December 2024

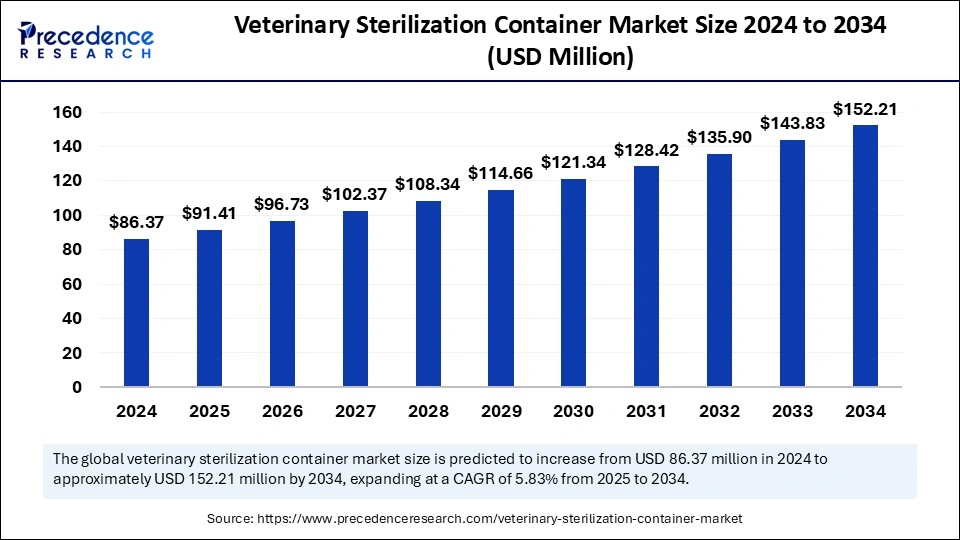

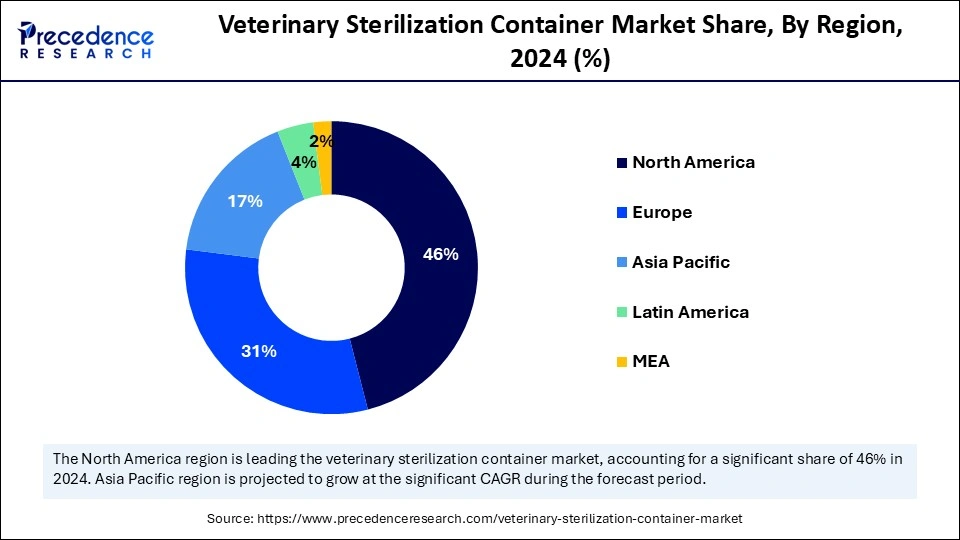

The global veterinary sterilization container market size is accounted at USD 91.41 million in 2025 and is forecasted to hit around USD 152.21 million by 2034, representing a CAGR of 5.83% from 2025 to 2034. The North America market size was estimated at USD 39.73 million in 2024 and is expanding at a CAGR of 5.94% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Million), with 2024 as the base year.

The global veterinary sterilization container market size was calculated at USD 86.37 million in 2024 and is predicted to increase from USD 91.41 million in 2025 to approximately USD 152.21 million by 2034, expanding at a CAGR of 5.83% from 2025 to 2034.The market is expanding at a CAGR of 5.83% between 2025 and 2034. The rising demand for veterinary sterilization containers is attributed to the widespread infection and disease among animals; there is an increasing need to ensure animal safety.

The integration of artificial intelligence in the veterinary sterilization container market is creating a positive impact by enhancing operational efficiency and accuracy. Ai-based algorithms have the ability to optimize sterilization cycles by adjusting the parameters based on real-time conditions and ensuring that the equipment and tools are effectively sterilized. Moreover, AI plays a crucial role in automation, which helps reduce human error and streamline workflows, leading to significantly reduced costs in hospital settings. Artificial intelligence creates a next-generation interactive platform that helps in organizing better sterile processes, increases case volumes without hiring more FTE (Full-time employees), and reduces overtime and burnout among the present staff.

