September 2024

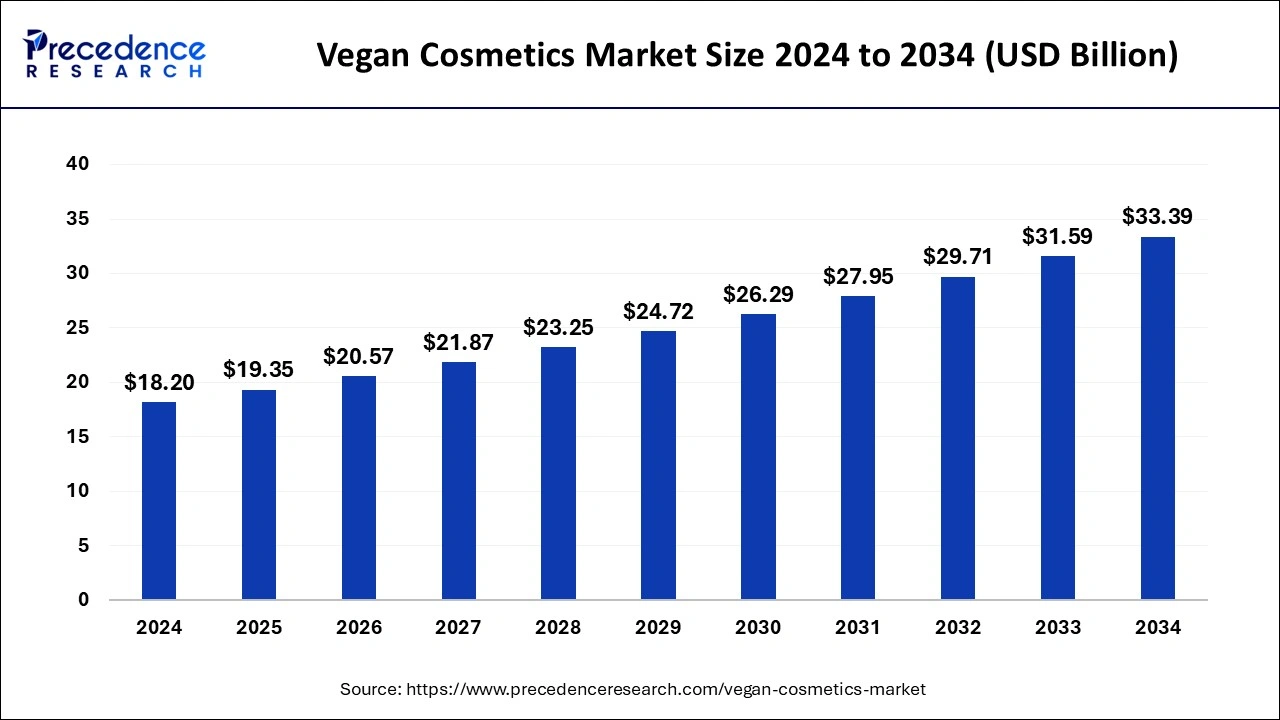

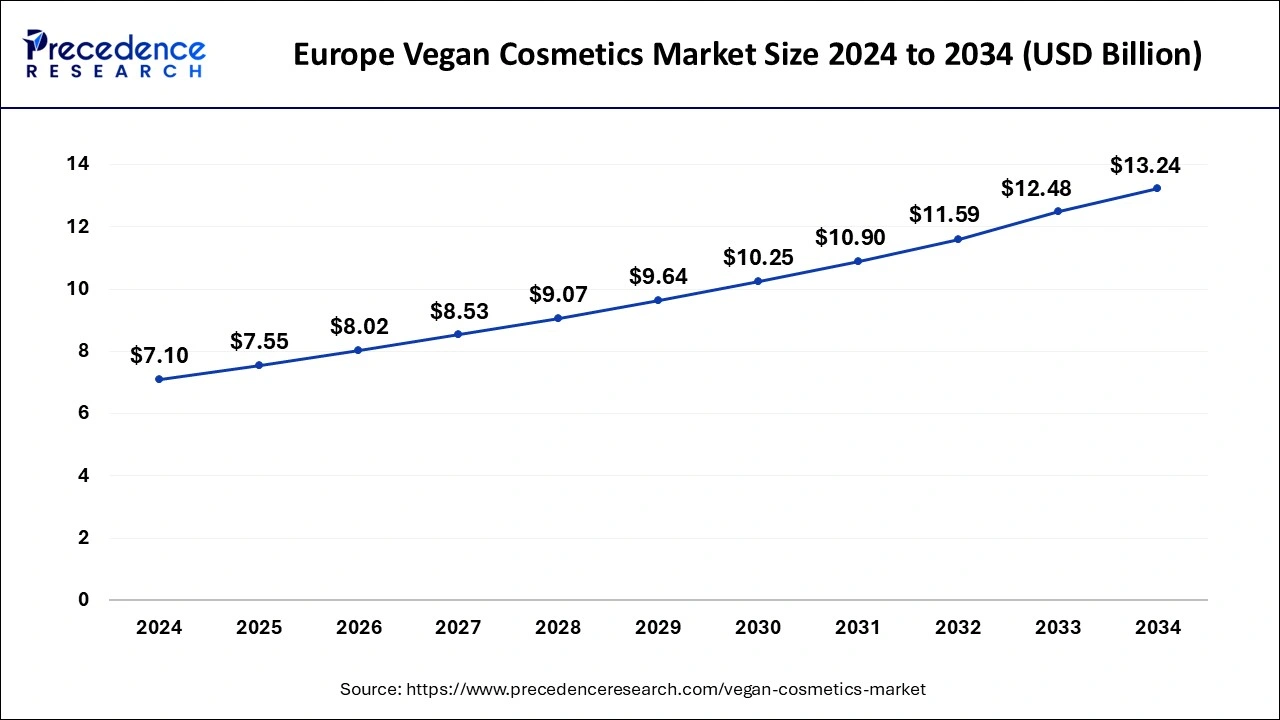

The global vegan cosmetics market size is calculated at USD 19.35 billion in 2025 and is forecasted to reach around USD 33.39 billion by 2034, accelerating at a CAGR of 6.26% from 2025 to 2034. The Europe vegan cosmetics market size surpassed USD 7.55 billion in 2025 and is expanding at a CAGR of 6.43% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global vegan cosmetics market size was estimated at USD 18.20 billion in 2024 and is predicted to increase from USD 19.35 billion in 2025 to approximately USD 33.39 billion by 2034, expanding at a CAGR of 6.26% from 2025 to 2034. One of the main factors driving vegan cosmetics market expansion is the rise of vegan consumerism worldwide, where consumers are against animal cruelty and seek cosmetics that do not contain animal ingredients.

The Europe vegan cosmetics market size was exhibited at USD 7.10 billion in 2024 and is projected to be worth around USD 13.24 billion by 2034, poised to grow at a CAGR of 6.43% from 2025 to 2034.

