December 2024

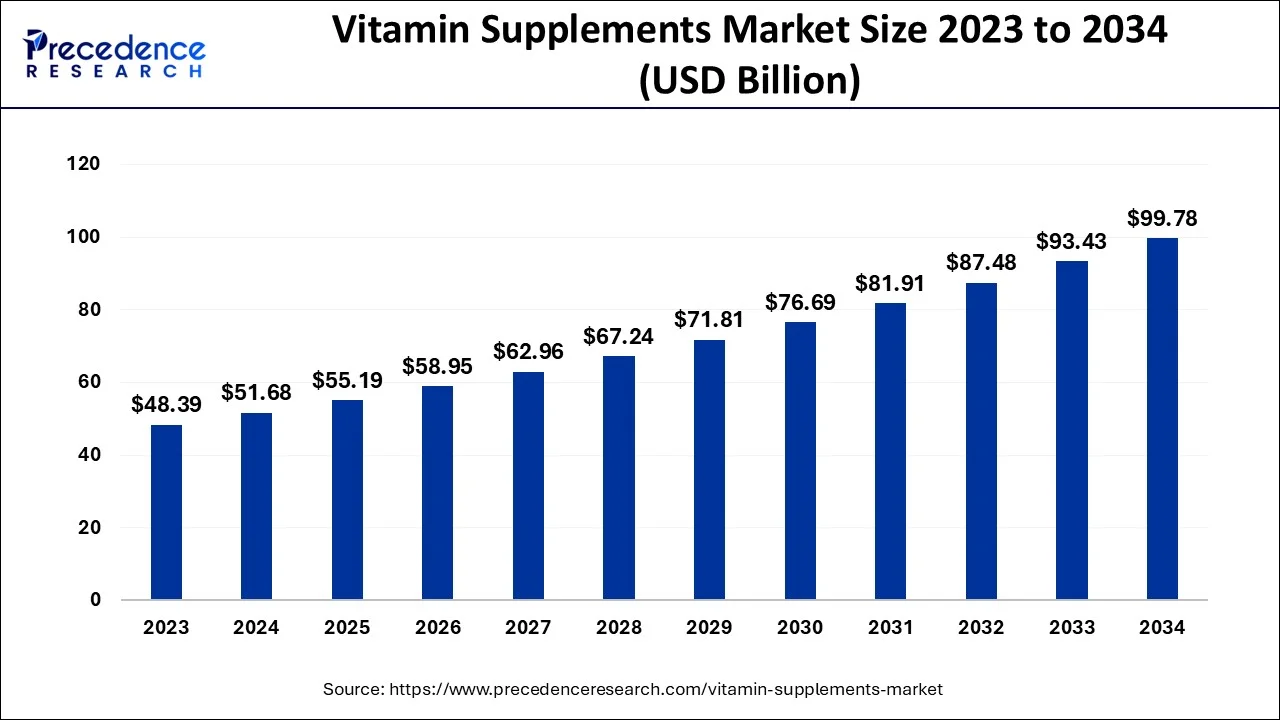

The global vitamin supplements market size accounted for USD 51.68 billion in 2024, grew to USD 55.19 billion in 2025 and is predicted to surpass around USD 99.78 billion by 2034, representing a healthy CAGR of 6.80% between 2024 and 2034. The North America vitamin supplements market size is calculated at USD 20.16 billion in 2024 and is expected to grow at a fastest CAGR of 6.92% during the forecast year.

The global vitamin supplements market size is estimated at USD 51.68 billion in 2024 and is anticipated to reach around USD 99.78 billion by 2034, expanding at a CAGR of 6.80% from 2024 to 2034.

