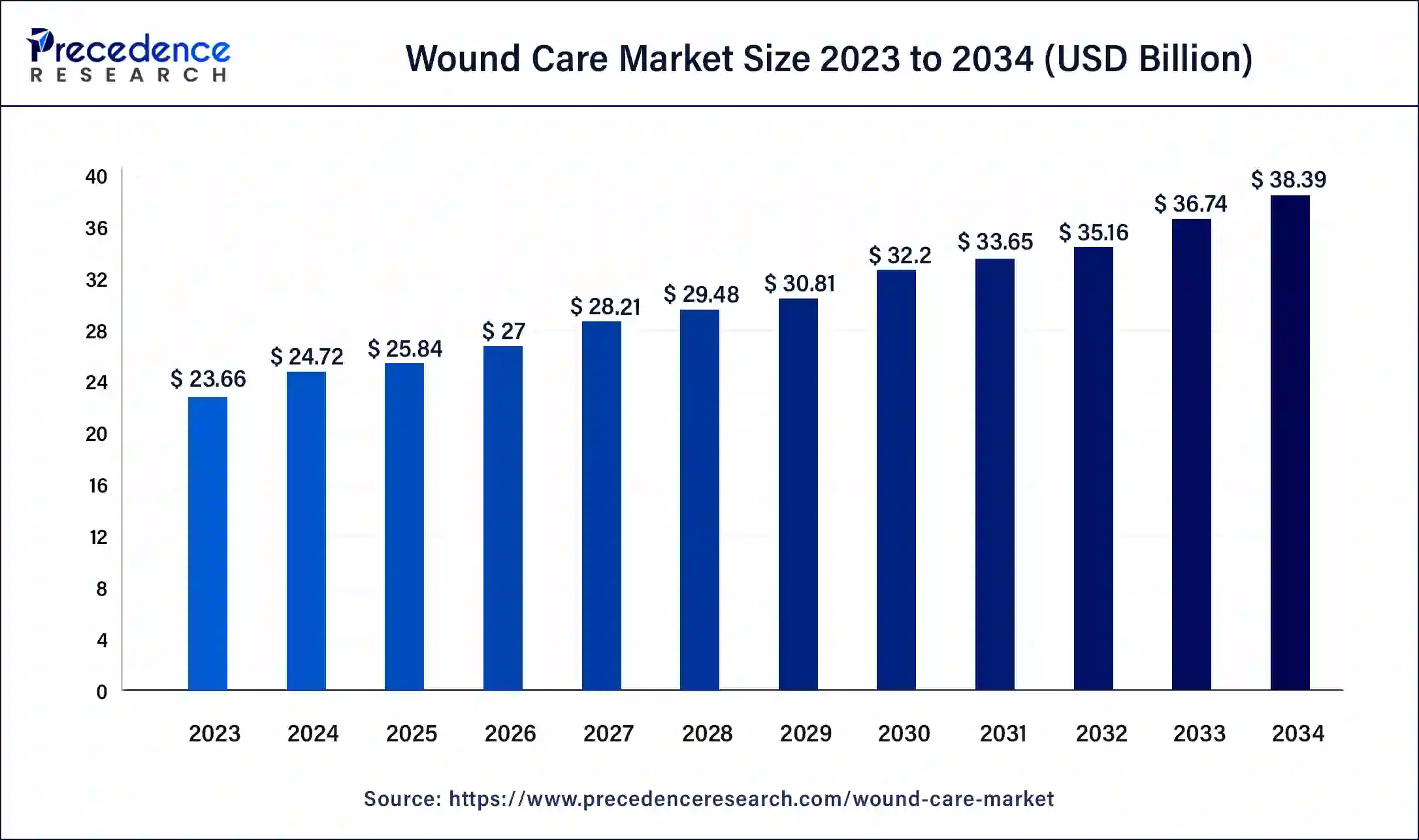

The global wound care market size was USD 24.72 billion in 2024, accounted for USD 25.84 billion in 2025, and is expected to reach around USD 38.39 billion by 2034, expanding at a CAGR of 4.5% from 2025 to 2034.

Wound Care Market Key Takeaways

- In terms of revenue, the wound care market is valued at $25.84 billion in 2025.

- It is projected to reach $38.39 billion by 2034.

- The wound care market is expected to grow at a CAGR of 4.50% from 2025 to 2034.

