December 2024

Veterinary Dental Equipment Market (By Product: Equipment, Hand Instruments, Consumables, Adjuvants, By Animal Type: Large Animal, Small Animal, By End-user: Hospitals & Clinics, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

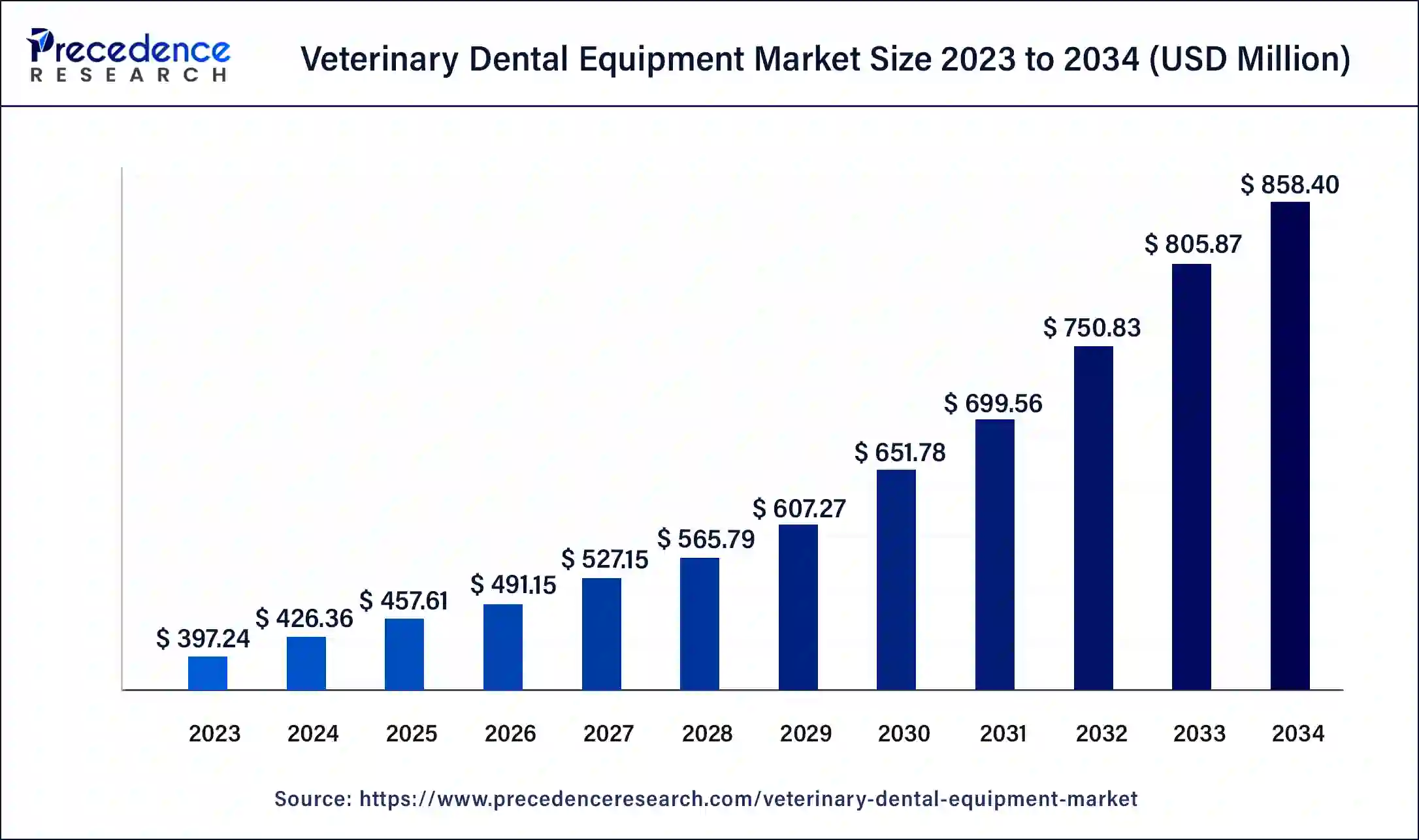

The global veterinary dental equipment market size was valued at USD 426.36 million in 2024 and is anticipated to reach around USD 858.40 million by 2034, growing at a CAGR of 7.2% from 2024 to 2034. The growth is mainly driven by the increasing prevalence of periodontal diseases like periodontitis and gingivitis.

