January 2025

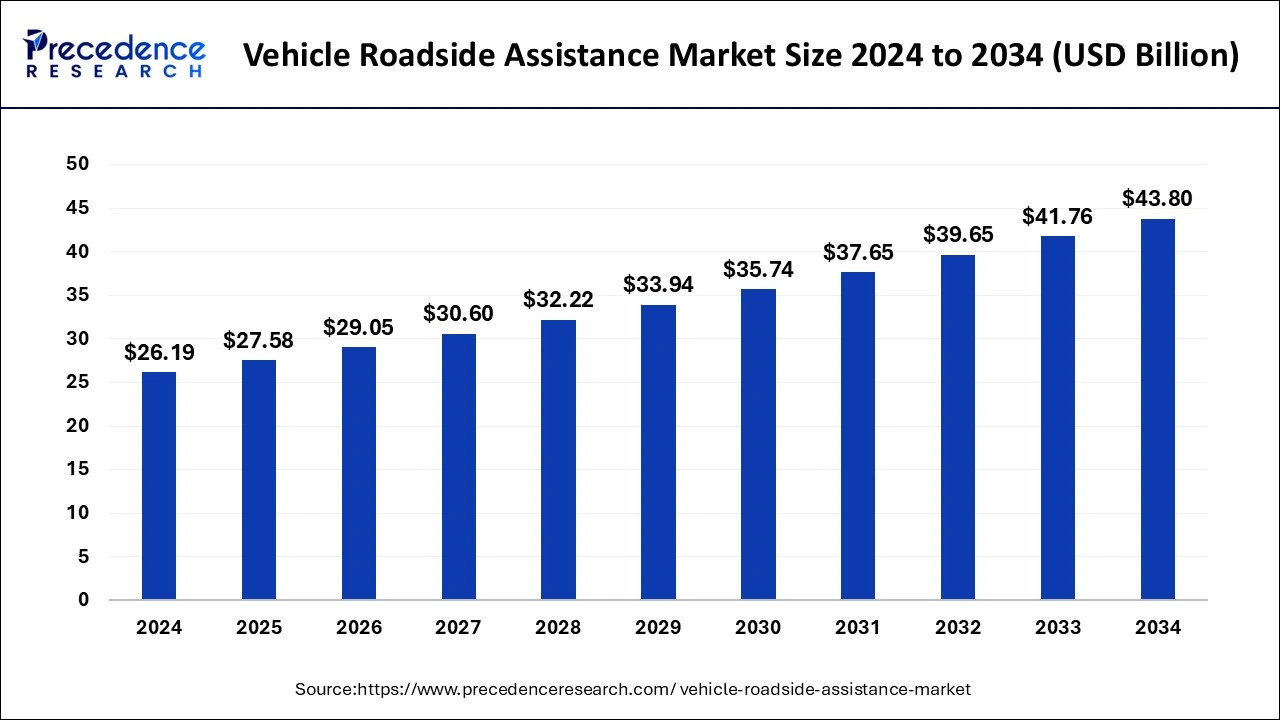

The global vehicle roadside assistance market size is calculated at USD 27.58 billion in 2025 and is forecasted to reach around USD 43.80 billion by 2034, accelerating at a CAGR of 5.27% from 2025 to 2034. The Europe vehicle roadside assistance market size surpassed USD 10.02 billion in 2024 and is expanding at a CAGR of 5.64 % during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global vehicle roadside assistance market size was estimated at USD 26.19 billion in 2024 and it is projected to reach around USD 43.80 billion by 2034, poised to grow at a CAGR of 5.27% during the forecast period 2025 to 2034. The rising adoption of vehicles, technological advancements, and favorable insurance schemes drive the vehicle roadside assistance market.

Artificial intelligence (AI) has been an integral part of the automotive industry, driving the latest innovations. AI will revolutionize the market in the future as it is still in its infancy. However, major market players such as Volkswagen, Mercedes-Benz, and Tesla have adopted AI in roadside assistance. AI can provide faster, better, and cost-effective services to the driver. The increasing adoption of smartphones enables drivers to use app-based services, facilitating advanced solutions. The advent of chatbots and conversational AI allows drivers to handle critical situations after accidents, reserve replacement cars, and answer all questions. This saves a lot of time for service providers and reduces man force. AI can also enable predictive maintenance for emergency prevention, forecasting prospective issues from the on-board diagnostics of a vehicle.

