January 2025

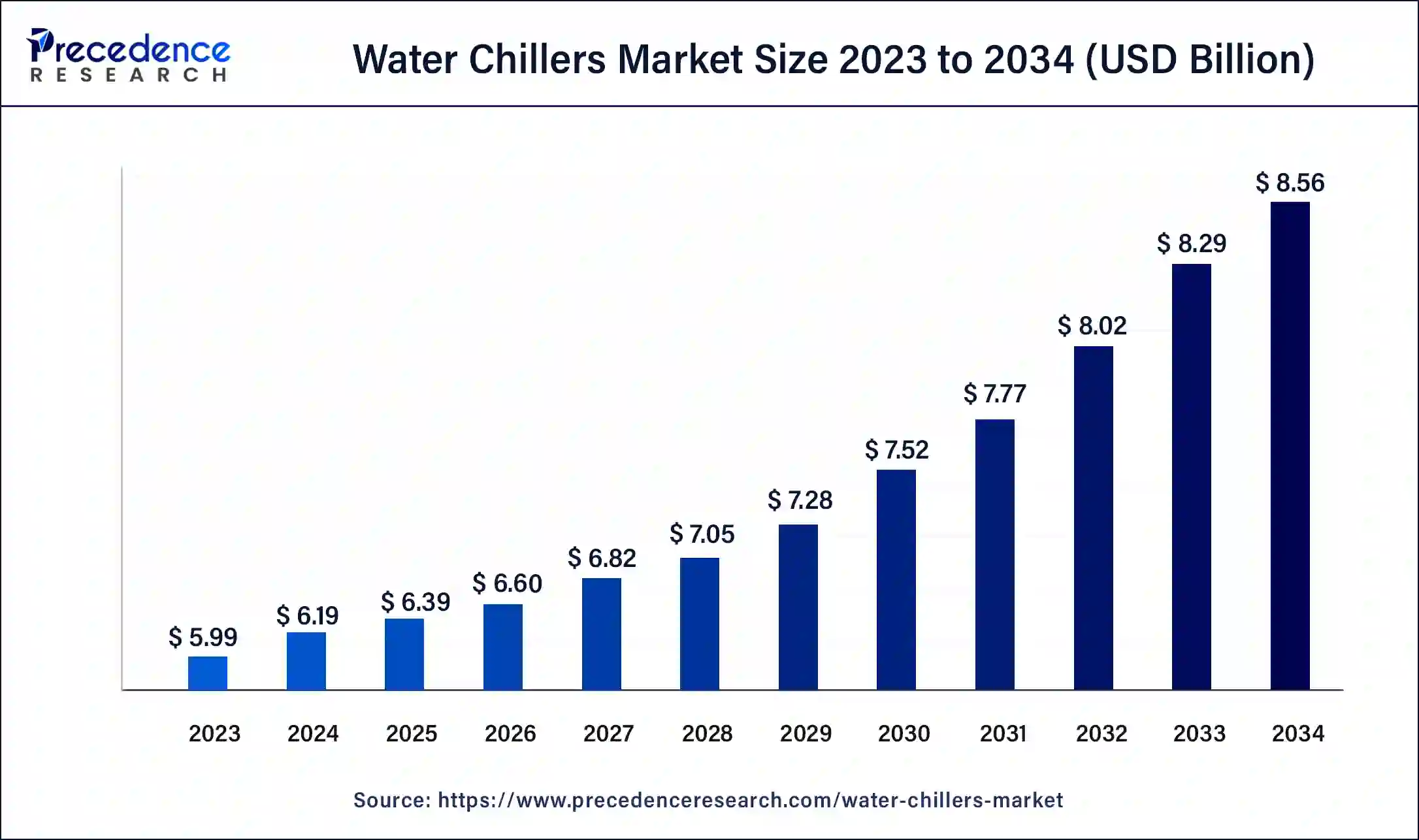

The global water chillers market size was USD 5.99 billion in 2023, calculated at USD 6.19 billion in 2024 and is projected to surpass around USD 8.56 billion by 2034, expanding at a CAGR of 3.3% from 2024 to 2034.

