Infrastructure as a Service (IaaS) Market Size and Forecast 2025 to 2034

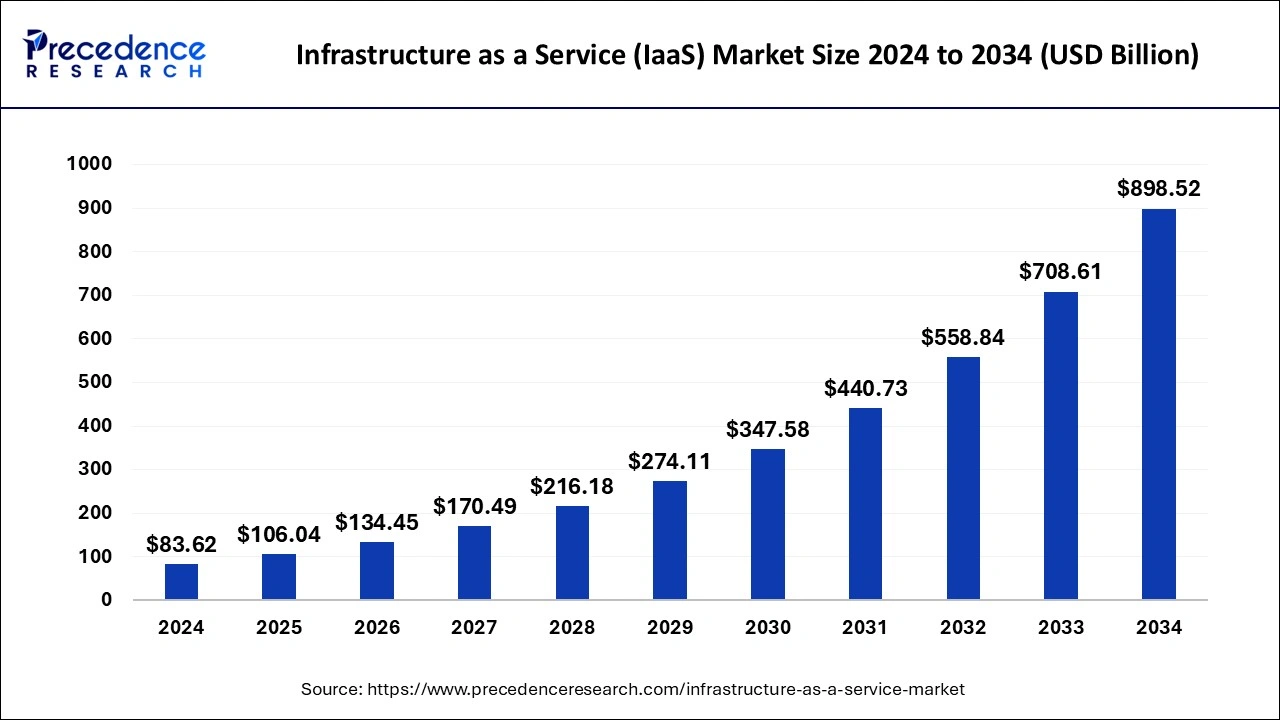

The global infrastructure as a service (iaas) market size was accounted at USD 83.62 billion in 2024 and is anticipated to reach around USD 898.52 billion by 2034, growing at a CAGR of 26.80% between 2025 and 2034.

Infrastructure as a Service (IaaS) Market Key Takeaway

- By component type, the compute segment hit 41% market share in 2024.