The Europe vehicle roadside assistance market size reached USD 10.02 billion in 2024 and is predicted to hit around USD 17.36 billion by 2034, growing at a CAGR of 5.64% from 2025 to 2034.

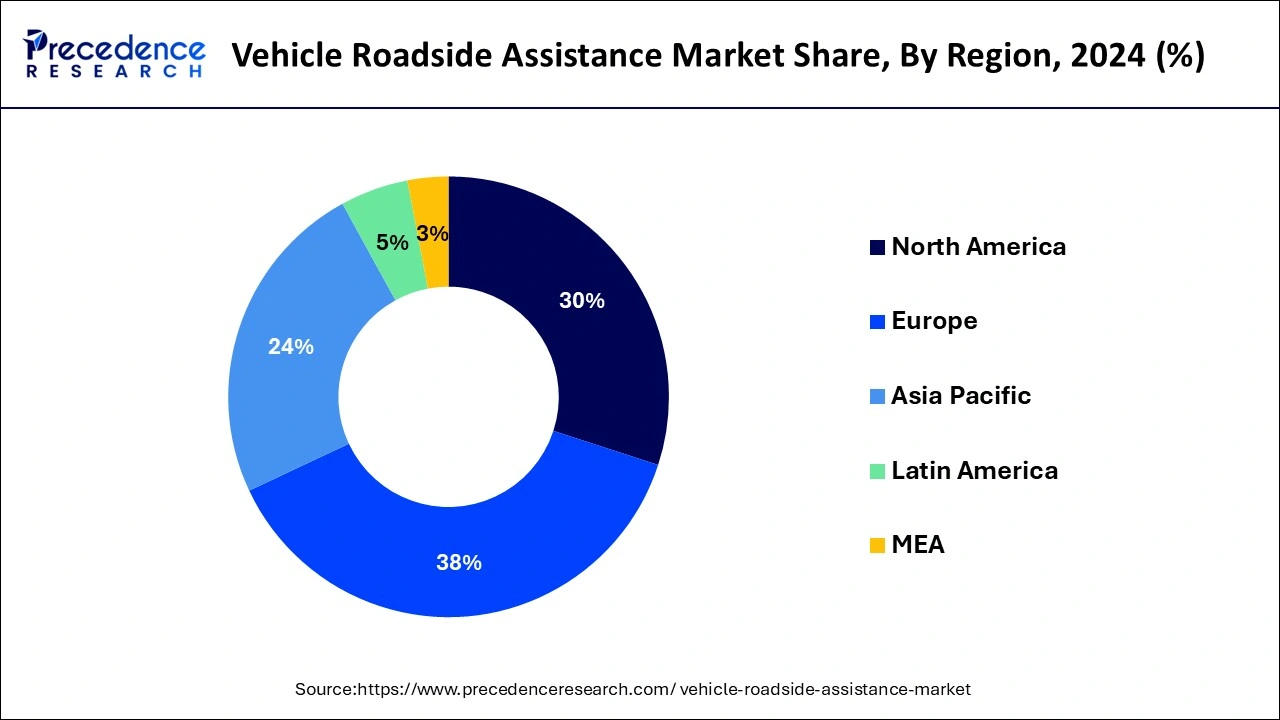

Rapid growth of the automobile sector in Europe has led the region as the most prominent revenue generator for the global vehicle roadside assistance market in 2023. Rising sales of vehicles across Europe coupled with significant number of on-road vehicle in the region are some of the prime factors driving the growth of the market. Escalated per capita income, consumer preference for lavishness, high standard of living, and rise in sale of premium vehicles are flourishing the demand for vehicle roadside assistance services in the region. Furthermore, North America roadside vehicle assistance market growth is also high owing to rising number of aging vehicles and adverse weather condition in several areas. The growing demand for car safety and assistance solutions, combined with advanced automobile production units, is propelling demand for vehicle roadside assistance in North America.

Markets in the Europe region are expected account for the largest share in the years to come owing to speedy growth of automobile sector, rising sales of vehicles across the region, preferences of individuals for improvidence, and growth in sales of luxury vehicles in this region. The European automobile roadside assistance market is driven by the presence of economically strong industrial units, an plenty of raw resources, and the availability of skilled labor, among other things. The European market will continue to be dominant, with Germany emerging as the leading country.

