November 2024

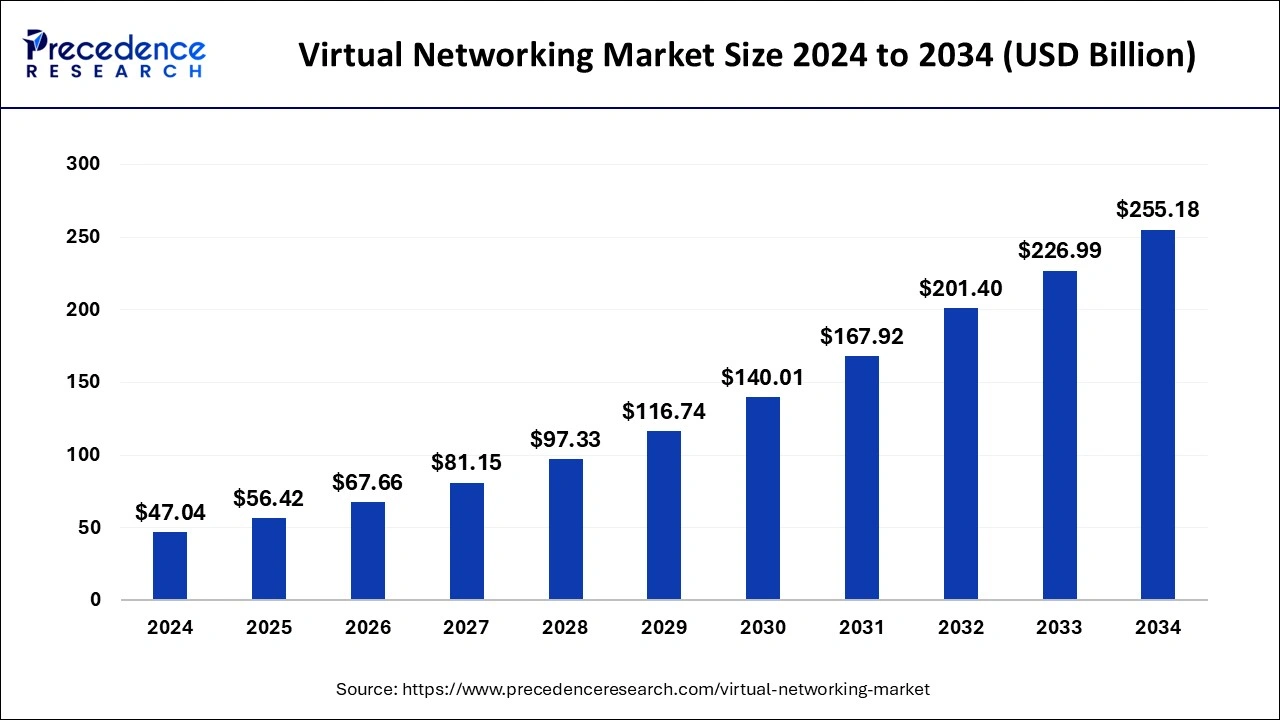

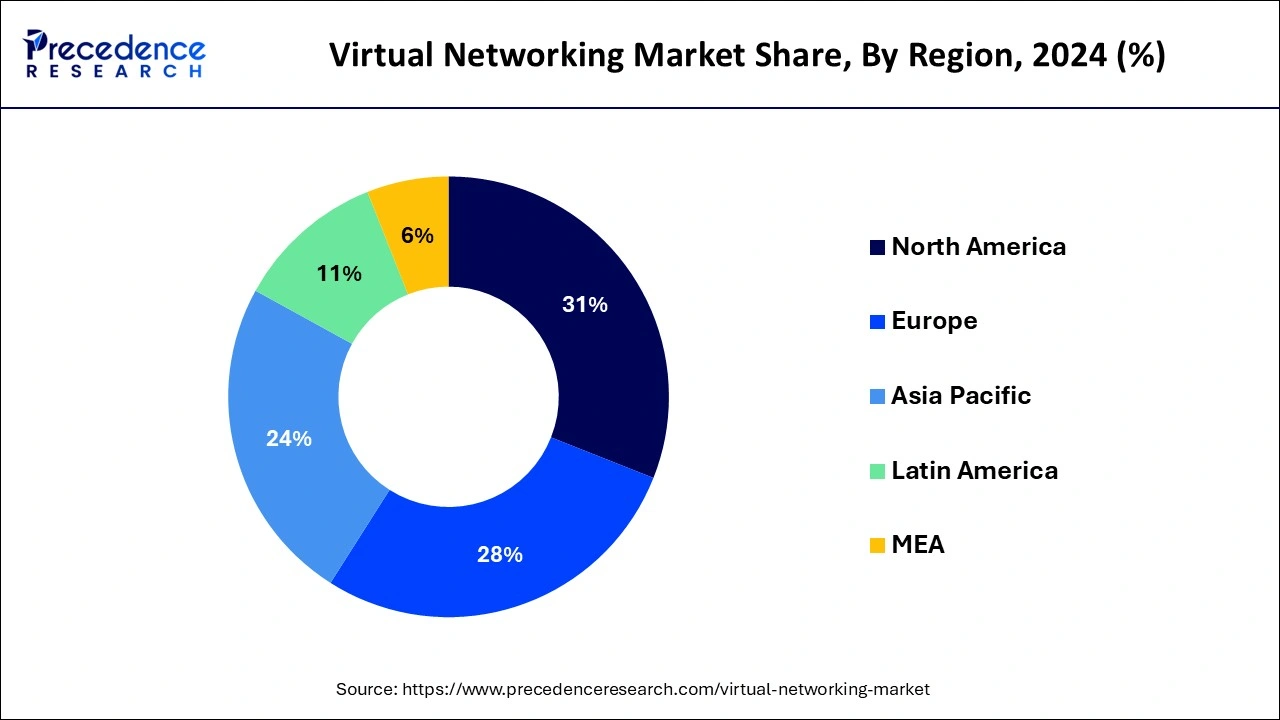

The global virtual networking market size is calculated at USD 56.42 billion in 2025 and is forecasted to reach around USD 255.18 billion by 2034, accelerating at a CAGR of 18.42% from 2025 to 2034. The North America virtual networking market size surpassed USD 14.58 billion in 2024 and is expanding at a CAGR of 18.61% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global virtual networking market size accounted for USD 47.04 billion in 2024 and anticipated to reach around USD 255.18 billion by 2034, growing at a CAGR of 18.42% between 2025 and 2034. The growth of virtual networking market can be attributed to the rising investments and collaborations among various industries to strengthen their global network, widespread adoption of network technologies in many regions as well as rural areas, innovations in enhancing networking capabilities and support from governments promoting the use of this technology.

The integration of AI in virtual network environments has enhanced the automated management, optimization and security by analysing network data which contributes to improved performance and identification of potential issues by taking charge of actions and minimizing downtime. Machine learning (ML) algorithms and deep learning tools such as complex neural networks (CNNs) are also applied in virtual network traffic allowing advanced pattern recognition capabilities and detection of anomalies enabling predictive analysis and predictive decision-making.