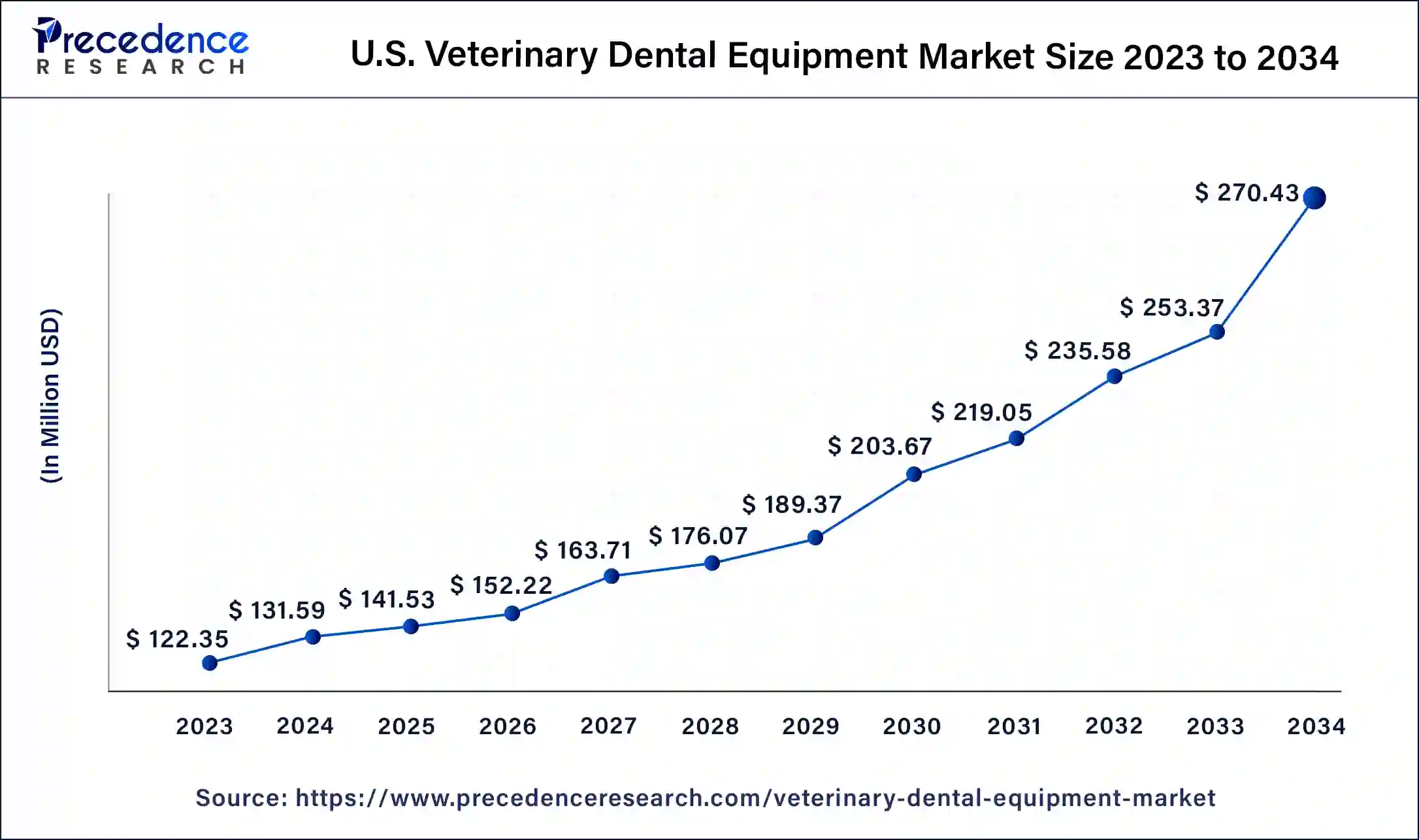

The U.S. veterinary dental equipment market size was estimated at USD 122.35 million in 2023 and is predicted to be worth around USD 270.43 million by 2034, at a CAGR of 7.47% from 2024 to 2034.