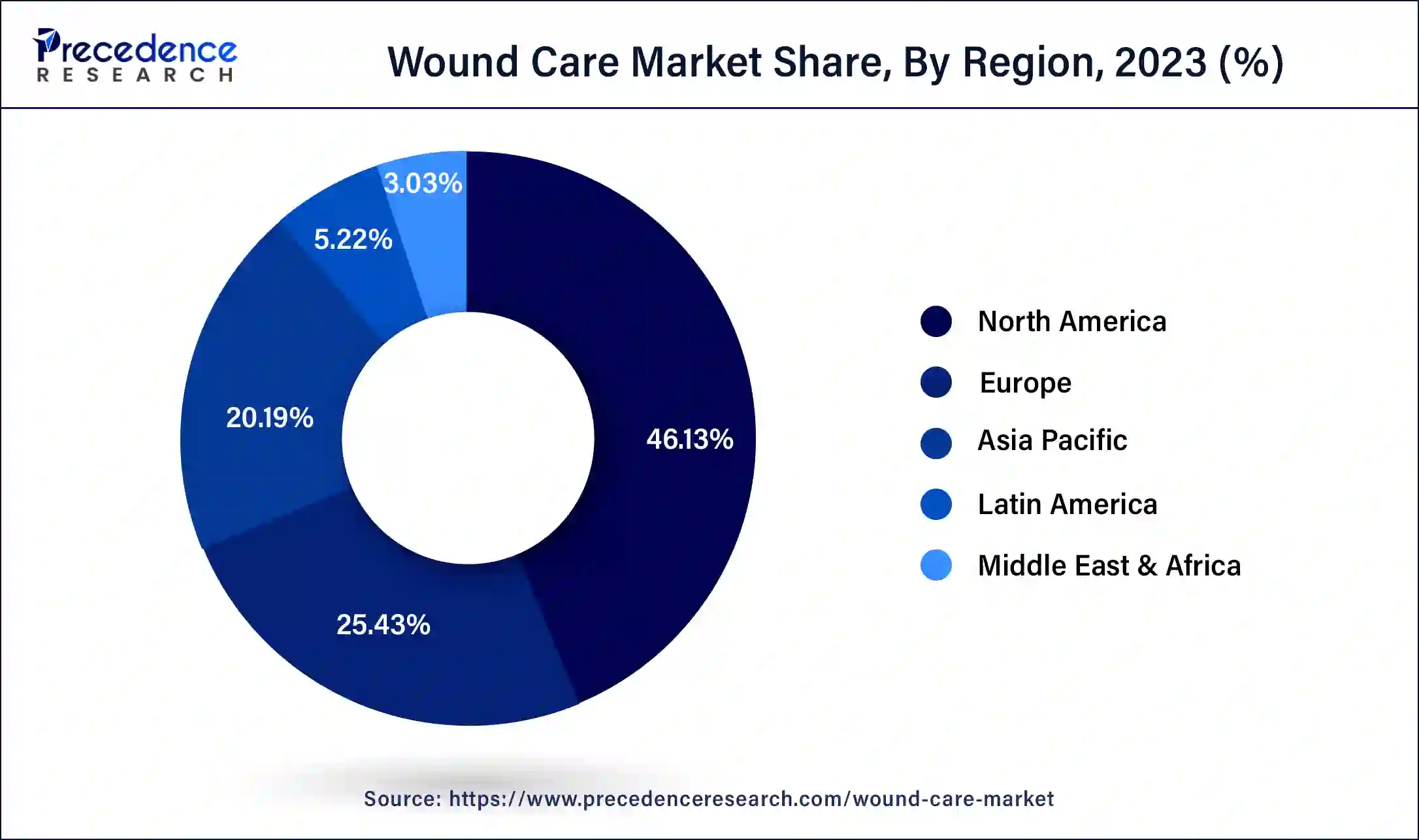

- North America contributed more than 46.13% of revenue share in 2023.

- Asia Pacific is estimated to expand the fastest CAGR between 2024 and 2034.

