December 2024

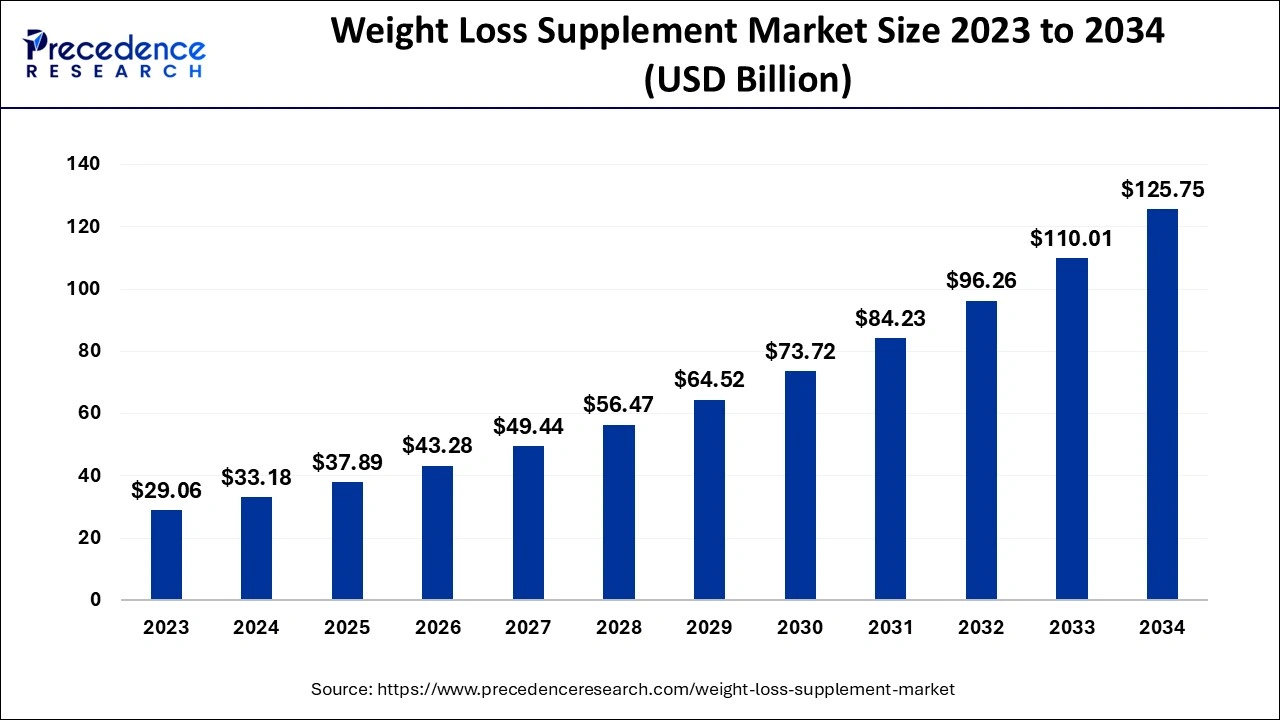

The global weight loss supplement market size accounted for USD 33.18 billion in 2024, grew to USD 37.89 billion in 2025 and is estimated to hit around USD 125.75 billion by 2034, representing a CAGR of 14.25% between 2024 and 2034. The North America weight loss supplement market size is evaluated at USD 12.28 billion in 2024 and is expected to grow at a CAGR of 14.39% during the forecast year.

The global weight loss supplement market size is calculated at USD 33.18 billion in 2024 and is predicted to reach around USD 125.75 billion by 2034, expanding at a CAGR of 14.25% from 2024 to 2034. The increasing cases of obesity are the key factor driving the growth of the weight loss supplement market. Also, the rise of unhealthy lifestyle habits along with easy access to fast food is expected to fuel market growth further.

In the weight loss supplement market, Artificial Intelligence (AI) can help medical professionals to develop personalized exercise and diet plans that meet patients' demands. The AI algorithm can utilize medical records, patient data, and health status to boost the whole process. Furthermore, AI can provide nutritional guidance and advice for diet planning to make sure that patients are taking a prescribed number of nutritious calories each day.

