Webcams Market (By Product: USB, Wireless; By Technology: Analog, Digital; By Distribution Channel: Brick & Mortar, E-commerce; By End-User: Security and Surveillance, Entertainment, Video Conference, Live Events, Visual Marketing, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

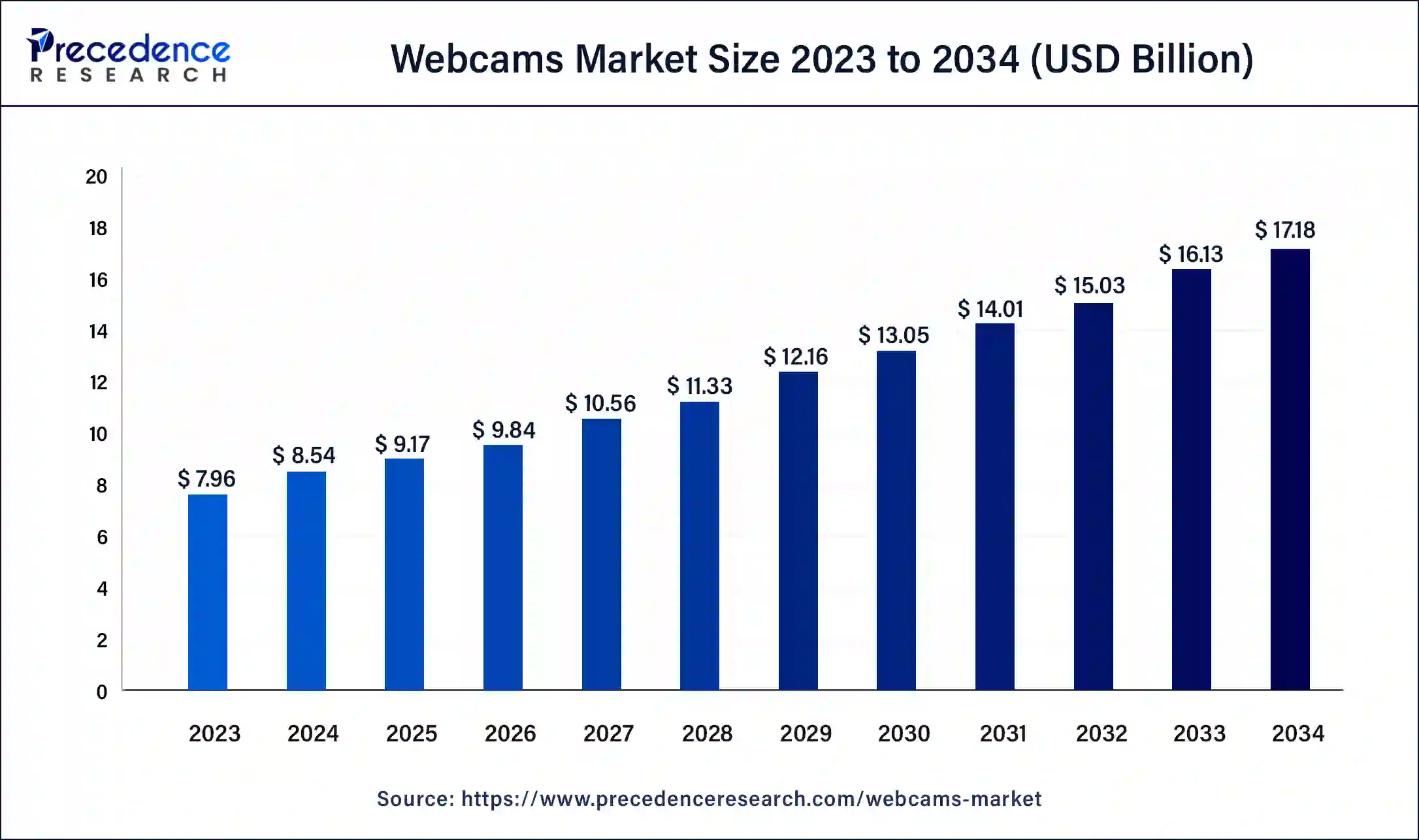

The global webcams market size was USD 7.96 billion in 2023, calculated at USD 8.54 billion in 2024 and is expected to reach around USD 17.18 billion by 2034, expanding at a CAGR of 7.32% from 2024 to 2034. The North America webcams market size reached USD 3.82 billion in 2023. The rising demand for real-time video conferencing technologies by the various sectors is driving the growth of the market.

