January 2025

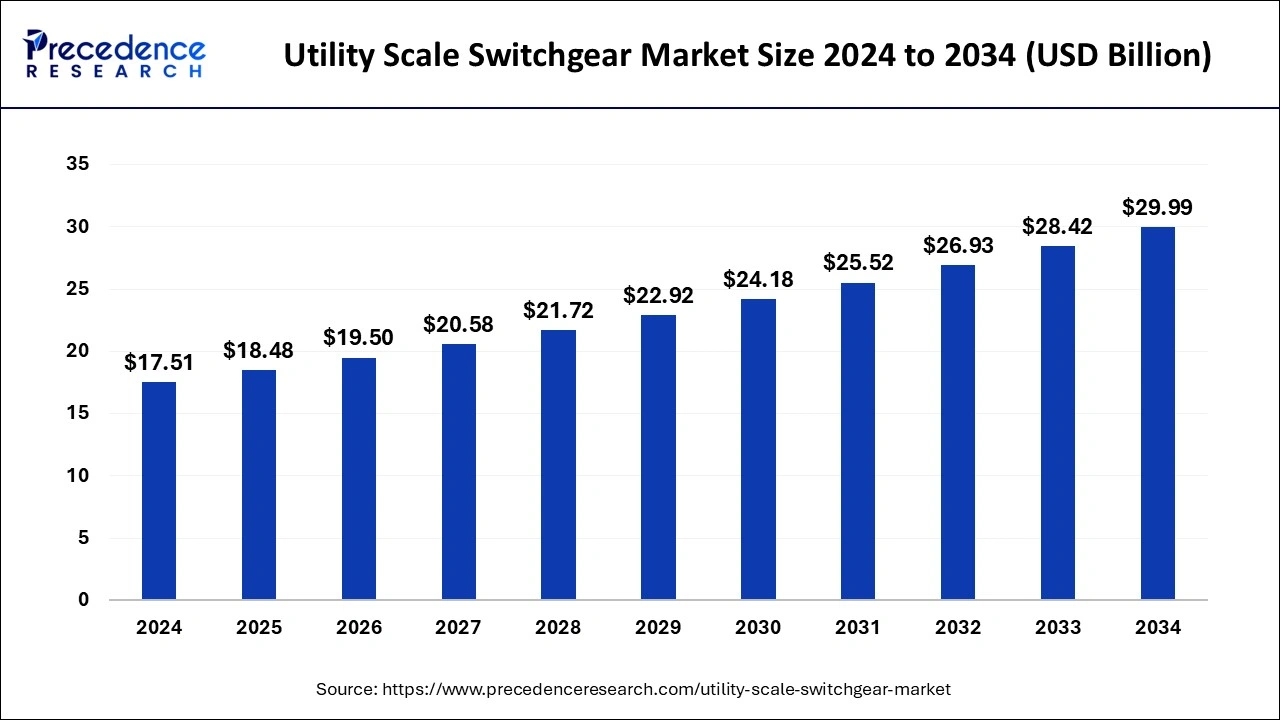

The global utility scale switchgear market size is calculated at USD 18.48 billion in 2025 and is forecasted to reach around USD 29.99 billion by 2034, accelerating at a CAGR of 5.53% from 2025 to 2034. The Asia Pacific market size surpassed USD 7.18 billion in 2024 and is expanding at a CAGR of 5.65% during the forecast period. The market size and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global utility scale switchgear market size was accounted for USD 17.51 billion in 2024 and is expected to exceed around USD 29.99 billion by 2034, growing at a CAGR of 5.53% from 2025 to 2034. The increasing demand for electricity in the wider range of applications and demand for the efficient power supply and distribution system that boosts the growth of the utility scale switchgear market.

The integration of artificial intelligence into the utility scale switchgear market helps in improving the distribution, generation, and energy consumption process. AI plays a significant role in utility adoption. It improves offset energy consumption by transforming the process like operations, management, and decision-making. AI-enhanced efficiency in grid optimization, energy management in buildings, energy trading and pricing, grid security and resilience, customer service, and engagement.