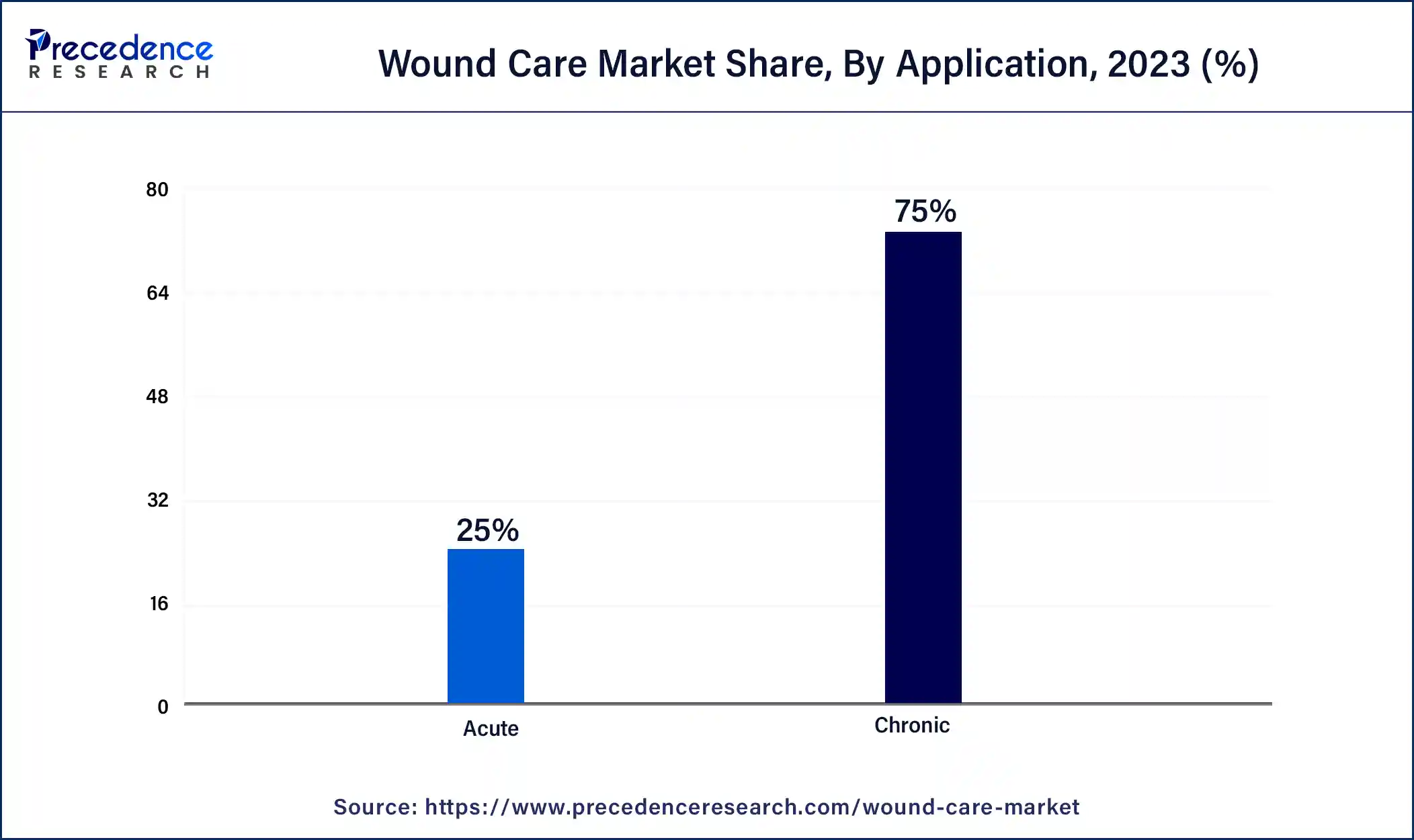

- By application, the chronic segment has held the largest market share of 75% in 2024.

- By application, the acute segment is anticipated to grow at a remarkable CAGR of 5.1% between 2025 and 2034.

- By end-use, the hospital segment generated over 39% of revenue share in 2024.

- By end-use, the home care segment is expected to expand at the fastest CAGR over the projected period.

- By product, the advanced wound dressing segment generated over 34% of revenue share in 2024.

- By product, the surgical wound care segment is expected to expand at the fastest CAGR over the projected period.

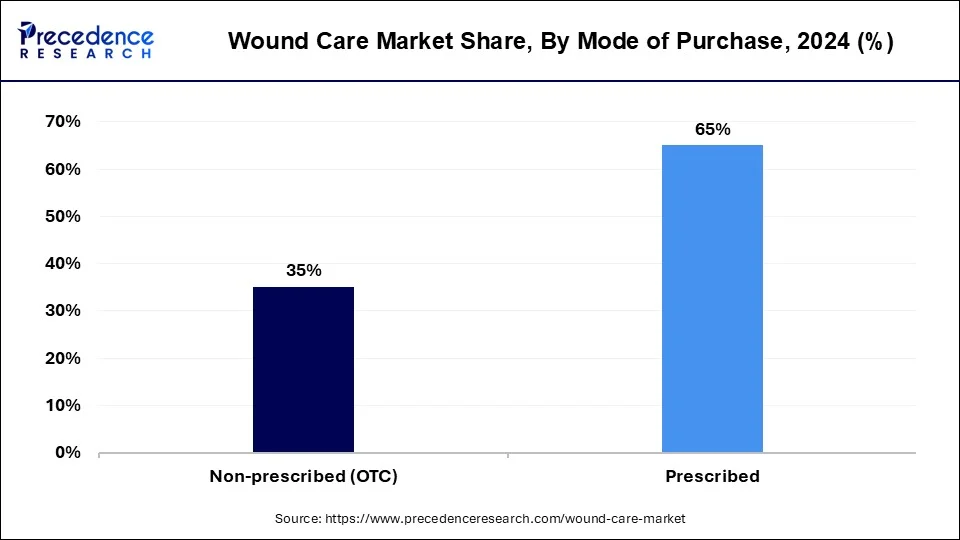

- By mode of purchase, the prescribed segment generated over 65% of revenue share in 2024.

