September 2024

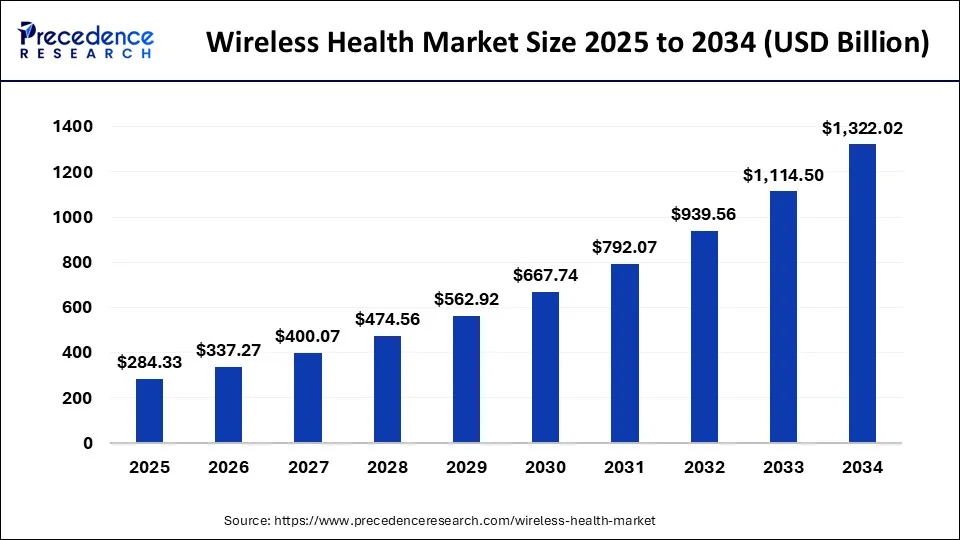

The global wireless health market size was USD 202.07 billion in 2023, calculated at USD 239.70 billion in 2024 and is expected to be worth around USD 1,322.02 billion by 2034. The market is slated to expand at 18.62% CAGR from 2024 to 2034.

