January 2025

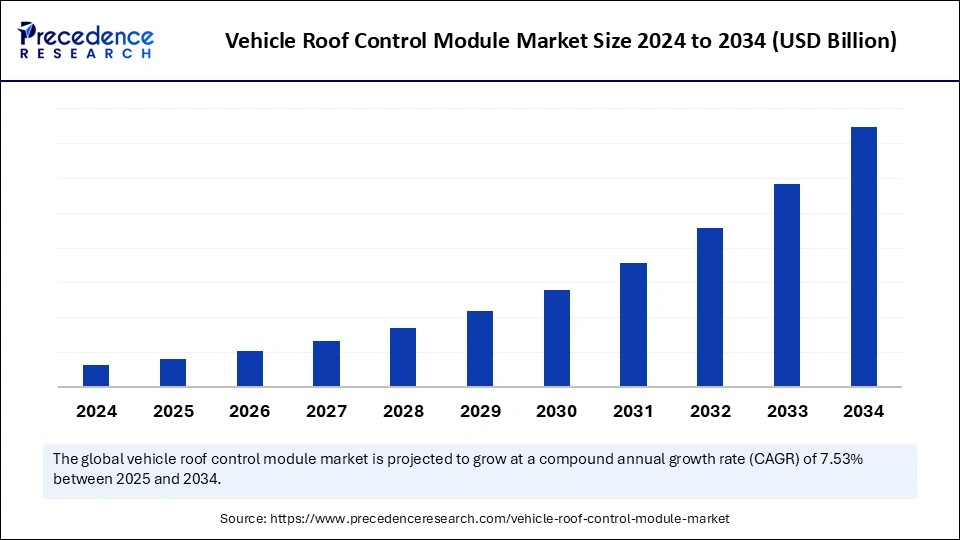

The global vehicle roof control module market. Global industry analysis, size, share, growth, trends, regional outlook, and forecast 2024-2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global vehicle roof control module market is growing steadily, driven by rising demand for smart features, enhanced comfort, and lightweight components. Increasing adoption in luxury, autonomous, and electric vehicles, along with stringent safety regulations, is further fueling market expansion. The rising demand for premium and luxury vehicles is the key driver of the global market. The demand for electric and hybrid vehicles with more safety and convenience has increased, making a crucial impact on market growth.

Artificial Intelligence is the key transformer for vehicle safety and convenience features. The adoption of advanced vehicles with AI integration features is a trending the world. Additionally, AI integration in the vehicle roof control module market is the spectacular scale-up in the vehicles. AI integration is enabling more advanced functionalities, including dynamic lighting adjustments, personalized comfort settings, and improved safety features via real-time data analysis. These are the sophisticating capabilities of roof control modules.

The integration of automatic emergency braking and vice control systems is leveraging crucial impact on the roof control module. Additionally, the integration of cutting-edge materials and designs of vehicle roofs enables lightweight and enhanced efficient fuel capabilities. Growing demand for advanced feature roof control module connectivity with other vehicle systems is driving major emphasis on AI integration with roof control modules.

The vehicle roof control modules operate control of vehicle roofs like sunroofs, moonroofs, coupe, and convertible roofs. The roof control module's function is beyond lights, encompassing interior and ambient light control, sunroof, and blind control. The increased adoption of luxury, premium, electric vehicles with advanced features is driving the integration of roof control modules. Manufacturers are highly focused on implementing sophisticated roof control modules to improve safety, comfort, and performance, driving significant transformation in the market. The demand for advanced featured roof control modules is high among SUVs, hatchbacks, and sedans.

Technological advancements like the integration of roof control modules with other systems are developing high-sophisticated roof control modules to improve functionality and convenience. Additionally, advancements in technologies are allowing the development of electric sunroofs, making more efficient and convenient roof control module features in vehicles. Several regulations, such as Safety regulations governing anti-entrapment and anti-theft features, are driving innovation in roof control systems, and environmental regulatory promotions for fuel efficiency are encouraging the use of lightweight materials, and efficient designs are drawing spectacular impact on the global vehicle roof control module market.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle Body Type, Roof Type, Sales Channel, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Demand for luxury vehicle

The vehicle roof control module market is gaining growth due to increased demand for luxury vehicles. Factors like rising urbanization and increased availability of disposable income allow consumers to spend on premium vehicles, leading to a boost in demand for vehicles with advanced features. Luxury vehicles are highly equipped with cutting-edge features, including panoramic roofs, sunroofs, and convertible roofs. The growing popularity of premium cars with power-operated roofs and complex roof opening mechanisms is trending; manufacturers are focusing on incorporating more complex roof designs with the integration of sunshades and light-up elements, making them a more premium choice.

