Utility Scale PV Inverter Market Size and Forecast 2025 to 2034

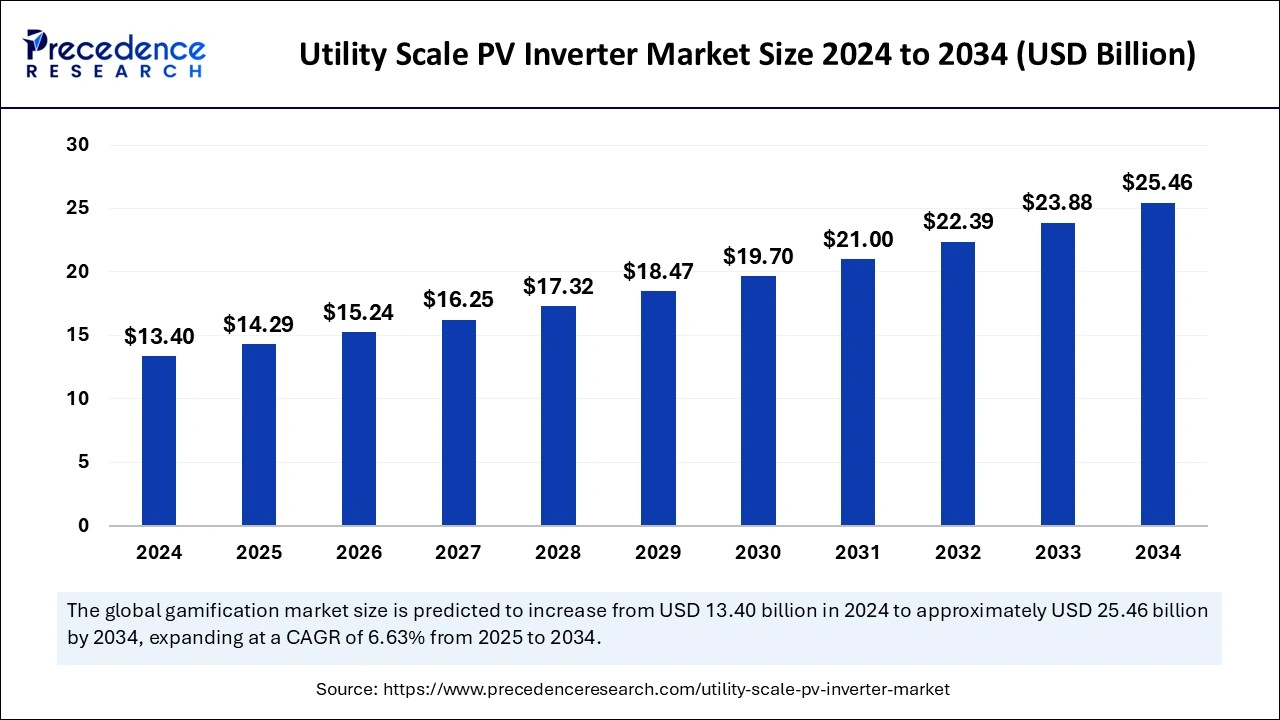

The global utility scale PV inverter market size was calculated at USD 13.40 billion in 2024 and is predicted to reach around USD 25.46 billion by 2034, expanding at a CAGR of 6.63% from 2025 to 2034. The market growth is attributed to the increasing adoption of large-scale solar installations and advancements in inverter technology that enhance efficiency and grid integration.

Utility Scale PV Inverter Market Key Takeaways

- Asia Pacific dominated the global utility scale PV inverter market in 2024.

- North America is projected to host the fastest-growing market in the coming years.

- By product, the string segment held a dominant presence in the market in 2024.

- By product, the central segment is expected to grow at the fastest rate during the forecast period.