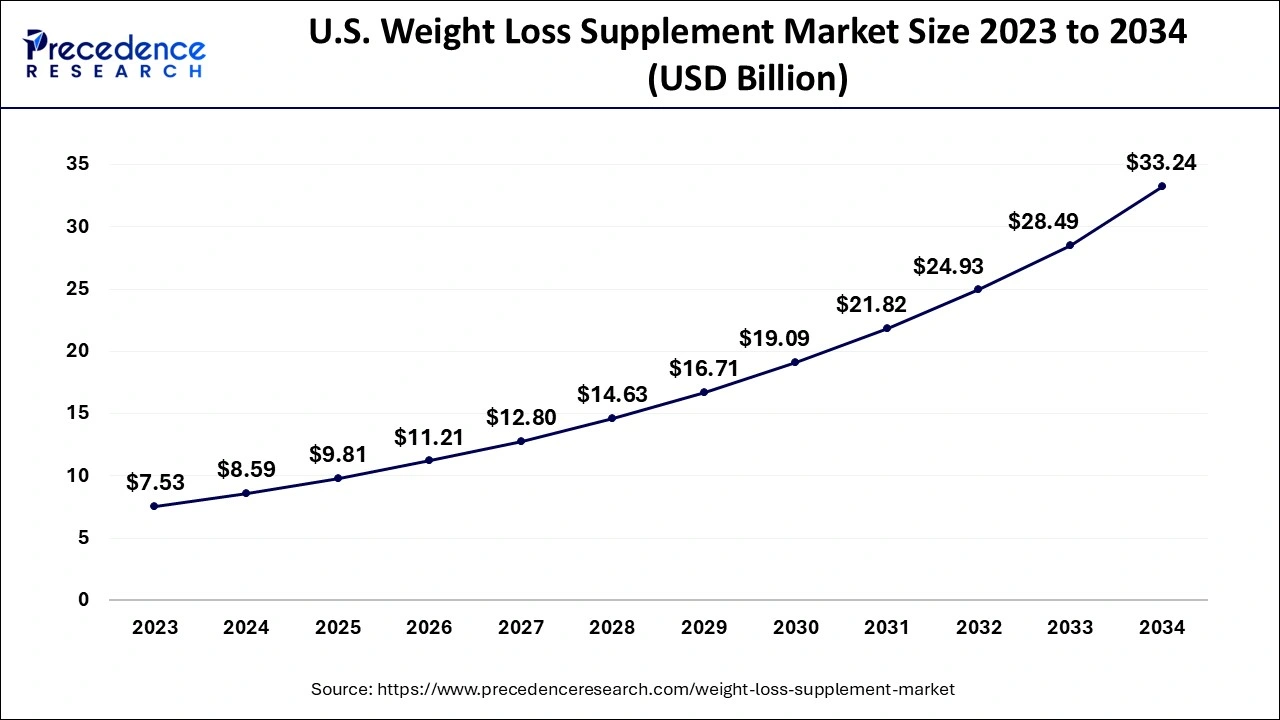

The U.S. weight loss supplement market size is exhibited at USD 8.59 billion in 2024 and is expected to be worth around USD 33.24 billion by 2034, growing at a CAGR of 14.45% from 2024 to 2034.

