May 2025

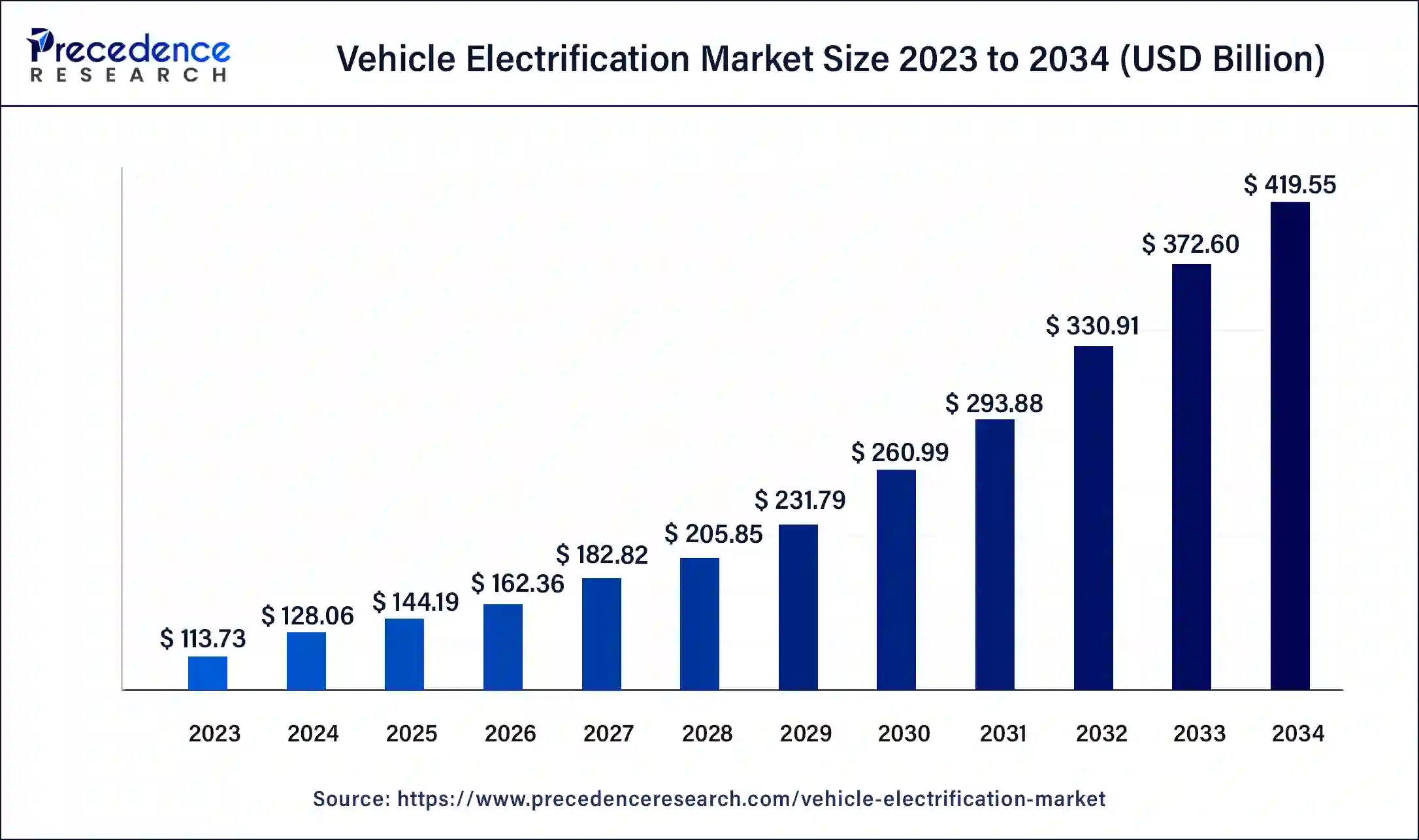

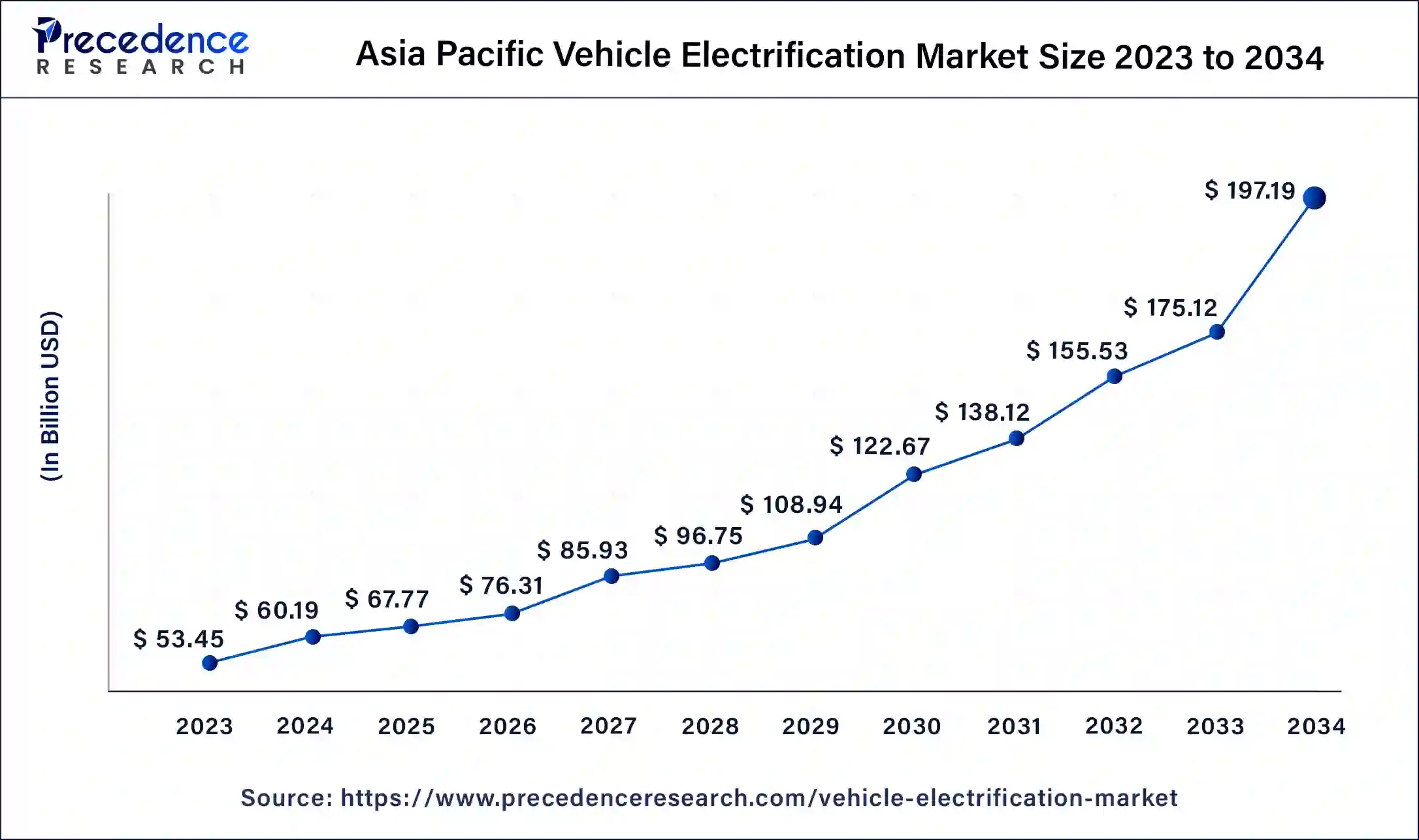

The global vehicle electrification market size is calculated at USD 144.19 billion in 2025 and is forecasted to reach around USD 419.55 billion by 2034, accelerating at a CAGR of 12.6% from 2025 to 2034.The Asia Pacific vehicle electrification market size surpassed USD 67.77 billion in 2025 and is expanding at a CAGR of 12.8% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global vehicle electrification market size was estimated at USD 128.06 billion in 2024 and is predicted to increase from USD 144.19 billion in 2025 to approximately USD 419.55 billion by 2034, expanding at a CAGR of 12.6% from 2025 to 2034.