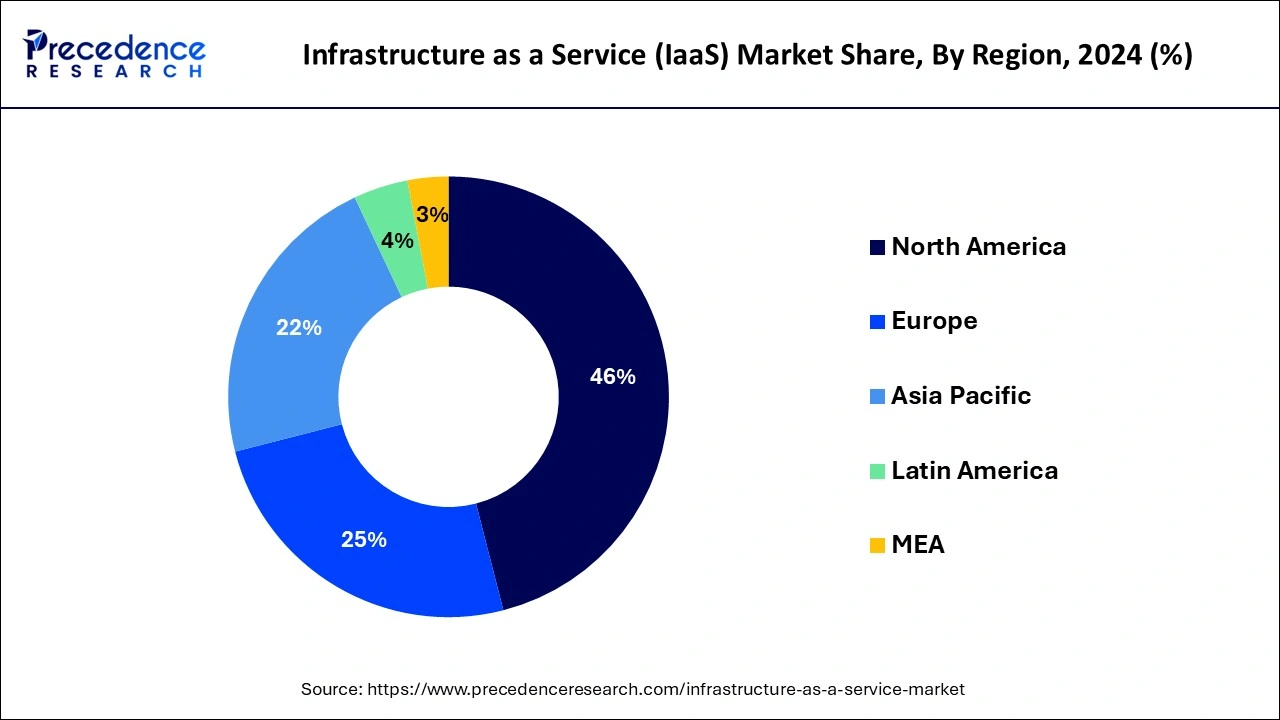

- North America region has garnered the highest revenue share of 46% in 2024.

- By deployment model, the hybrid segment accounted highest revenue share in 2024.

AI Impact on the Infrastructure as a Service (IaaS) Market

AI is performing a transformative role in the infrastructure as a Service (IaaS) Market through Design/Planning, Project Operation Prediction/Prevention, Monitoring/Inspection, Traffic management, and Green initiatives. With increasing AI implementation and restructuring, infrastructure and AI will create new opportunities that will help smarten up the infrastructure development process, making it faster and environmentally friendly. AI plays a crucial role in cloud computing to improve the cloud services range and to maintain its automation, decision-making, and scalability.