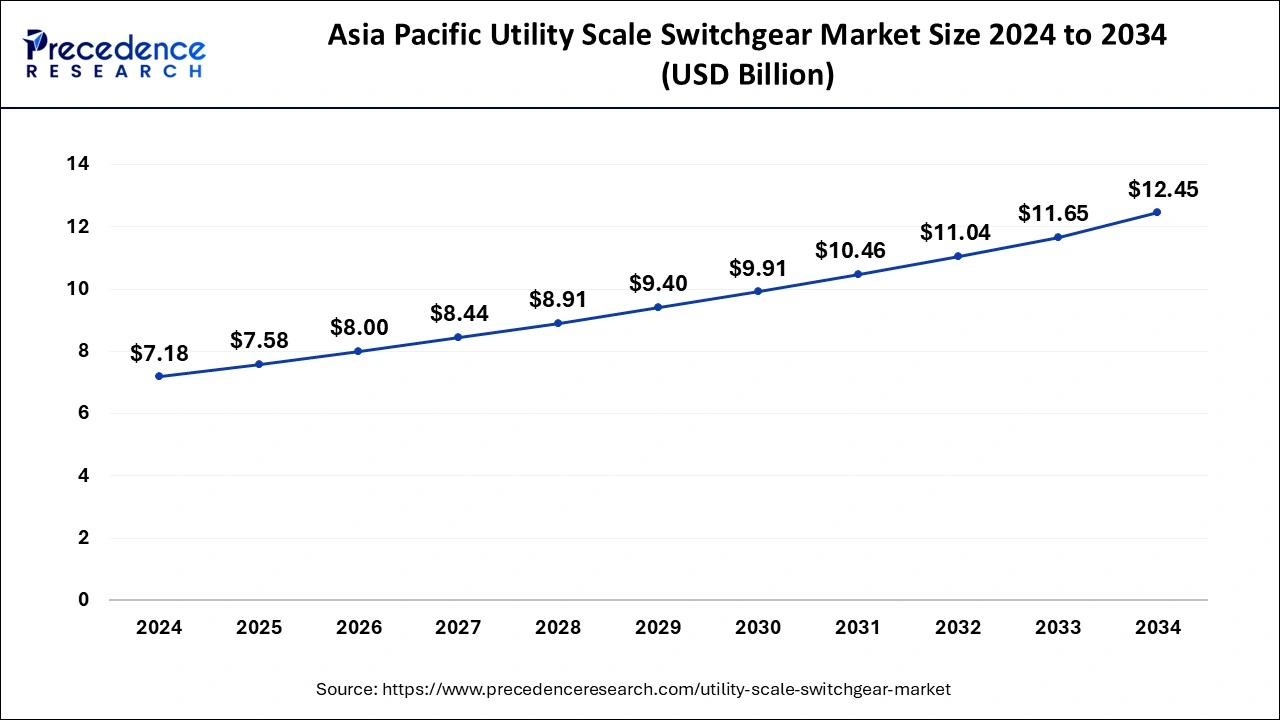

The Asia Pacific utility scale switchgear market size was exhibited at USD 7.18 billion in 2024 and is projected to be worth around USD 12.45 billion by 2034, growing at a CAGR of 5.65% from 2025 to 2034.