Asia Pacific is likely to observe the finest CAGR compared with other regions in the next few years. Increasing demand for vehicles along with rising per capita income are the significant factors that drives the market growth. In addition, this region is the most attractive automotive market for numerous market players. Penetration of advanced driver assistance, and electric vehicles have encountered significant automotive sales in the region and that in turn has increased the vehicle roadside assistance service demand.

Asia Pacific is anticipated to register for the highest CAGR over the next decade due to growing demand of vehicles, an increase in per capita income, and the strong presence of automotive market players.

Vehicle roadside assistance may help with everything from a flat tire to a motorized problem. Vehicle roadside assistance is a service offered by automakers or other service providers. This service provides assistance in case of breakdown or crash of the vehicle. Roadside vehicle benefits onsite support namely mechanical and electrical repairs and other common roadside problems, involving dead batteries, flat tires, etc. The mobile fuel delivery service is creating a phenomenal change in the vehicle roadside assistance market. The US based startup in the mobile fuel delivery “Booster” is gaining traction for servicing corporate campuses, residential consumers, fleet operators, and others.

Augmented demand for vehicle roadside assistance service is primarily due to the increasing number of aging vehicles that faces several electrical & mechanical issues. Each service provider offers all the services under their membership plan, though every player has their own terms and conditions. Nonetheless, a spike in vehicle registration along with rise in per capita income are likely to boost the demand for vehicle roadside assistance in the coming years.

| Report Scope | Details |

| Market Size in 2025 | USD 27.58 Billion |

| Market Size By 2034 | USD 43.80 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.27% |

| Largest Market | Europe |

| Base Year | 2024 |

| Fastest Growing Region | Europe |

| Segments Covered | Service, Providers, Vehicle, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing demand for vehicle roadside assistance systems

The rising quantity of vehicle issues, such as worn tires, tire blowouts, and worn brake lines, causes a significant demand for roadside help. Highways England expects to respond to 700 more breakdowns this week, raising the weekly average to nearly 5,000. When a result, as the number of car breakdowns rises, demand for vehicle roadside help rises as well.

Increasing vehicle ownership

The growing number of vehicles on the road has led to an increase in the demand for roadside assistance services.

According to Gov.UK, there were 551,000 vehicles registered in the U.K. in 2022.

Moreover, the increase in vehicle production and sales has a larger customer base and potential demand for roadside assistance services. With more vehicles on the road, there is a greater need for assistance in case of breakdowns or emergencies, which aligns with the services provided by Vehicle Roadside Assistance.

According to the Society of Indian Automobile Manufacturers,

Rising Urbanization

According to the world bank, approximately 56% of the global population, equivalent to around 4.4 billion people, resides in urban areas. Projections suggest that this trend will persist, and by 2050, the urban population is anticipated to more than double its current size. Rapid urbanization and the resulting increase in traffic congestion have amplified the need for roadside assistance services. In urban areas, limited parking space, complex road networks, and higher vehicle density lead to more breakdowns and emergencies. Urban dwellers often have limited DIY repair options and rely on their vehicles for time-sensitive lifestyles. Safety concerns and the need for 24/7 availability further drive the demand for roadside assistance services in cities.

Increasing insurance premiums

Insurance prices have risen, causing consumers to lose faith in the market. As a result, in nations like India, mandated auto insurance is helping to bridge the gap between insurers and customers. Furthermore, as both vehicle miles traveled and average vehicle age reach all-time highs, demand for roadside assistance is increasing. As a result, this factor is restricting the growth of the global vehicle roadside assistance market.

Increasing insurance premiums

As insurance costs rise, vehicle owners shift to reduce expenses, which leads to a decrease in demand for optional services like roadside assistance. Additionally, alternative options such as automobile clubs or independent service providers offer more competitive pricing, as a threat to traditional roadside assistance providers. Insurance companies also modify their coverage plans, potentially reducing or eliminating roadside assistance as part of their offerings. Furthermore, the perception of increasing insurance premiums as an added financial burden deter customers from opting for standalone roadside assistance plans.