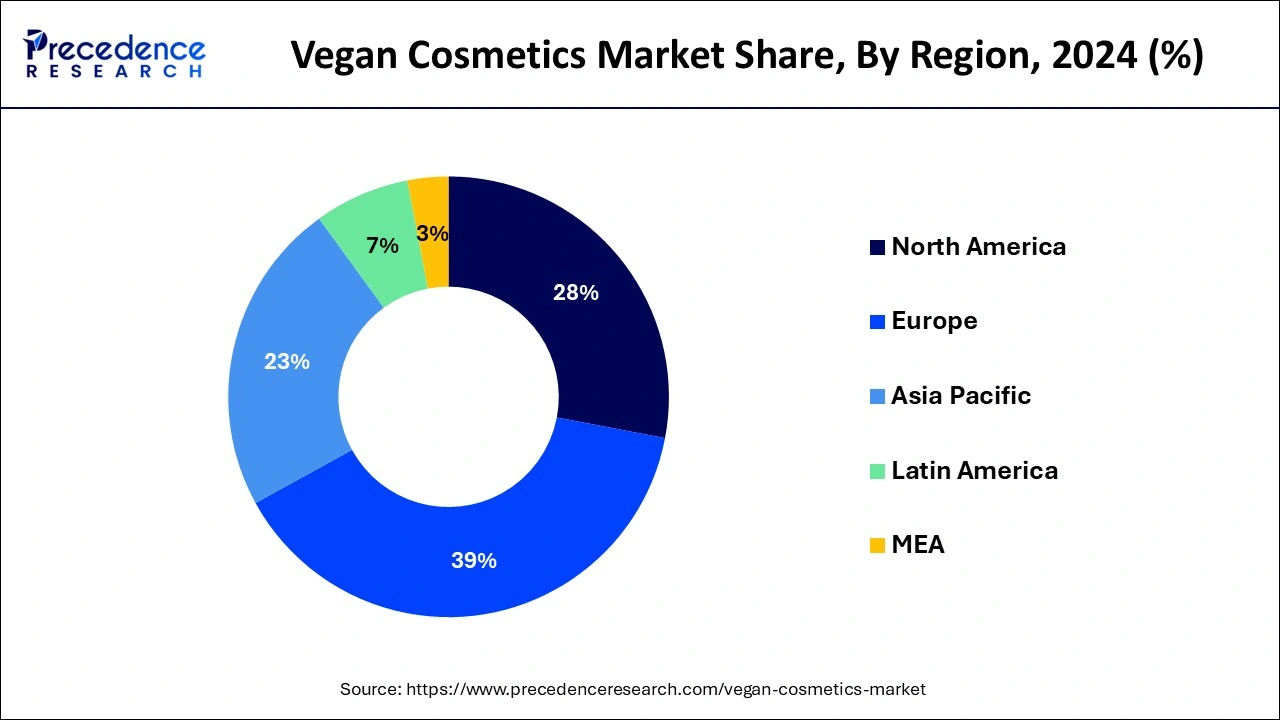

Europe dominated the global vegan cosmetics market in 2024. As more individuals adopt vegan diets, particularly in countries like the United Kingdom, France, and Germany, the demand for vegan cosmetics is expected to rise. European retailers, including specialty beauty stores, pharmacies, department stores, and online platforms, actively promote vegan and cruelty-free cosmetics through dedicated sections, labels, and promotions.

As ethical and environmentally conscious consumer trends gain traction, the vegan cosmetics market in the United Kingdom is expanding substantially. Growing concern for animal welfare and a preference for cruelty-free products are driving the popularity of vegan cosmetics. In line with the UK's commitment to sustainability, there is also a rising demand for pure and natural cosmetic formulas within the vegan cosmetics market. This can fuel market growth in the UK.

Asia Pacific is expected to host the fastest-growing vegan cosmetics market during the forecast period. In countries like India and Australia, there is a growing demand for vegan cosmetics due to increased awareness of animal cruelty. Additionally, since the pandemic, veganism has gained popularity in several nations, including India, Australia, and Japan. Hence, the region is expected to experience significant growth during the forecast period.

The vegan cosmetics market encompasses a variety of beauty products, including skincare, makeup, haircare, and personal care items such as moisturizers, shampoos, lipsticks, foundations, and body lotions. These products cater to consumers who follow vegan lifestyles, are concerned about animal welfare, or have sensitivities to animal-derived ingredients.

Vegan cosmetics exclude ingredients like collagen, lanolin, carmine, beeswax, and several derivatives of glycerin obtained from animals. Instead, they use plant-based alternatives, synthetic ingredients, and mineral-based pigments to achieve the desired colors, functionalities, and textures. Furthermore, innovations in sustainable packaging and eco-friendly manufacturing practices are shaping the future of vegan cosmetics.

| Report Coverage | Details |

| Market Size by 2034 | USD 33.39 Billion |

| Market Size in 2025 | USD 19.35 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.26% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Gen Z's call for inclusive and authentic branding

Gen Z consumers are discerning when it comes to brands, seeking more than just product efficacy and transparency. They expect brands to authentically embrace values that extend beyond basic functionality. Gen Z values businesses that demonstrate approachability and authenticity and incorporate principles of sustainability, diversity, and inclusivity. They also seek brands that offer a compelling narrative beyond their products and provide a supportive community of consumers. This generation is challenging traditional norms regarding gender and product categories and redefining the concept of physical attractiveness, all of which can drive the vegan cosmetics market.

Closures of hypermarkets and supermarkets

The beauty and personal care industry has been severely impacted by the pandemic, facing substantial challenges in adjusting to shifting consumer preferences. Consumers are now prioritizing products that are safer, with reduced risk of contamination and longer shelf life, when spending their money. Furthermore, closures of hypermarkets, supermarkets, and department stores have greatly hindered growth opportunities in the vegan cosmetics market, which leads brands to concentrate on enhancing their online retail capabilities.

Innovation in formulations and ingredients

The vegan cosmetics market is characterized by advancements in ingredient and formulation technologies that enhance the usability, effectiveness, and sensory appeal of vegan products. Manufacturers are investing in research and development to create innovative vegan formulas that meet ethical and sustainable standards and deliver results comparable to or better than traditional cosmetics. This includes improving the texture, color, and longevity of vegan cosmetics using state-of-the-art ingredients derived from plants, botanical extracts, natural oils, and mineral pigments. Moreover, technological advancements have enabled the development of vegan alternatives to traditional animal-derived ingredients such as collagen, keratin, and beeswax.