U.S. Infrastructure as a Service (IaaS) Market Size and Growth 2025 to 2034

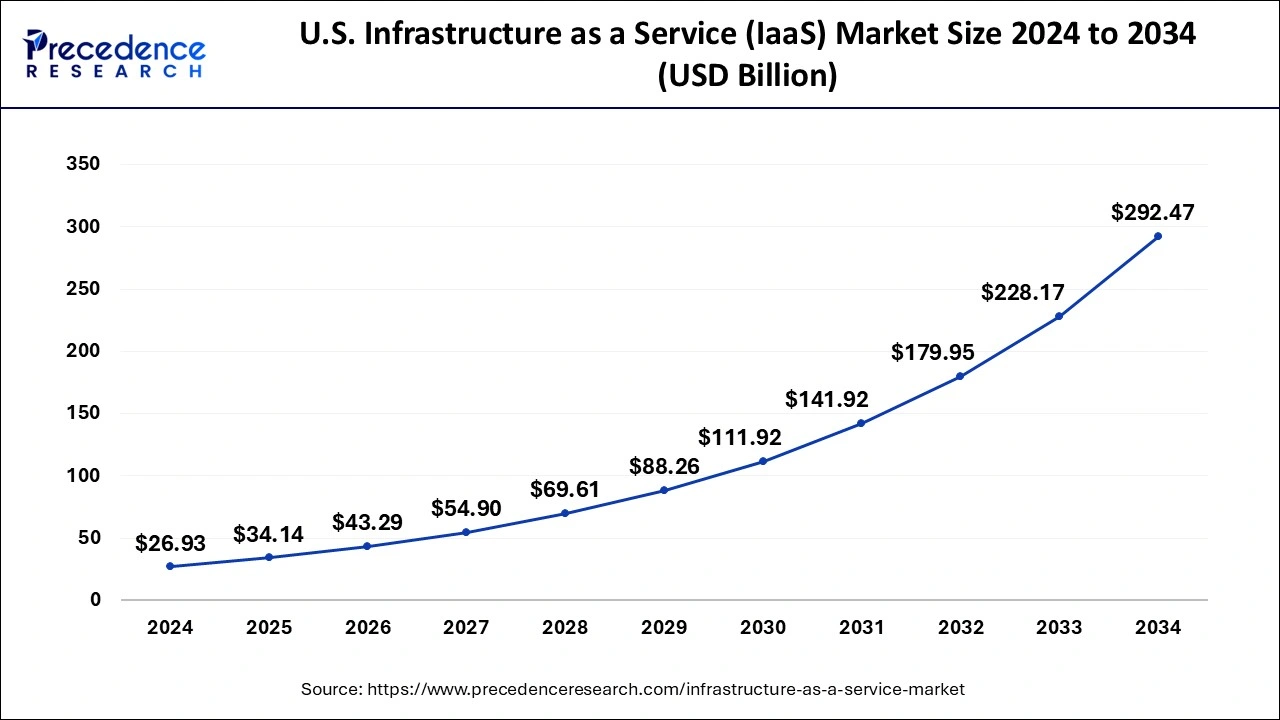

The U.S. infrastructure as a service (iaas) market size was accounted for USD 26.93 billion in 2024 and is expected to be worth around USD 292.47 billion by 2034, at a CAGR of 26.94% between 2025 and 2034.

North America held the largest share of the infrastructure as a service (IAAS) market in 2024. Factors such as cloud integration, technology networks, and the existence of strong key players stimulate the demand of the market. The drivers include the shift in goods and services to digital, increasing demand for remote work solutions, and key players such as Amazon Web Services, Microsoft Azure, and Google Cloud. Thus, further growth of the North American IAAS market is expected due to the IT demands for affordable and flexible infrastructure services.

- The research by Gartner, Inc. has revealed that in 2023 the IaaS market, Amazon alone remained the market leader, followed by Microsoft, Google, Alibaba, and Huawei.

Asia Pacific is expected to showcase notable growth in the infrastructure as a service (iaas) market in the upcoming period. This is because of increased retail business and also increased information demands, especially in the retail business. The rising number of SMEs, high demand for smart devices, and digital trends are factors that are supporting the Infrastructure as a Service market growth in this region such as China, India, Japan, and South Korea.

Market Overview

Infrastructure-as-a-Service (IaaS) is a cloud computing solution, which enables in removing hardware price through imparting digital server rooms and community structures on 1/3 birthday celebration or in-residence information facilities. It offers whole IT infrastructure additives including servers, networks, garage structures, and information facilities to numerous person agencies which include massive and small & medium enterprises (SMEs).

The price-powerful blessings of IaaS technology, boom in call for quicker information accessibility, and boom in cloud adoption throughout numerous enterprise verticals are a number of the important thing elements that pressure the boom of the worldwide IaaS marketplace. In addition, sizable shift closer to hybrid cloud as number one deployment model, ICT spending through governments in numerous developed and growing areas improve the marketplace boom. However, loss of familiar requirements and upward thrust in protection and privateness issues are expected to limitation the marketplace boom. On the contrary, integration of AI with IaaS and upward thrust in call for of IaaS through SMEs is expected to offer rewarding boom possibilities for the worldwide IaaS marketplace at some point of the forecast period.

