December 2024

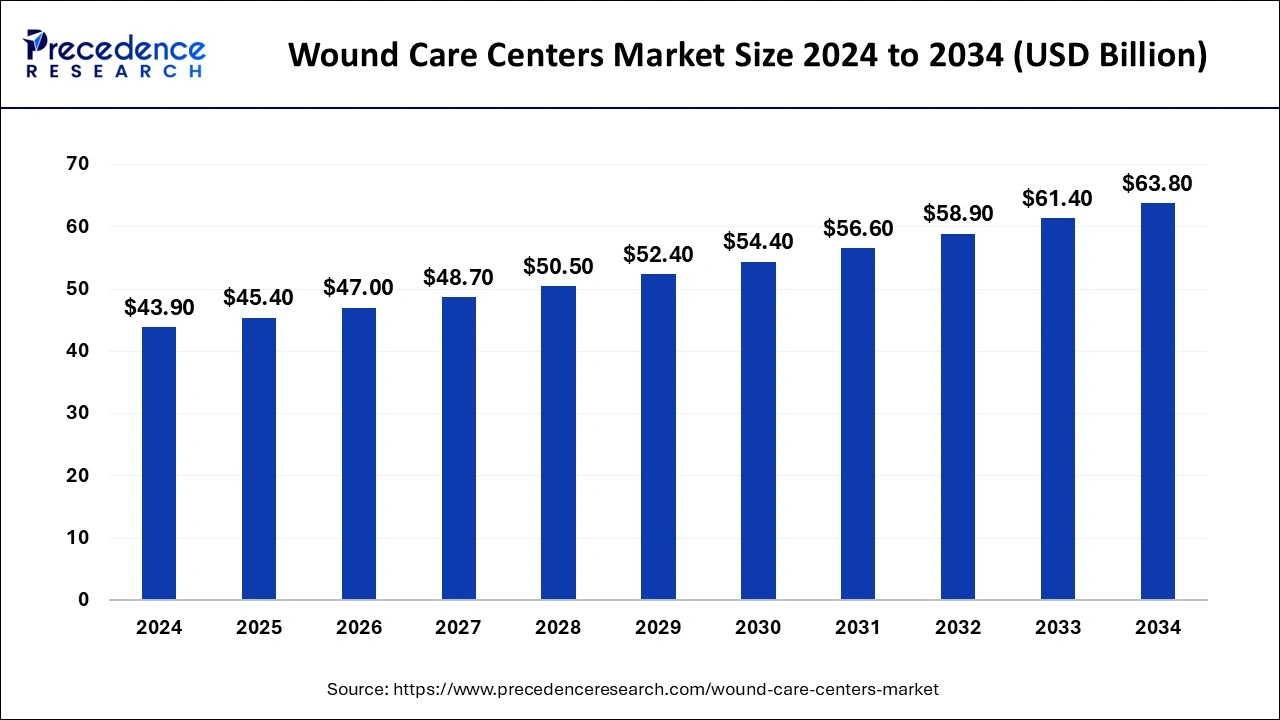

The global wound care centers market size is calculated at USD 45.40 billion in 2025 and is forecasted to reach around USD 63.80 billion by 2034, accelerating at a CAGR of 3.81% from 2025 to 2034. The North America wound care centers market size surpassed USD 19.76 billion in 2024 and is expanding at a CAGR of 3.85% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global wound care centers market size was estimated at USD 43.90 billion in 2024 and is predicted to increase from USD 45.40 billion in 2025 to approximately USD 63.80 billion by 2034, expanding at a CAGR of 3.81% from 2025 to 2034. Wounds with a poor healing rate can be caused by chronic conditions like diabetes and obesity. The need for specialist wound care facilities has surged due to the increasing prevalence of these illnesses around the globe.

