December 2024

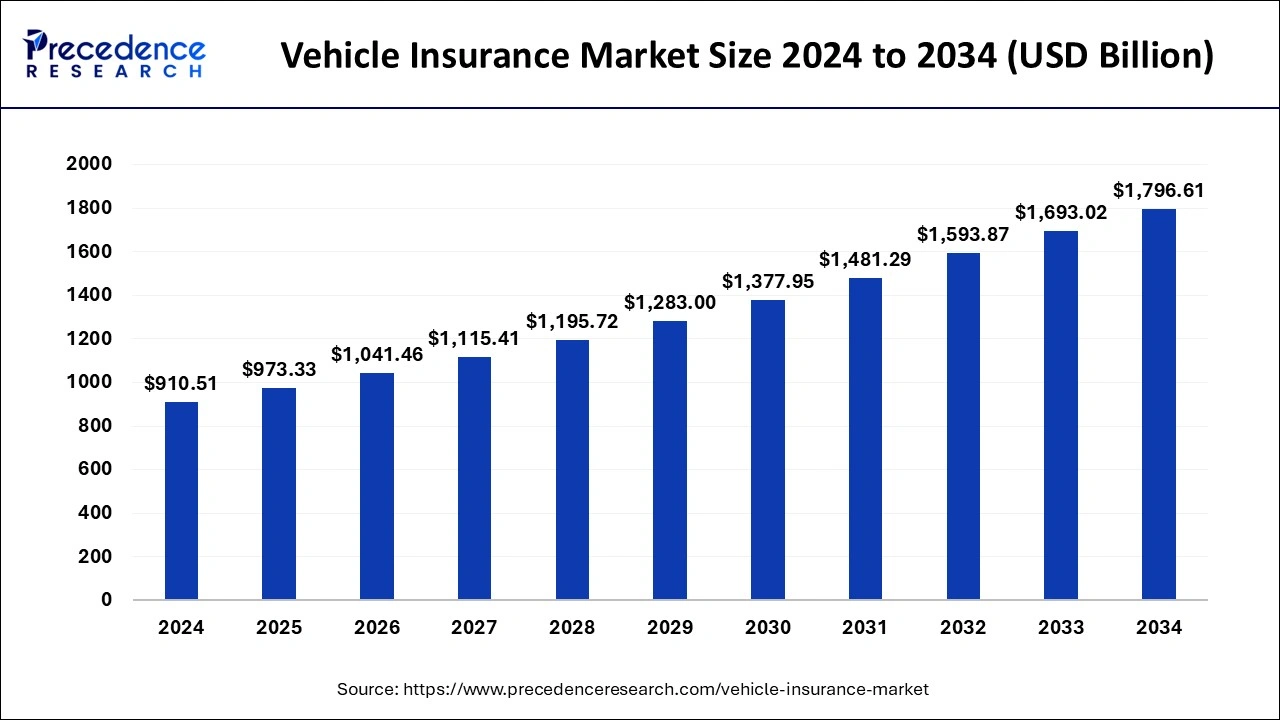

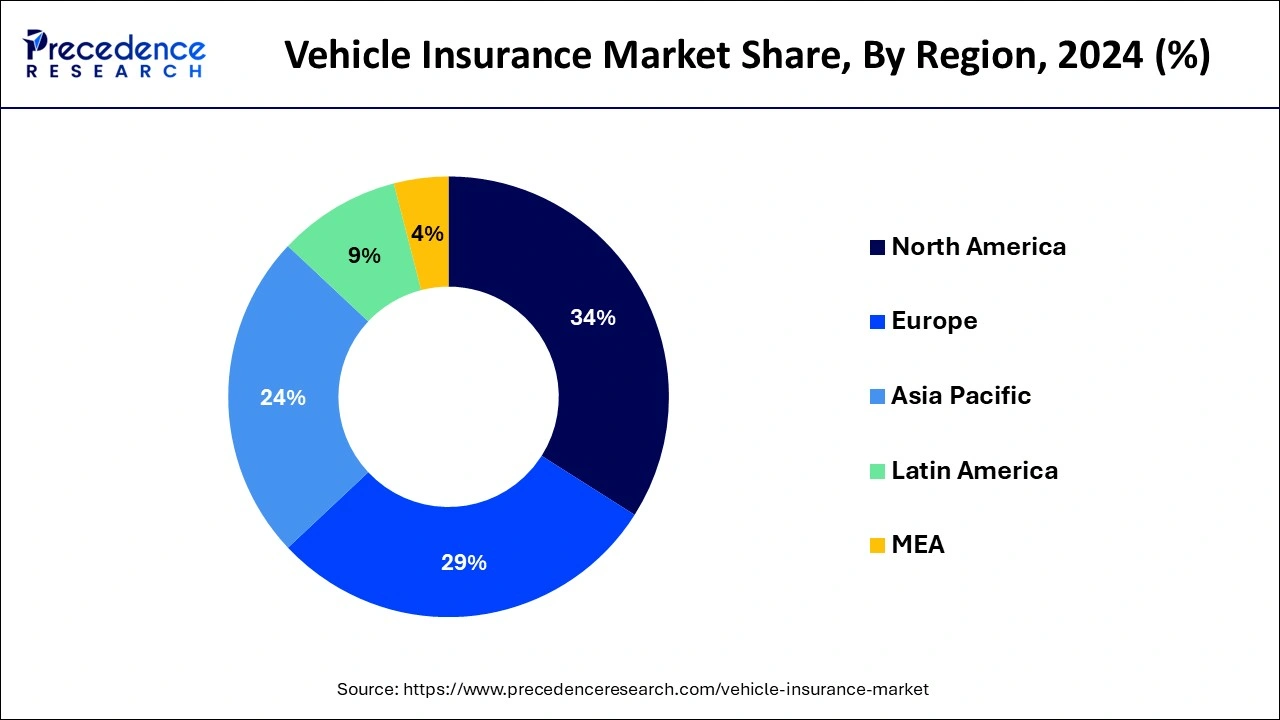

The global vehicle insurance market size is calculated at USD 973.33 billion in 2025 and is forecasted to reach around USD 1,796.61 billion by 2034, accelerating at a CAGR of 7.03% from 2025 to 2034. The North America market size surpassed USD 309.57 billion in 2024 and is expanding at a CAGR of 7.05% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global vehicle insurance market size accounted for USD 910.51 billion in 2024 and is expected to exceed around USD 1,796.61 billion by 2034, growing at a CAGR of 7.03% from 2025 to 2034. The growth of the vehicle insurance market is driven by rising vehicle ownership worldwide. As more people purchase vehicles, the demand for vehicle insurance increases.

Artificial intelligence allows insurance companies to incorporate speed, accuracy, and customer-centric performance in their workflows, which are dedicated to providing insurance coverage plans to all vehicles. AI helps to enhance the efficiency and accuracy of industrial performances. AI can also detect fraud cases which improves customer satisfaction. AI helps insurers to streamline their business operations and provides better services to their customers. AI technology handles insurance claim processes, making them faster, more accurate, and highly efficient. With the help of AI, automated claim processing helps to reduce operational costs, improve accuracy, and speed up claims processing through immediate claim approvals, fewer errors, and a transparent process.