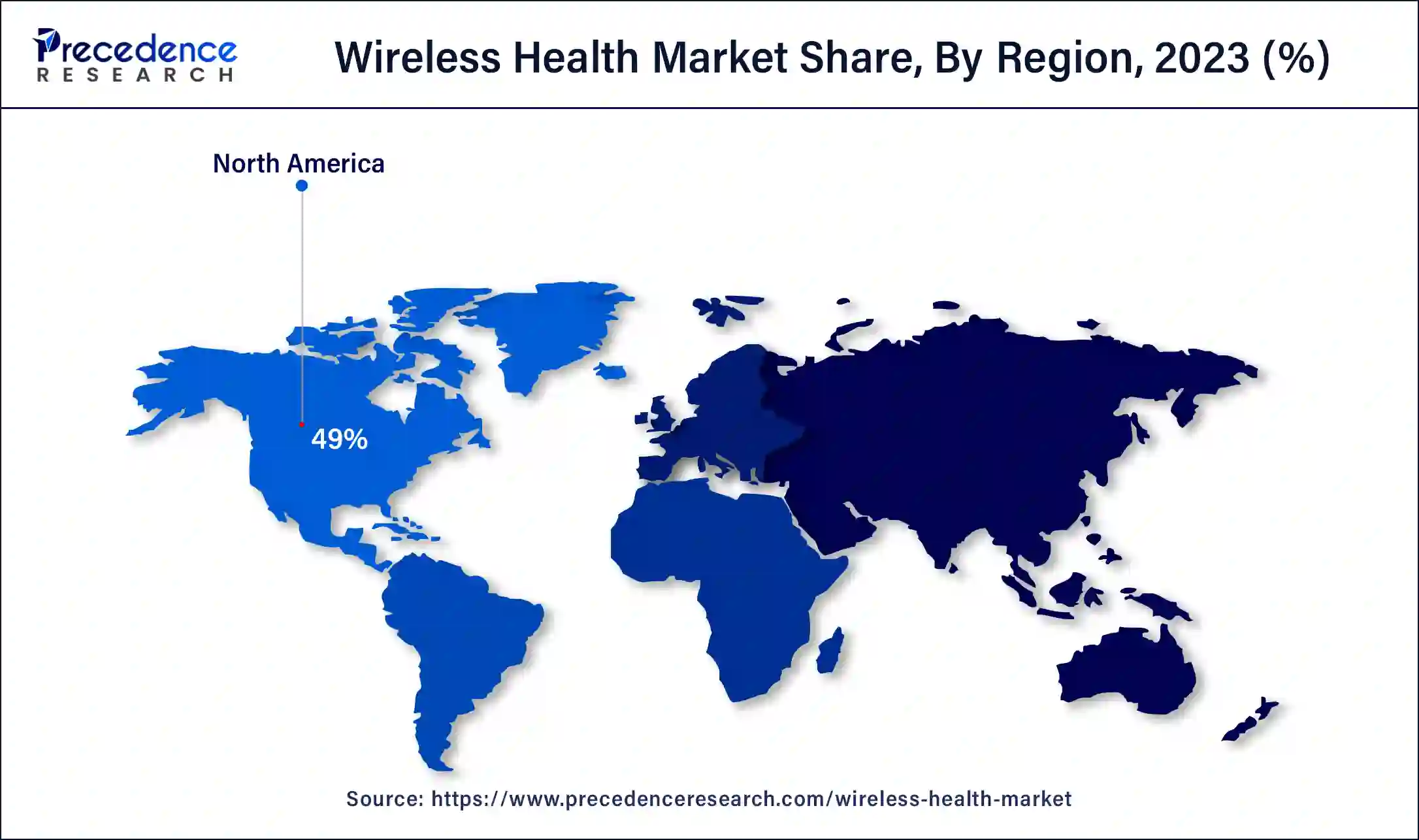

The global wireless health market size is worth around USD 239.70 billion in 2024 and is anticipated to reach around USD 1,322.02 billion by 2034, growing at a CAGR of 18.62% over the forecast period 2024 to 2034. The North America wireless health market size reached USD 99.01 billion in 2023. The wireless health market is driven by the growing acceptance of fitness trackers, smartwatches, and other wearable technology. It is a significant factor propelling the market for wireless health. These gadgets can track a number of health indicators, including blood pressure, heart rate, sleep patterns, and activity level. This data is helpful for both patients and medical professionals.

