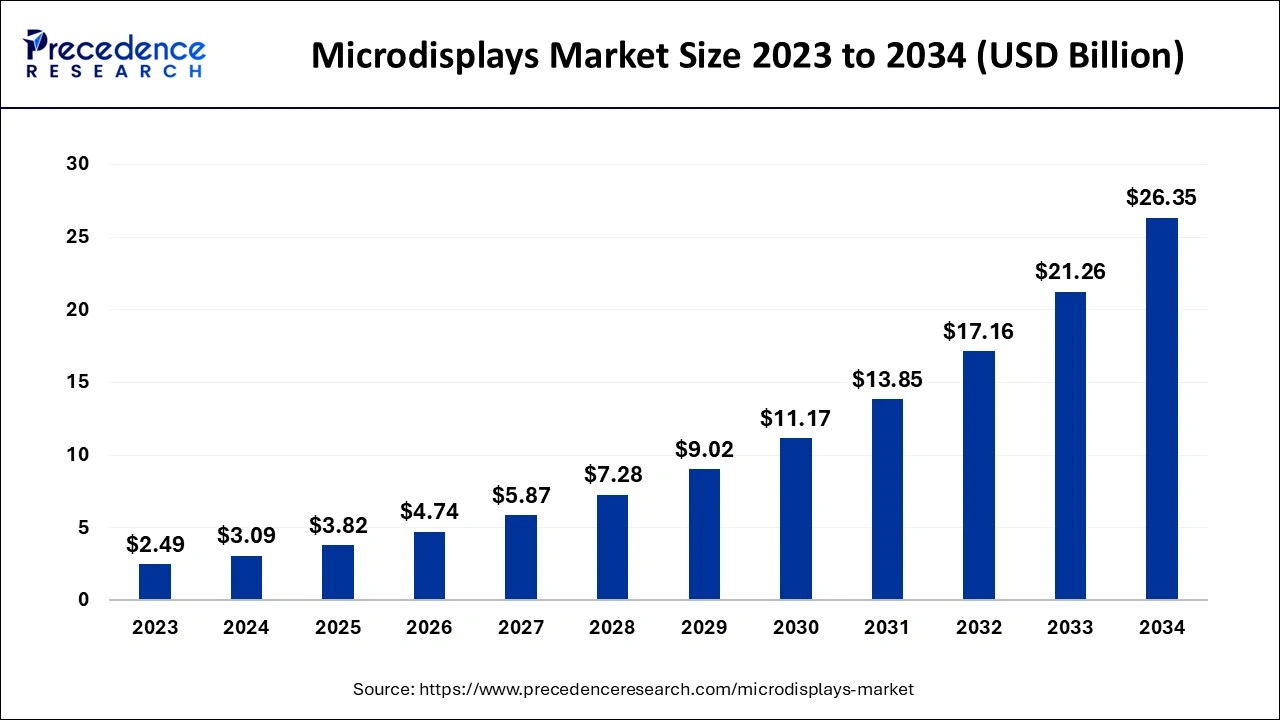

The global microdisplays market size accounted for USD 3.82 billion in 2025 and is expected to be worth around USD 26.35 billion by 2034, registering a double-digit CAGR of 23.90% between 2025 and 2034. The Asia Pacific microdisplays market size is evaluated at USD 1.11 billion in 2024 and is expected to grow at a notable CAGR of 24.10% during the forecast year. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global microdisplays market size was calculated at USD 3.09 billion in 2024, and is anticipated to surpass USD 3.82 billion by 2025, and is predicted to reach around USD 26.35 billion by 2034, expanding at a CAGR of 23.92% from 2025 to 2034. Growing advancements in microdisplay technology are the key factor driving the market growth. Also, the increasing adoption of next-generation display technology coupled with the rising utilization of head-mounted displays (HMDs) can fuel the microdisplays market growth further.