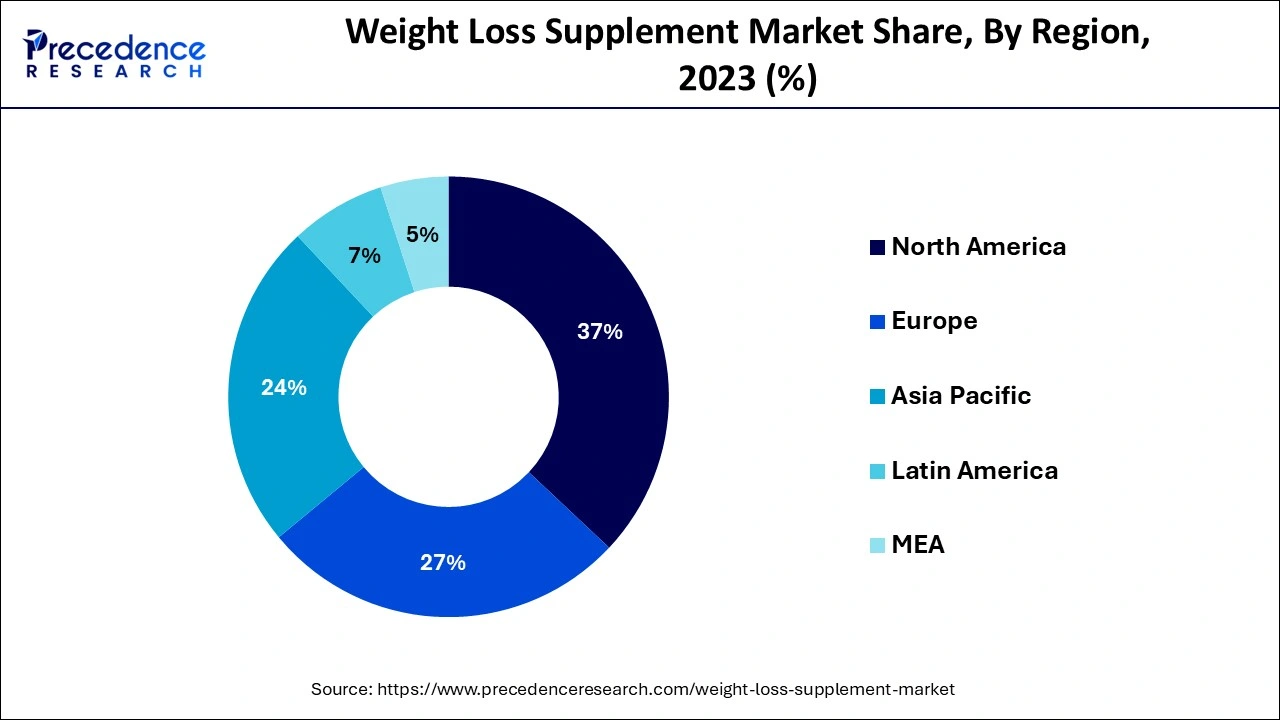

North America dominated the weight loss supplement market in 2023. The dominance of the segment can be attributed to rising health awareness, increasing disposable incomes in middle-class families, and the incidence of sedentary lifestyles. Furthermore, development in product formulations and launches of new marketing strategies have boosted consumer engagement by expanding the accessibility and convenience of end-use platforms.

Asia Pacific is anticipated to grow at the fastest rate in the weight loss supplement market over the studied period. The growth of the segment can be credited to the growing obesity rates and increasing preference for herbal and natural products. Moreover, in the region, China shows significant growth owing to the growing incidence of lifestyle-related diseases. Chinese citizens are becoming more health conscious regarding their whole lifestyle.

The weight loss supplement market encompasses products and services that optimize weight loss by cutting body fat and muscles. These products are of many medication forms such as liquids, powders, capsules, and tablets, and also contain an extensive range of ingredients. In this market, the quality of supplements is more important and is determined by supplements' safety, purity, efficacy, and transparency concerning their adherence to ethical marketing principles.

Top 5 Countries with the Highest Obesity Rates in the World 2023

| Country | Approximate numbers |

| United States | 79.4 million |

| China | 57.3 million |

| India | 45.0 million |

| Brazil | 29.4 million |

| Mexico | 26.9 million |

| Report Coverage | Details |

| Market Size by 2034 | USD 125.75 Billion |

| Market Size in 2024 | USD 33.18 Billion |

| Market Size in 2025 | USD 37.89 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 14.25% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Ingredient, End-use, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Rising collaboration and sustainability practices

Weight loss supplement market players, with the help of fitness organizations and medical professionals, are collaborating willingly in this sector. This can help to create more detailed weight-management plans that contain exercise regimens, food recommendations, etc. In addition, sustainable weight loss practices are becoming essential across the supply chain, from choosing selective ingredients to packaging. This further signifies the global importance of sustainable stewardship.'

Stringent regulatory enforcement

Regulatory enforcement is anticipated to hinder the weight loss supplement market growth. There are many obstacles to ensuring reliable regulatory enforcement. Moreover, insufficient assessment of safety, inadequate regulatory demands, coupled with fewer resources for inspection and monitoring can contribute to these hurdles. Safety concerns are another major factor limiting the market growth throughout the forecast period.

The increase in promotional and marketing activities

In the weight loss supplement market, key players implement advanced business strategies to fuel product sales and visibility. These initiatives are specific to people looking to maintain a fit lifestyle while consuming their diet of choice. Furthermore, downstream channels such as gyms, fitness centers, and health clubs provide obese gym members with personalized assistance and guidance.

The powders segment led the global weight loss supplement market in 2023. The dominance of the segment can be attributed to the introduction of new powder forms by the key market players. The powdered formulation provides bulkier supplement quantities with a long shelf life. Additionally, powders are sophisticated dosage forms that enable more efficient and rapid drug absorption, improving overall bioavailability as compared to other forms.

The pills segment is anticipated to grow at the fastest rate in the weight loss supplement market over the forecast period. The growth of the segment can be credited to the growing preference for this supplement in pill form, created by their availability in different forms like sustained-release pills, chewable tablets, and sublingual pills. Moreover, Clinical trials play a significant role in impacting the overall segment's growth.

The vitamins & minerals segment led the weight loss supplement market. The dominance of the segment can be linked to the increasing awareness among consumers regarding nutritional deficiencies. These supplements also aid in weight management keeping good body functions and metabolism. Moreover, vitamins and minerals play an important role in energy generation and optimize the health of the heart, brain, and other body parts.