Infrastructure as a Service (IaaS) Market Growth Factors

- The global IaaS market is expected to witness significant growth during the forecast period, due to the increasing trend towards serverless computing, the growing demand for cloud services hybrid cloud, and the increase in Internet penetration.

- Integrated IaaS services are expected to drive the next wave of cloud infrastructure adoption as the major cloud service providers move towards hybrid environments i.e. collaboration of diverse infrastructure.

- The demand for IaaS solutions is expected to increase significantly in sectors such as government and education, BFSI, healthcare, and manufacturing. In addition, increasing technological advancements such as the integration of IaaS with IoT and increasing internet penetration in emerging economies are expected to complement the growth of the market.

Infrastructure as a Service (IaaS) Market Scope

| Report Coverage |

Details |

| Market Size in 2025 |

USD 106.04 Billion |

| Market Size by 2034 |

USD 898.52 Billion |

| Growth Rate from 2025 to 2034 |

CAGR of 26.80% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Type, Deployment Model, Enterprise Size, Vertical, and Geography |

| Region Covered |

North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

- Rising demand for cheaper IT infrastructure - With the fastest scalability of cluster cloud servers, end users find IaaS to be a significant cost-saving service where customers pay only for what they use. In addition, the end user also avoids the installation costs that would otherwise be incurred by bringing individual servers onto the network. This is the main factor that is expected to drive the growth of the index during the forecast period.

- Increasing adoption of cloud service across various industry verticals - Several verticals such as banking, financial services and insurance (BFSI), healthcare, retail, manufacturing, telecommunications and IT, media and entertainment, and many more are adopting cloud services at lightning speed. In addition, the banking industry has adopted IaaS on a large scale due to benefits such as cost savings, data protection, and disaster recovery services.

- Latest technological advancements increasing penetration of cloud services- Technological improvements within side the IT zone and their programs in massive organizations and SMEs additionally create an ok area for marketplace improvement within side the evolved areas along with North America and Europe. For instance, in December 2016, American Airlines partnered with IBM Corporation to enforce IaaS to combine and streamline its commercial enterprise processes. This strategic circulate through IBM is predicted to enhance cloud adoption most of the end-users.

Key Market Challenges

- Security concerns related to private cloud deployment - Concerns about safeguarding stakeholders' information and private data are cited as a major impediment to cloud infrastructure deployment by several industrial sectors, including BFSI, government, healthcare, retail, and others. Some of the major factors expected to impede market growth include organizational, physical, technological, compliance, and data breaches. Furthermore, extended security services raise the cost of cloud deployment, slowing the process of cloud adoption among users.

- Lack of IT infrastructure in underdeveloped regions - Lack of IT infrastructure in developing regions is also expected to limit market growth to some extent. According to the World Economic Forum, an international organization for public-private cooperation, several countries in Asia-Pacific, Latin America, the Middle East, and Africa have yet to transform into technologically advanced hubs with robust IT infrastructure and digital content, which is expected to stymie market growth in the coming years. Furthermore, slow ICT adoption and IT project procurement in countries such as Mexico, Chile, Egypt, Thailand, and others are expected to stymie market growth.

- Challenges related to hacking - Due to data privacy and client information, industry verticals such as BFSI, retail, healthcare, and public sector with large customer bases are prone to retaining critical business information of stakeholders. Major cloud service providers follow security guidelines to provide storage and network security in both developed and developing regions such as North America, Europe, Asia-Pacific, and Latin America. In February 2017, Amazon Web Services, Inc. introduced dashboard alarms in its Cloud Watch (network monitoring solution) to improve oversight of critical metrics on dashboards. High-profile hacking and security breaches in the public cloud have increased significantly in recent years.

Key Market Opportunities

- Growth in cloud adoption among SMEs - Cloud infrastructure adoption has increased among SMEs in recent years due to benefits such as increased uptime, reliability, enhanced IT service, increased flexibility of data access, and operational speed. According to the Cloud Industry Forum, SMEs typically use the cloud for cost-effective business models as well as virtual networking and storage options. During the forecast period, factors such as improved customer support, improved business continuity, and the replacement of traditional IT infrastructure are expected to create adequate space for market growth.