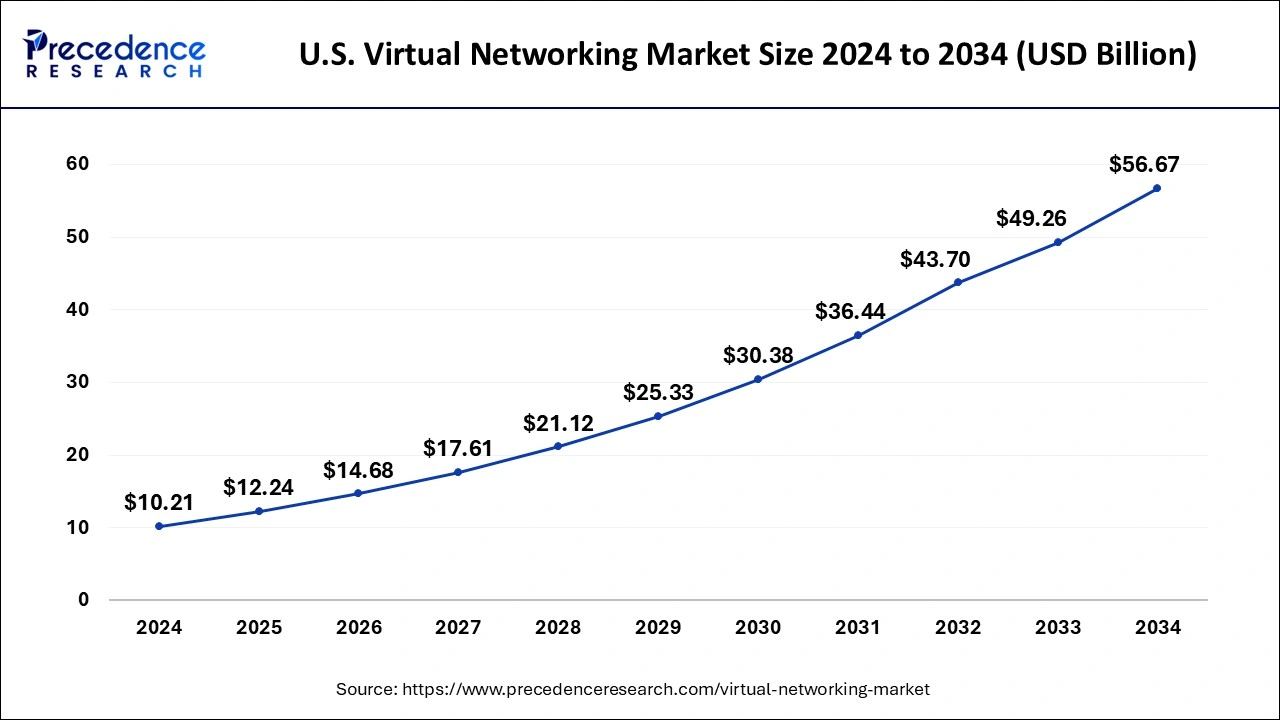

The global virtual networking market size reached USD 10.21 billion in 2024 and expected to be worth around USD 56.67 billion by 2034, rising at a CAGR of 18.70% between 2025 and 2034.

In 2024, North America led the local market. It is projected that increasing cloud computing adoption in the region will considerably aid in boosting regional market expansion.

Virtual Networking Market Overview

Virtual networking technology utilizes software for connecting devices and virtual machines (VMs) over a network allowing remote and local communication between devices across various locations. Virtual networks offer enhanced productivity and security with flexibility and at cheaper rates which drives the widespread adoption of this technology in various industrial settings. The technology is changing the global perspective for data communication and connection essentially contributing to the market growth.

Furthermore, the increased adoption of cloud computing networks for data reliability and storage, digitalization in various industries, growing IT infrastructure, utilisation of virtual machines, development of highly enhanced communication networks, surge in industrial automation and technological advancements with introduction of innovative solutions is encouraging the growth of the virtual networking market.

Government organizations are significantly contributing to the growth of virtual networks by engaging in contracts with virtual network providers and also by consolidating the setup of network channels for enhanced communication. For instance, in December 2024, Rivada Networks entered into a contract with the United States Navy for developing and delivery of Virtual Network Operator Capabilities over Rivada’s Outernet constellation.

| Report Coverage | Details |

| Market Size in 2024 | USD 47.04 Billion |

| Market Size by 2035 | USD 255.18 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 18.42% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Deployment, By Enterprise Size, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cloud computing & ease of communication and network management

Cloud computing and the ease of communication and network management are key drivers behind the growth of the virtual networking market.

Cloud computing plays a pivotal role in driving the adoption of virtual networking. With the rise of cloud platforms, businesses are increasingly leveraging Infrastructure as a Service (IaaS) and Platform-as-a-Service (PaaS) solutions, which provide virtualized resources and services. These cloud environments enable organizations to deploy and manage virtual networks on demand, without the need for dedicated physical infrastructure. This flexibility allows businesses to quickly adapt to changing demands, scale their network resources up or down as needed, and efficiently allocate computing resources. Furthermore, the ease of communication and network management facilitated by virtual networking solutions contributes to market growth. Virtual networking technologies provide centralized control and management capabilities, allowing administrators to configure, monitor, and troubleshoot networks from a single interface. This streamlines network operations reduces manual configuration efforts, and improves overall network agility.