The global water chillers market size accounted for USD 6.19 billion in 2024 and is expected to be worth around USD 8.56 billion by 2034, at a CAGR of 3.3% from 2024 to 2034.

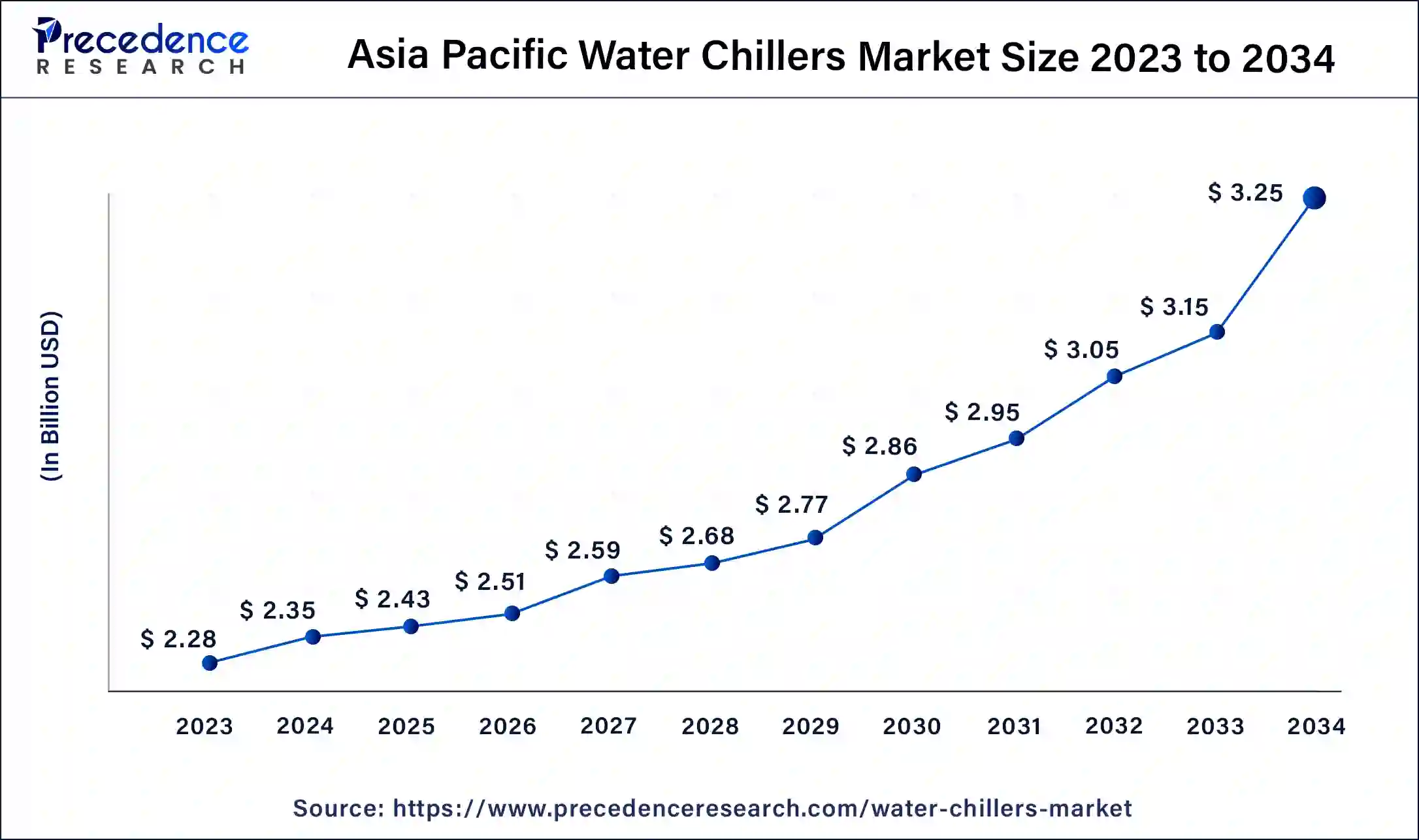

The Asia Pacific water chillers market size was estimated at USD 2.28 billion in 2023 and is predicted to be worth around USD 3.25 billion by 2034, at a CAGR of 3.5% from 2024 to 2034.