- By mode of purchase, the non-prescribed (OTC) segment is expected to expand at the fastest CAGR over the projected period.

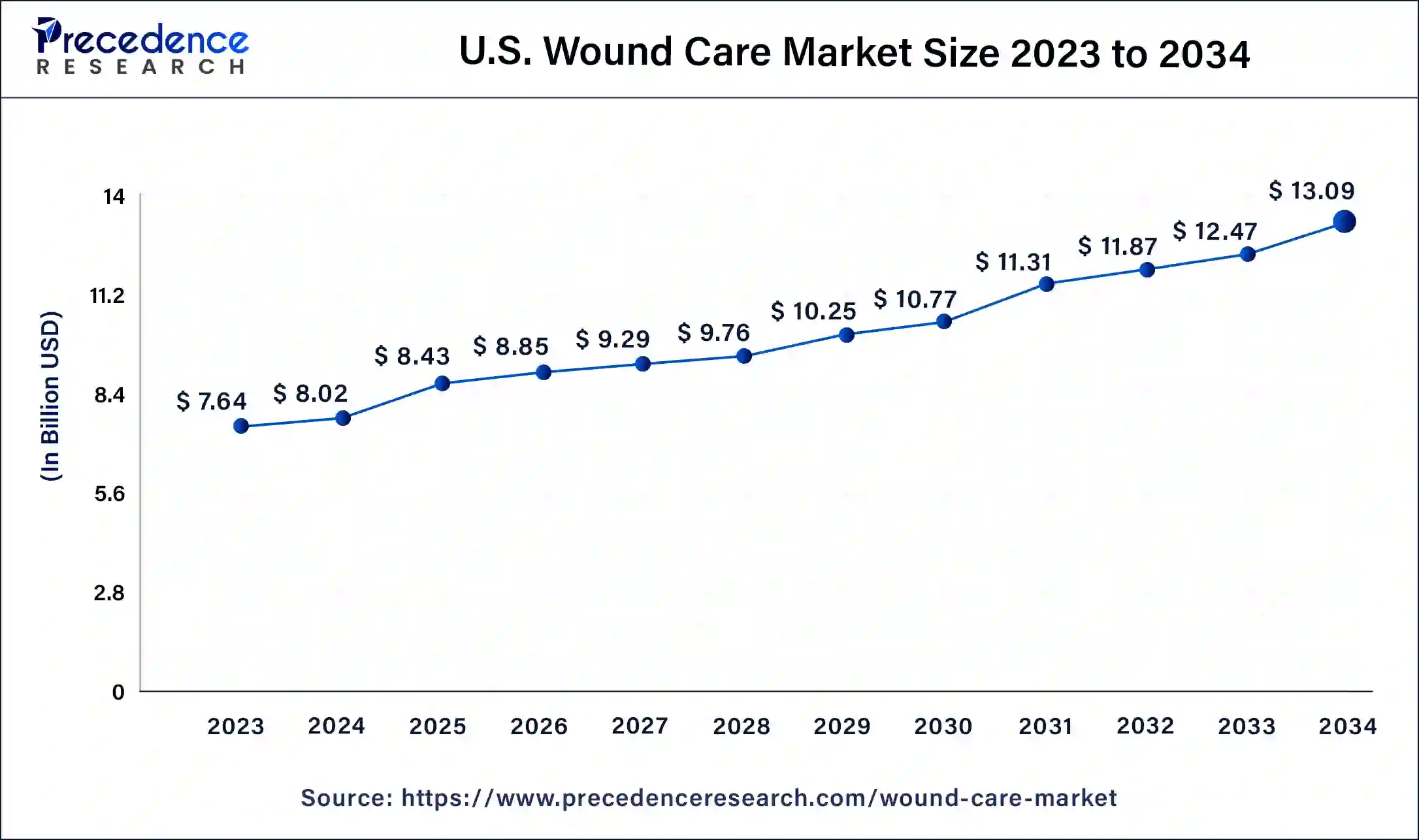

U.S. Wound Care Market Size and Growth 2025 to 2034

The U.S. wound care market size was estimated at USD 7.93 billion in 2024 and is predicted to be worth around USD 12.59 billion by 2034, at a CAGR of 5.69% from 2025 to 2034.