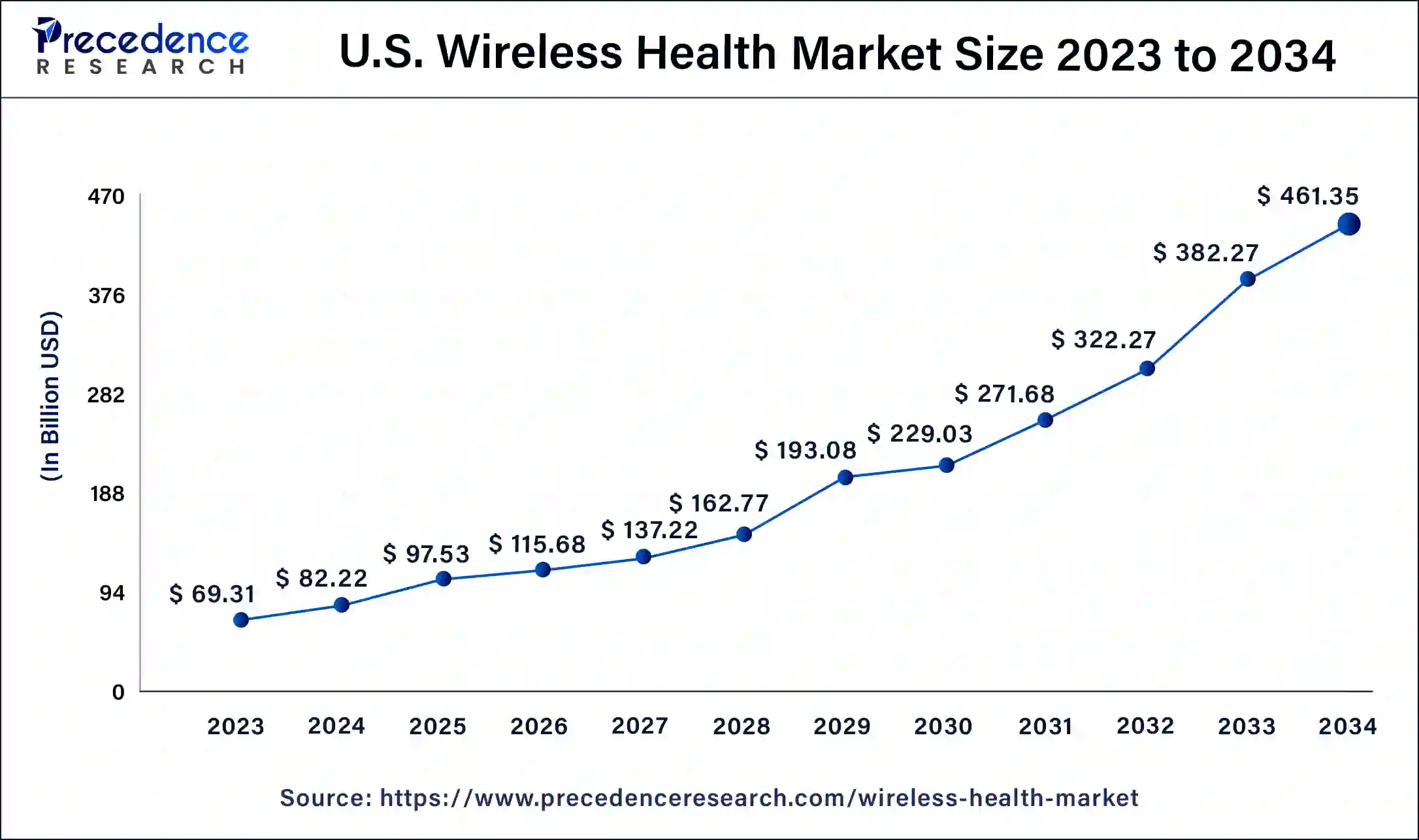

The U.S. wireless health market size was exhibited at USD 69.31 billion in 2023 and is projected to be worth around USD 461.35 billion by 2034, poised to grow at a CAGR of 18.80% from 2024 to 2034.

North America dominated the wireless health market in 2023. The wireless health market has expanded thanks partly to North America's high adoption rate of smartphones, wearables, and internet connectivity. Since most consumers own a smart device, they can monitor health data with wearables and mobile health apps. North America has a well-developed internet infrastructure, making it easy to access wireless health solutions like telemedicine and virtual healthcare platforms easily and dependably.

Telemedicine Trends in North America - 2024

Asia- Pacific is observed to be the fastest growing in the wireless health market during the forecast period. In nations like China and India, where smartphone adoption rates are high, wearable technology and mobile health apps are widely used. Consumers' growing health consciousness drives the need for health monitoring tools and apps that offer real-time data and individualized health insights. In 2024-25, The amount allotted to the Ministry is Rs 90,659 crore, a 13% increase over the updated 2023–24 forecasts. The Department of Health and Family Welfare received 97% of the Ministry's funding in 2024–2025.

The wireless health market is the industry devoted to creating, deploying, and utilizing wireless technology and equipment in the healthcare field. This covers a variety of uses, including telemedicine solutions, health tracking applications, wireless medical devices, and remote patient monitoring. By bridging the distance between patients and healthcare providers, these technologies make it easier for those who live in rural or underserved areas to obtain healthcare. Improved health outcomes for different populations and more equitable healthcare delivery may result.

How is AI helping the wireless health industry?

Healthcare technology and artificial intelligence (AI) applications may be able to help with some of these supply-and-demand issues. Advances in mobile, Internet of Things (IoT), computing power, and data security, along with the growing availability of multimodal data (economic, demographic, clinical, and phenotypic), herald a moment of convergence between healthcare and technology that will fundamentally change models of healthcare delivery through AI-augmented healthcare systems. Cloud computing makes efficient AI technologies into healthcare delivery possible.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,322.02 Billion |

| Market Size in 2024 | USD 239.70 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 18.62% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Component, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Prevalence of chronic conditions

Aging populations, sedentary lifestyles, poor eating habits, and environmental factors are contributing to the rising prevalence of chronic illnesses such as diabetes, hypertension, heart disease, and respiratory ailments. Wireless health solutions improve patient engagement by giving people simple ways to measure their health data and real-time feedback. This proactive participation encourages improved adherence to treatment regimens and lifestyle adjustments. Wireless health systems can facilitate thorough patient profiles and efficient care coordination amongst several healthcare providers by integrating with electronic health records (EHRs) and other healthcare databases.

