January 2025

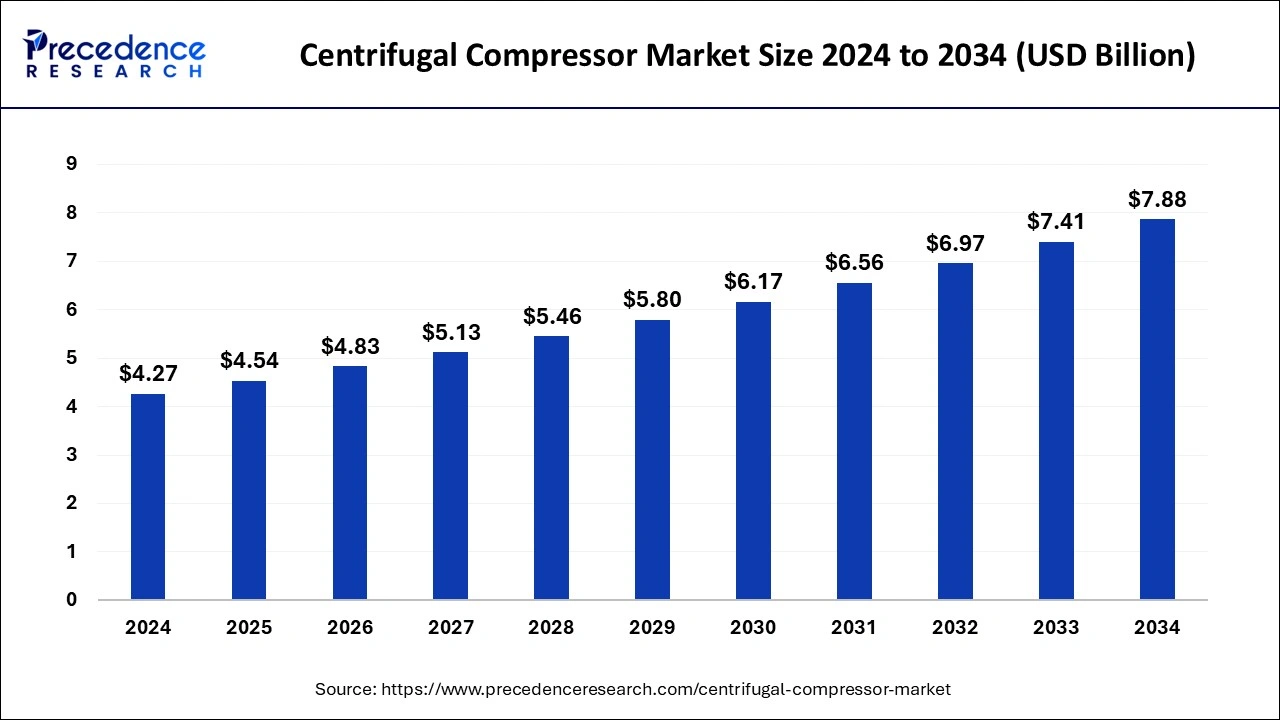

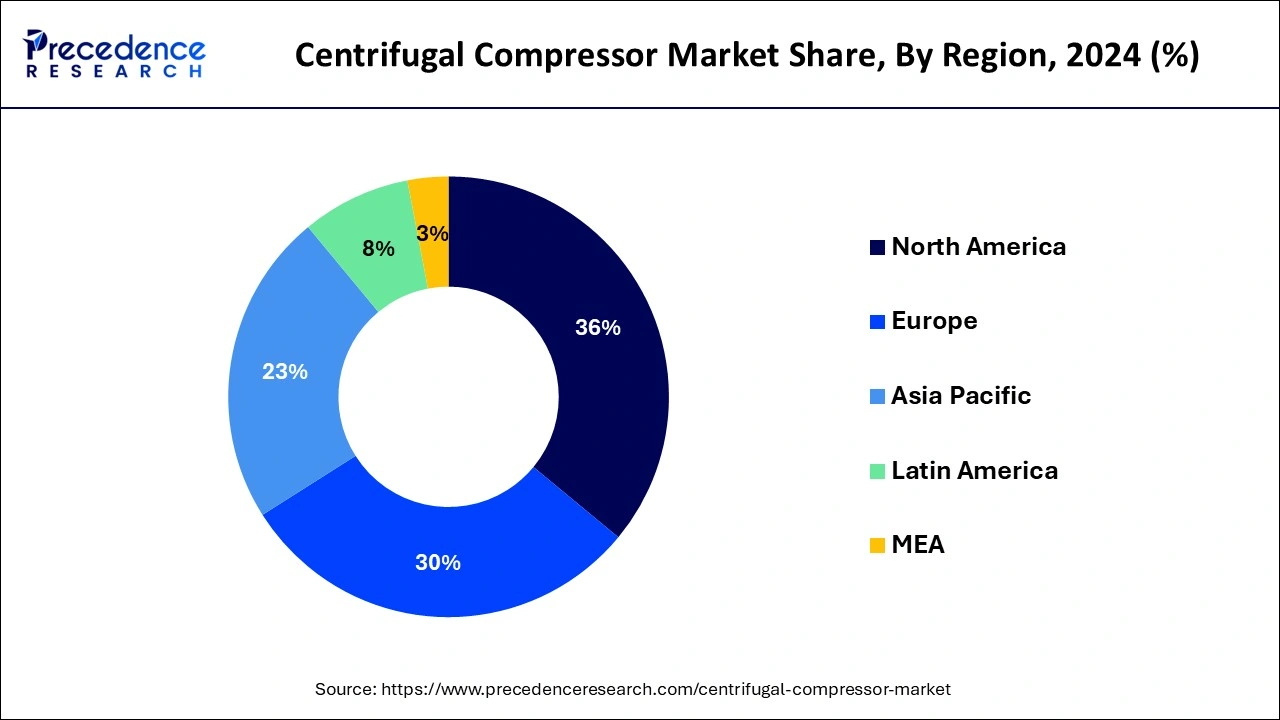

The global centrifugal compressor market size is calculated at USD 4.54 billion in 2025 and is forecasted to reach around USD 7.88 billion by 2034, accelerating at a CAGR of 6.31% from 2025 to 2034. The North America market size surpassed USD 1.54 billion in 2024 and is expanding at a CAGR of 6.46% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global centrifugal compressor market size accounted for USD 4.27 billion in 2024 and is expected to exceed around USD 7.88 billion by 2034, growing at a CAGR of 6.31% from 2025 to 2034. The factors that propel the growth of the centrifugal compressor market include industrial demand, technological development, concerns for energy efficiency, and business development in new regions.

Artificial Intelligence technologies enhance accurate prediction for maintenance thus enabling companies to reduce downtime drastically as well as operating expenses. The integration of an AI-based framework in the centrifugal compressor market for automating the production cycle provides analytics and machine learning as part of its approach to enhance productivity while, most crucially, minimizing energy consumption. The application of smart techniques and automation is expected to have positive impacts in changing the air centrifugal compressor industry and moving towards progression.