The high price of vehicle roof control module

The major hindrance to the adoption of vehicle roof control modules is their high cost. The high-cost related implementation of technology in non-premium vehicles leads to an expense burden. Vehicle roof control modules are majorly associated with premium vehicles, which are less affordable for budget-conscious consumers. The complexity of designs and material costs like aluminum and steel make roof control modules more expensive. Additionally, the leverage of roof control modules with other vehicle features can cause more cost and complexity, making it less preferred and accessible.

Increased adoption of sunroofs in sports utility vehicles (SUVs)

The comfort, convenience, and style of sunroofs are gaining popularity in sport utility vehicles (SUVs). Advanced features of panoramic options and automated opening/closing mechanisms of sunroof-equipped vehicles are driving significant impacts on SUVs. Sport utility vehicles are the key trends of the recent vehicle roof control module market. Implementing sunroof features is expected to boost the segment insights. Sunroofs are often equipped with luxury vehicles, making them more standard features in various SUV models. Additionally, advancements in technology enable sunroofs to be more cost-effective, reliable, and efficient to enhance their adoption in SUVs.

The sports utility vehicle (SUV) dominated the vehicle roof control module market due to the increased adoption of standard feature sport utility vehicles. SUVs are gaining popularity due to their comfort, style, and versatility. SUVs are high adopters of roof control modules, especially controlling the opening and closing of sunroofs and panoramic roofs. The growing popularity of large roof areas and demand for standard roof features, including panoramic sunroofs, moonroofs, and complex opening mechanisms, are emerging adoption of roof control modules in sports utility vehicles.

The sedan segment is anticipated to grow with the highest CAGR during the studied years due to increased demand for luxury and premium sedans. The rising demand for sophisticated roof control systems with cutting-edge features, including panoramic sunroofs and power-operated tops, is trending the shift toward luxury and premium sedans. The sedan has a high adoption rate of convertible and sunroof features. The rising concerns for safety and convenience are leading to demand for advanced roof control modules in sedans.

The panoramic roofs segment accounted biggest vehicle roof control module market share in 2024. Growing demand for luxury and premium vehicles with panoramic roof features is all over the automotive area. The adoption of panoramic sunroofs has increased due to the rising need for Roof Control Modules with advanced control mechanisms to manage opening/closing, shading, and ventilation features of vehicles. The growing popularity of panoramic roofs is playing a favorable role in the demand for sophisticated roof control modules.

On the other hand, the hard-top segment is expected to witness notable growth in the forecast period. The segment growth is majorly attributed to rising demand for convertible and coupe vehicles. Convertible and coupe vehicles have complex mechanisms involved in opening and closing. The prioritized sleek and seamless hard-top designs of vehicle roofs are further driving the need for a Roof Control Module for smooth operations of opening/closing.

The OEM segment contributed the highest market share. This growth is accounted for due to increased demand for advanced roof control features and systems in new vehicles. The rising large-scale vehicle production demands with roof control modules are leveraging segment growth. OEM sales channels have long-term contracts with manufacturers. OEM channels provide high-quality products to comply with all needs of vehicle manufacturing to ensure the reliability, durability, and performance of the roof control modules. The growing emphasis of OEMs on the integration of roof control modules with other vehicle systems is emerging further segment expansion.

The aftermarket segment is projected to expand rapidly in the coming years because of the rising demand for upgrades and replacements of roof control modules with existing vehicles. The growing trend of standard features like sunroofs and panoramic roofs is driving consumer demand for their implementation with existing vehicles. Growth in customization options and accessibility to newer technologies are the factors driving the adoption of roof control modules aftermarket.

Asia Pacific dominates the global vehicle roof control module market because of the region's large vehicle production area. Asia Pacific is advanced in automotive manufacturing, and major vehicle production countries such as India, China, Japan, and South Korea play crucial roles in the market. Factors like the rising adoption of advanced roof control modules in existing vehicles and the high demand for luxury and premium vehicles are driving the market in Asia Pacific. The presence of several major suppliers is the major contributor to market expansion.

China is leading the regional market with countries highest demand for premium vehicles. Well-established automotive infrastructure and high adoption of hybrid and electric vehicles are driving demand for roof control modules among countries' consumers. The availability of disposable income allows spending on premium and luxury vehicles. Additionally, manufacturers are emphasizing updating and replacing the roof control module version to enhance their safety, performance, and functions, making a favorable impact on the country's market. Japan is the second largest country leading the market due to increased demand for advanced automobiles with high safety and convenience features.

North America is anticipated to witness significant growth in the market due to the increased adoption of luxury & premium vehicles and a large base for vehicle production in the United States, Canada, and Mexico. High demand for convertible vehicles is the major factor contributing to market share in North America. Growing adoption of electric and hybrid vehicles with advanced safety and convincing features is emerging in the market. The United States is leading the regional market due to the country's large vehicle production area and increased adoption of electric vehicles. Canada is the second largest country, leveraging market growth due to increased demand for cutting-edge safety-featured vehicles.

By Vehicles Body Type

By Roof

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

August 2024