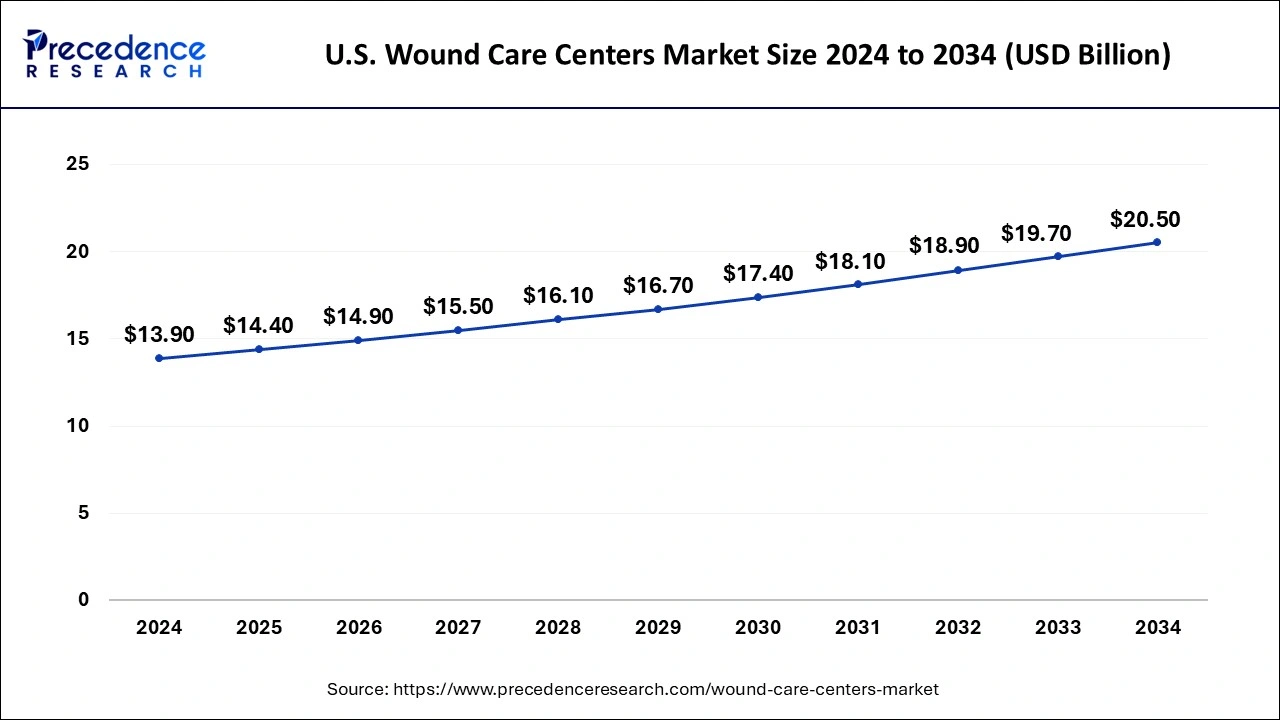

The U.S. wound care centers market size was estimated at USD 13.90 billion in 2024 and is anticipated to reach around USD 20.50 billion by 2034, growing at a CAGR of 3.96% from 2024 to 2033.