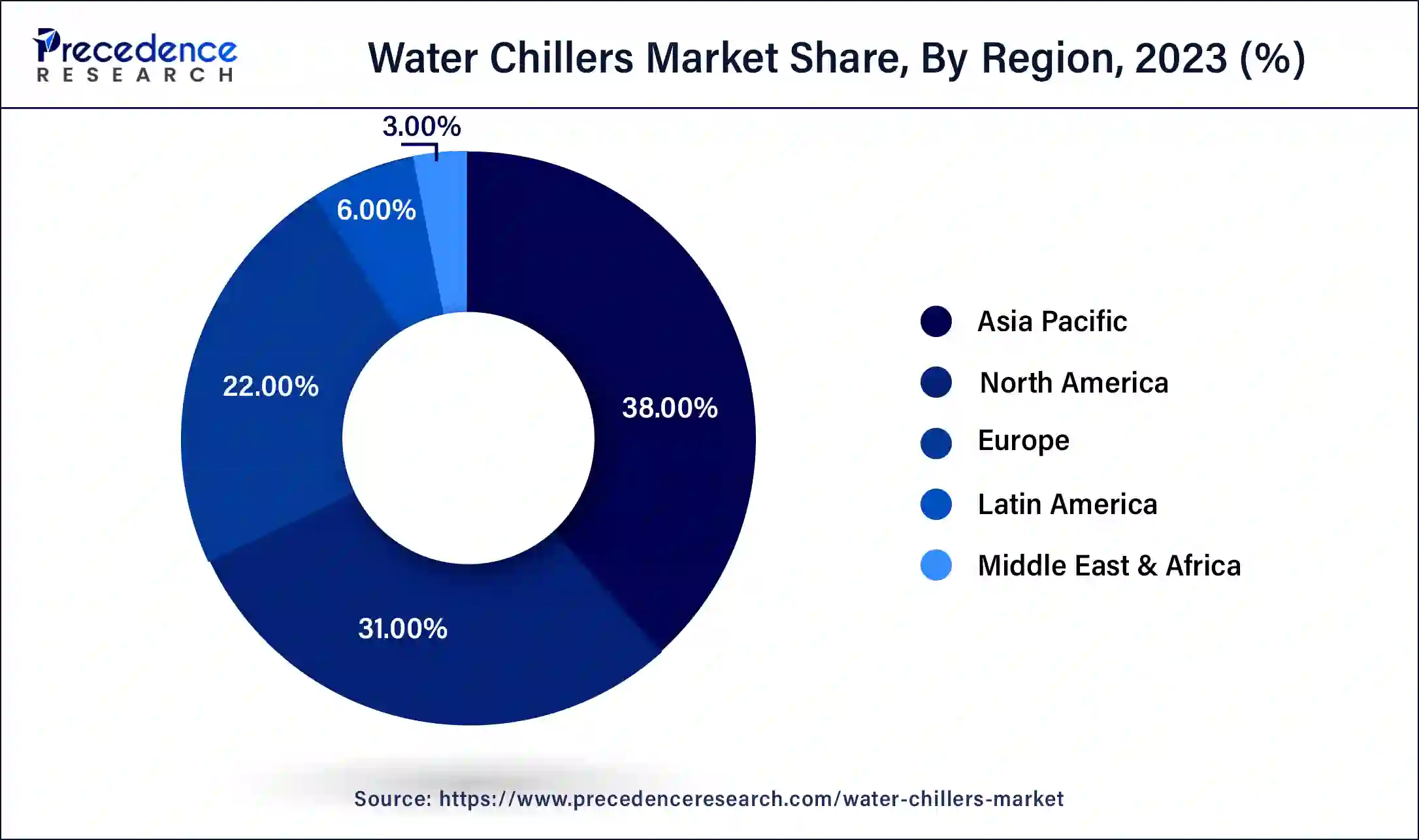

Asia-Pacific held the largest market share of 38% in 2023. This was due to the rapid urbanization in Asia-Pacific has led to increased demand for HVAC systems and cooling solutions in commercial and residential buildings. Water chillers are an essential component of these systems. Furthermore, there is a growing focus on energy efficiency and sustainability in the region. As a result, businesses and organizations are adopting more energy-efficient and eco-friendly cooling solutions, which can drive the demand for advanced water chillers.