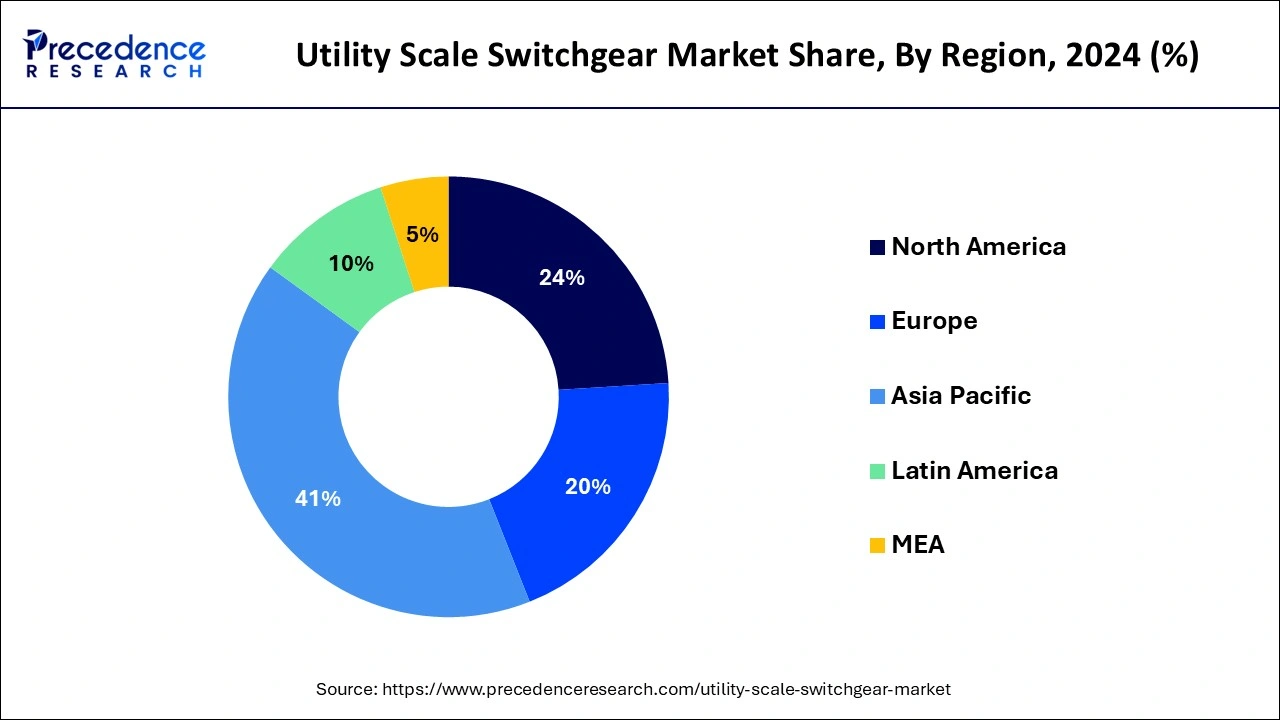

Asia Pacific dominated the utility scale switchgear market in 2024. The growth of the market is attributed to the rising population, and the demand for efficient power supply and distribution is driving the demand for electricity, which anticipated the growth of the market. The growing awareness regarding the renewable source of energy is contributing to the growth of the market. The increasing demand for electricity from countries like India, China, Japan, and others countries due to rising urbanization and economic development.

India is the third largest consumer of electricity worldwide, with a power installation capacity of 442.85 GW as of April 30, 2024. In FY23, the power consumption in India logged a 9.5% growth to 1,503.65 billion units (BU). India is committed to installing a renewable electricity generation capacity of over 5,00,000 MW by 2031-32.

The power industry is expected to gain an investment worth INR 17 lakh crore (USD 205.31 billion) in the next 5-7 years. There is an increase in power generation in India by 6.8% to 1,452.43 billion kilowatt-hours (kWh) as of January 2024. The highest demand for power stood at 249.85 GW in June 2024.

North America expects significant growth in the utility scale switchgear market during the forecast period. The growth of the market is attributed to the rise in industrialization and the demand for the per capita power supply that contributes to the expansion of the market. The rise in demand for modernization in the country is driving the demand for electricity and the rising development of renewable energy in regional countries like the United States and Canada.