- Opportunities to expand in new industry verticals - Cloud computing has become a major trend in several verticals, including banking and finance, public sectors, healthcare, manufacturing, telecommunications and IT, service providers business and many other fields. Document storage, network security, virtual data centers and many other operational needs are accomplished through a single cloud application, so it is expected to create the potential space for IaaS across the world. According to US International Trade, by 2020 Infrastructure as a Service (IaaS) and PaaS (Platform as a Service) are expected to be more commercialized than physical data centers and be part of 'IaaS for years to come.

Deployment Insights

The hybrid models segment was also the largest in the Infrastructure as a Service (IaaS) Market share in 2024. The hybrid deployment models can offer significant flexibility and scalability to the IT structures. This allows businesses to use cloud services for better access/elasticity, affordability, and new functionalities while at the same time storing core data/applications in-house for security/proprietary. This leads to optimal performance, enhanced security, and a marginal decline in expense.

- In February 2024, Hitachi Vantara and Cisco unveiled next-gen Hybrid Cloud Managed Services.

Service Insights

The compute segment was the largest in the Infrastructure as a Service (IaaS) market share in 2024. Infrastructure as a Service (IaaS) is one of the cloud computing models that allow clients to have on-demand usage of computing resources like storage, network, and hardware devices such as servers. IaaS is one of the fundamental services and can serve as the base for building up the platform as a service (PaaS) and software as a service (SaaS). The key motivation of Services Computing is to enable IT services and computing technology to perform business services more efficiently and effectively.

Vertical Insights

The IT & telecom segment was the largest in the Infrastructure as a Service (IaaS) Market share in 2024. Infrastructure as a Service (IaaS) allows the consumer to deploy storage space, bandwidth, processing, and other computer networking services through a virtual IT environment. For most IT firms, IaaS is cogent for backup solutions for a sustainable and integrated data set. The continuous drive towards finding new solutions means the help of new technologies like AI or IoT, new powerful cloud infrastructures are required. The geographical spread of the IT and telecom segment along with the emphasis on improving network capacity consolidates its position in the IaaS market.

The healthcare segment is expected to grow significantly in the Infrastructure as a Service (IaaS) Market. IaaS means Infrastructure as a Service, which offers healthcare organizations computing resources for cloud usage. Also, electronic health records support the healthcare sector for better healthcare measures. The healthcare industry depends on telehealth telemedicine to provide databases to hospitals and deliver better patient care, thus making the data difficult to store. Cloud-based IaaS becomes a perfect choice in this scenario, as it gives the healthcare sector flexibility to the data storage systems.

Infrastructure as a Service (IaaS) Market Companies

- Amazon Web Services, Inc.

- EMC Corporation

- Google Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Rackspace Hosting, Inc.

- Red Hat, Inc.

- Redcentric plc.

- VMware, Inc.

- Profitbricks

- Cisco Systems Inc.

- Computer Sciences Corporation (CSC)

- Fujitsu

- Alibaba Group Holding Limited

- Dell EMC

- Hewlett Packard Enterprise

- Profitbricks Inc.

- Mindtree Pvt. Ltd.

Recent Developments

- In September 2024, Volumez Unveiled a Revolutionary Data Infrastructure as a Service Platform, Empowering Organizations to Optimize Cloud Data Performance and Cost.

- In July 2024, Happiest Minds launched an AI-infused packaged offering for managed infrastructure services.

- In July 2023, ZKTeco Partnered with Amazon Web Services to Build Secure and Robust Cloud Infrastructure for the Minerva IoT Platform.

- In December 2022, F5 announced the launch of F5 Distributed Cloud App Infrastructure Protection (AIP), a cloud workload protection solution that expands application observability and protection to cloud-native infrastructures.

Segments Covered in the Report

By Type

- Storage

- Compute

- Network

- Disaster Recovery

- Desktop

- Others

By Deployment Model

By Enterprise Size

By Vertical

- IT & Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Retail and E-commerce

- Government & Defense

- Energy & Utilities

- Manufacturing

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)