October 2024

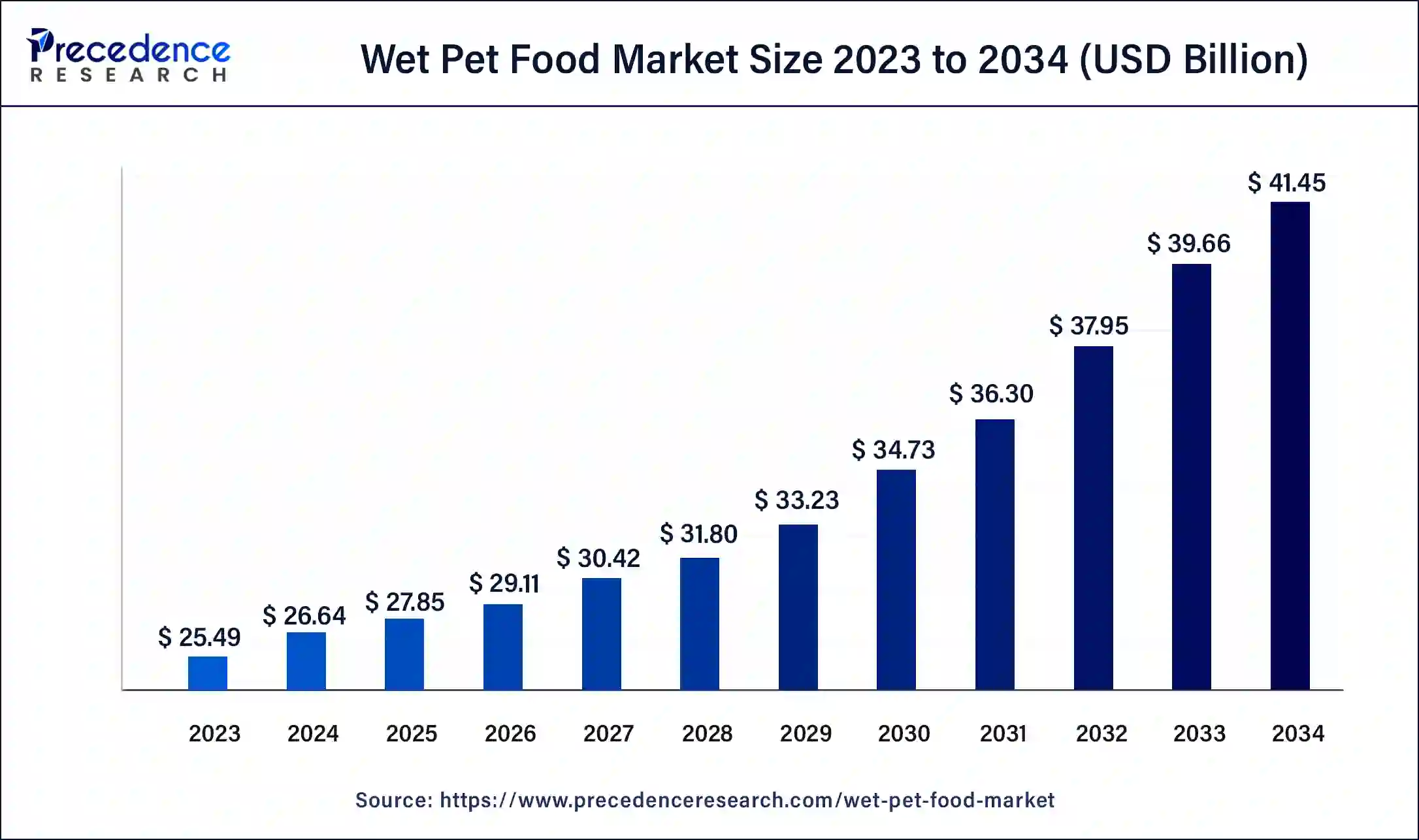

The global wet pet food market size was USD 25.49 billion in 2023, calculated at USD 26.64 billion in 2024 and is expected to be worth around USD 41.45 billion by 2034. The market is slated to expand at 4.52% CAGR from 2024 to 2034.

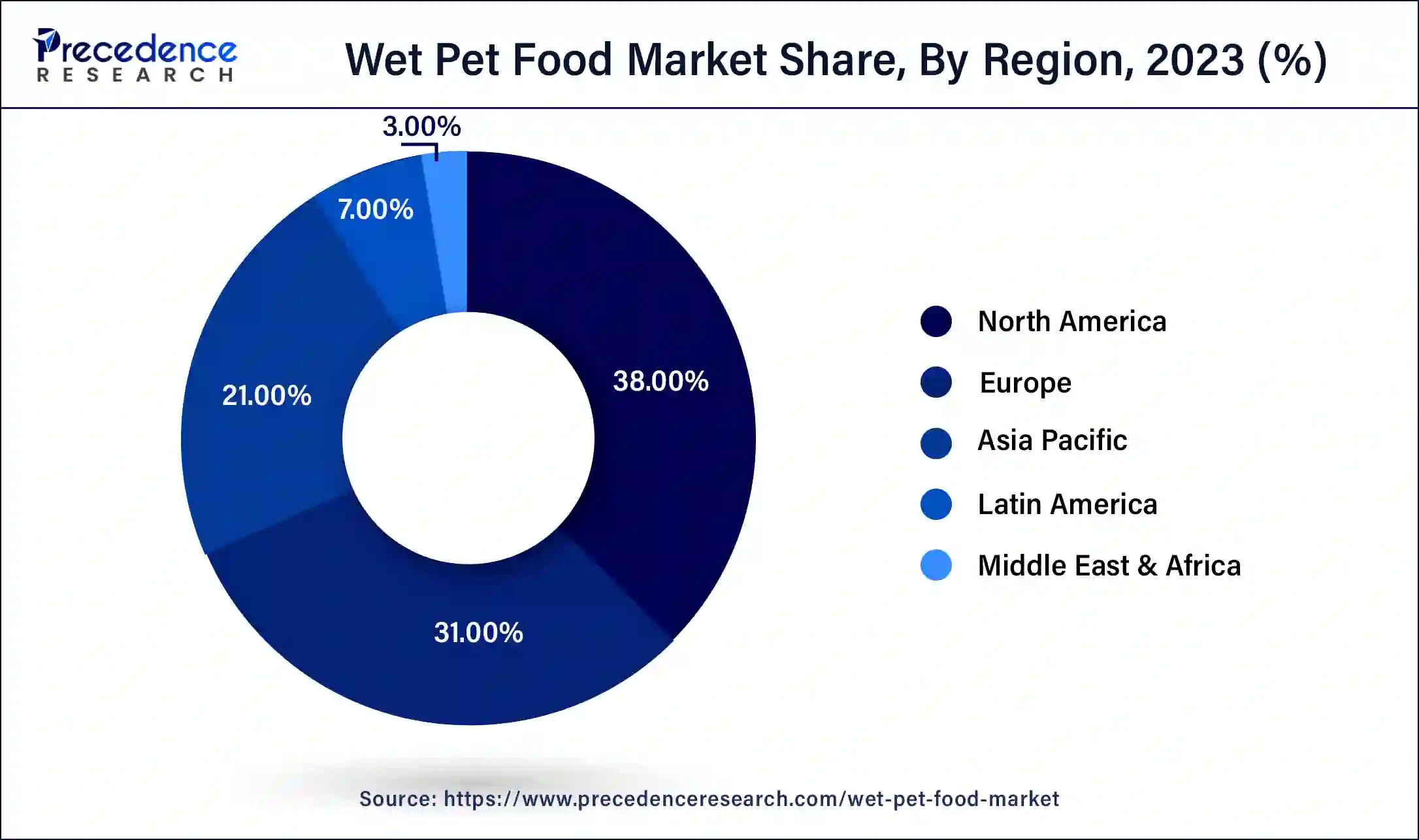

The global wet pet food market size is worth around USD 26.64 billion in 2024 and is anticipated to reach around USD 41.45 billion by 2034, growing at a CAGR of 4.52% over the forecast period 2024 to 2034. The North America wet pet food market size reached USD 9.69 billion in 2023. Increasing demand to incorporate multiple nutrients into one container that keeps pets hydrated, tempted, healthy, and provides low calories contributes to the growth of the wet pet food market.

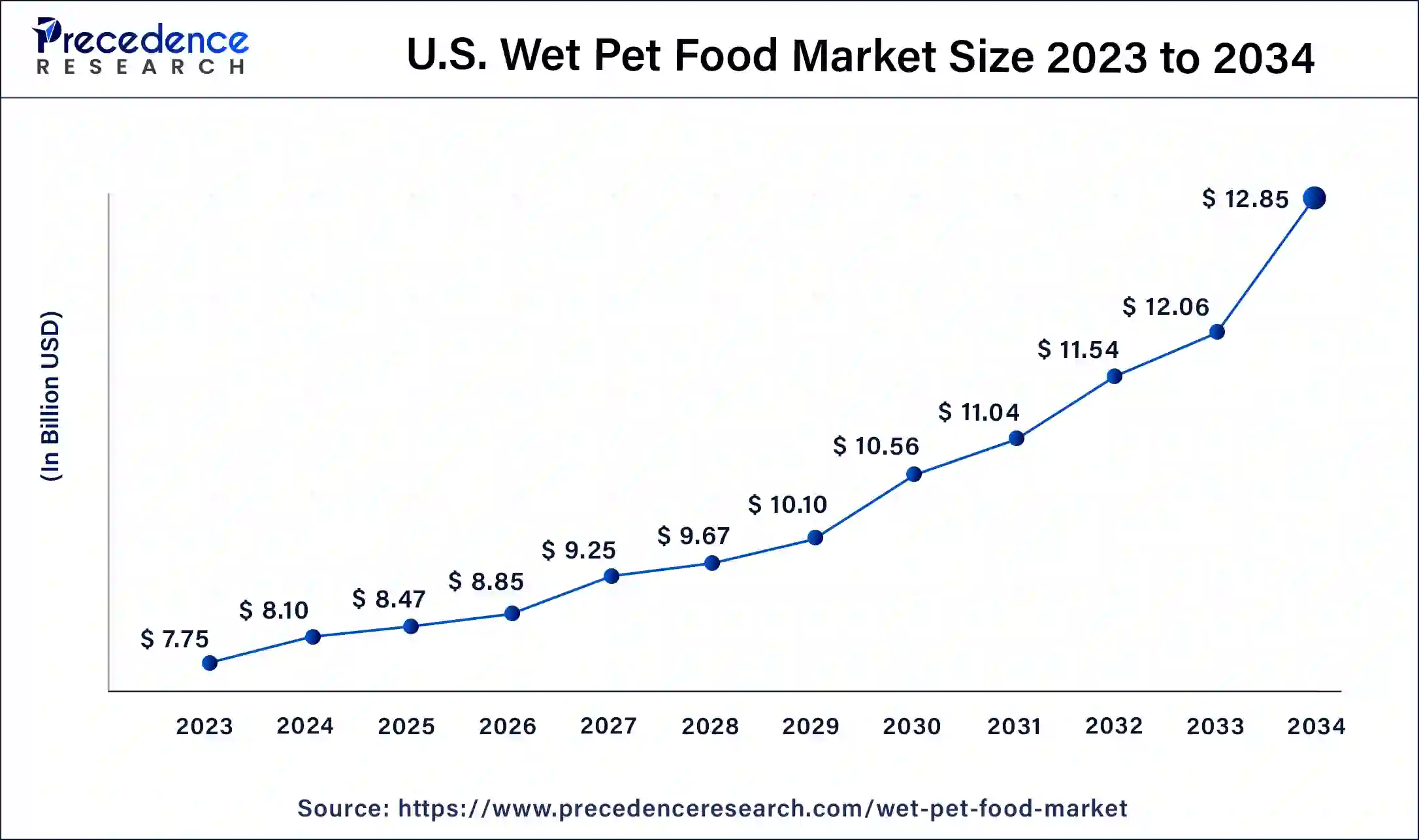

The U.S. wet pet food market size was exhibited at USD 7.75 billion in 2023 and is projected to be worth around USD 12.85 billion by 2034, poised to grow at a CAGR of 4.70% from 2024 to 2034.

North America dominated the global wet pet food market in 2023. Increasing awareness of adequate pet nutrition is raising demand for market. Several pet food companies are introducing innovative pet food products, forging alliances, and expanding their manufacturing units in the North American region. The U.S. is well known for its research and development sectors in the pet food industry.

Asia Pacific is projected to host the fastest-growing wet pet food market in the coming years due to increasing demographics and demand trends that favor continued growth in the wet pet food category. Asia Pacific is proven to be the largest pet owner globally, as the majority of pet owners are young, so there's an awareness regarding pets' health and well-being. Humanization of pets is widely noticed in Thailand and China due to the decline in the number of nuclear families and the increasing trend of single, unmarried parent or childless parent-adopts pets.

The Asia Pacific region has the highest population of vegetarians (19%) and vegans (9%). The household environment depends on the nourishment of the pet. A vegetarian pet owner generally feeds plant-based wet pet food to their pet animal. India has the highest percentage of vegetarians. Moreover, the expansion of pet adoption, pet ownership, and awareness of healthy nutrition for pets has increased the wet pet food market.

Wet pet food is a ground form of the protein source or meat ingredient. It is high in moisture content, about 75-78% water, providing hydration to the pet animal. Hydration is important for the pet's health. It helps to maintain the body's regular temperature, improves digestion and absorption of nutrients in pet food, moves nutrients in and out of cells, cushions joints, and internal organs, and helps with elimination. Wet pet foods are available in different packaging formats, such as canned foil trays and pouches. The components in it are in various forms, including chunks in gravy, chunks in jelly, casserole, and meatloaf. Ingredients present in wet pet foods are oils and fats, vitamins, minerals, cereals, pasta, grains, vegetables, or meat.

How is AI Helpful in the Wet Pet Food Market?

The wet pet food industry is constantly changing and evolving. Integration of AI in the composition and production of pet food recipes leads to enhancing operational efficiency, cost reduction, and resource optimization. Utilization of AI in pet food manufacturing companies improves the quality and consistency of their products, fulfilling consumer’s demand for premium, reliable, and nutritious pet food. With the rapid evolution of the industry, companies are bound to benefit from formulation and production. For instance, PawCo Foods uses AI to improve the nutrition and palatability of their products.

| Report Coverage | Details |

| Market Size by 2034 | USD 41.45 Billion |

| Market Size in 2024 | USD 26.64 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Pet, Source, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Consumer demand drives the market

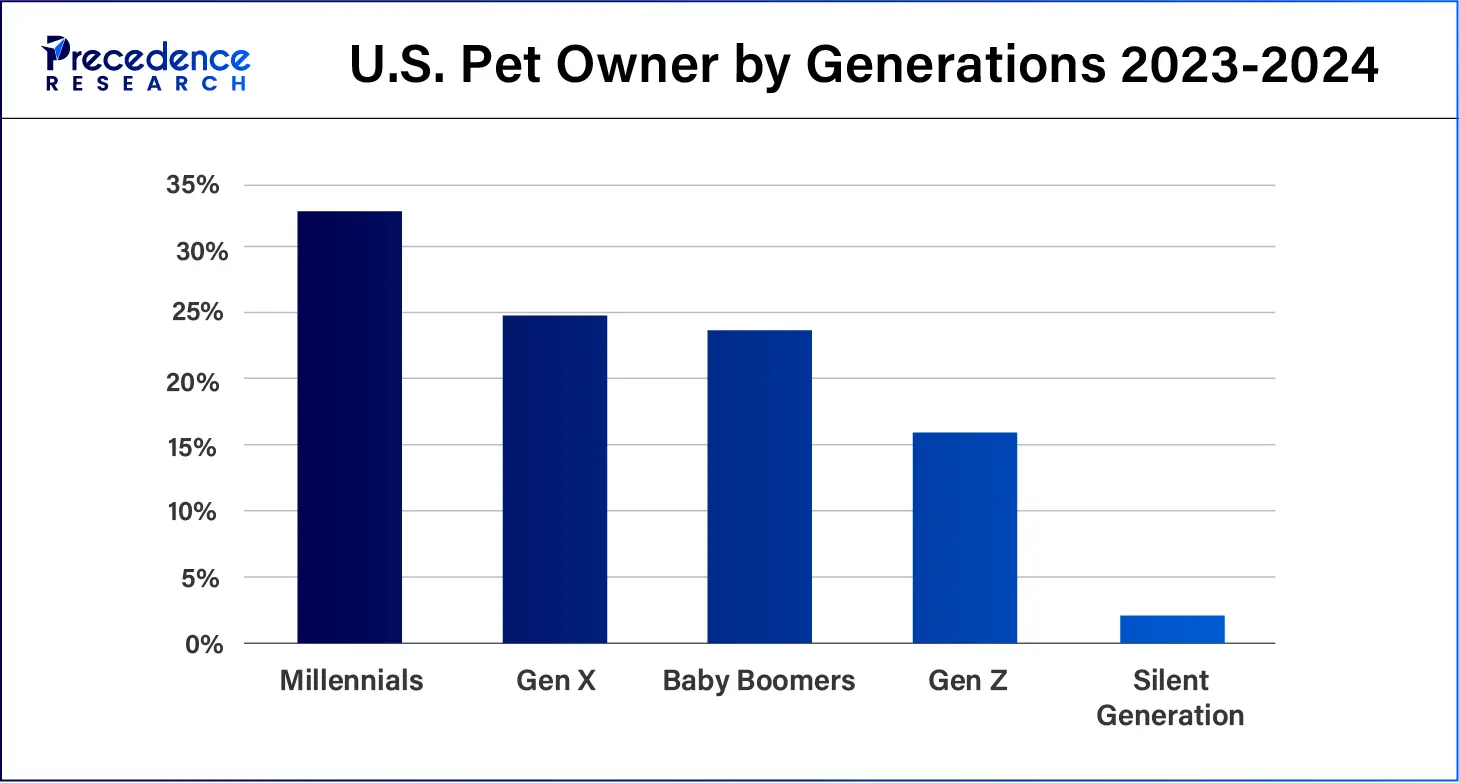

The rising population of pet owners is driving the wet pet food market. A large number of pet owners prefer wet pet food for their pets due to its premium ingredients, local sourcing, customized recipes, weight loss, and variety. The consumer interest lies in good quality and naturally nutritious wet pet food. Owners realize better food options influence their pet’s health; therefore, they tend to purchase premium quality wet pet food. For instance, a tangible improvement in the cat’s fur or obesity reduction is convincing the consumer to make reliable purchases.

Restraints

Additives and Preservatives

Despite the longer shelf life, the process behind preserving the food is not preferable. According to All About Dog Food, artificial preservatives and antioxidants are present in dog food. The preservatives used in food are antimicrobials, which prohibit the growth of bacteria, molds, or yeasts, and antioxidants that slow down the oxidation of fats and lipids that cause rancidity. Some of the most commonly used artificial preservatives and antioxidants are BHA, BHT, propyl gallate, and potassium sorbate. Preservatives in animal food lead to poor digestion and cause some harmful skin conditions. Pet owners should feed their animals natural preservative-containing pet food such as vitamin C (ascorbic acid), vitamin E (mixed tocopherols), or rosemary. Although natural preservatives do not offer a longer shelf life, they are safer choices for animals. Adapting to canned food is a great option to eliminate the need for chemical preservatives.

Technology Advancements

The future of wet pet food looks promising in the coming years. Innovations are expected to be witnessed in the creation of a healthier and more enjoyable meal for all pet animals. Technological advancements in the production processes of pet food. Integration of AI and automation are anticipated in pet food production. This will enhance efficiency, safety, and quality in the pet food manufacturing industry. Al-powered platforms will help in feeding solutions according to many factors such as age, breed, weight, activity level, and specific health concerns. This advancement will be helpful in customizing meal plans for each pet. Complex algorithms are designed to identify the optimal nutrient ratio and ingredients required for individual animals.

Another innovation in AI is genetic testing; by analyzing DNA samples and AI algorithms, genetic markers are identified, which help in specific health conditions, sensitivities, and potential nutrient deficiencies or excesses. The future is expected to shift to sustainable and eco-friendly product packaging. Moreover, all these factors expand the growth of the wet food market in the forecast period.

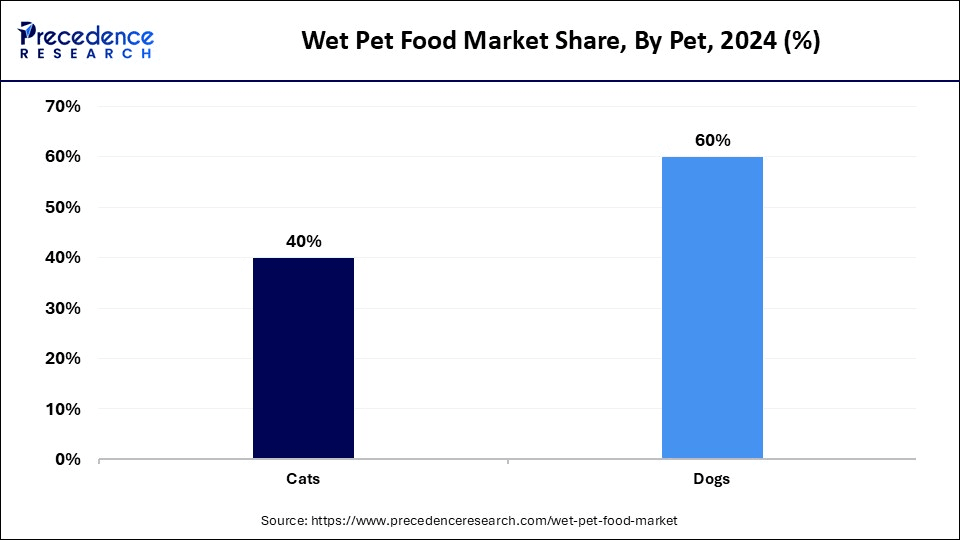

The dog segment held a dominant share of the wet food market in 2023. The wet pet food market for dogs has grown exponentially over the years. The wet food ensures that the dog gets proper nutritious food for its better health. The primary function of wet pet food is to provide moisture. When a dog doesn't get enough water, it becomes dehydrated, resulting in some health conditions affecting kidney functions and developing a risk of kidney stones. Wet pet food has a big impact on digestive health. It prevents constipation and other digestive problems. Due to its soft and easy-to-chew properties, wet food gets digested quickly and is well absorbed in the intestines. It also reduces the risk of obesity and weight gain due to its lower calorie intake than dry food. Wet food is less processed than dry food, and dogs are able to consume wet food daily without disturbing their gastrointestinal system.

The cat segment is expected to grow at a significant rate in the wet pet food market during the forecast period of 2024-2034. Felines need more hydration than any other animal. The demand for wet pet food among cats is greatly increasing. A diet that is low in moisture content can make a cat dehydrated, causing kidney problems and urinary tract problems. On average, a cat requires one cup of water every day, that is 4 ounces of water per 5 pounds of lean body weight every day. The weight of the cat is directly proportional to the cat's required water intake. Canned food is highly preferred by cat owners, as it contains 80% water, and dry food has 6-10% water. Due to the strong aroma and flavor of wet food, it is often more palatable to cats than dry food.

According to an article published in the Journal of the American Veterinarian Association, Wellness Gravies Salmon Entree is the best wet cat food for adult felines. It contains a healthy balance of protein from salmon, turkey, and egg whites.

The animal-based segment led the global wet pet food market in 2023 and is expected to grow at the fastest CAGR from 2024 to 2034. Animals-based foods are rich sources of protein for pet’s meals. Different parts of animals are used in pet food, such as liver, kidney, tripe, lungs, pig’s trotters, spleen, udders, and chicken feet. According to the Pet Nutrition Alliance, the by-product of animals used in pet food is an excellent source of protein and other nutrients, and it is also safe to consume. Protein supplies amino acids to the hair, skin, nails, muscles, tendons, ligaments, and cartilage. Protein is also helpful in the production of hormones and enzymes. It is important to ensure that the animal-based product is approved by AAFCO and USDA guidelines. Any waste products, road kill, and diseased meat are not permitted for pet food.

The plant derivative segment is expected to grow at a significant rate in the wet pet food market during the forecast period of 2024 to 2034. The rising number is due to livestock animal consumption, which is impacting the environment; many pet parents are switching to plant-derivative food for their pets. A study shows that pet food is responsible for 20-30% of the livestock sector's environmental impact in the U.S. Researchers suggest that dogs and cats are able to maintain a good healthy life on a plant-based diet. As dogs and cats are carnivorous animals, it is assumed that they only consume meat.

The pet specialty stores segment held a dominant presence in the wet pet food market in 2023 due to the availability of a variety of brands. Purchasing pet food from a pet specialty store for new pet parents is helpful, as they don't have much experience with pet animals. The shopkeeper or the vet can suggest to the owner about the right food for their pet. Considering the age, breed, and any special condition, an expert on the matter is the right person to provide guidance. A personal physical inspection of the product, ingredients, and nutrient content is possible when purchasing pet food from the store. A local store might offer services such as grooming, treatment, training, and adoption.

The online segment is expected to grow at the fastest rate in the wet pet food market during the forecast period. Online shopping for pet food saves traveling and time and allows you to get products for a better price. According to APPA (American Pet Production Association), 90% of pet owners have made some type of online pet product purchase over the last 12 months. In 2022, food and treats were the two most popular pet product categories for online purchasing, with 80% of pet owners purchasing pet food online and 76% purchasing treats online. Online shopping offers some occasional offers, discounts, and coupons that benefit purchasers.

Segments Covered in the Report

By Pet

By Source

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025

January 2025

September 2024