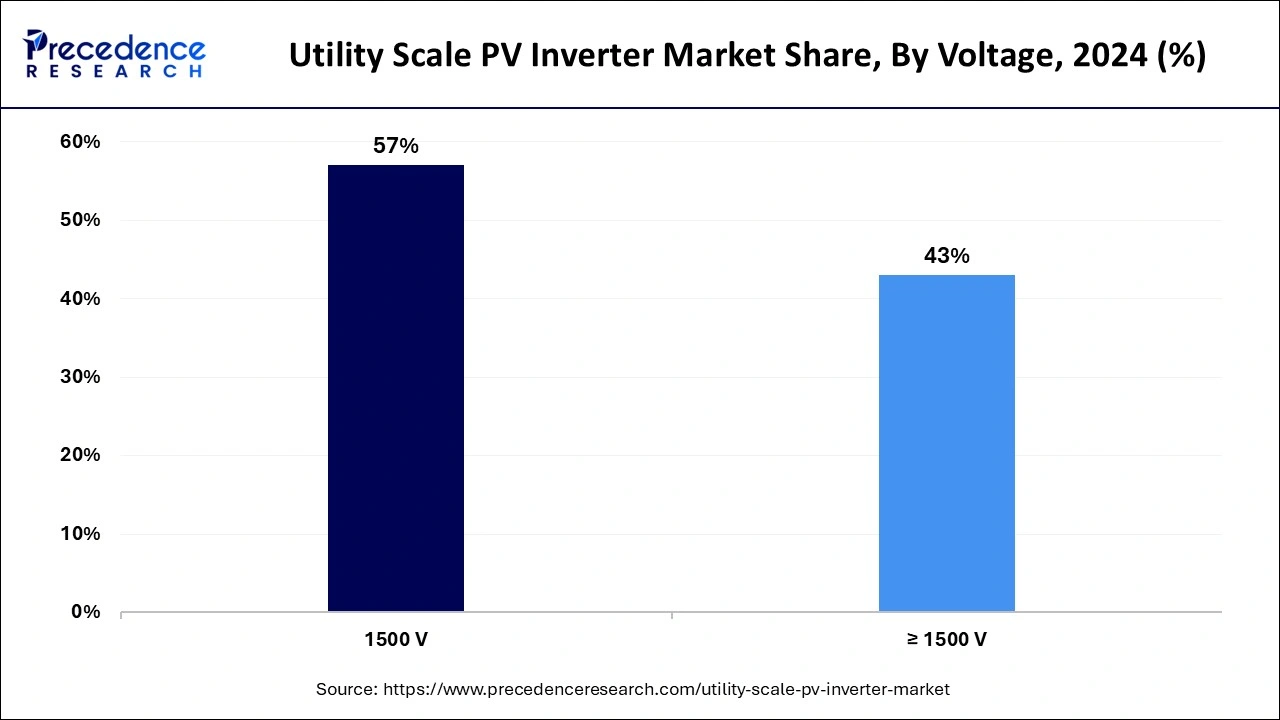

- By voltage, the 1500 V segment accounted for the largest market share of 57% in 2024.

- By voltage, the central segment is anticipated to grow with the highest CAGR during the studied years.

Impact of Artificial Intelligence (AI) on the Utility Scale PV Inverter Market

Artificial Intelligence features a defining position in utility scale PV inverter market technology since it enhances the system's energy conversion and optimization. Machine learning makes it possible for inverters to operate analytically by adjusting to the current weather conditions, optimizing energy harvesting, and decreasing energy loss. AI-driven ‘predictive maintenance' enables early identification of the tendency for defects, lessening plant-up time and reparations. Furthermore, AI optimizes efficiency by improving the control of voltage and frequencies by the inverters, which becomes vital as grid integration of renewables intensifies.

Market Overview

Increased demand for renewable energy forms is contributing to the growth of the utility scale PV inverter market. Governments across the globe are sourcing for large solar systems to boost carbon cut and energy security. This has boosted the need for PV inverters as a key component since they act in the conversion of the direct current or DC power generated from solar panels into alternating current or AC suitable for integration into the utility grid.

The new capacity of photovoltaic systems installed in the world, according to IRENA, in 2023 exceeds 1,000 GW, the growth of which is mainly linked to the expansion of utility-scale power stations. Additionally, the key demand for advanced inverter technologies is generated by the United States, India, and China, which are the countries that retain the highest demand for utility-scale solar energy .

- According to the U.S Energy Information Administration (EIA), the annual installation of solar power capacity beyond 2024 will be over 42.6 GW in the U.S., which is an indicator of bright prospects for the inverters market.

Utility Scale PV Inverter Market Growth Factors

- Government incentives and subsidies for large-scale solar projects are fueling the growth of the utility scale PV inverter market by making solar installations more financially viable.

- Increasing renewable energy demand across residential, commercial, and industrial sectors is boosting the need for advanced utility-scale PV inverters.

- Expanding solar installations in emerging markets like Africa and Southeast Asia are creating new opportunities for utility-scale PV inverter adoption.

- Technological innovations in inverter designs are driving the development of more efficient inverters that handle higher energy capacities.