Surge in demand for electric vehicles

One of the primary reasons influencing the growth of the market for car roadside assistance is the increased demand for hybrid and electric automobiles. Several governments have taken steps to encourage the use of hybrid and electric vehicles, such as granting subsidies and tax rebates, in order to reduce carbon emissions. As a result, hybrid and electric vehicle sales have increased, necessitating the expansion of vehicle roadside help services. Thus, this factor is supporting the growth of global vehicle roadside assistance market over the forecast period.

Technological advancement: On-demand auto repair & assistance

The introduction of smartphone app-based on-demand services has revolutionized the auto repair industry, allowing customers to conveniently request immediate assistance or schedule repairs without leaving their homes or offices. This advancement has greatly enhanced the overall customer experience, minimized wait times, and eliminated the hassle of searching for nearby repair shops. The integration of this has made it possible for customers to access the full spectrum of services with ease. Through integrating car data and the power of connected vehicles, companies offer immediate and convenient roadside assistance, proactive maintenance services, and additional offerings such as fuel delivery, car washing, and online car rental pickup. Moreover, the collaboration with e-commerce companies for in-car delivery services is fuelling market growth.

Rising labor costs

When it comes to choosing a roadside help service provider, cost is a big consideration. The key elements driving the increase in roadside assistance service fees have been rising labor and gasoline costs. Salaries and benefits account for more than 35% of a service provider's total cost structure. Wage fluctuations can have a significant impact on a vendor's profitability. As a result, it is a major challenge for market expansion.

Towing service accounted for the highest revenue share in the global vehicle roadside assistance market in the year 2022. Breakdown and collision are the major cause for the rising demand for towing service. The U.S. department of Transportation and National Highway Traffic Safety Administration has declared that total motor vehicle crashes in 2018 were 6,734,000. Towing is the most common service provided during the emergency roadside assistance. In 2022, the U.S. registered almost all revenue only from towing services. In addition, technological advancements in towbars such as retractable, electric, and detachable towbars projected to flourish the towing services during the forecast period.

All types of vehicles, from light passenger vehicles to big commercial vehicles, require this type of servicing, and demand in this category is expected to drive market expansion. Vehicle towing service leads the service type sector due to its cost-effectiveness, speed, and lack of maintenance, and is predicted to maintain its position during the projection period.

On the other hand, tire replacement, battery assistance, Jump Start/Pull Start, Trip Routing/ Navigational Assistance, and other mechanical services contribute notably to the market revenue.

The auto manufacturer segment is likely to dominate the global vehicle roadside assistance market in the next few years. This is mainly attributed to the warranty services and after sales assistance services offered by automobile manufacturers. Several auto manufacturers, for example Honda, provide vehicle roadside assistance services in many countries. Similarly, Toyota, Ford, Hyundai, General Motors, and many other auto manufacturers provide roadside assistance to their customers. Since this vehicle industry is rapidly evolving, offering a wide choice of fast, contemporary, efficient, cost-effective, and diverse solutions, this segment is projected to maintain its leadership in the near future.

Passenger vehicles held the largest market share in 2024 and the segment will remain dominant until 2033. The purchase of passenger vehicles is increasing in countries such as Brazil, India, China, the UAE, Qatar, and South Africa because of the rising disposable income. Consequently, there has been a rise in investments in vehicle insurance and related services such as vehicle roadside assistance. Luxury car owners are readily availing premium rapid services. Moreover, the increasing sales of electric vehicles will also drive the need for roadside assistance services. Additionally, growing consumer preference for luxury and hybrid vehicles with advanced safety systems such as assisting at point and increasing deployment of different income class people in passenger cars is expected to drive the growth of the vehicle road assistance market over the forecast period.

Passenger vehicles segment is predicted to account for the largest share of the global market due to its cost-effectiveness, it’s widely preferred, not much hassle in maintenance, and, it can be customized for various purposes. The demand for this vehicle is projected to increase rapidly keeping it dominant in the market.

Commercial vehicle is further bifurcated as light commercial vehicle, heavy commercial vehicle. Light commercial vehicle hold 64.05 % share of total commercial vehicle share in 2024 and is anticipated to continue its dominance through the forecast period.

By Service

By Provider

By Vehicle

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

August 2024

March 2025