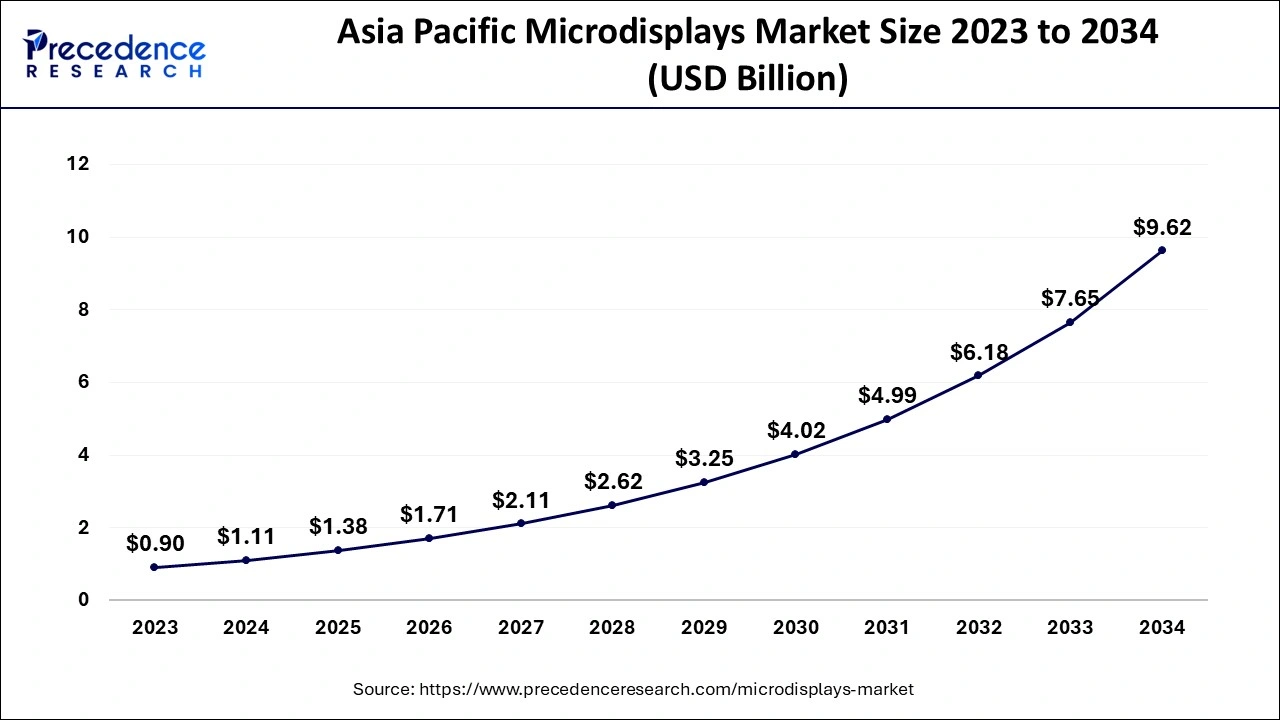

The Asia Pacific microdisplays market size is exhibited at USD 1.38 billion in 2025 and is projected to be worth around USD 9.62 billion by 2034, growing at a CAGR of 24.03% from 2025 to 2034.