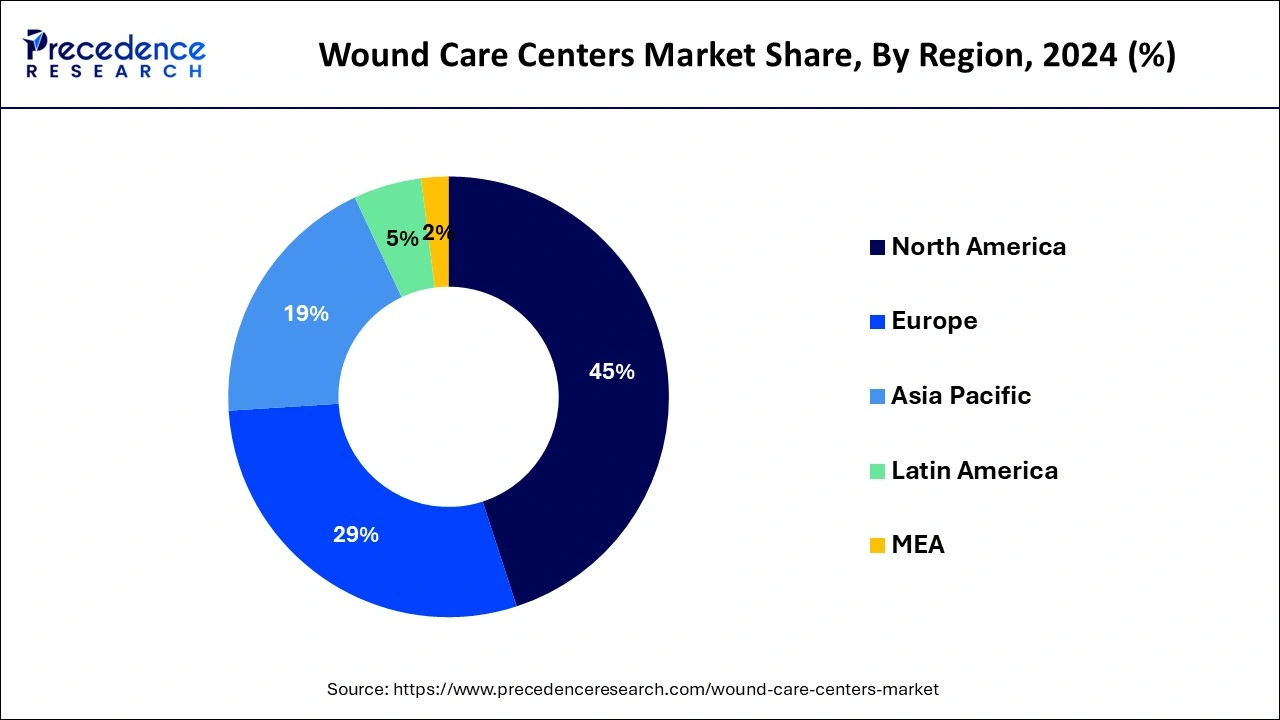

North America held the largest share of 45% in the wound care centers market in 2024. In order to improve patient outcomes and lower healthcare costs, the wound care center industry has seen technological advancements such as the creation of smart dressings and telemedicine solutions for remote wound monitoring. The wound care centers market in North America has also seen a common practice of collaboration between manufacturers, research institutions, and healthcare providers, which aids in the development of new products, treatment modalities, and the sharing of best practices. The wound care centers market is impacted by changes in healthcare regulations and standards. Companies operating in this sector must adhere to quality standards and comply with regulatory requirements.

The Asia Pacific wound care centers market is observed to expand at a CAGR of 4.8% during the forecast period as a result of factors such as population aging, the rising incidence of chronic wounds, and growing consumer awareness of cutting-edge wound care products. Asia Pacific is seeing an increase in demand for sophisticated wound care products and therapies, such as antimicrobial dressings, active therapy for chronic wounds, and wound dressings. The creation of bioactive materials and smart dressings, among other ongoing technological developments in wound care facilities, has fueled the expansion of the regional market. Diabetes-related wounds, such as diabetic foot ulcers, have a sizable market for wound care products and clinics due to the increased prevalence of diabetes in many Asia Pacific nations.

The wound care centers market is extensive and includes a variety of goods and services intended to manage and heal acute and chronic wounds. This covers topical medications, dressings, bandages, gauze, and cutting-edge wound care technology. Wound care centers are essential sources of expert care for patients with complicated or chronic wounds. Chronic wounds are on the rise as a result of the aging population and the increased prevalence of chronic illnesses like diabetes. Creating novel dressings, negative pressure wound therapy, and bioactive materials are examples of advances in wound care technology that support market expansion.

Given that diabetes is a primary cause of chronic wounds, the rising number of people with diabetes worldwide is a significant driver of the wound care industry. Strict regulatory restrictions and the demand for product approvals impact market dynamics. Wound care centers market participants must adhere to regulatory criteria. Adopting advanced wound care products and services is influenced by insurance coverage, reimbursement rules, and healthcare spending. Market expansion is facilitated by educational and awareness-raising programs highlighting the value of prompt wound treatment.

The wound care centers market may have experienced favorable and unfavorable repercussions from the COVID-19 epidemic. Although COVID-19 issues may have led to a rise in the need for wound care, supply chain, and healthcare system interruptions may have created difficulties.

| Report Coverage | Details |

| Market Size in 2025 | USD 45.40 Billion |

| Market Size by 2034 | USD 63.80 Billion |

| Growth Rate From 2025 to 2034 | 3.81% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type and By Procedure |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Globalization and market expansion

Because globalization has made it possible for businesses to operate outside of national lines, the wound care centers market has grown. As healthcare infrastructure advances, emerging markets in places like the Middle East, Latin America, and Asia-Pacific provide fresh prospects for market expansion. International partnerships are becoming more common among wound care facilities as a means of exchanging research findings, best practices, and technology innovations.