Europe is estimated to observe the fastest expansion. Europe is home to a diverse range of industries, including manufacturing, pharmaceuticals, food and beverage, and data centers, all of which rely on water chillers for precise temperature control in their processes. Additionally, the commercial and residential sectors require cooling solutions, which contribute to the market's demand.

The North America water chillers market is continually evolving due to economic factors, environmental considerations, technological advancements, and the region's focus on energy efficiency and sustainability. Businesses, industries, and institutions in North America continue to adopt efficient and eco-friendly cooling solutions to meet their specific cooling needs and reduce their environmental footprint.

A water chiller is a cooling system designed to remove heat from a liquid, typically water or a water-glycol mixture. It is used in various applications to maintain a consistent and lower temperature for processes or spaces, such as industrial manufacturing, commercial HVAC (Heating, Ventilation, and Air Conditioning), data centers, medical equipment, and others. Water chillers operate by removing heat from the water or fluid and then returning the cooled liquid to the application or process. Key components of a water chiller include a compressor, an evaporator, a condenser, and an expansion valve.

The market for water chillers includes manufacturers, suppliers, distributors, and service providers who cater to a wide range of industries and applications. It encompasses a variety of water chillers, including centrifugal chiller, reciprocating chiller, Scroll chiller, Screw chiller, absorption chiller, and others. It involves the use of different refrigeration technologies. It plays a crucial role in maintaining efficiency and preventing overheating in a wide range of applications such as cooling industrial machinery, data centers, air conditioning systems, and various processes where temperature control.

The factors driving demand for the water chillers market are industry growth, technological advancements, environmental regulations, and regional economic conditions. It is an essential component of maintaining temperature control and efficiency in various industrial and commercial processes.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 3.3% |

| Market Size in 2023 | USD 5.99 Billion |

| Market Size in 2024 | USD 6.19 Billion |

| Market Size by 2034 | USD 8.56 Billion |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Capacity, and By End User Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing emphasis on energy efficiency and sustainability

The water chiller market is experiencing a significant boost due to a growing emphasis on energy efficiency and sustainability. In an era marked by environmental consciousness and the need to reduce energy consumption, water chillers have emerged as essential solutions for maintaining cooling in various industrial, commercial, and institutional applications. These systems offer precise temperature control while minimizing the carbon footprint and operating costs, making them increasingly attractive to businesses and organizations.

One of the primary drivers for the water chiller market is the commitment to energy efficiency. With rising concerns about global warming and the depletion of natural resources, industries and commercial sectors are actively seeking energy-efficient cooling solutions. Water chillers meet this need by efficiently removing heat from processes and spaces, resulting in reduced energy consumption and operational expenses.

Furthermore, sustainability is another key factor fueling the demand for water chillers. Organizations across the globe are striving to align with eco-friendly practices, and water chillers that use environmentally friendly refrigerants and comply with stringent environmental regulations are gaining prominence. The reduced environmental impact and compliance with sustainability goals make water chillers an ideal choice for businesses and industries looking to lower their carbon emissions while maintaining optimal cooling performance. As this emphasis on energy efficiency and sustainability continues to grow, the water chiller market is set to expand further, meeting the evolving needs of a more environmentally conscious world.

High initial and operating costs

The water chiller market, while poised for growth, faces a notable restraint in the form of high initial and operating costs. These financial barriers can discourage potential customers from adopting water chiller systems, despite their many advantages. Substantial upfront cost associated with purchasing and installing water chiller equipment is one of the primary challenges for the water chillers market.

These costs can be significant, especially for larger and more complex systems. For many businesses and organizations, especially those with limited capital budgets, these initial expenses can be a deterrent. This financial barrier can prevent some potential users from benefiting from the energy-efficient and precision cooling capabilities that water chillers offer.