North America has held the largest revenue share of 46.13% in 2024. North America commands a significant share of the wound care market due to a combination of factors. The region benefits from advanced healthcare infrastructure, a high prevalence of chronic diseases necessitating wound care, and robust research and development activities. Additionally, well-established reimbursement policies and a proactive regulatory environment contribute to the rapid adoption of innovative wound-care solutions. The market's growth in North America is further propelled by a strong focus on technological advancements, increasing awareness among healthcare professionals, and a growing aging population with elevated wound care needs.

Asia Pacific is estimated to witness the highest growth. The region dominates the wound care market due to factors such as a large and aging population, a rising prevalence of chronic diseases, and increasing awareness of advanced wound care solutions. Rapid urbanization and improving healthcare infrastructure further contribute to the region's significant market share. Additionally, the adoption of innovative technologies, government initiatives promoting healthcare accessibility, and a growing demand for personalized medicine contribute to the robust growth of the wound care market in Asia Pacific.

Market Overview

Wound care involves the systematic management of skin injuries, ranging from minor cuts to more complex surgical wounds. The primary objective is to support the natural healing process, minimizing complications like infections and promoting optimal tissue recovery. This comprehensive approach includes activities such as cleaning, dressing, and closely monitoring wounds to ensure effective healing.

Advancements in wound care have led to the creation of sophisticated products and technologies, such as antimicrobial dressings, negative pressure wound therapy, and bioengineered tissues. These innovations enhance the overall efficiency of the healing process. Taking a holistic approach considers individual factors like nutrition and underlying health conditions, recognizing their impact on the overall healing process. The field of wound care is dynamic, marked by ongoing research and continual improvements, all aimed at enhancing the overall care provided to individuals dealing with both short-term and long-term wounds.

Europe is observed to grow at a considerable growth rate in the upcoming period, propelled by an aging demographic, a rise in chronic and surgical wounds, and heightened awareness of innovative wound care options. There is a notable shift toward incorporating bioactive dressings, hydrocolloids, and antimicrobial wound care products. The growth is further supported by robust healthcare infrastructure, government initiatives, and reimbursement policies. Countries such as Germany, the UK, and France lead in technological innovations, home healthcare integration, and digital wound monitoring systems, transforming conventional treatment approaches and improving patient recovery experiences in both hospital and home environments.

Germany is pivotal in the European wound care sector due to its advanced healthcare system and strong focus on innovation. The country demonstrates significant adoption of bioactive dressings and advanced moist wound healing therapies. The rising incidence of diabetic ulcers, pressure injuries, and surgical wounds is fueling demand. Additionally, Germany promotes patient-centric strategies and home-based care, bolstered by digital health integration and increased investment in local manufacturing and research and development initiatives.

Wound Care Market Growth Factors

- Increasing aging population: The growing elderly demographic globally contributes to a higher incidence of chronic wounds, driving the demand for advanced wound care solutions.

- Rising prevalence of diabetes: The escalating prevalence of diabetes, often associated with slow-healing wounds, fuels the need for specialized wound care products and therapies.

- Advancements in technology: Ongoing technological innovations, such as smart dressings and telemedicine solutions, are reshaping the wound care landscape, providing more effective and patient-friendly options.

- Growing awareness of advanced wound care: Increasing awareness among healthcare professionals and patients about the benefits of advanced wound care products is expanding the market.

- Demand for minimally invasive treatments: The preference for minimally invasive wound care treatments is on the rise, driving the development of novel techniques and products.

- Rising incidence of chronic diseases: The surge in chronic diseases, including obesity and cardiovascular conditions, contributes to an increased incidence of wounds, necessitating advanced wound care interventions.

- Expanding surgical procedures: The rising number of surgical procedures worldwide enhances the demand for post-operative wound care solutions and accelerates market growth.

- Government initiatives and healthcare policies: Supportive government initiatives and healthcare policies aimed at improving wound care outcomes are propelling market expansion.

- Increasing investments in research and development: Growing investments in R&D by key market players are leading to the introduction of innovative wound care products and technologies.

- Globalization of wound care companies: The globalization of wound care companies expands market reach, fostering international collaborations and boosting market growth.

- Patient preference for home-based care: A shift toward home-based wound care solutions, driven by patient preferences and cost-effectiveness, is positively influencing market growth.

- Environmental factors: Growing awareness of environmentally friendly wound care products and sustainable practices is influencing product development and market dynamics.

- Telehealth and remote monitoring: The integration of telehealth and remote monitoring in wound care enhances patient engagement and allows for timely intervention, contributing to market growth.