Complex healthcare concerns can be addressed through collaboration with international healthcare organizations, research institutes, and industry partners. Globalization facilitates the cross-border exchange of cutting-edge wound care techniques and technologies, resulting in more standardized and effective practices. Companies can expand their product offerings and gain access to new technology through international collaborations and acquisitions.

Technological barriers

It can be quite difficult to integrate and make different wound care technology work together. It can be challenging to transmit and exchange information easily when different systems employ incompatible data formats or standards. Concerns regarding patient privacy and security are raised by the use of digital technology and electronic health records (EHRs) in wound care facilities.

For some healthcare practitioners, the upfront expenditures of deploying modern wound care technologies—like telemedicine platforms, digital imaging instruments, or smart dressings—can be a major obstacle. Smaller wound care facilities, especially, could find it difficult to finance the purchase of cutting-edge equipment.

Educational programs and training

Numerous organizations and establishments provide wound care-specific certification programs. Healthcare workers are intended to gain practical skills in wound care through planned workshops and seminars. These sessions could include hands-on practice with cutting-edge wound care products, application of various dressings, and demonstrations of various wound care techniques.

As technology has advanced, a wide variety of instructional programs are now accessible online. These courses usually address infection management, advanced wound care technology, wound assessment, and wound healing principles. They are helpful for hectic schedules since they let healthcare professionals access training modules and materials at their own pace.

The hospital segment held the largest share of the wound care centers market in 2024. A wide variety of wounds, including those brought on by surgeries, mishaps, long-term illnesses like diabetes, and other medical procedures, can be treated in hospitals and clinics. Specialized wound care clinics or centers are located within several hospitals. These facilities specialize in sophisticated wound care services and frequently employ a multidisciplinary team of medical specialists, including surgeons, nurses, and wound care specialists. For wound treatment, hospitals and clinics use cutting-edge technologies and medical equipment. This could involve cutting-edge methods to hasten wound healing, such as hyperbaric oxygen therapy, negative pressure wound therapy (NPWT) equipment, and creative wound dressings.

The development of telemedicine has made it possible for clinics and hospitals to provide consultations at wound care centers remotely. This enables patients to stay in touch with medical specialists while getting advice on wound care from the comfort of their homes. Wound education and prevention are also major priorities for hospitals and clinics. Patients are given information on wound care techniques, lifestyle changes, and ways to lower the risk of wounds, particularly while dealing with chronic diseases. Government laws and wound care service reimbursement guidelines have an impact on the hospitals and clinics market. For healthcare providers in the wound care centers market, it is imperative that they follow quality standards and legal requirements.

The hyperbaric oxygen therapy segment held the largest share of the wound care centers market in 2024. By breathing pure oxygen in a pressurized chamber or room, high-oxygen therapy (HOBT) raises blood oxygen levels, which can support the body's inherent healing mechanisms. HBOT is frequently used in wound care facilities to treat ailments like diabetic foot ulcers, damaged flaps and grafts, crush injuries, and other forms of non-healing wounds. The need for better wound care procedures, coupled with an aging population and a rising incidence of diabetes, has resulted in an increase in the demand for wound care services, including therapies like HBOT. The wound care centers market is expanding as a result of advances in technology and a better understanding of the processes involved in wound healing.

Regulations pertaining to hyperbaric oxygen therapy may differ depending on the location. Regulatory clearances and payment guidelines are important factors in the wound care facilities' implementation of HBOT. Many businesses produce oxygen therapy equipment, including hyperbaric chambers. Prominent medical device firms may face rivalry in the market for these items. The use of HBOT in wound care may be influenced by ongoing studies and clinical trials. The market may expand as a result of recent discoveries and proof of the effectiveness of hyperbaric oxygen therapy. Establishing and maintaining a facility for hyperbaric oxygen therapy can be expensive. Healthcare financing arrangements and reimbursement rules may have an effect on HBOT service accessibility.

By Type

By Procedure

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

July 2024

January 2025