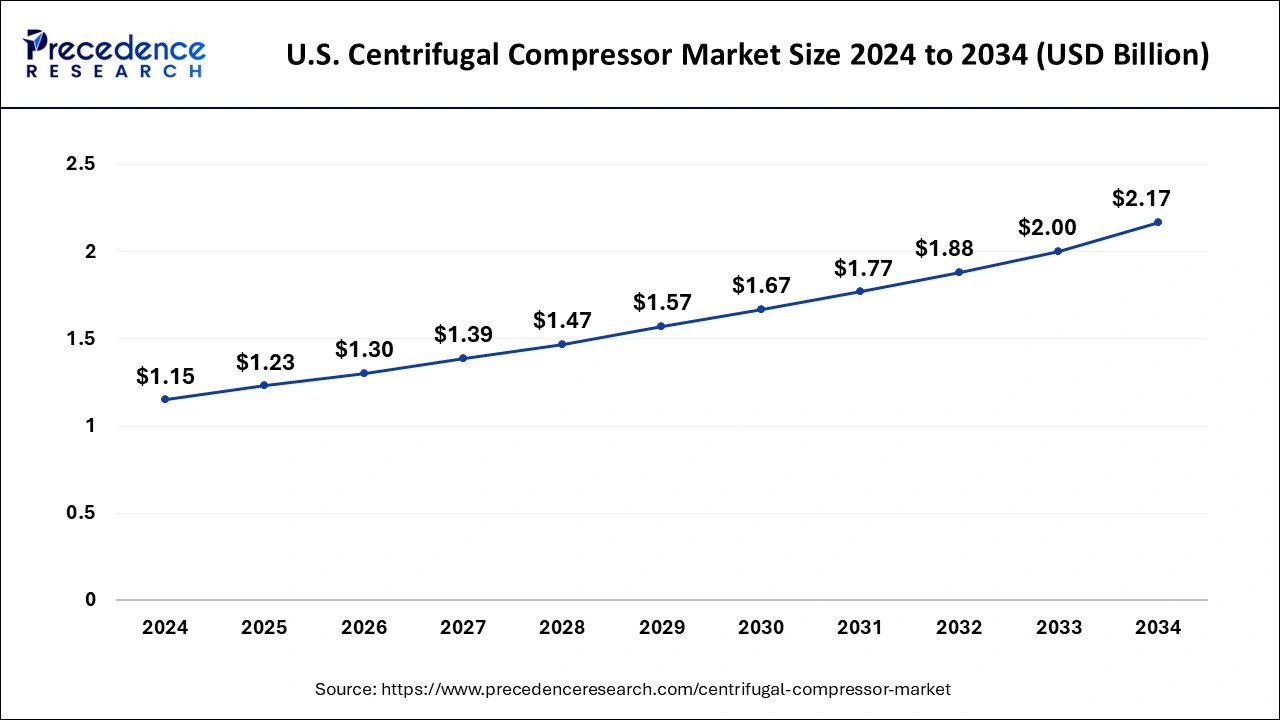

The U.S. centrifugal compressor market size was exhibited at USD 1.15 billion in 2024 and is projected to be worth around USD 2.17 billion by 2034, growing at a CAGR of 6.55% from 2025 to 2034.

North America accounted for the largest share of the centrifugal compressor market in 2024 due to increasing strict regulatory standards on environmental issues and continuing emphasis on energy conservation in many industries, including oil and gas, power generation, and manufacturing. The United States shows the highest demand for these compressors because of the large manufacturing industry that includes petrochemicals, oil gases, and chemicals. The demand is further supported by technological innovation and concern for energy use in the region. Additionally, ongoing investments in upgrading existing facilities and the growth of manufacturing capabilities contribute to the growing market in North America.

Asia Pacific is anticipated to witness the fastest growth in the centrifugal compressor market during the forecasted years. Increased economic growth, especially within developing countries such as China and India, is resulting in a drastic rise in energy consumption within several sectors. The increase in demand for oil & gas, power generation, chemicals, and manufacturing industries and their applications demands more centrifugal compressors.

Asia Pacific is emerging as a regional hub for centrifugal compressor manufacturing to meet the growing demand and potentially reduce reliance on imports. These compressors are popular in pipeline facilities that are used to move and compress natural gas from producers to consumers. Similarly, the transformation of energy generation from coals to gases, especially for electric power generation, is also anticipated to augment the market growth.

A centrifugal compressor is a dynamic compressor that is used to raise the pressure of gas through the conversion of energy from kinetic energy into potential energy. They are commonly used in industries such as pneumatic conveying systems, natural gas transportation, oil refineries, chemical plants, and power plants. The increasing demand for energy-efficient and reliable compression solutions is also boosting the centrifugal compressor market expansion. Furthermore, the acceptance of centrifugal compressors in developing markets is expected to offer ample opportunities for market players.

The market trends are increased demand for larger and more efficient centrifugal compressors and increased adoption of digital monitoring and control systems. Power generation by renewable energy systems, including biofuels and natural gas compression using centrifugal compressors, are other factors that create opportunities in the market. The centrifugal compressor market has the potential to expand due to the current need in several sectors, such as oil and gas, petrochemical, and power plants.

| Report Coverage | Details |

| Market Size by 2024 | USD 4.27 Billion |

| Market Size in 2025 | USD 4.54 Billion |

| Market Size in 2034 | USD 7.88 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.31% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Discharge Pressure, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for energy-efficient solutions

There is a high demand for centrifugal compressors in the market because centrifugal compressors are more efficient than conventional compressors and could help lower energy consumption. As a result of their energy characteristics, centrifugal compressors have been widely used in most industries. To push for more sustainable sources of energy that are at the same time more affordable. Higher levels of environmental awareness are placing pressure on manufacturers to look for more environmentally friendly compressor solutions.