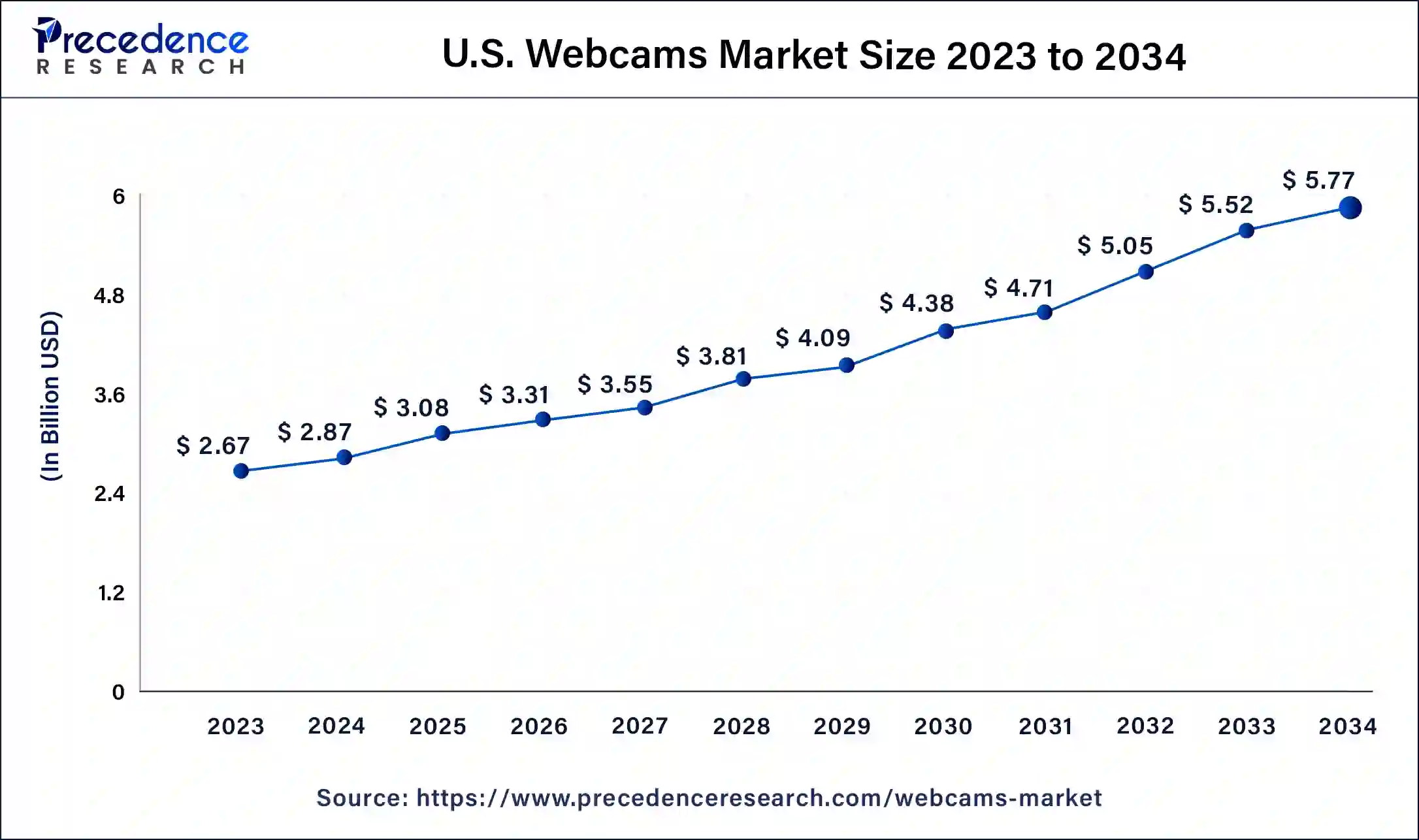

U.S. Webcams Market Size and Growth 2024 to 2034

The U.S. webcams market size was exhibited at USD 2.67 billion in 2023 and is projected to be worth around USD 5.77 billion by 2034, poised to grow at a CAGR of 7.53% from 2024 to 2034.