- Regulatory support for advanced products: Supportive regulatory frameworks for the approval and market entry of advanced wound care products accelerate industry growth.

- Increasing disposable Income in emerging markets: The rise in disposable income in emerging economies allows for greater affordability and accessibility to advanced wound care solutions, propelling market expansion.

Major Key Trends in Wound Care Market

- Adoption of Advanced Wound Dressings: The market is transitioning from conventional products to advanced dressings, including hydrocolloids, foams, and bioactive materials, which enhance healing duration and patient outcomes in both chronic and acute wound management.

- Growth of Home-Based Wound Care: The demand for home-use wound care solutions is rising due to aging populations and cost-effective treatment alternatives, facilitated by remote monitoring and self-application kits.

- Focus on Antimicrobial and Infection-Control Products: Growing concerns regarding wound infections have accelerated the usage of antimicrobial dressings and silver-based solutions, improving infection prevention and lowering hospitalization risks.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 38.39 Billion |

| Market Size in 2025 | USD 25.84 Billion |

| Market Size in 2024 | USD 24.72 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.50% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, End-use, Product, Mode of Purchase and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing surgical procedures and government initiatives

The escalating number of surgical procedures globally is a pivotal driver for the burgeoning demand in the wound care market. As surgical interventions become more prevalent, particularly with advancements in medical procedures and technologies, there is an inherent need for effective post-operative wound care solutions. This surge in demand encompasses a spectrum of wound care products and services, including advanced dressings and healing technologies, to ensure optimal recovery and reduce the risk of complications. Simultaneously, government initiatives play a crucial role in propelling market demand for Wound Care. Supportive policies and healthcare programs focused on enhancing patient outcomes and reducing healthcare costs contribute significantly.

These initiatives may involve funding for research and development, promoting awareness campaigns, and creating favorable reimbursement frameworks, all of which collectively foster the adoption of advanced wound care solutions. Together, the increasing frequency of surgical procedures and proactive government involvement synergistically drive the expansion of the wound care market.

Restraint

Limited reimbursement policies and concerns about product efficacy

Limited reimbursement policies and concerns about product efficacy act as significant restraints in the wound care market. The inadequate coverage or reimbursement for certain advanced wound care treatments restricts accessibility, making these solutions financially burdensome for both healthcare providers and patients. This limitation particularly affects those who may benefit the most from innovative wound care but face challenges in covering the associated costs.

Moreover, concerns about the efficacy of some advanced wound care products contribute to hesitancy among healthcare professionals and patients. Skepticism regarding the actual benefits and outcomes of these products can hinder widespread adoption. Overcoming these restraints requires collaborative efforts from stakeholders, including policymakers, to establish more comprehensive reimbursement frameworks and address concerns through rigorous clinical validation and education. Striking a balance between cost considerations and proven efficacy is essential to foster the broader acceptance and integration of advanced wound care solutions into mainstream healthcare practices.

Opportunity

Home-based wound care solutions and environmental sustainability

Home-based wound care solutions and a focus on environmental sustainability are creating significant opportunities in the wound care market. The increasing trend toward home-based healthcare presents a substantial opportunity for the development of convenient and patient-friendly wound care products. Innovations such as easy-to-use dressings and telemedicine solutions empower patients to actively participate in their care, promoting better adherence to treatment plans and reducing the burden on healthcare facilities. Simultaneously, the growing emphasis on environmental sustainability opens avenues for the creation of eco-friendly wound care products.

Biodegradable dressings and sustainable packaging align with consumer preferences for environmentally responsible choices. Companies investing in green technologies and sustainable practices not only contribute to global environmental goals but also position themselves favorably in a market where eco-consciousness is becoming a key factor in product selection. The intersection of home-based care and environmental sustainability not only addresses patient needs but also reflects a broader commitment to holistic and responsible healthcare practices.

Application Insights

In 2024, the chronic segment held the highest market share of 75% on the basis of the application. In the wound care market, the chronic segment focuses on addressing long-term wounds that often result from conditions such as diabetes, vascular diseases, or pressure ulcers. This segment is characterized by a growing demand for advanced wound care solutions, including specialized dressings, bioengineered tissues, and negative pressure wound therapy. As the prevalence of chronic diseases continues to rise, the chronic wound care segment is expected to witness sustained growth, with a trend toward personalized and technologically advanced interventions to enhance patient outcomes and quality of life.

The acute segment is anticipated to witness the highest growth at a significant CAGR of 5.1% during the projected period. The acute segment in the wound care market pertains to the management of sudden injuries or surgical wounds that require immediate attention. This includes trauma wounds, surgical incisions, and burns.