The utility switchgear is the electrical solution that is designed to protect, regulate, and isolate power with different control-housed metal enclosures. Switchgear includes different components such as switches, fuses, and other power conductors. Circuit breakers are one of the essential parts of the switchgear, which detects malfunction and restricts the power flow, which helps protect the electrical equipment. Gas-insulated switchgear, air-insulated switchgear, and shielded solid switchgear are some types of utility-scale switchgear.

| Report Coverage | Details |

| Market Size by 2024 | USD 17.51 Billion |

| Market Size in 2025 | USD 18.48 Billion |

| Market Size in 2034 | USD 29.99 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.53% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Voltage Level, Type, Installation, Application, Functional Features and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising penetration of renewable energy sources

The rising inclination towards renewable energy sources by the worldwide population to reduce the carbon footprint and pollution level occurs due to the non-renewable energy generation system. The rise in renewable energy sources drives the development of wind and solar power, which causes a higher demand for efficient and reliable energy infrastructure that drives the demand for the utility scale switchgear market for the effective transmission and distribution of power.

Failure in system

Overheating or excessive load in capacity causes damage to the system or insulation failure. The system failure caused a reduction in the life cycle of the products, which restrained the growth of the utility scale switchgear market.

Evaluation of the smart switchgear

The evaluation of the switchgear into the advanced smart switchgear with improved grid stability, such as mitigating the disturbance and maintaining power fluctuations. The smart utility scale switchgear market offers adaptive protection and control, enhanced situational awareness, interoperability, and future-ready flexibility. The smart switchgear has integrated digital instrumentation, automated control logic, connectivity and remote access, modularity, compact footprint, and cybersecurity.