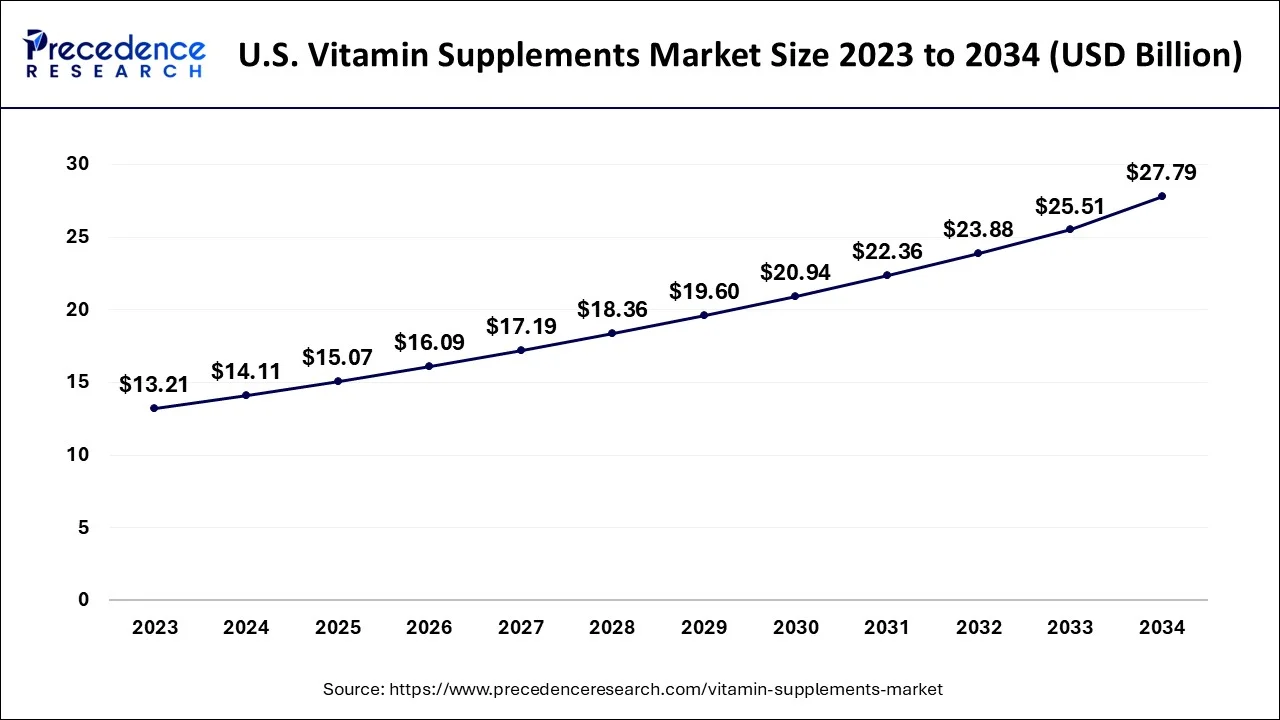

The U.S. vitamin supplements market size is estimated at USD 14.11 billion in 2024 and is expected to be worth around USD 27.79 billion by 2034, rising at a CAGR of 6.99% from 2024 to 2034.