A notable trend in this segment involves the increasing adoption of advanced wound care products, such as antimicrobial dressings and negative pressure wound therapy, to accelerate the healing process and minimize complications. The emphasis on early intervention and technologically advanced solutions in acute wound care is driven by the quest for improved patient outcomes and cost-effective healthcare practices.

End-use Insights

According to the end-use, the hospitals segment has held a 39% revenue share in 2024. The hospital segment in the wound care market refers to the utilization of wound care products and services within hospital settings. This includes acute care facilities where patients receive specialized wound care treatments. Trends in this segment include the adoption of advanced wound care technologies, increased focus on infection control, and the integration of telehealth solutions for remote monitoring. Hospitals strive to optimize patient outcomes by leveraging innovative wound care solutions, ensuring efficient wound healing and minimizing the risk of complications in a clinical environment.

The home care segment is anticipated to witness the highest growth over the projected period. The home care segment in the wound care market refers to products and services designed for patient use in a non-clinical setting. This includes wound dressings, topical solutions, and telemedicine solutions that enable individuals to manage their wounds at home. A notable trend in this segment involves the increasing adoption of user-friendly and technologically advanced home-based wound care solutions. Patients are benefiting from convenient options that enhance treatment adherence, promote comfort, and empower them to actively participate in their wound care, reflecting a shift towards patient-centric healthcare.

Product Insights

According to the product, the advanced wound dressing segment has held a 34% revenue share in 2024. The advanced wound dressing segment in the wound care market includes innovative products designed to accelerate healing and reduce complications. These dressings often incorporate technologies like hydrogels, foams, and films. Current trends in this segment focus on the development of antimicrobial dressings, promoting infection control, and the integration of smart materials for real-time monitoring.

Additionally, there's a growing emphasis on creating dressings with improved breathability and flexibility, enhancing patient comfort and overall wound management. This segment continues to evolve with a strong emphasis on patient-centric solutions and technological advancements.

The surgical wound care segment is anticipated to witness highest growth over the projected period. The surgical wound care segment in the wound care market encompasses products specifically designed for managing wounds resulting from surgical procedures. This includes dressings, tapes, and antimicrobial agents to promote optimal healing and reduce the risk of infections.

A notable trend in this segment involves the increasing adoption of advanced materials, such as hydrogels and bioactive dressings, to enhance the efficacy of post-operative care. The demand for innovative surgical wound care solutions is driven by a continuous focus on minimizing complications, improving patient outcomes, and accelerating the overall healing process.

The advanced wound care segment dominated the market in 2024. The increasing geriatric population, increasing prevalence of chronic diseases like diabetes, obesity, and other chronic conditions, has led to increasing demand for advanced wound care such as foam dressings, hydrocolloid dressings, hydrogel dressings, alginate dressings, collagen dressings, and film dressings. The rapid technological innovations in advanced wound dressings and therapies reduce the spread of infection risk, improve patient comfort, and accelerate healing. On the other hand, the wound care devices segment is witnessing the fastest growth. The growth of the segment is driven by the increasing geriatric population, along with an increase in the incidence of chronic diseases and acute wounds, which is likely to spur the demand for advanced devices in the wound care market. These devices are specifically designed to provide effective treatment for wounds such as diabetic ulcers, pressure ulcers, surgical wounds, and others. Additionally, the introduction of negative pressure wound therapy (NPWT) and increasing emphasis on developing antimicrobial devices to prevent and manage wound infections are expected to fuel the segment's expansion in the coming years.

Mode of Purchase Insights

According to the mode of purchase, the prescribed has held 65% revenue share in 2024. The prescribed wound care segment in the wound care market pertains to products recommended and prescribed by healthcare professionals for the treatment of various wounds. This includes advanced dressings, medications, and therapeutic devices. A notable trend in this segment involves a shift towards personalized and evidence-based prescribing, tailoring wound care solutions to individual patient needs. With an increasing focus on value-based healthcare, healthcare providers are emphasizing the use of prescribed wound care products that demonstrate efficacy, cost-effectiveness, and improved patient outcomes.

The non-prescribed (OTC) segment is anticipated to witness the highest growth over the projected period. The non-prescribed (OTC) wound care segment in the wound care market refers to products available without a prescription, enabling consumers to directly purchase them. This category includes over-the-counter wound dressings, ointments, and antiseptics. A notable trend in this segment is the increasing consumer preference for self-care and convenience, driving the demand for easily accessible OTC wound care solutions. The market sees a surge in innovative OTC products catering to minor wounds and injuries, providing users with quick and effective remedies for everyday wound management.