- The global focus on carbon emissions reduction is accelerating investment in renewable energy, thus increasing the demand for high-performance PV inverters.

- The integration of large-scale energy storage systems with solar power is enhancing the need for smart inverters to manage excess energy.

- Growing energy security through decentralized solar solutions is pushing the demand for utility-scale PV inverters, driven by investments in large-scale solar installations.

Market Scope

| Report Coverage | Details |

| Market Size by 2024 | USD 13.40 Billion |

| Market Size in 2025 | USD 14.29 Billion |

| Market Size in 2034 | USD 25.46 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.63% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Voltage, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for renewable energy

Increasing global efforts to transition towards renewable energy sources are anticipated to drive the demand for products in the utility scale PV inverter market. The increase in energy usage further proves that the change in the transition to clean energy sources is ongoing and hastening, thus creating the demand for utility-scale PV inverter technology. The United States Inflation Reduction Act of 2022 provides a kind of carry forward for the tax credit, thereby boosting solar and other new clean energy technologies. Furthermore, the developments in state-of-the-art PV inverters handle enhanced ratings and accommodate complex grid support features in order to meet the growing need for effective and reliable integration of renewable power into the grids.

- The IEA's 2023 report highlights a remarkable surge in global annual renewable capacity additions, which soared by nearly 50% to approximately 510 gigawatts (GW) in 2023. This marks the fastest growth rate in two decades, shattering previous records and setting a new benchmark for renewable energy expansion over the past twenty years.