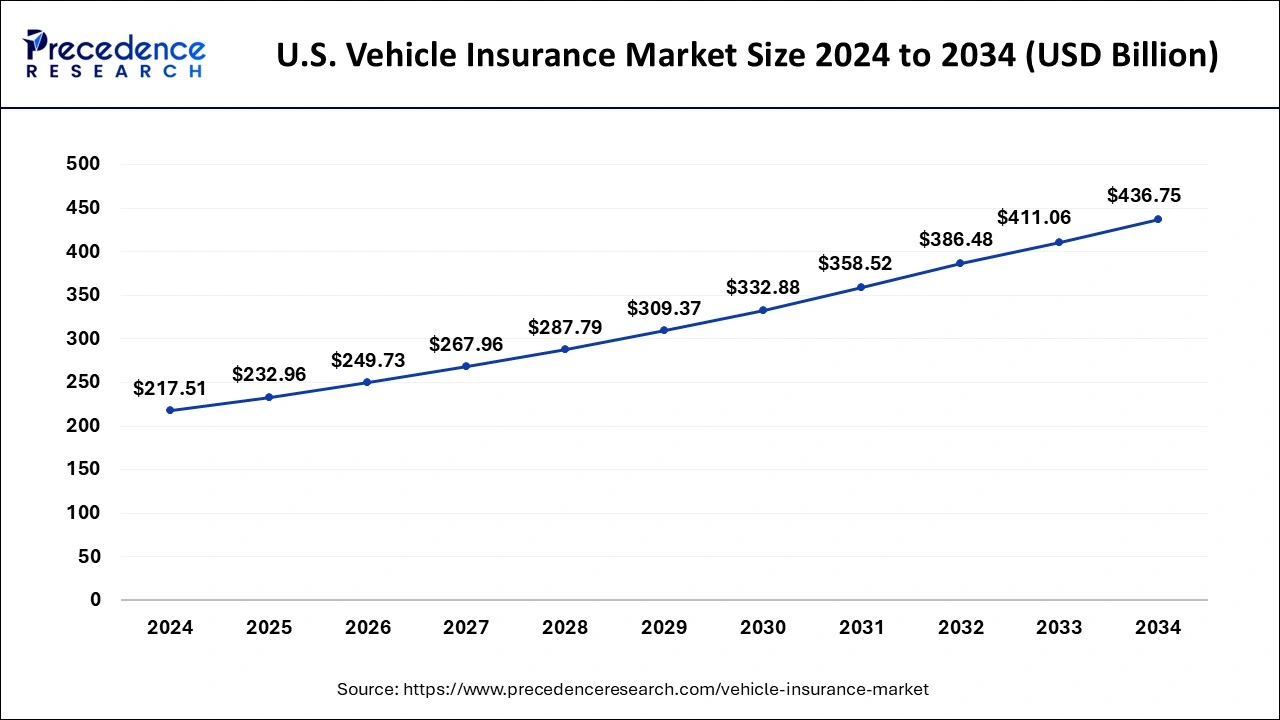

The U.S. vehicle insurance market size was exhibited at USD 217.51 billion in 2024 and is projected to be worth around USD 436.75 billion by 2034, growing at a CAGR of 7.22% from 2025 to 2034.

North America dominated the global vehicle insurance market in 2024. The presence of leading insurance providers, increased consumer awareness regarding the benefits of vehicle insurance, high disposable income, higher demand for vehicles, and rising affordability of the middle class is boosting the growth of the North America vehicle insurance market. The rising consumer awareness regarding the benefits of electric vehicles is anticipated to boost the demand for the EVs in the upcoming years and hence the demand for the vehicle insurance is expected to rise significantly in North America. The penetration of insurance sector is significantly high in the developed market of US and Canada. The rising adoption of the digital platforms for buying and renewing vehicle insurance policies is playing a significant role in the growth of the North America vehicle insurance market. Furthermore, the rising technological advancements and growing adoption of the digital technologies among the insurance providers is expected to have a positive effect on the growth of the vehicle insurance market during the forecast period.

Asia Pacific is expected to be the fastest-growing market during the forecast period. The rising demand for the vehicles owing to rising economic activities, increasing government investments in the infrastructural development, and rapid urbanization. The presence of huge population and rising middle class is fueling the demand for the vehicles in the region. The mandatory government regulations regarding the adoption of vehicle insurance in nation like India is exponentially contributing to the growth of the Asia Pacific vehicle insurance market. The rapidly rising demand for the alternative fuel vehicles in the developing nation like China is boosting the vehicle insurance market growth. China is the largest producer and consumer of the electric vehicles in the globe.