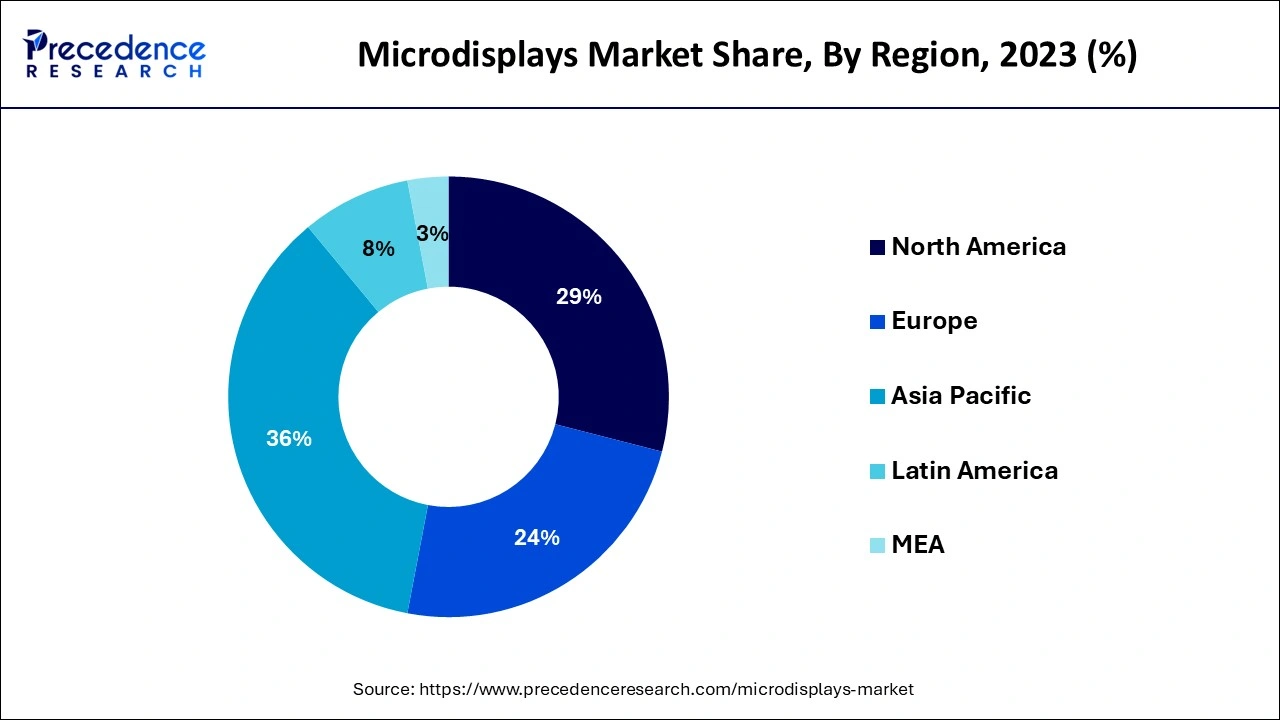

Asia Pacific dominated the global microdisplays market in 2024. The dominance of the region can be attributed to the increasing demand for consumer electronics in developing nations like China and India. Furthermore, in the region, Japan shows remarkable growth owing to the rising utilization of high-resolution display devices and growing demand for innovative consumer electronics like smart glasses and smartphones.

North America is expected to grow at the fastest rate in the microdisplays market over the studied period. The growth of the segment can be credited to the strong presence of major market players that utilize microdisplays in their product designs. Moreover, the growing adoption of AR/VR technologies in countries like the U.S. further boosts the market expansion in the region. Microdisplays are also widely utilized in the electronics and automotive industry due to their exceptional picture quality and high resolution.

A microdisplay is a small electronic display panel. These displays are less than two inches in length and diagonal size and can be viewed through an optical system. Microdisplays have been utilized in many applications, such as near-eye applications, rear-projection TVs, data projectors, head-mounted displays (HMDs), etc. The microdisplays market offers super extended graphics array (SEGA) resolution for improved brightness. Some common types of microdisplays are OLED microdisplays and AMOLED microdisplays.