The Asia Pacific vehicle electrification market size was estimated at USD 60.19 billion in 2024 and is predicted to be worth around USD 197.19 billion by 2034, at a CAGR of 12.8% from 2025 to 2034.

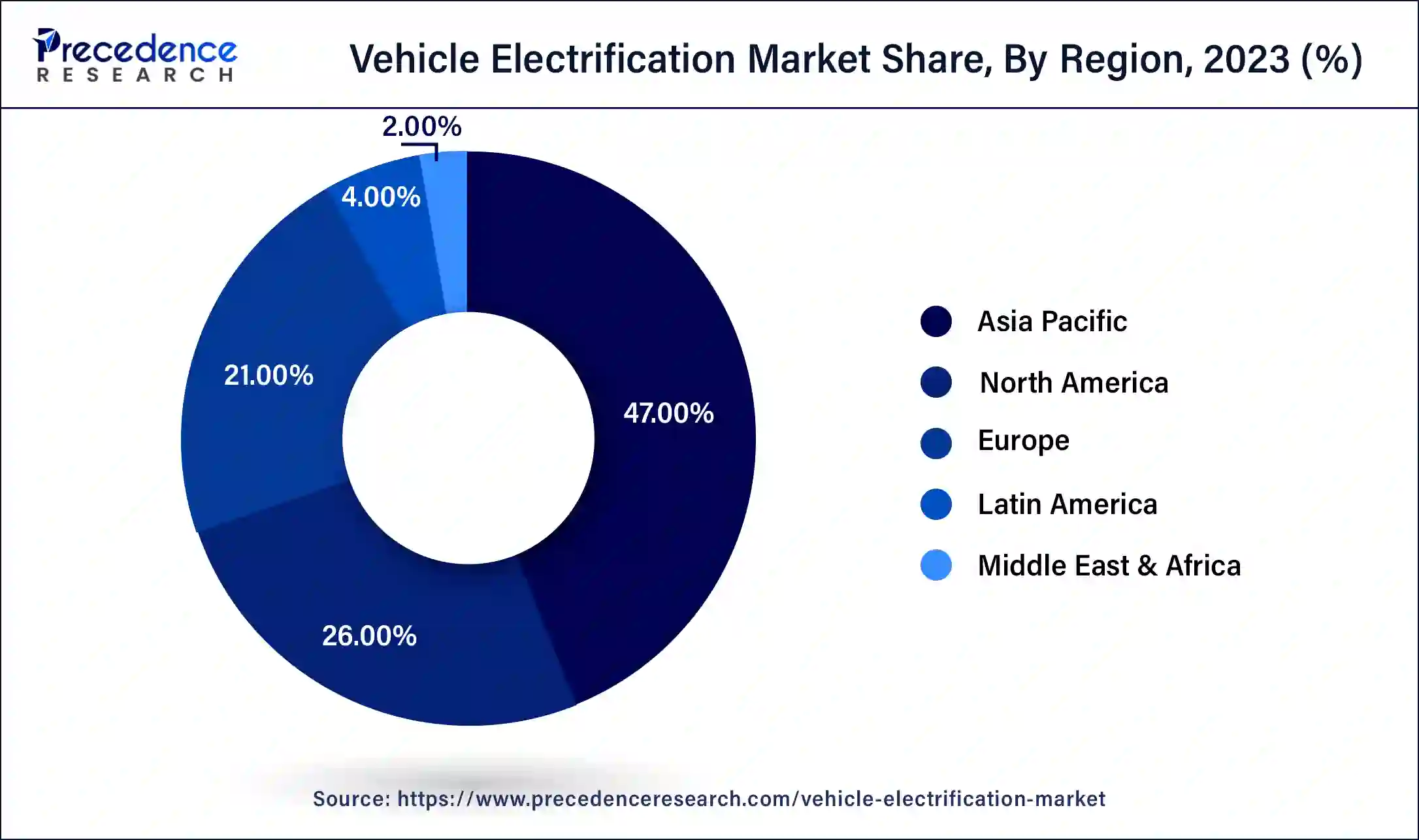

The Asia Pacific emerged as the market leader with prominent revenue share in the year 2024. High demand for vehicle supplements in China and India propels the market growth in the region. In addition, high per capita income along with rising population in the region stimulates the growth of vehicle electrification in the Asian countries. Rapid adoption of green transportation in Asian countries triggers the adoption of battery-powered vehicles such as BEV, HEV, and PHEV. This again contributes positively towards the market growth.