The skin care segment dominated the vegan cosmetics market in 2024 and is projected to sustain its position throughout the forecast period. Today, conscientious consumers prefer vegan skin care products due to their awareness of the benefits these products offer. Vegan skincare products, typically made with plant-based ingredients, are less likely to cause itchiness, irritation, acne, and other skin issues. This growing consumer awareness drives the preference for vegan options in skincare.

The hair care segment is expected to grow at the fastest rate in the vegan cosmetics market during the projected period. Vegan hair care products, such as shampoos, hair oils, conditioners, and hair masks, are available in various forms to cater to customer needs. This variety is driving the all-over demand for hair care products.

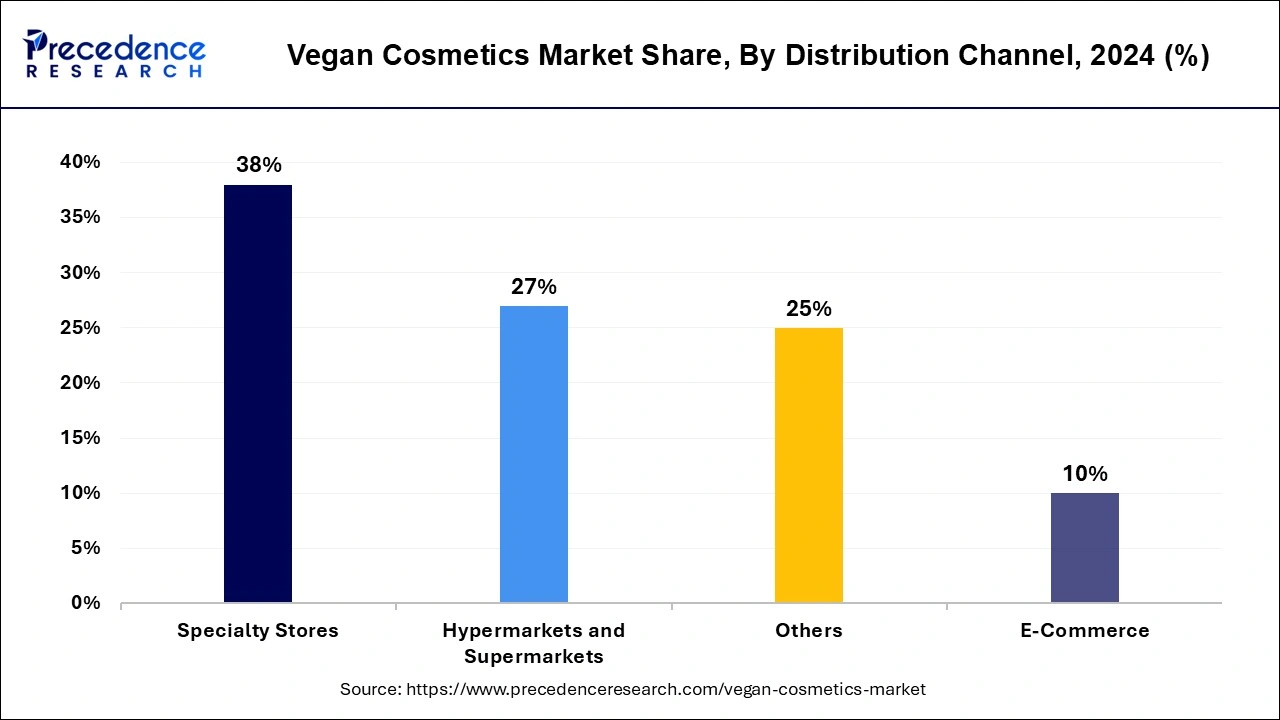

The specialty stores segment led the vegan cosmetics market in 2024. Specialty stores often collaborate with beauty brands to launch exclusive vegan collections or partnerships. These limited-edition releases and curated assortments attract consumers seeking innovative and trendy vegan beauty products, boosting foot traffic and sales for both retailers and brands. Specialty stores serve as hubs for brand discovery, which allows consumers to explore new and emerging vegan cosmetics brands alongside established favorites.

The supermarkets & hypermarkets segment is anticipated to grow at a considerable pace in the vegan cosmetics market over the projected period. Supermarkets and hypermarkets typically cover large areas and offer a wide variety of beauty products, including vegan cosmetics, all under one roof. Strategically located near residential areas, these stores provide convenient and easy access to a range of products for consumers.

By Product

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

November 2024

November 2024

November 2024