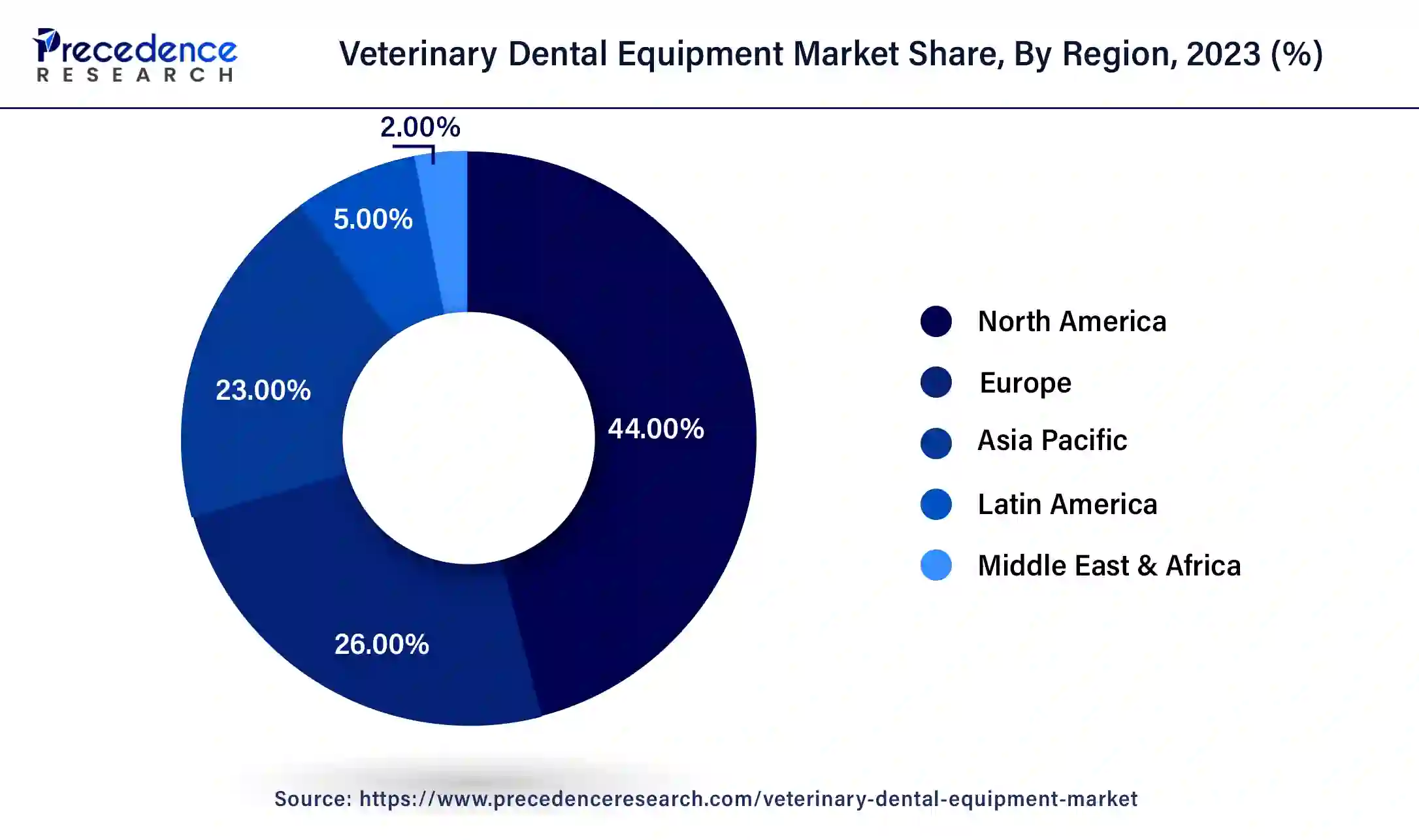

North America held the largest share of the veterinary dental equipment market. This is because there's been a rise in periodontal disease among pets, leading to increased spending on companion animal healthcare. Moreover, there are plenty of veterinary dental services available in this region. More people own pets, and there's a growing concern for their health, including dental care, which could drive market growth in the coming years. Also, efforts by major players to enhance their products and maintain high-quality standards are likely to further drive demand for veterinary dental equipment in North America.