Growing demand for convenient, user-friendly health solutions

Nowadays, consumers are increasingly looking for health solutions that work with their hectic schedules. Conventional approaches to health monitoring and management frequently call for frequent trips to medical facilities and the use of heavy equipment. Conversely, people may monitor their health from the comfort of their homes or while on the go due to wireless health solutions, which provide great convenience. Due to their ease of use, wireless health devices sometimes require no setup or intervention. Users who like user-friendly solutions that don't need a lot of technical understanding may find this appealing.

High costs of technology

Developing and implementing wireless health technologies, such as integrated health platforms, wearable sensors, and sophisticated diagnostic tools, frequently takes a significant initial financial investment. This high cost can be a major obstacle for new and smaller businesses looking to enter the market. Besides the initial outlay, continuous expenditures are associated with maintaining and updating wireless health equipment. For both customers and healthcare providers, regular upgrades, maintenance services, and tech support can raise the total cost of ownership.

Expansion of telehealth services

Patients' health measurements, like blood pressure, glucose levels, and heart rate, must frequently be remotely monitored to provide telehealth services. Continuous health monitoring outside of typical clinical settings is made possible by wireless health technologies, such as wearables and remote sensors. The need for wireless health solutions that offer real-time data transfer and analysis is growing. This covers the cost of remote monitoring services and telehealth consultations. These regulations can potentially boost the adoption of wireless health solutions and promote additional industry growth.

The WPAN segment dominated the wireless health market in 2023. Short-range communication, usually within 10 meters, is the focus of WPAN design. They are, therefore, perfect for use in medical settings like clinics, hospitals, and even home health care. Numerous gadgets in the healthcare industry must connect in a small area. Security mechanisms built into WPAN protocols guarantee the integrity and confidentiality of private medical data. Data security about private and sensitive information, including patient medical records, is crucial in the healthcare industry. To protect data, many WPAN protocols, like Bluetooth and Zigbee, include integrated authentication and encryption features.

The WWAN segment is observed to be the fastest growing in the wireless health market during the forecast period. Wide-area coverage is offered via WWAN technology, frequently made possible by cellular networks (such as 3G, 4G). This is especially important for telemedicine and remote patient monitoring applications in the healthcare industry, which require constant connectivity across broad geographic areas.

With WWAN, scalable solutions to manage numerous devices without network congestion are made possible as healthcare IoT devices grow more common. This supports applications such as emergency response systems, patient health management platforms, and automated warnings for important health occurrences.

The software segment dominated the wireless health market in 2023. Mobile health applications are becoming widely used due to the development of smartphones and other mobile devices. These applications, which cover everything from remote monitoring of chronic illnesses to fitness tracking, mainly rely on complex software for collecting, analyzing, and reporting health data. Many healthcare facilities are implementing AI-powered software to streamline processes and automate repetitive operations. This lessens the administrative burden on healthcare providers and frees them up to concentrate more on patient care.

The services segment is observed to be the fastest growing in the wireless health market during the forecast period. The need for remote patient monitoring services has grown as chronic diseases, including diabetes, cardiovascular ailments, and respiratory disorders, become more common. Wireless sensors and gadgets integrated with IoT, and linked platforms offer continuous health data, enabling clinicians to monitor patients' health in real-time and take appropriate action. Robust wireless health systems are essential for tracking and reporting health outcomes, as highlighted by outcome-based payment schemes. Managed services are essential for maintaining these systems' uptime and supporting real-time monitoring and reporting through maintenance and troubleshooting.