Furthermore, the operating costs associated with water chillers can also be a concern for water chillers market. This is due to these systems require electricity to run the compressors, pumps, and other components, as well as water for the cooling process. Over time, these operational expenses, including maintenance and repairs, can add up, impacting the total cost of ownership. In industries and applications where cost control is a critical factor, the ongoing expenses may limit the adoption of water chillers.

To address these cost-related restraints, manufacturers and businesses are exploring various strategies, such as developing more energy-efficient and cost-effective chiller systems, providing financing options to spread out the initial costs, and highlighting long-term energy savings and environmental benefits. Despite these challenges, the advantages of water chillers, including their energy efficiency and precise temperature control, continue to drive their adoption in applications where their benefits outweigh the associated costs.

Ongoing innovations in chiller technology

Ongoing innovations in chiller technology represent a significant opportunity for the water chiller market. These advancements are not only driving the growth of the market but also enhancing the efficiency, performance, and versatility of water chiller systems. Moreover, manufacturers are continually developing chiller systems with higher Coefficient of Performance (COP) and Seasonal Energy Efficiency Ratio (SEER) ratings.

These improvements reduce energy consumption and operational costs, making water chillers more appealing to businesses and organizations looking to cut their carbon footprint and reduce utility expenses. Variable-speed compressors and advanced control systems are another focal point of innovation. These technologies allow chillers to adapt their cooling capacity to match the specific cooling demands, leading to precise temperature control and improved energy efficiency. Smart controls, often integrated with Internet of Things (IoT) platforms, enable remote monitoring and predictive maintenance, ensuring optimal chiller performance.

Moreover, the development of environmentally friendly refrigerants with lower global warming potential (GWP) addresses regulatory and sustainability concerns, creating new opportunities for water chiller manufacturers. These refrigerants reduce the environmental impact of chiller systems while maintaining high cooling efficiency. Incorporating sustainable materials and manufacturing processes can also help chiller manufacturers align with eco-friendly practices, meeting the demand for more responsible and green cooling solutions.

The emerging trend of modular and scalable chiller designs enables customization to specific customer needs, making them adaptable for a wide range of applications. As the need for precision cooling continues to grow in industries such as data centers, pharmaceuticals, and manufacturing, these innovations in chiller technology position manufacturers to seize new market opportunities and address evolving customer requirements effectively.

In 2023, the screw chiller segment had the highest market share of 45% on the basis of type. This is owing to screw chillers being known for their energy efficiency and commonly used in large industrial and commercial settings. They use a rotary screw compressor to cool water.

The centrifugal chiller segment is anticipated to expand at the fastest CAGR of 4.6% over the projected period. Centrifugal chillers are used in large commercial and industrial facilities, such as hospitals and manufacturing plants. They feature a centrifugal compressor to provide cooling.

In 2023, the chemicals & petrochemicals segment had the highest market share of 42% on the basis of the end user industry. Water chillers are used in the chemicals and petrochemicals industry to maintain specific temperatures in various processes, ensuring product quality and safety. They help control exothermic reactions and manage cooling requirements in manufacturing and refining.

The healthcare segment is anticipated to expand at the fastest CAGR of 4.6% over the projected period. The healthcare industry relies on water chillers for applications like MRI machines, medical laser systems, and laboratory equipment. These chillers ensure precise and stable temperature conditions for critical medical and diagnostic procedures.

In 2023, the 351-700 kW segment had the highest market share of 42% on the basis of the capacity. Water chillers in the 351-700 kW category are considered high-capacity systems. They are ideal for larger commercial buildings, manufacturing facilities, and more substantial industrial processes that demand higher cooling loads.

The >700 kW segment is anticipated to expand fastest CAGR of 3.9% over the projected period. Chillers with a capacity exceeding 700 kW are large and powerful systems, primarily suited for significant industrial facilities, large data centers, and extensive HVAC applications in commercial and industrial complexes.

Segments Covered in the Report

By Type

By Capacity

By End User Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

November 2024

January 2025