The centrifugal compressor market is on the rise in demand for units that incorporate low GWPs and technologies that lower carbon profiles. Manufacturers increase research and development to produce compressors with minimal environmental impact, supporting stringent regulatory frameworks and sustainable business practices.

Inconsistent prices of raw materials

The instability of raw material prices is one of the major issues that affect market growth and development. The market experiences intense competition among several companies, leading some to offer discounts to continue their market presence. Additionally, steel, aluminum, and carbon steel are some of the raw materials used in the production of compressors. Variation in the price of these raw materials affects the price of centrifugal compressors due to their direct usage in making the final products.

Growing investment in oil and gas exploration

The activities involved in the oil and gas industry are drilling, production, processing, and transportation of oil and gas products. The upstream, midstream, and downstream operations of this industry heavily rely on centrifugal compressors. Governments and companies all over the world are increasing their expenditures to increase the levels of production of hydrocarbons. They are also applied in other industries, including the vaporization system in fish feed factories and pipeline projects. As environmental awareness rises, the demand for cleaner energy sources is growing, making centrifugal compressors a vital component in the natural gas production process.

The single-stage segment noted the largest centrifugal compressor market share in 2024. They have a simpler design with fewer moving parts related to multi-stage models, which provides low manufacturing costs and easier maintenance. Single-stage compressors can be more energy-efficient than multi-stage models because of their simpler design in the lower pressure output application area. The single-stage centrifugal compressor design involves the intake of air into a cylindrical casing with subsequent compression by an impeller. The compressed air is then released into a storage tank. Single-stage centrifugal compressors are particularly suited for powering tools and, because of their reliability, are generally favored over two-stage models.

The multistage segment is projected to witness the fastest growth in the centrifugal compressor market during the forecast period. Multistage compressors achieve high pressure by progressively growing the pressure of the gas in each stage. A multistage centrifugal compressor is a kind of compressor that contains more than one impeller-diffuser set up for compressing gases. Many industries require compressed gas at very high pressure. Multistage compressors are applied in the application area, for example, in gas reinjection, natural gas transmission, and refinery processes.

The between 20 and 200 bars segment dominated the global centrifugal compressor market in 2024, driven by the number of applications that need moderate pressure to deploy centrifugal compressors. Pressure ranges from 20 bar to 200 bar, and these compressors are suitable for use in refrigeration, air conditioning, and power industries.

The between 200 and 400 bars segment is projected to witness the fastest growth in the centrifugal compressor market during the forecast period, due to the need for high-pressure compression in specific sectors like the petrochemical industry and oil refining. Compressors that work at a pressure range of 200 to 400 bar are used in oil and gas exploration, moving natural gas, and using and distributing industrial gases.

The oil and gas segment led the global centrifugal compressor market in 2024. Centrifugal compressors are used in several applications like gas transportation, compression for gas injection, gas gathering, gas lift, etc. It is used in the production, transportation, and refining of oil and gas. Moreover, such growth is likely to be particularly notable in regions with vast oil and gas reserves and the growing amounts of investments in this sector, along with rising exploration activities. Rising global consumption of oil and natural gas is anticipated to come with increased demand for centrifugal compressors. In particular, centrifugal compressors are applied in gas compression, gas reinjection, and gas transportation, which are deemed to be conventional operations in the oil and gas industry.

The power sector segment is projected to witness the fastest growth in the centrifugal compressor market during the forecast period. Natural gas is becoming a fuel of choice for new power plants due to its fuel efficiency. It also burns cleaner than coal or oil, and more governments are employing national or regional plans to decrease carbon dioxide (CO2) emissions. Natural gas-based power generation has been recognized to be the most efficient and clean way to meet the growing global power demand. One of the major applications that leads to the consumption of centrifugal compressors is the generation of power using natural gas.

By Product

By Discharge Pressure

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

September 2024

November 2024