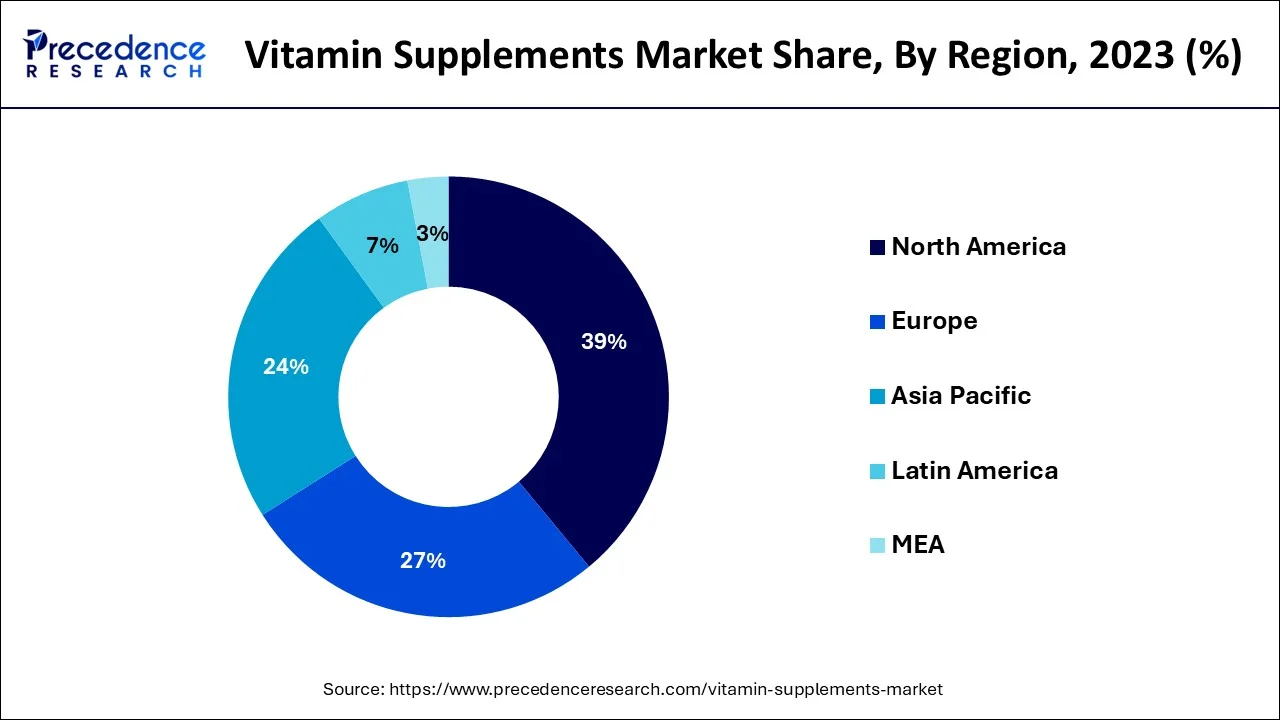

On the basis of region, North America was the largest market in 2023. The region has the highest market share of 39% in 2023. North America is the major market for Vitamin Supplements owing to increased consumer awareness regarding the daily requirements of vitamins, easy availability of Vitamin Supplements, the presence of a huge geriatric population, and the high standards of living of consumers.

Vitamin Supplements are intended to supplement the diet and are different from conventional food. Vitamins support healthy bodily growth and operation. The normal functioning of the organism depends on the hormones, coenzymes, and antioxidants that vitamins serve as. The use of vitamins, minerals, immune-boosting foods, organic products, supplements, and other dietary aids has increased. According to the National Health Service of the United Kingdom, a shortage of vitamin D can induce bone discomfort in adults with osteomalacia and rickets in children. Additionally, as a result of COVID-19, people began concentrating on their food in order to boost their immunity.

| Report Coverage | Details |

| Market Size in 2024 | USD 51.68 Billion |

| Market Size by 2034 | USD 99.78 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.80% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Increased healthcare cost

Increasing preference regarding vitamins in daily diet

Stringent government regulation

The rise in the geriatric population

Vitamin A, Vitamin B, Vitamin C, Vitamin D, Vitamin E, Vitamin K, and multivitamins are the types of vitamins that make up the global market for dietary supplements. In 2022, the multivitamin segment had a dominant market share. Around 40% of the market is accounted for by multivitamins, which are anticipated to continue to rule the market during the projected period. Customers take multivitamins to meet their daily needs for all the important vitamins needed to promote healthy body growth and function.

Based on form, the Vitamin Supplements market is classified into tablets, powders, capsules, gummies, and others. Due to its widespread availability and ease of use, the tablet category is anticipated to dominate the market over the projection period. Vitamin Supplements in pill form are regularly consumed by adults worldwide. Even though the natural coating has a higher solubility, other factors that influence the effectiveness and calibre of the absorption also come into play.

All of these factors are expected to raise demand for Vitamin Supplements in tablet form throughout the course of the projected period. Tablet form is one of the simplest ways to take Vitamin Supplements. It can be taken both with and without a prescription. The oral route of administration is one of the simplest and most practical ways to take supplements and medications, hence it is in high demand across the globe.

Supermarkets and hypermarkets, retail pharmacy, online sales, and others are the distribution channel considered in the scope Cross-border sales of Vitamin Supplements through online sales channel is on an exponential increase. Factors including low risk and easy and quick shipping propel the growth of online sales.

A retail pharmacy is a retail shop that offers prescribed drugs, tablets, and beauty & health products. These stores prepare, dispense, review products, and provide additional clinical services. Moreover, these stores aim to ensure the safe, effective, and affordable use of products and provide information to consumers. Dietary supplements products, including Vitamin Supplements products, are available easily along with medicines through these retail pharmacies.

Vitamin Supplements products such as vitamin A, vitamin B, vitamin C, vitamin D, and others are related to the nutrition of the person and hence, retail pharmacies have become a popular distribution channel for Vitamin Supplements products. The easy availability and convenience associated with the buying of Vitamin Supplements products from pharmacies propel the growth of this segment. Furthermore, manufacturers are targeting this sales channel to reach the maximum number of consumers and to increase the sales volume during the forecast period, owing to an increase in the number of pharmacies globally.

Adults, geriatrics, and others are the end-user considered in the scope of the market. The adult segment dominated the market with 47% of the market share in 2023. A rising senior population, particularly in low- and middle-income regions like Asia-Pacific and LAMEA, is predicted to make the geriatric category grow at the highest rate. The adult market is expanding as a result of increasing cases of vitamin insufficiency and greater knowledge of the health advantages of dietary supplements. The percentage of the population in the working age group (15–59 years) is predicted to increase from 60.7% in 2011 to 65.1% in 2036, according to the Technical Group on Population Projections Report of the Indian government. The growth of Vitamin Supplements among adults is anticipated to be fueled by expanding employment in developing countries and the rising standard of living.

By Type

By Form

By Distribution Channel

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

July 2024

April 2025

September 2024