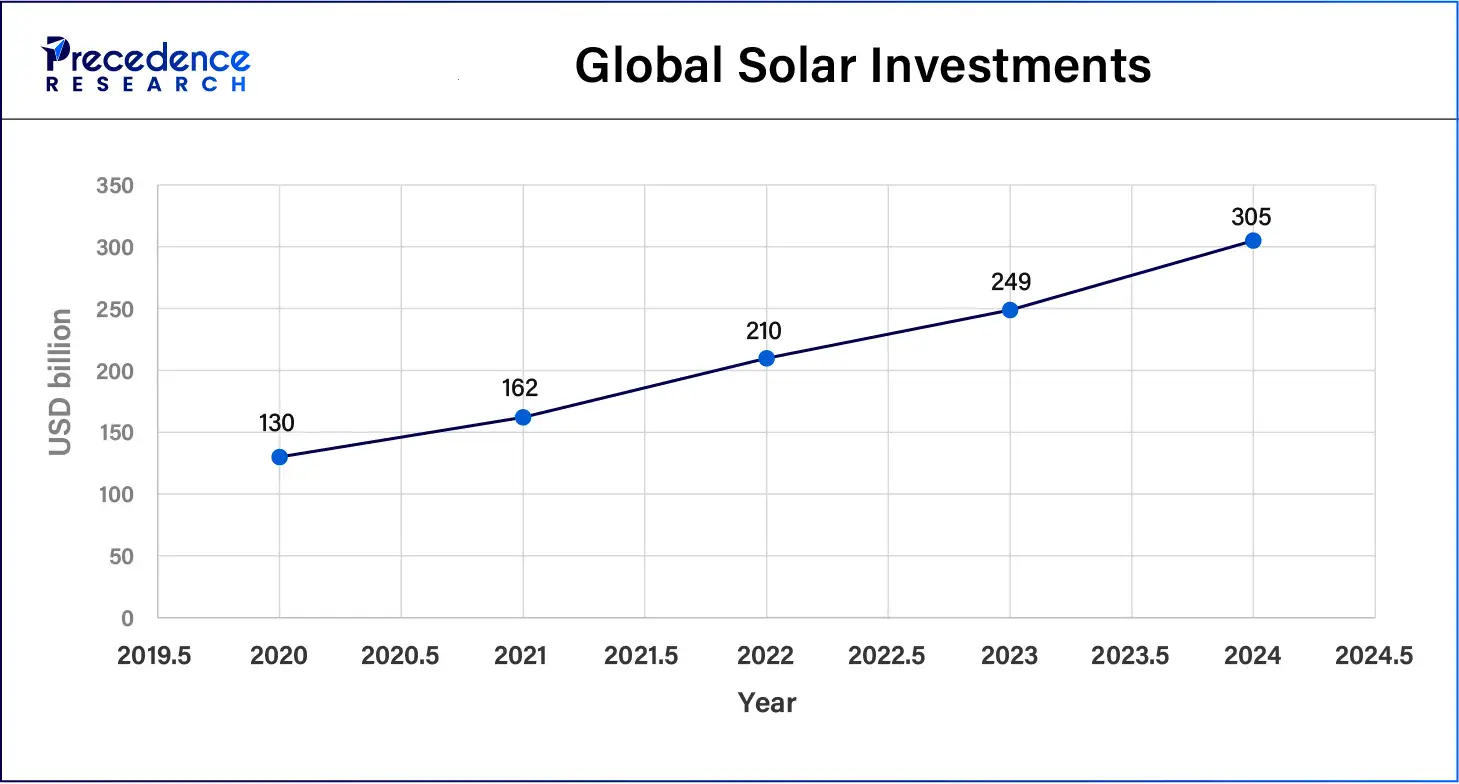

| Year | Global Solar Investments (USD Billion) | Share of Total Renewable Energy Investments (%) | Capacity Additions (GW) |

| 2020 | 130 | 40 | 150 |

| 2021 | 162 | 43 | 185 |

| 2022 | 210 | 46 | 240 |

| 2023 | 249 | 48 | 290 |

| 2024 | 305 | 51 | 335 |

Restraint

Supply chain vulnerabilities

Restraining supply chain disruptions are anticipated to hinder consistent growth in the utility scale PV inverter market. There is a major dependency on a set of countries for strategic raw materials such as semiconductors and rare earth metals , and a high degree of concentration causes critical shortages in geopolitical crises or pandemics. The semiconductors continued to cause delays in several solar energy projects, reducing the achievement of renewable energy goals.

Increased costs in transportation and logistics compounded this, so protracted completion times for component deliveries became an issue. Furthermore, these weaknesses explain the importance of diversifying the supply chain and having localized manufacturing to help stabilize production and meet increasing demand.

Opportunity

Rising demand for advanced grid services

Rising demand for advanced grid services drives the development of smart PV inverters with enhanced functionalities, thus further creating immense opportunities for the players competing in the utility scale PV inverter market. These inverters are essential in dealing with voltage, frequency control, and the grant of reactive power for the stability of the grid as the proportion of renewable energy rises. The A-Two inverters used in systems and areas that require high compliance with comprehensive grid codes that include the dynamic energy standards are progressively being embraced in Europe and the United States.

California utilities have newly defined the following smart inverter capabilities for the improvement of grid support functions such as voltage and frequency. Smart inverters' integration makes it possible to offer support services, which include voltage and frequency, to help make the grid stronger and safer. This trend corresponds to the goals of the modernization of GRI and the increase in the share of renewable energy sources for the world. Moreover, the increased adoption of smart inverters is forecasted to occur as a result of new requirements and as an answer to the need for optimized grid management techniques.

- In December 2024, GE Vernova Inc. announced securing a contract with 50Hertz Transmission GmbH, one of Germany's key transmission system operators. The partnership focuses on delivering advanced grid-stabilizing technology to enhance the reliability of Germany's power grid as the country accelerates its integration of renewable energy sources. This initiative aligns with Germany's commitment to achieving a more resilient and sustainable energy infrastructure.

Product Insights

The string segment held a dominant presence in the utility scale PV inverter market in 2024, as these models are efficient, cost-effective, and easy to install; hence, they are widely used. The key nations that identified the steady boost for large-scale solar projects are China, India, and the United States. String inverters enjoyed flexibility and scalability across different conditions, hence making them popular. Furthermore, the global solar component prices were reduced to nearly 10% at the end of 2023 as per IRENA and made string inverters more accessible and efficient for utility-scale related purposes.

- According to the International Energy Agency (IEA), China installed over 261 GW of solar PV capacity in 2023, surpassing all other countries and setting a global benchmark. This figure represents an impressive 85% increase compared to the 141 GW installed in 2022, underscoring China's leadership and rapid advancement in renewable energy deployment. This employed string inverters in projects as small as the residential level or as large as utility-scale power plant level projects.

The central segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034, owing to the rising number of solar farms that have been installed with more than 100MW. Pilot installations develop in 2024, with India, the U.S., and Australia showing the greatest interest in central inverters to advance their solar projects toward energy transition plans. In 2023, the U.S. Energy Information Administration (EIA) pointed out that central inverters were used in more than 30% of utility-scale solar installations across the country as their suitability for dealing with capacities of that kind. Furthermore, the evolution toward modern grids and more intensive use of smart grids is expected to increase the demand for central inverters.