Wound Type Insights

The chronic wounds segment was dominant, with the biggest share of the global wound care market in 2024. The growth of the segment is attributed to the surge in the aging population and increasing prevalence of chronic wounds such as diabetic foot ulcers, pressure ulcers, venous leg ulcers, and other chronic wounds. Moreover, the introduction of advanced wound care solutions, such as specialized dressings, antimicrobial dressings, bioengineered materials, and negative pressure wound therapy (NPWT) devices to enhance treatment outcomes and quality of life. Such factors are anticipated to drive the segment's growth during the forecast period. On the other hand, the acute wounds segment is also experiencing the fastest growth. The segment includes surgical & traumatic wounds and burns. The rapid growth of the segment is mainly attributed to the increasing surgical procedures, trauma-related injuries such as road accidents, and severe and minor burn cases globally.

End-User Insights

The hospitals segment held the largest segment of the wound care market in 2024, owing to the increasing utilization of wound care products and services within hospital settings. This includes well-established healthcare facilities where patients receive specialized treatments for chronic and acute wounds by healthcare professionals. Moreover, the adoption of advanced wound care technologies and the increasing focus on infection control in hospitals are driving the growth of the segment. Hospitals strive to optimize patient outcomes by leveraging innovative wound care solutions, ensuring efficient wound healing, and minimizing the risk of complications. On the other hand, the home healthcare segment is expected to grow significantly in the coming years. The home care segment market refers to products and services designed for patient use in a non-clinical setting. This includes wound dressings, topical solutions, and telemedicine solutions that enable individuals to manage their wounds at home. Home healthcare offers convenient options to patients that enhance treatment adherence, promote comfort, and reflect a shift towards patient-centric healthcare.

Wound Care Market Companies

- 3M Company

- Smith & Nephew plc

- Johnson & Johnson

- M�lnlycke Health Care

- Coloplast A/S

- ConvaTec Group plc

- B. Braun Melsungen AG

- Medtronic plc

- Acelity L.P. Inc.

- Integra LifeSciences Corporation

- Ethicon, Inc. (a subsidiary of Johnson & Johnson)

- Derma Sciences, Inc. (acquired by Integra LifeSciences)

- Misonix, Inc.

- Organogenesis Holdings Inc.

- Hollister Incorporated

Recent Developments

- In June 2023, Smith+Nephew launched a new manufacturing facility in Hull, UK, aimed at boosting its production of advanced wound care solutions. This new site addresses the rising demand throughout Europe and enhances the company's research and development capabilities for innovation in dressing technologies.

- In September 2023, 3M unveiled a next-generation antimicrobial foam dressing intended for complex wounds. This new offering boasts improved moisture management and prolonged protection, aiming for quicker healing and lowered infection risks across inpatient and outpatient environments.

- In August 2023, Coloplast has acquired Kerecis, an Icelandic firm specializing in fish-skin-based biologic wound care. This acquisition supports Coloplast's expansion into natural and regenerative wound treatments, bolstering its position in the European advanced wound care market.

- In April of 2021, 3M Company introduced the 3M Spunlace Extended Wear Adhesive Tape on Liner, 4576, boasting an extended wear time of 21 days to enhance user compliance and offer both health and economic advantages.

- In May 2021, Smith & Nephew unveiled ARIA Home PT, a component of the ARIA suite of solutions, introducing a remote physical therapy product.

- In March 2020, Cardinal Health released a surgical drape featuring Avery Dennison's patented BeneHold CHG adhesive technology. This innovation is designed to mitigate the risk of surgical site contamination.

Segments Covered in the Report

By Product Type

- Advanced Wound Care

- Foam Dressings

- Hydrocolloid Dressings

- Hydrogel Dressings

- Alginate Dressings

- Collagen Dressings

- Film Dressings

- Traditional Wound Care

- Gauze Dressings

- Adhesive Bandages

- Cotton Swabs and Tapes

- Surgical Wound Care

- Sutures & Staples

- Surgical Dressings

- Wound Care Devices

- Negative Pressure Wound Therapy (NPWT) Devices

- Portable NPWT systems

- Standalone NPWT units

- Compression Therapy Devices

- Compression bandages

- Compression stockings

- Compression pumps

- Hyperbaric Oxygen Therapy (HBOT) Devices

- Portable HBOT chambers

- Multi-patient HBOT units

- Electrical Stimulation Therapy Devices

By Wound Type

- Chronic Wounds

- Diabetic foot ulcers

- Pressure ulcers

- Venous leg ulcers

- Other chronic wounds

- Acute Wounds

- Surgical & traumatic wounds

- Burns

By End-User

- Hospitals

- Clinics

- Home Healthcare

- Ambulatory Surgical Centers (ASCs)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344