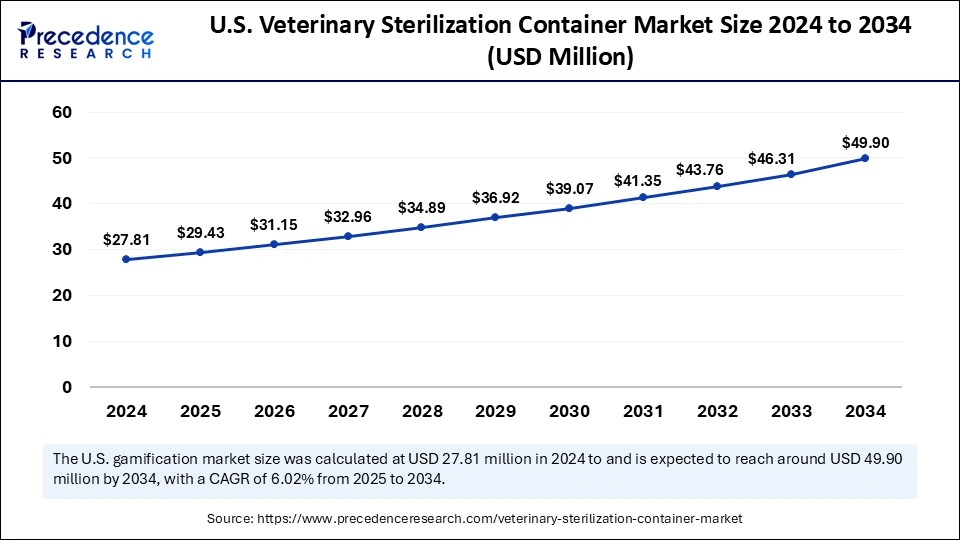

The U.S. veterinary sterilization container market size was exhibited at USD 27.81 million in 2024 and is projected to be worth around USD 49.90 million by 2034, growing at a CAGR of 6.02% from 2025 to 2034.

North America dominated the global veterinary sterilization container market in 2024. The dominance of this region is experienced due to the rising incidence of multidrug-resistant (MDR) pathogens and Hospital-acquired infections (HAIs). The primary driver of antimicrobial resistance is the overuse and misuse of antibiotics in humans, animals, and agriculture.

Inadequate infection control and prevention in healthcare settings drive the requirement for sterilization procedures. The United States national action plan for combating antibiotic-resistant bacteria presents a strategic goal to encourage the U.S. Government’s response to antimicrobial resistance, leading to improving health in America.

Asia Pacific is expected to grow at the fastest CAGR in the veterinary sterilization container market over the forecast period. The expansion of this region is experienced due to the increasing animal care standards and rising awareness regarding infection control. The market is driven by diverse applications in the management of disease in livestock, including cattle, pigs, poultry, and sheep.

Disease management ensures the better health and safety of animals, which involves diagnostics, updated vaccination, and treatment of various ailments. Additionally, the rising awareness of healthcare is noticed due to the growing population and demand for medical procedures.

Veterinary sterilization containers are the perfect tool for the sterile preparation of surgical kits and instruments. The veterinary sterilization container market technologies help lower operating expenses, support green purchasing initiatives, and improve patient outcomes. Sterilization acts as a barrier against microorganisms during storage, handling, and transport. The purpose of the sterilization act is to destroy all microorganisms present on the surface of medical devices and to prevent disease transmission associated with the use of that item.

| Report Coverage | Details |

| Market Size by 2034 | USD 152.21 Million |

| Market Size in 2025 | USD 91.41 Million |

| Market Size in 2024 | USD 86.37 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.83% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Material, Type, End Use and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Risk management

A sterilization container system is a safer and easy-to-use method. The sterilization containers keep the instruments sterile for 6 months if the lid is not opened and the container is kept under adequate storage conditions. The container is made of stainless steel with antibacterial and high-temperature resistance silicone covering.

Prevalence of hospital-acquiring infection

Hospital-acquired infection, also known as healthcare-associated infection (HAI), promotes the veterinary sterilization container market products and services. HAI are infections received while undergoing treatment at a healthcare facility such as a veterinary hospital or from healthcare professionals such as doctors or nurses. According to the Centers for Disease Control and Prevention, 1 in every 31 hospital patients has been associated with healthcare infection at least once. The main cause behind hospital-acquired infection is the exposure to germs that spread between animals, providers, staff, and visitors through unclean hands or improper use or reuse of equipment.