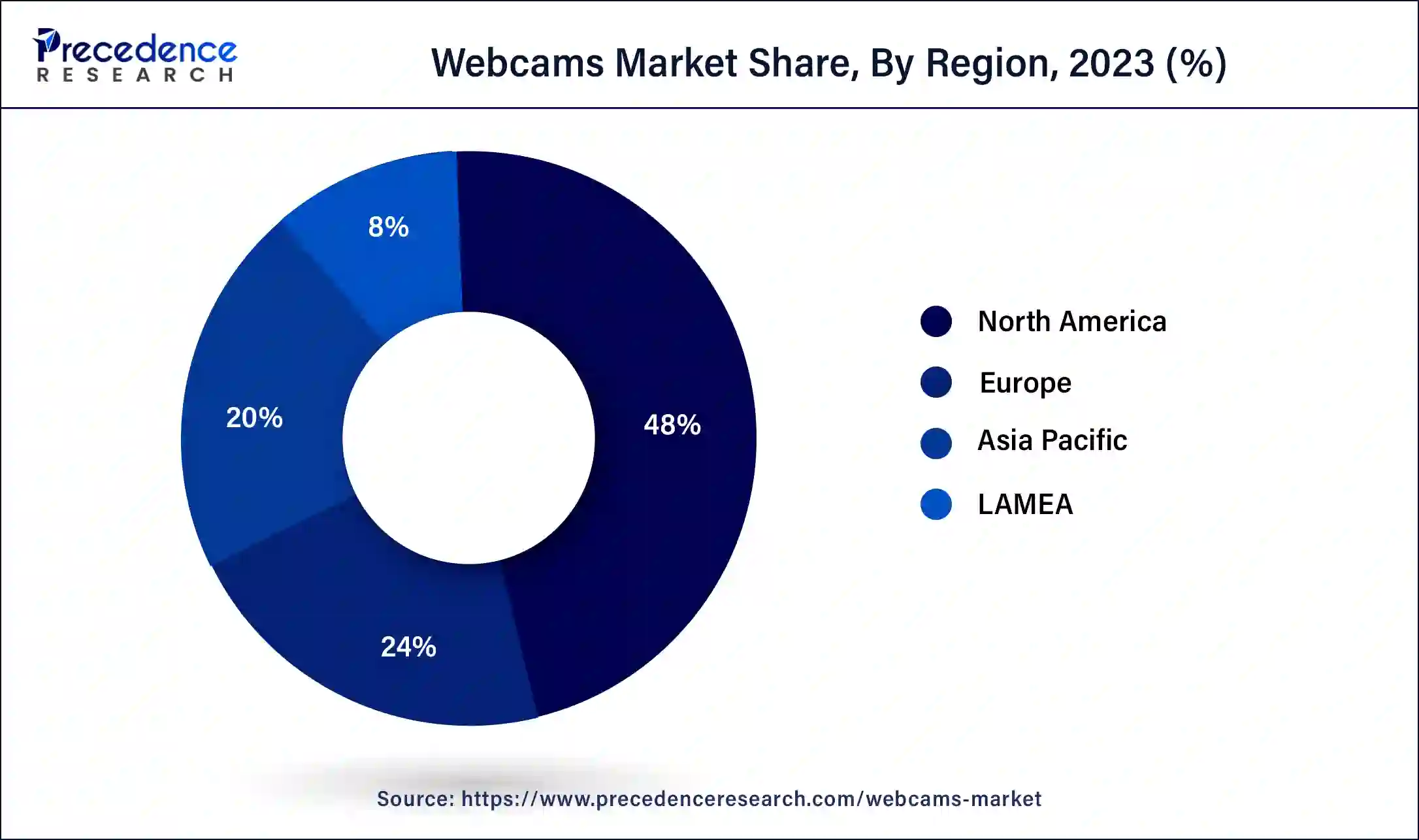

North America dominated the market with the highest market share in 2023. The growth of the market is attributed to the higher rate of technology adoption and innovations in the regional countries. The increasing use of webcams in private and public areas enhances security measures that drive the growth of the market. The rising preference towards online education and working culture after the pandemic has dramatically expanded the demand for webcams, and the increasing social media and advertisement industry is driving the growth of the webcams market in the region.

Asia Pacific is expected to have significant growth during the forecast period. The rising concern for public and private safety, which results in the increased number of webcam installations in public and private areas, drives the growth of the market. Additionally, the rising trend in the WFH and hybrid working culture in the regional countries and the increasing social media culture as a profession are highly contributing to the growth of the webcams market.