Asia Pacific is seeing rapid growth in the global veterinary dental equipment market. This is fueled by factors like the increasing number of pet owners, higher disposable income, and a growing emphasis on animal welfare. Furthermore, countries like China and India are undergoing significant urbanization and witnessing a rise in the middle-class population, leading to greater pet ownership and demand for quality veterinary dental services. As a result, the region is expected to have the highest growth rate soon.

Veterinary science encompasses the medical care and welfare of animals, spanning from beloved pets to livestock and wildlife. Veterinary dental equipment plays a pivotal role in ensuring the oral health of these creatures. It covers an array of specialized tools tailored for the diagnosis, treatment, and maintenance of dental conditions in animals. The burgeoning demand for veterinary dental equipment is the growing trend of pet ownership.

As more individuals embrace animals as integral members of their families, there arises a heightened willingness to invest in their well-being. While many aspects of animal health receive attention, dental health often remains overlooked by pet owners. The veterinary dental equipment market caters to the holistic care of animals, aligning with the prime goal of veterinary science to preserve the health and vitality of our animal companions.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.2% |

| Global Market Size in 2023 | USD 397.24 Million |

| Global Market Size in 2024 | USD 426.36 Million |

| Global Market Size by 2034 | USD 858.40 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Animal Type, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rise in pet ownership

The ongoing research and development facilities drive innovation in next-generation veterinary dental technologies, for the market thrives on several key drivers. The surge in pet ownership and the rise in veterinary dental issues, particularly periodontal diseases among cats and dogs aged three and above, can propel the veterinary dental equipment market growth. This spectrum of inflammatory conditions affecting tooth-supporting structures underlines the necessity for advanced dental solutions.

The proliferation of veterinary dental services and increased awareness among pet owners about the significance of oral hygiene can boost the market for dental equipment globally. Moreover, the increasing number of veterinary practitioners and the upward trajectory of disposable incomes empower consumers to prioritize their pets' health, which fuels market expansion. Also, ongoing research and development facilities drive innovation in next-generation veterinary dental technologies for companion animals, which can fuel the growth of the veterinary dental equipment market.

High equipment cost

The high cost associated with veterinary dental equipment poses a significant hurdle to the veterinary dental equipment market expansion, especially for small animal clinics and pet owners. This barrier stems primarily from the advanced technology integrated into these devices. Modern veterinary dental equipment consists of high-speed drills, ultrasonic scalers, cutting-edge imaging systems, and other intricate tools, generating substantial investments across the spectrum of research, development, manufacturing, and marketing endeavors.

The surge in veterinary periodontal diseases

The growth in veterinary periodontal diseases (PD) serves as a prominent driver for market growth. PD typically initiates around a single tooth and advances progressively. In its initial stage, known as stage 1, dogs manifest symptoms of gingivitis. As the disease progresses to stage 2, approximately 25 percent of teeth start to detach from the gums. Subsequent stages 3 and 4 witness further deterioration as gum tissue recedes, potentially exposing tooth roots. Moreover, the escalating focus on dental disease research in companion animals amplifies the demand for veterinary dental equipment. The continuous introduction of veterinary dental equipment and consumables globally significantly fuels the market expansion throughout the forecast period.

The equipment segment dominated the veterinary dental equipment market in 2023. Veterinary dental equipment is vital for conducting dental procedures on animals. The increasing awareness of oral health in animals and the growing need for dental surgeries and treatments are the major contributors to the dominance of dental equipment in the market. Dental equipment comprises a range of tools and devices such as drills, imaging equipment, scaling units, etc. which are used for veterinary dental procedures.

The X-ray systems segment is anticipated to grow at a significant rate during the forecast period. This is due to the associated benefits of oral examination and rising adoption by veterinary doctors. It also helps to see 50% of teeth below the gums, which can then help with a proper diagnosis and treatment options.