Time-consuming and labor-intensive

The predominant challenge of the veterinary sterilization container market is that it must be dismantled, refurbished, reconstituted, and checked before each use. This is a lengthy and staff-depended process, which leads to delays in the medical setting, restraining operational productivity. Additionally, sterilization containers require regular, careful maintenance to ensure they are aseptic after processing and before medical procedures.

Reusable, airtight sterilization containers

The veterinary sterilization container market is expected to witness the incorporation of reusable, airtight sterilization containers that are used to pack and protect medical devices during sterilization, transport, and storage. These containers will be made of a rigid material such as lightweight anodized aluminum, which is a great alternative for pouches and wraps and equally easy to handle and stack.

Sterilization containers can also be used as pre-vacuum steam sterilizers and come with accessories, including filters, indicator cards, and tamper-evident seals. The airtight containers will prevent bacteria and mold growth by minimizing air and moisture exchange between the container and its surroundings. Reusable sterilization containers reduce the environmental harm caused by disposable containers; they are eco-friendly and reduce the amount of waste.

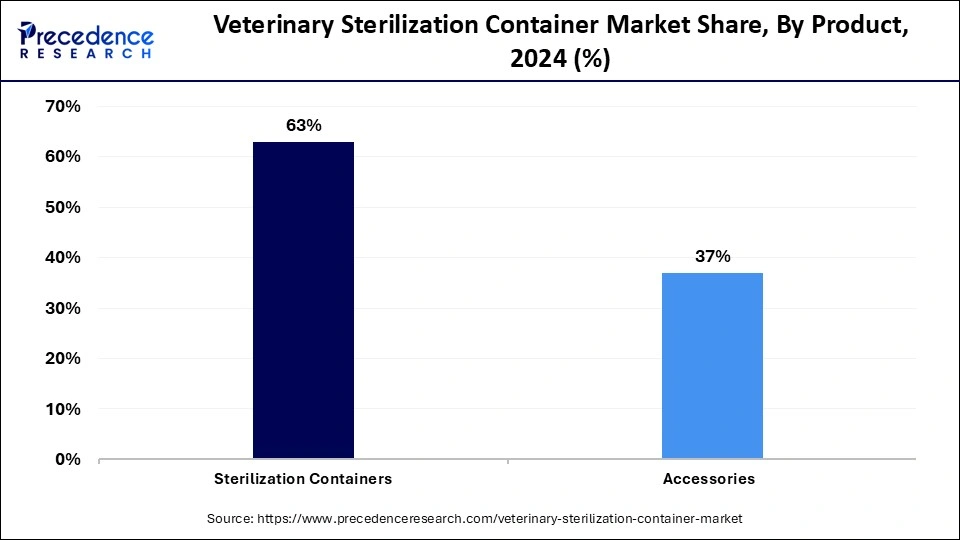

The sterilization container segment contributed the highest veterinary sterilization container market share in 2024. The primary reason behind the dominance of this segment is the ability to keep the equipment and instruments safer than the other methods. The sterilization container can keep the tools sterile for 6 months if the life is never opened and placed in proper condition. Sterilization is essential to prevent disease transmission associated with the use of the items.

The accessories segment is predicted to expand at the fastest rate during the forecast period. The growth of this segment is mostly noticed as it enhances the container’s functionality. There are various accessories available, including instrument dividers, silicone mats or liners, instrument holders, filters, identification labels, and tamper-evident seals. The utilization of accessories depends upon the intended use. It is recommended that healthcare facilities consult with sterilization experts or suppliers to determine the most suitable containers and accessories for their requirements.

The aluminum segment captured the biggest share of the veterinary sterilization container market in 2024. Aluminum is widely used in sterilization containers due to its durability, lightweight, and corrosion resistance. Aluminum mage sterilization containers are more economical to use compared to single-use wraps; they have the ability to last for more than 5 years. Additionally, it protects the environment by not causing medical waste.

The stainless steel segment is anticipated to grow at the fastest CAGR during the projected period. The anticipated growth of the segment is due to the use in the healthcare setting to sterilize and store equipment. Stainless steel is suitable for routine sterilization procedures. It offers a barrier to microorganisms, protects the instrument, and eliminates torn wrappers. Additionally, they are easy to clean and sanitize with an antibacterial cleaner.