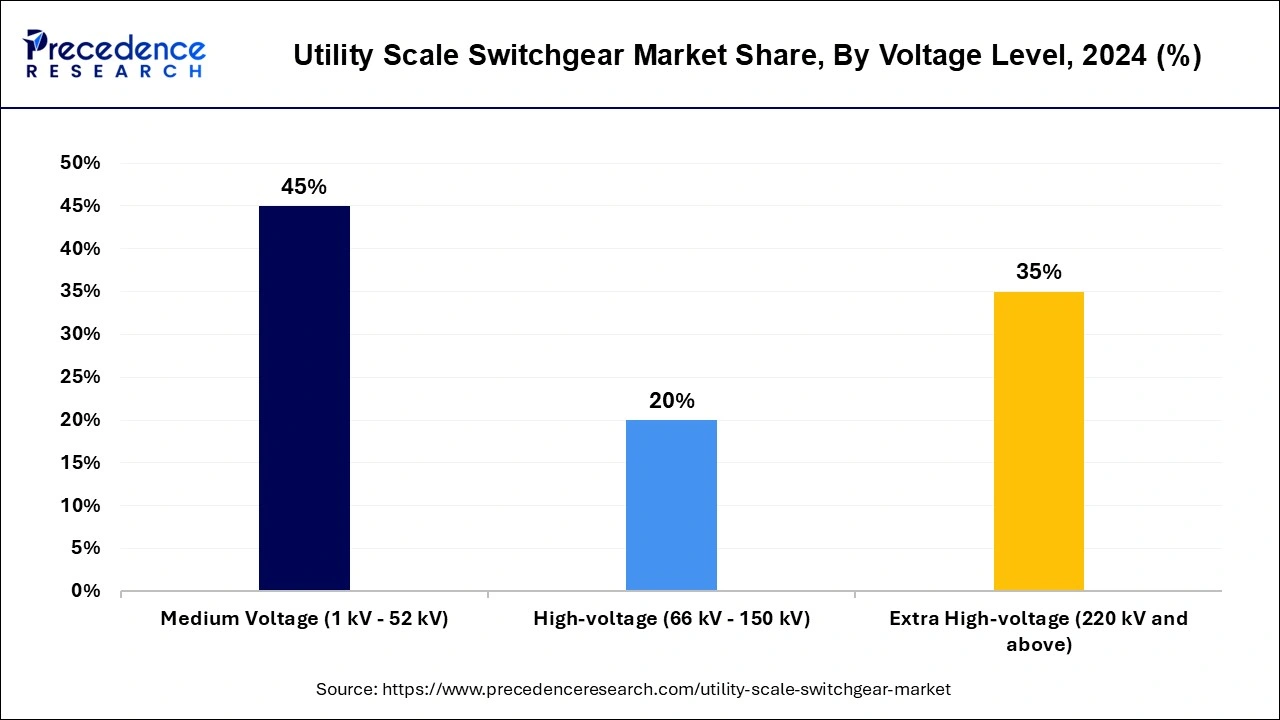

The medium voltage segment dominated the utility scale switchgear market in 2024. The increasing acceptance of medium voltage switchgear from a wide range of industries and applications such as industrial facilities, healthcare institutes, and oil and gas applications. These are the unique primary devices made to regularize the irregular and unsteady flow of current or power. The medium voltage switchgear operates between 1 kV - 52 kV. It is used in functions like design, operations, machine control, and maintenance.

The extra high voltage segment expects significant growth in the utility scale switchgear market during the forecast period. The extra high-voltage switchgear is used in a wide range of applications and industries; it is used in protecting high-voltage equipment. It prevents the equipment by automatically closing the disabled and faulty circuits.

The gas-insulated switchgear (GIS) segment led the global utility scale switchgear market in 2024. The gas-insulated switchgear is designed to be installed in limited spaces, such as building roofs, industrial plants, offshore platforms, city buildings, and hydropower plants. It is the metal encapsulated switchgear, which is components such as disconnectors and circuit breakers operated in confined spaces. It is used in a wide range of applications, including power transmission, railways, and the Integration of renewable power generation units into the grid.

The air-insulated switchgear (AIS) segment will witness for the substantial growth in the utility scale switchgear market during the predicted period. The air-insulated switchgear is used in the primary insulating medium. The air-insulated switchgear consists of different components, such as disconnect switches, circuit breakers, and busbars.

The indoor segment accounted for the largest share of the utility scale switchgear market in 2024. The indoor switchgear is designed to be built or installed inside the building; it is generally installed in residential and commercial buildings and is used in controlling the flow of power. The indoor switchgear is used to protect residential devices. An automatic heating system, automatic ventilation system (optional), internal, external, and emergency lighting system, security alarm (fire) system, and auxiliary power supply system are some of the auxiliary systems that come with the switchgear.

The outdoor segment expects significant growth in the utility scale switchgear market during the forecast period. The outdoor switchgear is designed to be installed in the outdoor station. The outdoor switchgear is used in different outdoor power applications such as generators, transmission, power equipment, and distribution systems. The outdoor switchgear has fuses, switches, and circuit breakers used for protecting electrical equipment.

The circuit breakers segment led the utility scale switchgear market in 2024. The circuit breakers are the electric switchgear that is used to protect the electrical equipment from damage. It is used to interrupt the faulty current. Fixed contact and moving contacts are the two important contacts in the circuit breakers. Air circuit breakers, SF6 circuit breakers, Vacuum circuit breakers, and Oil circuit breakers are the four main types of circuit breakers.

The disconnectors segment will witness substantial growth in the utility scale switchgear market during the predicted period. Switch disconnectors are efficient electrical systems used in different industries, such as commercial and industrial applications for manual switching, circuit breakers, and isolating power supply. It is used in emergency devices.

The substation segment dominated the global utility scale switchgear market in 2024. The switchgear substation offers interconnection of transmission and distribution circuits system and different voltage levels. The substation is divided into two major types: air-insulated substation (AIS) and gas-insulated substation (GIS). The increasing industrialization across the world is driving the demand for the segment.

The power plants segment expects significant growth in the utility scale switchgear market during the forecast period. The rising demand for a robust and reliable power supply is driving the growth of the number of power plants. The increasing urbanization and economic development are driving the demand for the power supply.

By Voltage Level

By Type

By Installation

By Application

By Functional Features

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

October 2023

August 2024