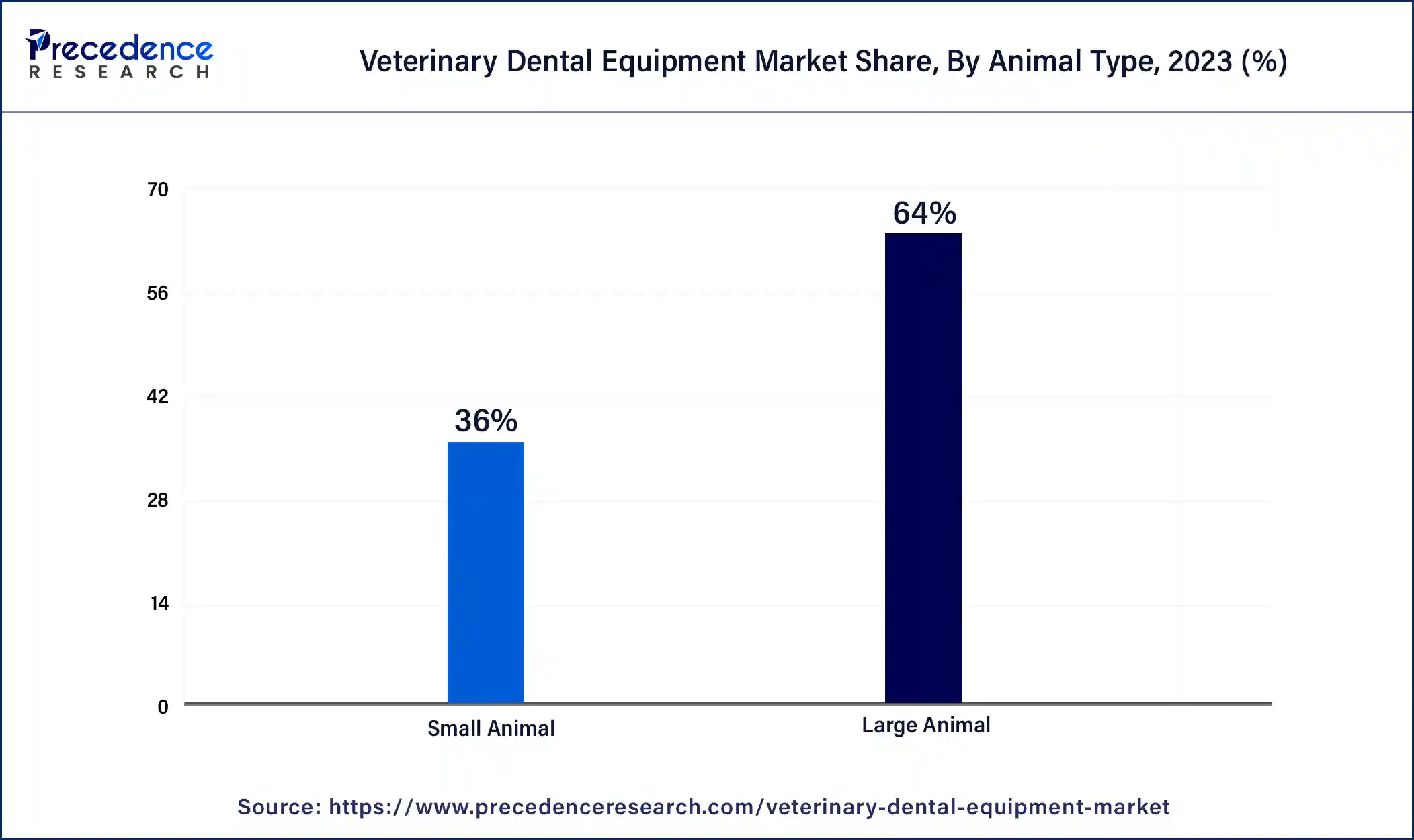

The large animal segment dominated the market by holding the largest share of the veterinary dental equipment market in 2023. Dental issues often lead to breeding difficulties, weight loss, and reduced nursing ability in animals. Regular dental check-ups are necessary to ensure good health. Detecting dental problems early is crucial for effective treatment, even though it can be challenging to identify based solely on external signs.

The small animal segments are expected to see the fastest growth during the projected period. The rising incidence of periodontal disease in pets is propelling the market growth. Early diagnosis and treatment are necessary as they help to prevent conditions that can cause chronic pain in the future.