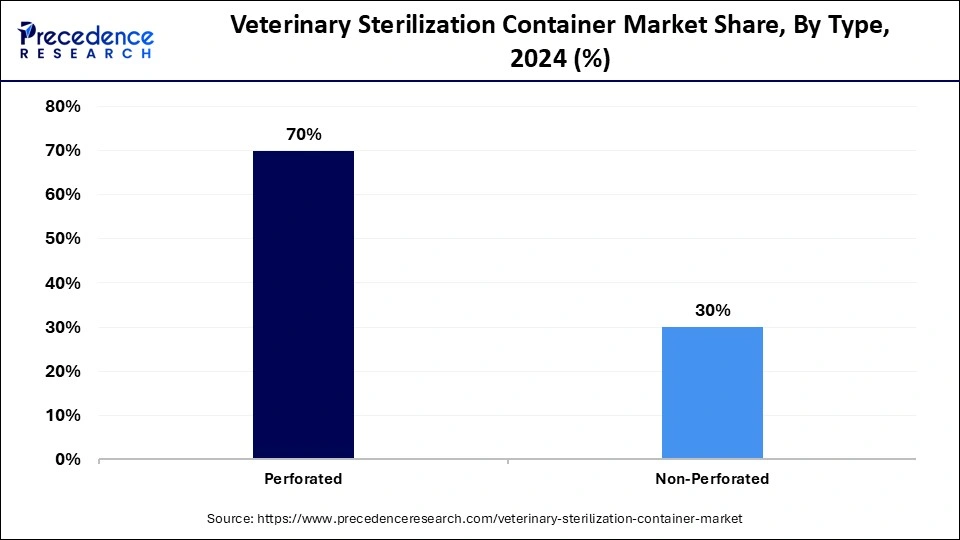

The perforate segment dominated the global veterinary sterilization container market in 2024. The perforation allows steam or gas to penetrate the tray during sterilization, which ensures that the steam or gas reaches every piece and every corner for ideal sterilization. It is commonly used for implants, surgical instruments, and textiles. They are specially designed for small and delicate instruments for microsurgery, ENT, dental, and neurosurgery.

The non-perforate segment will show significant growth during the forecast period. The demand for this segment is mostly due to the secure locking mechanisms it offers. There are no holes or perforation or penetration in these types of sterilization containers. They create a completely sealed atmosphere to prevent contamination of instruments after sterilization.

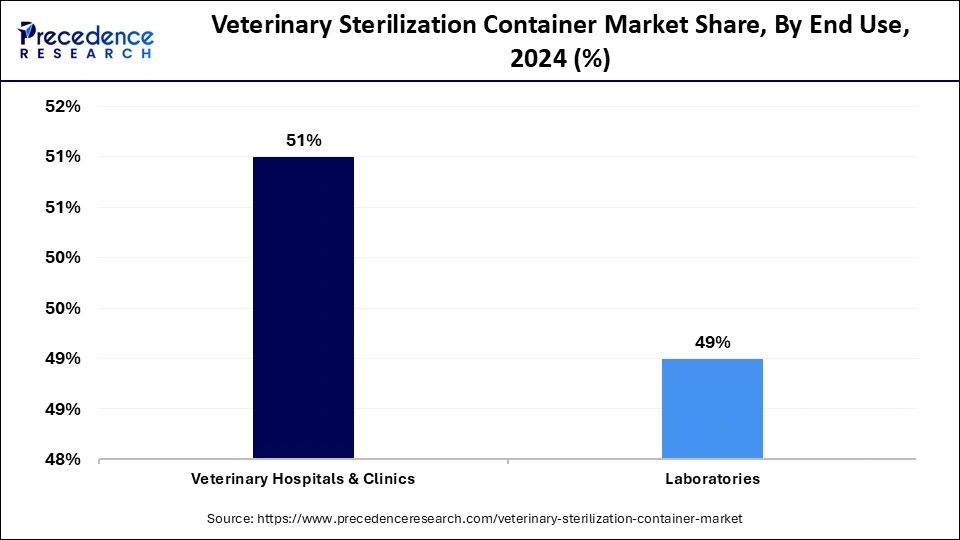

The veterinary hospitals and clinics segment captured the biggest veterinary sterilization container market share in 2024. The dominance of this segment is elevated surgical throughput and the implementation of strict infection control practices. The sterilization process at hospitals destroys all forms of microbial life and carries out healthcare facilities in physical or chemical ways. Every veterinary hospital and clinic has a preventative plan to stop the spreading of HAIs. The hospital germ warfare strategy includes the process of cleaning, disinfection, and sterilization. The Central Sterile Services Department (CSSD) ensures equipment and material from the autoclave stay sterile until they reach the operating room.

The laboratories segment is anticipated to grow at the fastest CAGR during the forecast period. The growth of this segment is credited to veterinary laboratory preparation equipment, reagents, and culture media, the most commonly used sterilization method used in labs in autoclaving. Sterilization containers in equipment and tools labs lead to accurate test results and reliable research outcomes.

By Product

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

August 2024

November 2024