Webcams are considered one of the most important tools or technologies used in most personal electronic gadgets like laptops, mobile phones, tablets, etc. These are digital cameras used to capture audio and video data at the same time and transmit through the internet in real-time. Webcams consist of several parts, like lenses, sensors, and a processor. Webcams are generally used for video conferencing, virtual calls, and video calls. They allow a person or group to communicate and see each other in real-time. There are two basic types of webcams: basic webcams and network/IP cameras. Traditionally, webcams were attached to personal computer systems through USBs, but these have now been replaced by in-built webcams in laptops.

| Report Coverage | Details |

| Market Size by 2034 | USD 17.18 Billion |

| Market Size in 2023 | USD 7.96 Billion |

| Market Size in 2024 | USD 8.54 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.32% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Technology, Distribution Channel, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rise in the adoption of webcams in healthcare industries

The rise in telehealth and other remote healthcare programs by the healthcare industries is driving the expansion of the webcams market. The IoT plays an important role in the healthcare industry, and the higher adoption of the internet of medical things such as interconnected devices like webcams are used in several healthcare applications such as disease monitoring, nursing, rehabilitation, patient monitoring, anomaly detection, conditioning, and remote and telemedicine care. The webcams allow physicians or doctors to monitor the patient’s health remotely.

Webcams are an effective solution to providing medical help to people with mobility issues, geographic conditions, and aging factors. Webcams are the most important devices for connecting with patients remotely; they can connect to PCs and provide high-quality video and audio that help physicians monitor and diagnose their health conditions. Thus, the rise in telehealth is driving the growth of the webcams market.

High cost

The higher cost of the webcams is limiting the adoption of the webcams by several industries, restraining the growth of the market. The high cost of webcams is associated with the advancements and integration of smart technologies such as artificial intelligence, enhanced audio and video quality, sensors, and others that limit the adoption rate and restrain the growth of the webcams market.

Trending advancements in the USB webcams

The ongoing research on the advancements and integration of smart technologies in webcams is driving growth opportunities for the webcams market. The advancements such as 4K resolution, virtual background, and AI-powered features are driving the growth of the market. The higher adoption of webcams in different sectors, such as remote working, entertainment and streaming, and online education, as well as the rising focus on privacy and security concerns in commercial and residential buildings, are fueling the adoption of webcams. Additionally, emerging technologies and the entrance of new market players are driving the advancement of the competition. Thus, all these factors are anticipated to drive the opportunity in the market’s growth.