Vehicle insurance refers to compliance with laws that offer financial assistance to the people who are injured and vehicles that are damaged. It covers a financial amount that can be provided to concerned people in the form of compensation. It considers various factors such as the type of vehicle under driving, the age and gender of drivers, the driving history of people, the locations of accidents, and the amount of coverage chosen by people. Several insurance coverages including third-party liability insurance, own damage insurance, comprehensive damage insurance, and collision insurance drive the vehicle insurance market. These exclusive benefits are given for two-wheelers, three-wheelers, and four-wheelers which boosts the demand for vehicle insurance premiums or coverage plans to protect the vehicles and achieve personal safety. Allianz, Geico, American International Group, Bajaj Allianz Car Insurance, etc. are leading industries in the market contributing to upscale vehicle protection facilities by protecting people too.

| Report Coverage | Details |

| Market Size in 2025 | USD 973.33 Billion |

| Market Size in 2034 | USD 1,796.61 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.03% |

| Largest Market | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Coverage, Application, Distribution Channel, Vehicle Type, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regulatory Changes

With the rise in vehicle ownership, there has been a significant rise in the adoption of vehicle insurance. However, governments worldwide are continuously changing regulations regarding vehicle insurance, which influence the growth of the market. Consumers are becoming more aware of the importance of vehicle insurance. This, in turn, boosts the demand for customized insurance plans, such as low premiums. Moreover, online insurance websites are gaining immense traction since they provide comprehensive coverage at lower costs than insurance sold through traditional approaches.

Rising Competition

The entry of new players intensifies competition among insurers. New companies often come with innovative products and technologies, which force existing insurance companies to reduce their prices. Moreover, a lack of awareness about vehicle insurance and the availability of limited coverage options, especially in underdeveloped areas, limit the growth of the market. People in underserved areas often face challenges due to the digital shift of insurance companies.

Expansion of Insurtech Companies

The rapid expansion of Insurtech companies creates immense opportunities in the market. These companies use technologies such as telematics and mobile applications to offer personalized policies. These companies strive to standardize motor insurance policies to improve clarity and customer confidence. “Use and File Framework” is an initiative that encourages insurers to experiment with newly launched products and technologies to develop motor insurance solutions such as “pay-as-you-drive or pay-as-you-go.”

Based on the coverage, the third party liability coverage segment dominated the global vehicle insurance market in 2024. The major benefits of this coverage type is that it compensates any damage caused to the third party like disability, death, or any loss to his/her property. The legal and financial care is taken care in case of third party liability coverage. The probability of the vehicle accidents and damage to the third party is a major reason behind the increased preference for the third party liability coverage insurance.

On the other hand, the comprehensive coverage is anticipated to be the fastest-growing segment during the forecast period. The comprehensive policy not only covers the third party damages but also the damages caused to the customers’ vehicles. This is a major benefit of the comprehensive insurance over the third party insurance coverage, which is propelling the demand for the comprehensive coverage across the globe.

Based on the application, the personal vehicle segment dominated the global vehicle insurance market in 2024. The huge number of personal vehicles across the globe has led to the increased demand for the vehicle insurance. The rising affordability owing to the easy financing and EMI options is further fueling the demand for the personal vehicles and consequently the demand for the vehicle insurance is also growing. The rapidly growing popularity of the electric vehicles is expected have a significant impact on the growth of the global vehicle insurance market in the forthcoming years.

The commercial segment is anticipated to witness the highest growth rate during the forecast period. The growing adoption of car rental services and online cab services, along with the growing adoption of electric public transport vehicles is boosting the growth of the commercial vehicles segment. Furthermore, the rising economic development and economic growth owing to rapid industrialization and growing number of economic activities in the developing and underdeveloped regions is significantly boosting the demand for the commercial vehicles and hence it is expected to boost the growth of the vehicle insurance market during the forecast period.

By Coverage

By Application

By Distribution Channel

By Vehicle Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

August 2024

September 2024