The natural extracts and botanicals extracts segment is estimated to grow at the fastest rate in the weight loss supplement market over the projected period. The growth of the segment is driven by rising interest in vegan and organic supplements across the globe due to increasing environmental awareness. Supplements extracted from natural sources such as green tea extract, caffeine, licorice root, and Garcinia Cambogia are famous. Additionally, the growing demand for conventional remedies is opening new avenues for cutting-edge products.

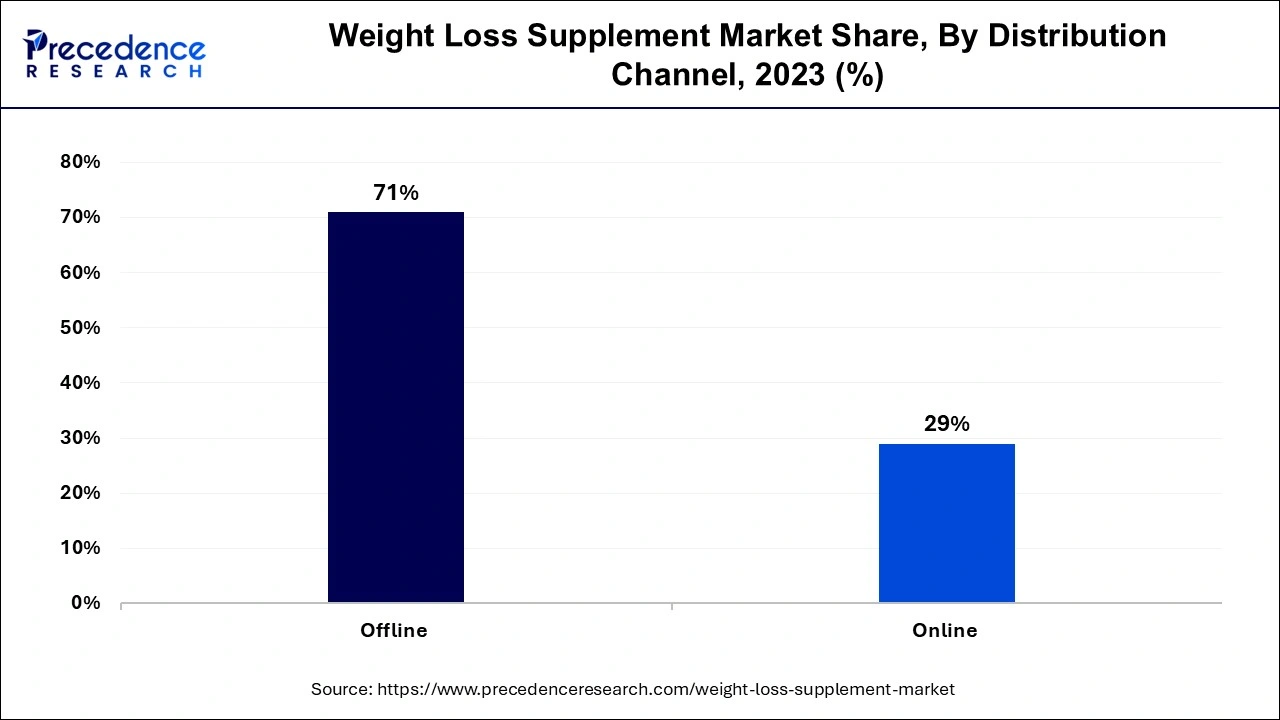

The offline segment dominated the weight loss supplement weight loss supplement market in 2023. The dominance of the segment is due to the rising availability of weight loss supplements in pharmacy stores, health & beauty stores, and drug stores. Also, departmental stores are taking new initiatives to grow awareness about healthy lifestyles. Offline stores are constantly improving the overall shopping experience.

The online segment is projected to grow at the fastest rate in the weight loss supplement market during the forecast period. The growth of the segment can be attributed to the growing prevalence of the e-commerce industry coupled with the increasing shift toward online distribution channels. Furthermore, the rise in self-directed consumers is also a substantial factor fuelling segment growth.

The 18 to 40-year-old segment dominated the weight loss supplement market 2023. The segment's dominance is due to the growing need to maintain a healthy body weight by keeping a toned physique. In addition, the increasing awareness of the benefits of weight loss supplements.

The under-18 years segment is expected to show fastest growth in the weight loss supplement market over the projected period. The growth of the segment can be driven by rising fitness awareness among the age group under this age, coupled with the advantages of these products. Also, an increase in disposable income among the majority of the population will contribute to segment growth shortly.

By Type

By Ingredient

By End-use

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024