Moreover, virtual networking supports the concept of software-defined networking (SDN), which separates the network's control plane from the data plane. This decoupling enables dynamic network programmability, where network configurations can be defined and modified using software-based controllers. SDN allows organizations to create virtual networks that are tailored to specific requirements, optimizing performance, security, and resource utilization.

Virtual networking, which also enables network management and monitoring, gives end users full access to the network. Solution providers assist enterprises by warning users and managing network endpoints when danger is discovered. Network management is also made much simpler for businesses by having access to a portal where all network-related processes, such as service management, mobile health monitoring, SLA management, and performance reporting, are documented. Managed network services also help firms utilize all resources to their fullest potential, increasing business efficiency. As a result, it is anticipated that network administration simplicity would be a crucial factor in driving up demand for virtual networking.

Cost & lack of infrastructure for support and complicated business models

Finding data gets difficult when everything is moved to a virtual network since virtual PCs and containers can be moved across servers. Due to the large number of virtual machines and containers, the administrator manages several endpoints. Another issue in this scenario is the bandwidth and latency problems that develop if the infrastructure is not built with the required changes in mind. Additionally, the difficulty of integrating software from many suppliers and the complexity it causes make choosing the right vendor for the virtual network installation essential.

Although there are many advantages to virtual networking, such as lower hardware costs and better resource usage, there may be upfront expenses associated with implementing and integrating virtualization technologies. Some firms that are considering using virtual networking may be constrained by these prices. Purchasing physical infrastructure, such as servers with enough processing power, memory, and network connections to support virtualization, is frequently required for virtual networking.

Additionally, enterprises might have to spend money on network switches that enable SDN management software and protocol. In addition to hardware costs, there can be outlays for IT staff training, virtualized management platforms, and software licenses. Organizations must also take into account the costs of continuous operations, such as upkeep, updates, and support.

Internet of things (IoT) connectivity

The network of physically connected objects with connectivity, software, and sensor capabilities is known as the internet of things (IoT). IoT devices are used across many industries, including healthcare, transportation, smart cities, and industrial automation. Virtual networking is essential for effectively connecting and controlling these IoT devices. IoT devices may exchange information and carry out coordinated actions due to virtual networking, which enables seamless communication and data transfer between them. It makes it simpler to manage and control different IoT devices remotely by facilitating the integration of those devices into a single network infrastructure.

There are many advantages to virtual networking for IoT connectivity. It makes it possible for organizations to manage devices effectively, allowing them to remotely monitor, set up, and update Internet of Things (IoT) devices from a single location. Virtual networks may be set up to properly prioritize and route IoT data flow, ensuring top performance and cutting down on latency. Additionally, it permits encrypted and secure connection between IoT devices and data centers, safeguarding private data and preventing illegal access.

Virtual networking also makes it possible for companies to scale their IoT implementations quickly. Virtual networking can dynamically distribute network resources, accommodate new devices, and provide dependable connectivity as the number of IoT devices rises. For large-scale IoT solutions, like smart grids or smart cities, where hundreds or even millions of devices must be connected and controlled effectively, scalability is crucial.

The software segment dominated the market in 2024 due to their capacity to improve the scalability, robustness, and portability of applications. Software solutions are focusing on integrating security features throughout the development lifecycle to protect against risks as a result of the rising frequency of cyber-attacks.

In 2024, the cloud industry controlled the market. In order to enable clients to build and operate their own virtual networks inside the cloud environment, cloud solution providers are increasingly including virtual networking services as part of their cloud solutions.

In 2022, the market was dominated by the big enterprises sector. Large businesses can cut hardware and operating costs by virtualizing network resources because they no longer need to invest in pricey physical network equipment.

In 2024, the IT & Telecommunications sector dominated the market. By supplying connectivity between various cloud environments, IT and telecom businesses are enabling clients to access several clouds while still enjoying a consistent network experience.

By Component

By Deployment

By Enterprise Size

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

November 2024

January 2025

November 2024