Voltage Insights

The 1500 V segment accounted for a considerable share of the utility scale PV inverter market in 2024 due to their effectiveness in adding solar power plants on a utility scale. They are most applicable in utility power system distribution, where high power ratings are required, in adapting AC to DC or DC to AC technology. Furthermore, during 2023, 1500 V systems further gained popularity, which led to several breakthroughs in the year, especially in locations such as the U.S., India, and China, where the figure for solar installations is still on the rise.

The ≥ 1500 V segment is anticipated to grow with the highest CAGR during the studied years, owing to the growing customer appetite for higher efficiency and lower levelized cost of solar power in utility-scale solar plants. These inverters are anticipated to be sought after in utility-scale solar PV systems with power ratings of more than 100MW due to their higher efficiency at maximum power point. Higher voltage devices with≥1500 V inverters make it possible to handle larger quantities of electricity, implying lesser string connections and higher general costs. Solar developers are leaning towards the utilization of even and enlarged solar structures for high voltage capabilities and electricity demands.

Regional Insights

Asia Pacific dominated the global utility scale PV inverter market in 2024, owing to the area's rapidly developing solar power capability and positive policies regarding solar technology. At the end of the year 2024, Asia Pacific will become the region with the largest solar installations as large-scale IP projects in China and India progress. China has been leading the solar PV market, and it has added more than 40% of the global capacity in 2023, as stated by IEA. Such installations have been realized due to increased renewable energy goals formulated by the Chinese government with the vision to be a net-zero emission country by 2060. Furthermore, the countries within the region, including Japan, South Korea, and SE Asia, step up their solar development investments.

North America is projected to host the fastest-growing utility scale PV inverter market in the coming years due to the huge demand for clean energy and favorable policies. The United States is foreseen to lead this change as it remains committed to expanding its renewable power to achieve climate targets. A high amount of investment in solar infrastructure is expected as the government of the U.S. pushes for green energy by putting in place incentives, especially after the passing of the Inflation Reduction Act of 2022. These policies have led to a procedural increase in the uptake of more effective inverters capable of covering the requirements of utility-scale PV plants. Furthermore, the rising utilization of solar power is coupled with the government's pledge to make Canada a net-zero emission nation by 2050.

- According to the U.S. Energy Information Administration's 2024 report, solar capacity additions are projected to reach 37 GW in 2024, marking a record for any single year. This figure represents nearly double the 18.8 GW added in 2023, highlighting a significant acceleration in solar energy deployment across the United States.

Utility Scale PV Inverter Market Companies

- Canadian Solar

- Delta Electronics

- Eaton

- Fimer Group

- GoodWe

- GE Vernova

- Huawei Technologies

- Sungrow Power Supply

- Sofar Solar

- Solis Inverters

- Solplanet

- Sineng Electric

- SolarEdge Technologies

Latest Announcements by Industry Leaders

January 2025 – Sungrow

Vice President – Thompson Meng

Announcement - Sungrow, a global leader in PV inverters and energy storage systems, is excited to announce its participation in the World Future Energy Summit (WFES) 2025, set to take place in Abu Dhabi. Thompson Meng, Vice President of Sungrow PV & ESS BG, remarked, “WFES 2025 underscores the pivotal role renewable energy plays in building a sustainable future, particularly in the Middle East. We look forward to sharing valuable insights, forging strategic partnerships, and demonstrating how Sungrow's cutting-edge solutions are empowering businesses and communities globally.”

Recent Developments

- In October 2024, SolarEdge Technologies launched its high-power SolarEdge TerraMax Inverter with H1300 Power Optimizers in the UK. The SE330K inverter, now open for pre-orders, is scheduled for shipment starting in Q1 2025.

- In October 2024, Solplanet, a China-based inverter manufacturer, introduced its three-phase ASW350K-HT solar inverter for large-scale PV installations in India. The inverter supports a maximum input current of 75 amps for compatibility with large PV modules and boasts a high conversion efficiency exceeding 99%, ensuring minimal energy loss.

- In June 2024, SolarEdge Technologies launched the SolarEdge TerraMax Inverter with H1300 Power Optimizers in Germany. The certified SE300K1 inverter is now available for order, supporting advanced energy conversion and optimization needs in the region.

- In September 2024, GE Vernova introduced its 6 MVA, 2000-volt direct current utility-scale inverter, designed for cost reduction and efficient renewable energy integration. A multi-megawatt pilot installation in North America highlights its commitment to accelerating the renewable energy transition and decarbonization.

Segments Covered in the Report

By Product

- Central

- String

By Voltage

- 1500 V

- ≥ 1500 V

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting