August 2022

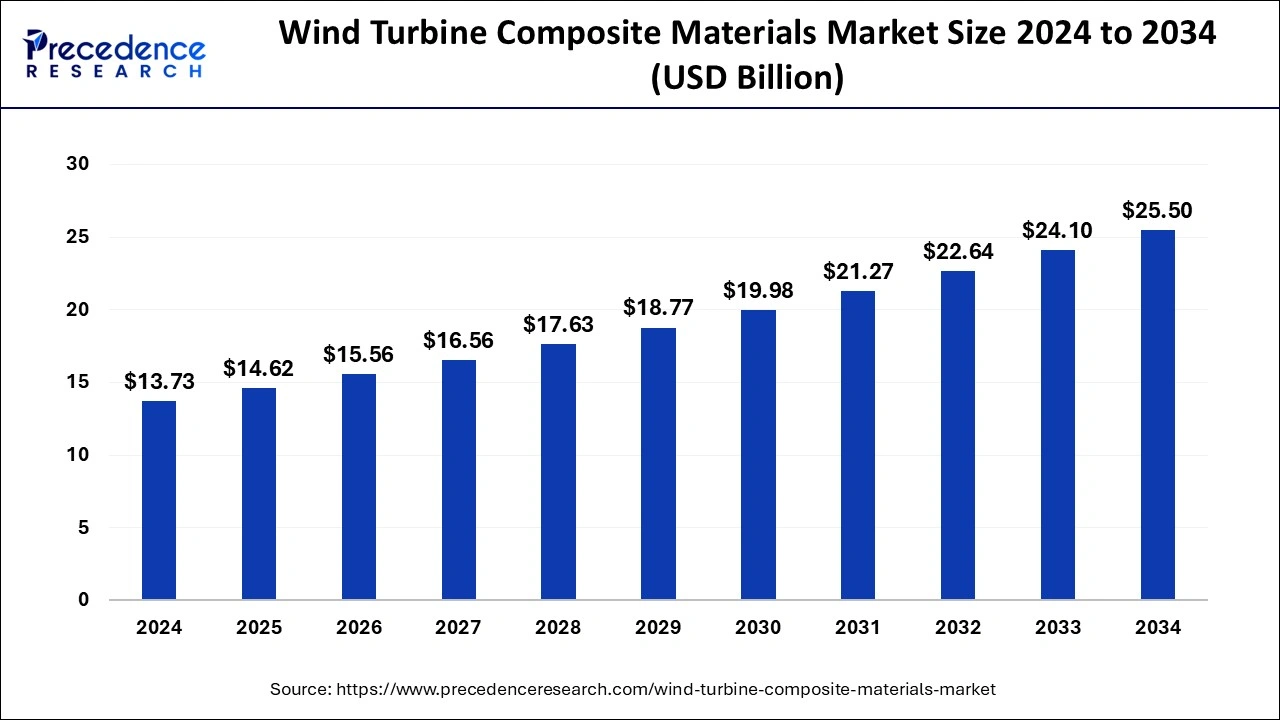

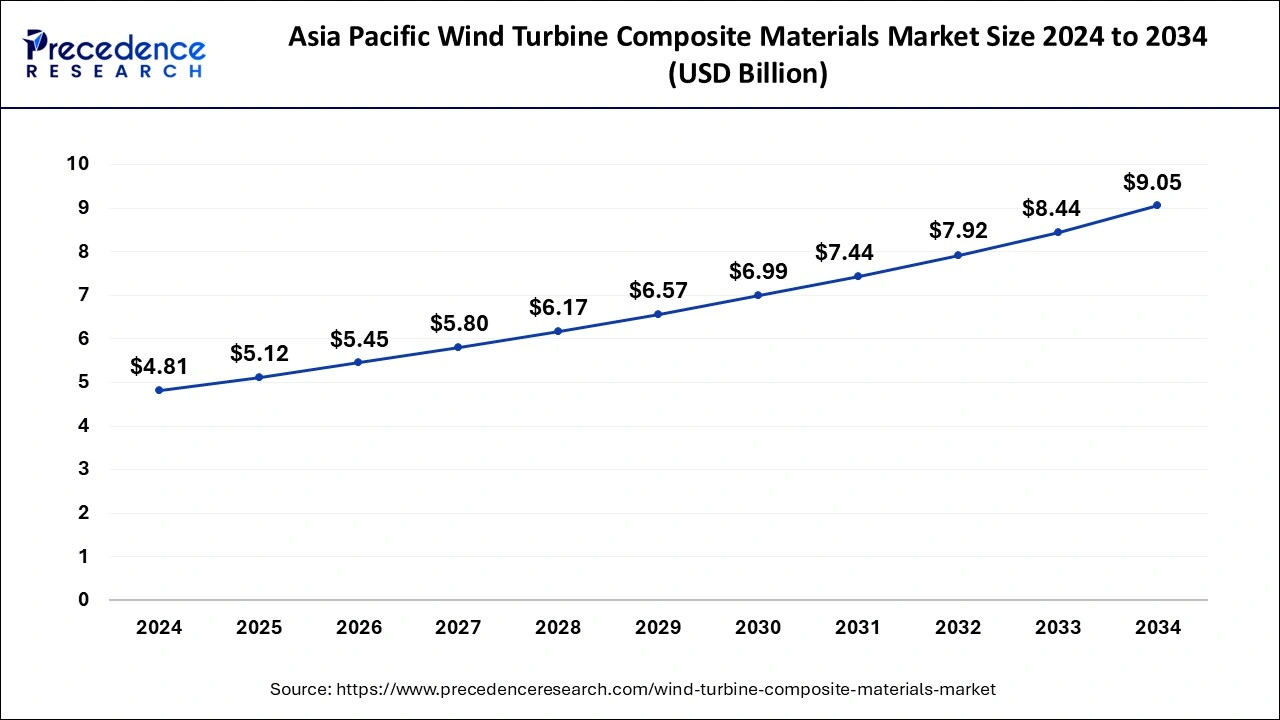

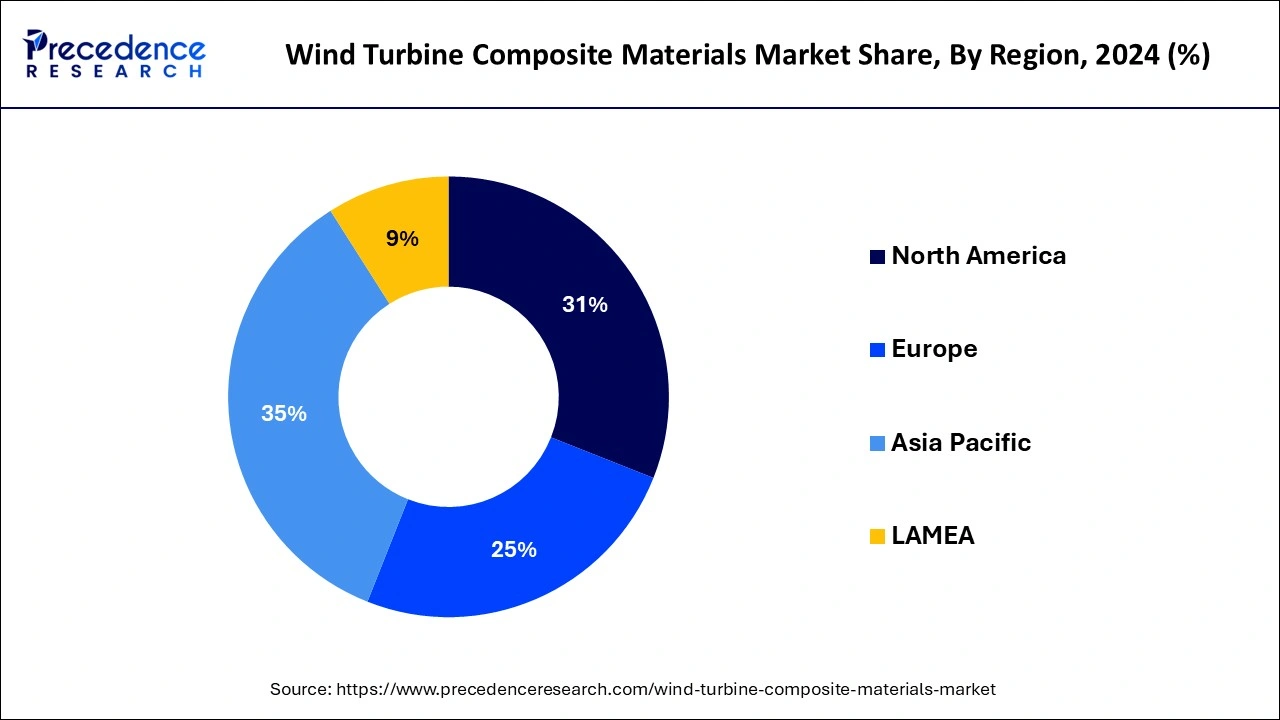

The global wind turbine composite materials market size is accounted at USD 14.62 billion in 2025 and is forecasted to hit around USD 25.50 billion by 2034, representing a CAGR of 6.39% from 2025 to 2034. The Asia Pacific market size was estimated at USD 4.81 billion in 2024 and is expanding at a CAGR of 6.52% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global wind turbine composite materials market size was calculated at USD 13.73 billion in 2024 and is predicted to increase from USD 14.62 billion in 2025 to approximately USD 25.50 billion by 2034, expanding at a CAGR of 6.39%.

The Asia Pacific wind turbine composite materials market size was exhibited at USD 4.81 billion in 2024 and is projected to be worth around USD 9.05 billion by 2034, growing at a CAGR of 6.52% from 2025 to 2034.

Asia Pacific dominated the wind turbine composite materials market in 2024 and is also observed to sustain the position during the forecast period owing to the rising focus on wind energy expansion, increasing investment in renewable energy sources, rapid pace of urbanization, rapid industrialization, technology advancement, electrification of end-use sectors, rising number favorable government policies and initiatives for increasing installations of offshore and onshore wind energy solutions. Such factors are expected to propel the market growth in the region during the forecast period.

In the Asia Pacific region, countries such as India and China are the major contributors to the wind turbine composite materials market owing to increasing investment in wind energy, favorable government policies, rising R&D activities, increasing adoption of advanced energy solutions, robust growth in domestic power consumption, rapidly rising demand for fossil-free sources of energy, presence of key market players, and increasing awareness about alternative sources of energy.

Additionally, the market has witnessed steady growth in the installation of wind power projects in China and India, which is likely to benefit the regional market during the forecast period. China represents the largest share of the global wind installed capacity while India has the fourth-largest installed capacity in wind power. Moreover, the government in these regions is offering incentives and subsidies for wind energy projects. Composite materials enable structures to be designed and facilitate several benefits including weight reduction, high-strength materials, excellent performance, and reliability in harsh weather.

Asia Pacific Wind Turbine Composite Materials Market Trends:

North America is anticipated to grow at a notable growth rate in the wind turbine composite materials market during the forecast period. The growth of the region attributed to the improvements in energy efficiency, rising power consumption, and rapid growth in the wind energy installations leading to an increase in the production of wind turbines, presence of prominent market players, increasing investment in wind energy, launch of various wind energy development programs, and implementation of stringent environmental regulations by the United States and Canadian governments. Such factors are anticipated to boost the growth of the wind turbine composite materials market in the North American region during the projection period.