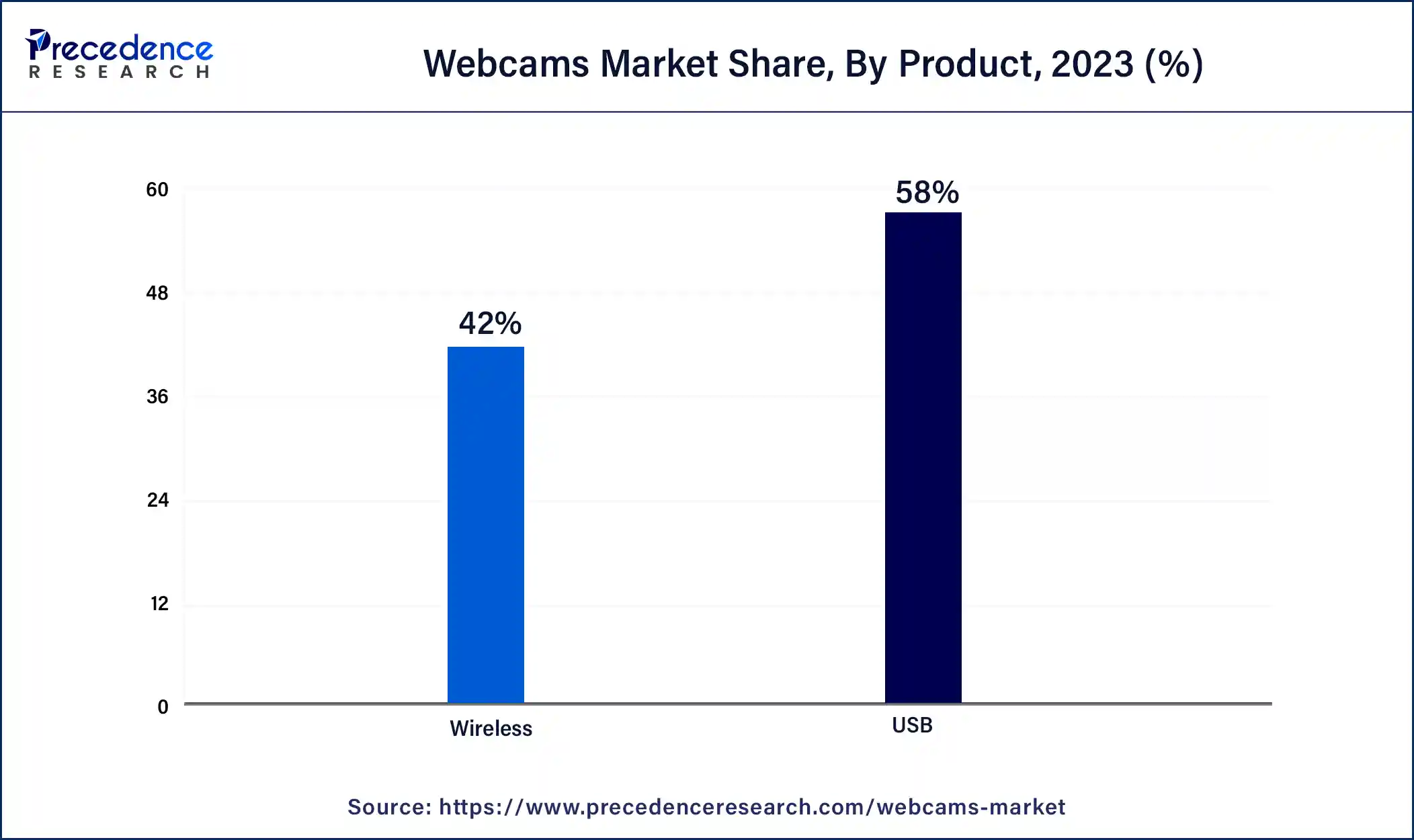

The USB segment dominated the webcams market in 2023 and is expected to remain dominant during the forecast period. The growth of the segment is attributed to the rising demand for USB webcams from the consumer due to their portable design and the quality of the products, which make them the ideal choice for video conferencing and other video chats. USB webcams are used in corporate offices to enable business associate to interact with their clients. Many of the USB webcams come with in-build microphones that enhance the quality of the product and eliminate the external need for microphones.

The USB webcams are attached to the top of the computers or laptop system. USB webcams come with a larger casing that allows them to dissolve the heating issue rapidly. USB webcams can be attached to the USB hub, which is located away from the computer to provide a wider view of the field. Webcams come with a stand or hook and contain bigger lenses than the in-built webcams, which help provide enhanced picture quality. It provides adjustable lenses and programs like an array of sound, color, focus, and several other adjustments that contribute to the developing growth of the USB webcams market.

The digital technology segment dominated the market in 2023. The increasing adoption of digital cameras for webcams is further contributing to the growth of the market. Digital webcams offer better data security, data encryption, and protection than traditional methods. Moreover, the rising digitization in every field is further expanding the adoption of digital webcams segment. The increasing investment in technological adoption and the integration of smart technologies like AI, IoT, and others into consumer electronics are boosting the growth of the digital webcam segment and contributing to the growth of the webcams market.

The e-commerce segment is estimated to grow significantly during the forecast period. The rising adoption of the e-commerce industry by the wide number of consumers due to the higher availability of products and attractive prices with discounted offers and EMI policies are driving the sales of webcams by the e-commerce industry. E-commerce allows several offers and variety in the same product with better prices, brand availability, and discounts. Furthermore, the rising inclination of consumers to the e-commerce industry for shopping and purchasing electronics and other products online that are driving the growth of the e-commerce segment.

The live events segment dominated the webcams market in 2023. The increasing demand for webcams for live streaming in various media platforms is due to enhanced picture quality and portability. The increasing use of webcams from mobile phones is one of the major reasons for the segment’s growth. The rising number of social media users and the increasing advertising media and new channels are boosting the number of live streaming, which has raised the demand for the webcams market.

Segments Covered in the Report

By Product

By Technology

By Distribution Channel

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client