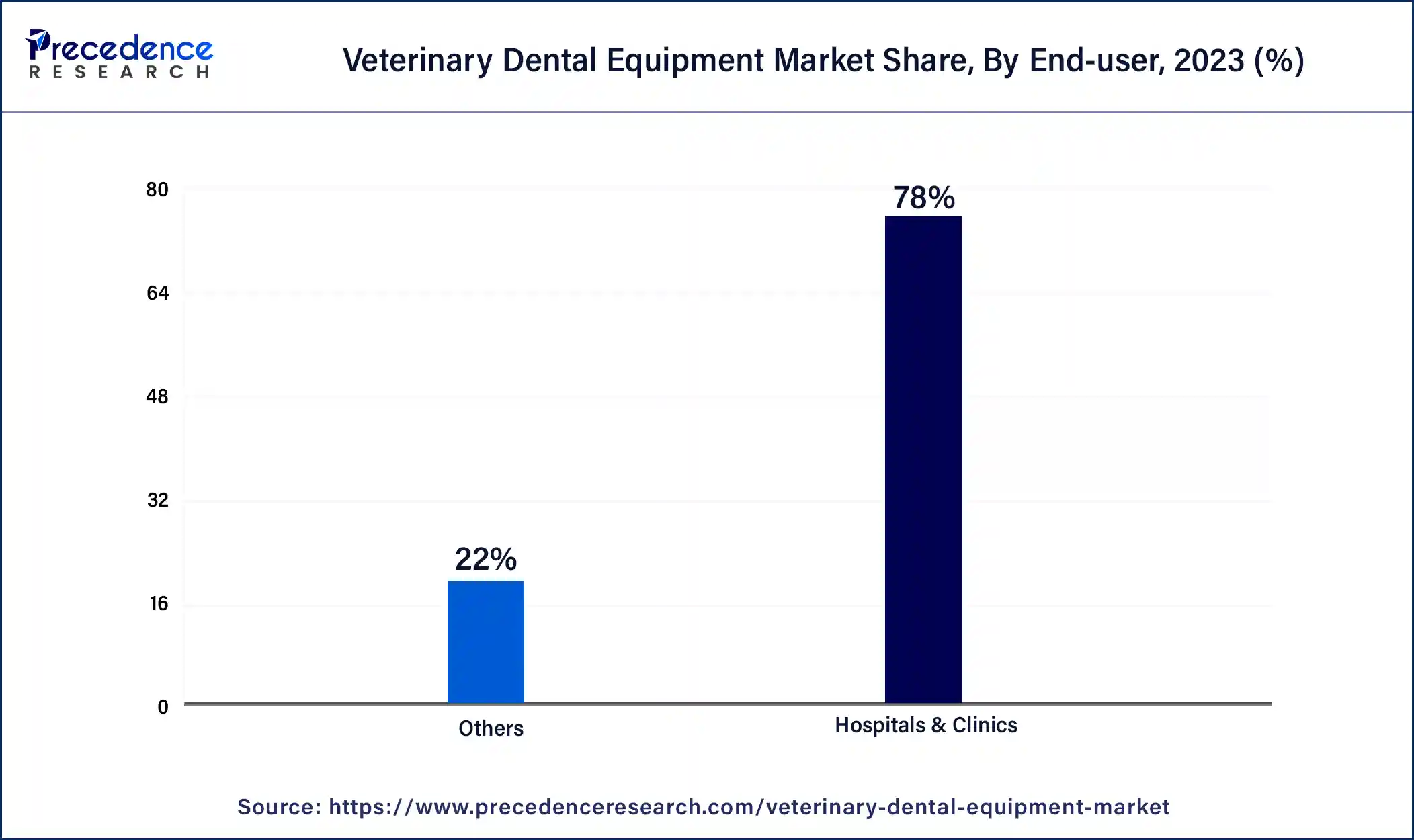

The hospitals & clinics segment dominated the veterinary dental equipment market in 2023. Veterinary hospitals and clinics hold the largest portion of the market because they are the main providers of dental care for animals. Equipped with specialized veterinary dental tools, these facilities diagnose and treat a range of dental issues in animals.

The other segment is expected to witness significant growth over the forecast period. The others segment comprises research institutes and various animal care centers. These institutes are increasingly investing in research initiatives to develop improved treatment options and diagnostic procedures, particularly for companion animals. There's also a growing focus on enhancing dental health in animals and adopting evidence-based practices, which is fueling the demand for veterinary dental equipment in research institutes.

Segment Covered in the Report

By Product

By Animal Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

August 2024

November 2024