North American Wind Turbine Composite Materials Market Trends

As wind energy generation is a clean, eco-friendly, and renewable source of energy, composite materials have continuously contributed to the increasing efficiency of wind power installations globally. Composite materials are used in the construction of lightweight components with superior properties and long product life. Advanced composite materials solutions were developed to keep the weight of the wind turbine blades as lighter as possible, maximizing their strength, stiffness, and durability. In wind turbines, composites are widely used to manufacture wind turbine blades and they serve as the prominent composite-based part of the turbine. Wind turbine composite materials refer to those materials that are used in the development of wind turbine blades, towers, nacelles, and other components.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.39% |

| Market Size in 2025 | USD 14.62 Billion |

| Market Size in 2024 | USD 13.73 Billion |

| Market Size by 2034 | USD 25.50 Billion |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fiber Type, Technology, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Rapid expansion of the wind energy industry

The growing global energy demand coupled with renewable energy targets is expected to boost the growth of the wind turbine composite materials market. The demand for fossil-free electricity is increasing significantly as fossil fuels are burned to generate energy causing harmful greenhouse gas emissions, such as carbon dioxide.

Gradually, the wind energy industry continues to advance the wind turbine rotors with the most updated blades and create higher capabilities to produce a clean source of energy. The wind power industry is positively influenced by cost-effective solutions and has the potential to transform the dynamics of the industry.

Additionally, the rising number of onshore and offshore wind energy installations around the world boosts the market’s growth. Therefore, the massive shift towards wind energy coupled with the increasing use of electricity globally led to a spurring of the demand for wind turbine composite materials market during the forecast period.

High cost

The high costs associated with these materials are anticipated to hamper the wind turbine composite materials market’s growth. In addition, the presence of substitutes for energy generation are likely to restrict the expansion of the global wind turbine composite material market during the forecast period. The high-cost manufacturing of composite materials and required set of skills during the process of manufacturing often create a significant limitation for manufacturers. Along with this, the regulatory compliances also hinder the market’s expansion.

Favorable government policies and incentives

The favorable government policies and incentives are projected to offer an immense opportunity for the wind turbine composite materials market. Governments around the world have launched several programs for the development of renewable energy sources such as wind energy. Wind energy is the fastest-growing source of renewable energy worldwide. The demand for wind energy rises rapidly as the most secure and sustainable solution to meet the ongoing energy demand.

Governments across the globe are embracing changes to create a safe, cheap, and sustainable energy system. The government is making numerous efforts in ensuring universal access to energy and providing power to every resident due to which they are deploying large-scale renewable energy projects, especially wind and solar. Thus, the implementation of stringent government rules and regulations to curb the loss of energy as well as reduce the impact on the environment is expected to fuel the expansion of the wind turbine composite materials market.