In terms of revenue, Europe holds second largest position in the global vehicle electrification market. The governments of France, Germany, UK, Italy, and other European countries focus on sustainable development in infrastructure growth, thisoffers significant opportunity for the market players to flourish their business.

According to the International Energy Agency, in 2023, global electric car sales soared by 35% year-on-year, increasing to almost 14 million new cars. While demand remained largely concentrated in China, Europe, and the United States, growth also picked up in some emerging markets such as Vietnam and Thailand, where electric cars accounted for 15% and 10%, respectively, of all cars sold.

In an electric vehicle electricity plays a major role in the function of its components. Adoption of clean power sources in these vehicles impact positively on the environment by reducing the harmful emissions. The aforementioned factor significantly drives the demand for vehicle electrification. Further, the electrification process reduces the overall operating costs and requires low maintenance compared to other vehicles by eliminating the use of coolant and lubrication in the vehicle. Mechanical integration with the help of electrification augments the efficiency of the vehicle that predicted to enhance the market growth during years to come.

However, difficulty in achieving an optimum power to weight ratio for the electrically powered vehicles expected to hinder the market growth. Lesser is the weight of the vehicle power, efficiency, and range will improve. Advanced and light-weight components are efficient in achieving optimum power to weight ratio. Original Equipment Manufacturers (OEMs) and Tier 1 companies are prominently working to improve the power to weight ratio by the implementation of light weight components such as e-axles and e-CVT, but still they are on their developing stages.

| Report Coverage | Details |

| Market Size in 2024 | USD 128.06 Billion |

| Market Size in 2025 | USD 144.19 Billion |

| Market Size by 2034 | USD 419.55 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 12.6% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Hibridization Type, Region Type |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Electric Power Steering (EPS) witness high demand in 2024 and expected to grow at a significant rate during the forecast period. Auto manufacturers are also switching towards electric power steering due to its primary benefits such as enhanced fuel economy in conventional ICE that is estimated to be the key factor driving the demand for EPS in automotive application. In addition, the extra comfort offered by the EPS system to the driver is the other potential driving factors that significantly boost the market growth. Presently, EPS is the most preferred steering system over the conventional Hydraulic Power Steering (HPS) as it is lighter and smaller along with the technology assist with computer-controlled electric motor in a vehicle. This efficiently eliminates the conventional components and result in energy-efficient solution for automobile. The aforementioned factors propel the market growth for the EPS system in the global market.

On the other hand, electric oil pump exhibit the fastest growth over the forecast period. The electric oil pump has an effective mechanical integration that fuels its application in the automotive sector. This results in equal distribution of oil in the required parts of the engine along with other parts of the vehicle.

Internal Combustion Engine (ICE) & Micro-Hybrid Vehicle dominated the global vehicle electrification market in the year 2024 and expected to witness a substantial growth in the coming years. In these vehicles, the electric motor is furnished with an ICE that helps it to shut-down immediately when the vehicle is stopped or brake is applied. The electric motor used in micro-hybrid vehicles replaces the conventional alternators and starters, thereby improves the fuel economy by reducing fuel consumption.

Plug-in Hybrid Electric Vehicle (PHEV) registered the highest growth over the analysis period. High fuel efficiency along with low maintenance and operational cost of the vehicle are the key factors attributed for the significant growth of the segment in the years to come. Furthermore, integration of electric engine with the ICE empower the vehicle with long driving range and fuel refilling or recharging flexibility. Government has also issued several norms related to decarbonization and environment safety that again propels the demand for PHEV during the forecast period.

The global vehicle electrification market is highly competitive, though seeks consolidation owing to large value share occupied by few top market players. These companies are mainly emphasized towards product enhancement, new product development, and expansion strategies for cementing their position in the global market.

By Product

By Hybridization

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

January 2025

May 2025

May 2025