Top 5 consumer electronics companies in the world by market capitalization (2022)

| Company | Market Capitalisation (in USD million) |

| Apple Inc | 2,220,978 |

| Microsoft Corp | 1,736,943 |

| Alphabet Inc | 1,250,740 |

| Amazon.com Inc | 1,151,194 |

| Meta Platforms Inc | 364,647 |

Impact of AI on the Microdisplays Market

The primary use of AU in the microdisplays market is user interaction, content creation, and customized recommendations. AI-generated content can improve the overall experience and offer precise visual environments in microdisplays. Furthermore, AI enhances user engagement by generating responsive interfaces that are compatible with the user's preferences and habits in wearables and smartwatches.

| Report Coverage | Details |

| Market Size by 2034 | USD 26.35 Billion |

| Market Size in 2025 | USD 3.82 Billion |

| Market Size in 2024 | USD 3.09 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 23.92% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Increasing demand for consumer electronics

The ongoing growth of augmented reality and virtual reality technologies in healthcare, training, and gaming is fuelling the demand for the microdisplays market to give immersive experiences. In addition, consumer electronics market players are increasingly incorporating microdisplays in electronic viewfinders for cam recorders and cameras is expanding the consumer base in the market. Also, there is a growing demand for consumer electronics in developing countries like China and India.

Limited content availability

There might be some limitations on the content in programs which is specially made for the microdisplays market. This can impact negatively on customer interest, particularly for applications related to entertainment and gaming. Moreover, in some applications, power efficiency is important, mainly for portable equipment. This can limit the adoption of microdisplays if they use a lot of power.

Increase in demand for power-efficient micro-LED display panels.

In the microdisplays market, micro LED displays present an innovative technology in the realm of display technology, distinguished by the utilization of microscopic LEDs as central pixel elements. These advancements provide improved contrast as compared to conventional LCD and OLED displays, along with minimal power consumption. Furthermore, the increasing need for consumer electronics with brighter displays and higher pixel density is fuelling the adoption of power-efficient micro-LED displays.

The near-to-eye segment led the global microdisplays market in 2023. The dominance of the segment can be attributed to the growing adoption of these displays and AR devices like electronic viewfinders (EVFs), and head-up displays (HUDs). Near-to-eye displays have the ability to create a large image from a lightweight and compact source display unit enabling its integration into technologies like wearables. Also, these displays have greater pixel density which leads to higher clarity and resolution.

The projection segment is anticipated to grow at the fastest rate in the microdisplays market over the forecast period. The growth of the segment can be credited to the expanding innovation of technologies like Liquid Crystal on Silicon (LCOS) which has an advantage t in high-end projection. The ability to offer larger size images distinguished by small size display units with higher quality. And power efficiency. Moreover, there are rapid advancements in display technology and the increasing use of AR technologies.

The liquid crystal display (LCD) segment dominated the microdisplays market in 2023. The dominance of the segment can be linked to the increasing use of LCD in head-up displays, low costs, and minimal energy consumption. The proliferation of smart devices is a key factor that impacts market growth positively. Furthermore, the escalating adoption of digital teaching practices in education can lead to a substantial surge in LCD display demand.

The liquid crystal on silicon (LCoS) segment is estimated to grow at a significant rate in the microdisplays market over the projected period. The growth of the segment is driven by the increasing utilization of LCoS in laser projections coupled with technological advancements. Furthermore, LCoS technology is essential for designing AR applications in the automotive industry. Also, the increase in learn by fun" trend in the education field is anticipated to raise the demand for LCoS.

The consumer electronics segment held the largest share of the microdisplays market. The dominance of the segment is due to a growing preference for convenient and portable devices and the increasing adoption of smartwatches and smartphones. Microdisplays play an important role in the functionality of products like wearable devices, VR headsets, and AR glasses in the electronics industry.

The automotive application segment is projected to grow at the fastest rate in the microdisplays market over the forecast period. The growth of the segment is linked to the ongoing advancements in microdisplays and the integration of cutting-edge features by key market players in the automotive sector which enable car drivers to respond to calls and control music without distracting attention. Mainly microdisplayes use in automotive technologies like AR dashboards and heads-up displays (HUDs).

Technological advancements transforming Microdisplay applications

Emerging trends emphasize versatility and integration

By Product

By Technology

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client