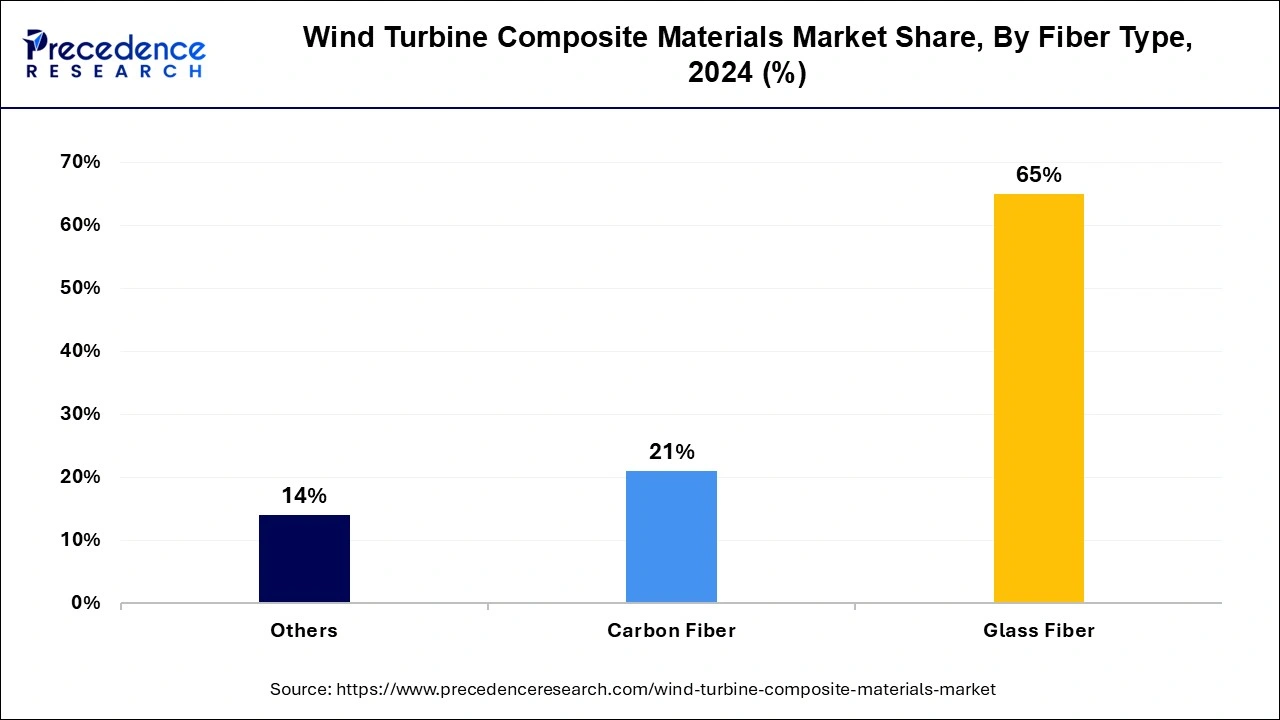

The glass fiber segment held the largest share of the wind turbine composite materials market in 2023, the glass fiber segment is expected to sustain the position throughout the forecast period owing to its good mechanical properties, durability, high strength-to-weight ratio, and cost-effectiveness. The economical cost of glass fiber is attracting manufacturers globally. Glass fiber possesses the quality to withstand the harsh environmental conditions faced by wind turbines.

On the other hand, the carbon fiber segment is expected to grow significantly during the forecast period. Carbon fiber composite materials are eco-friendly solutions. Carbon fiber assists in weight reduction and increases stiffness and strength which results in the construction of turbine blades more efficient and longer. Moreover, the rising environmental concerns over hazardous materials are observed to create a significant potential for the segment to expand.

The vacuum injection molding segment accounted for the dominating share in the year 2023. Vacuum Injection Molding (VIM) assists in producing superior-quality composite wind rotor blades with minimal voids and defects. The growth of the wind energy sector is driving the installation of wind turbines globally and increasing the adoption of vacuum injection molding (VIM) for the development of wind turbine composite components. The VIM process is widely to produce large and thick composite parts and is well-suited for wind turbine blades that can be over 80 meters in length. On the other hand, the prepreg segment is observed to witness a considerable growth rate in the global wind turbine composite materials market over the forecast period. Prepreg is the most extensively used technology to produce wind blades, particularly longer blades, and is resin infusion technology.

The wind blades segment dominated the wind turbine composite materials market in 2023. The segment is observed to sustain the position during the forecast period. Blades are the most critical component of wind turbines and impact the overall efficiency and output of the turbine. The market has observed the increasing use of glass fiber-reinforced polymer (GFRP) and carbon fiber-reinforced polymer (CFRP) in wind blade manufacturing owing to their corrosion resistance quality, high strength-to-weight ratio, reliability, and durability. The expansion of the wind energy sector has increased wind turbine installations which results in enhancing the demand for wind blades during the forecast period.

By Fiber Type

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2022

February 2025

March 2025

March 2025