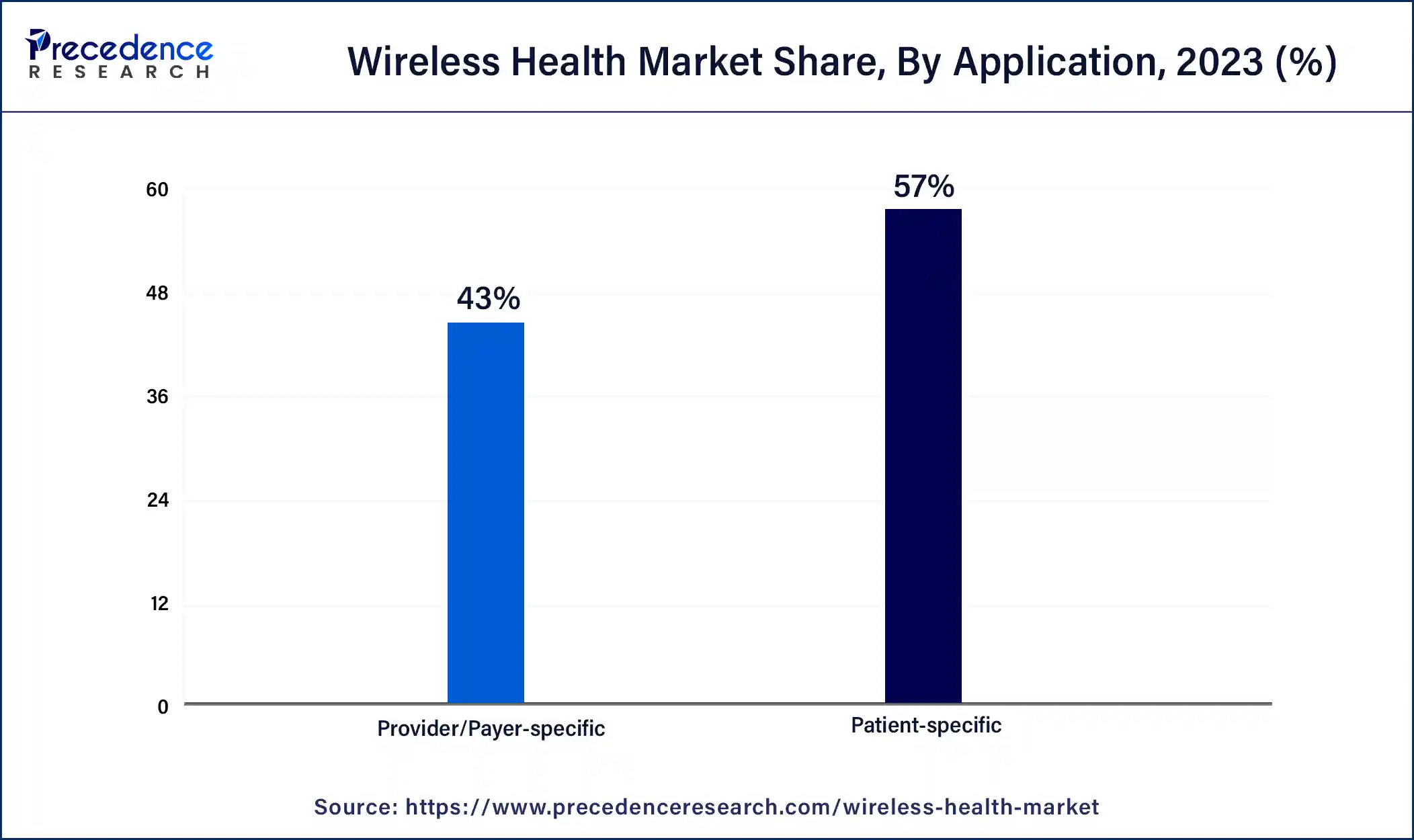

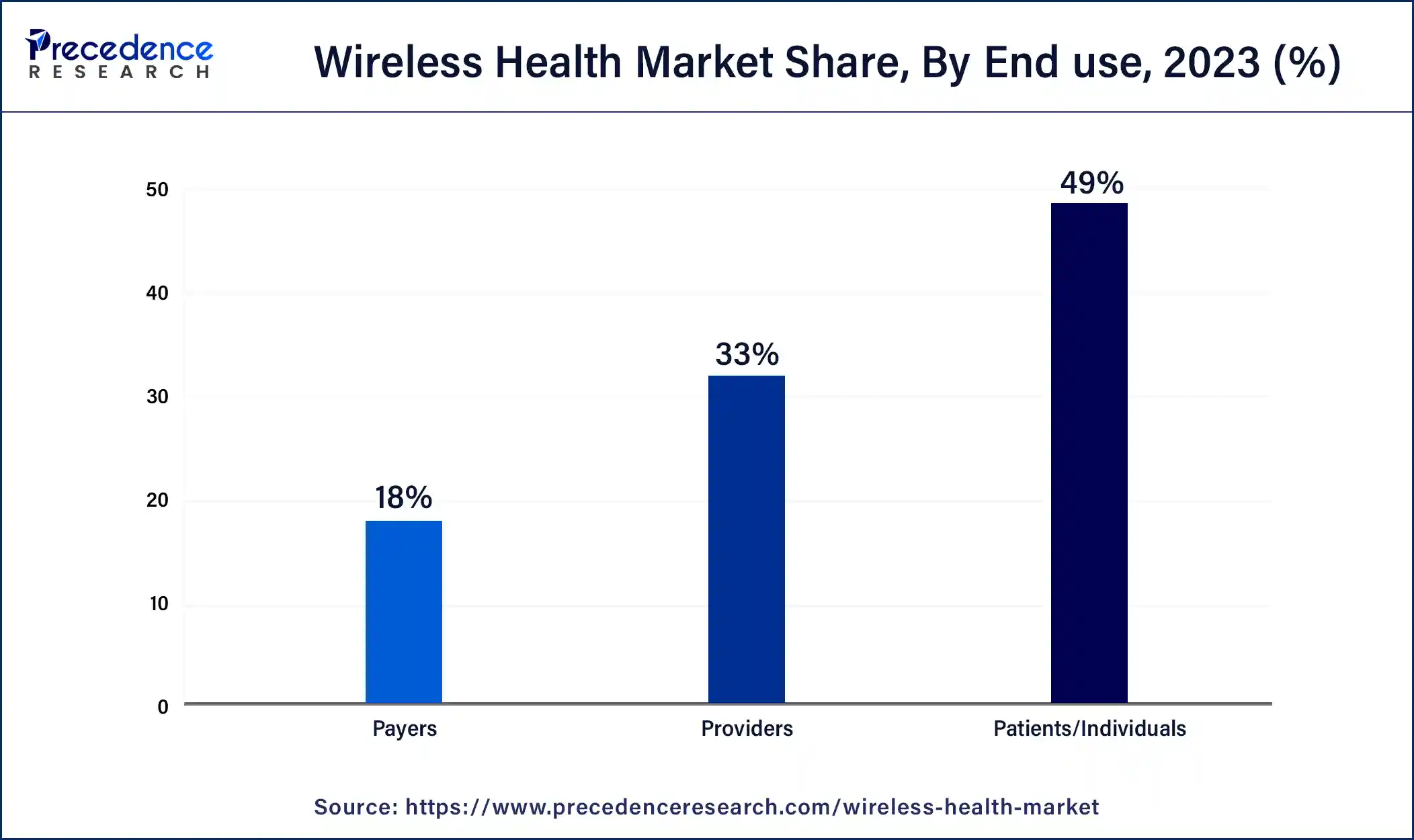

The patient-specific segment dominated the wireless health market in 2023. Due to its ability to save costs and enhance patient outcomes, wireless health technologies, particularly those tailored to individual patients, are being supported by more and more healthcare providers. The cost-effectiveness of these technologies is also acknowledged by insurance companies and government healthcare programs, which offer coverage for patient-specific wireless health solutions. This financial support has enhanced the adoption and market expansion of this area.

The provider segment is observed to be the fastest growing in the wireless health market during the forecast period. Providers are merging wireless health technology with electronic health record (EHR) systems to facilitate the easy exchange of patient data. This integration enables healthcare providers to provide more individualized and efficient care through improved communication across multidisciplinary teams and the ability to make data-driven decisions. Providers are turning to wireless health solutions to more successfully manage these illnesses. Continuous patient monitoring is made possible by wearable technology and sensors, which enables medical professionals to react early and modify patient care in response to real-time data.

The patients/individuals segment dominated the wireless health market in 2023. Patients are increasingly demanding personalized healthcare. Wearable technology and mobile health apps are wireless health technologies that enable individualized care by continually monitoring vital signs (e.g., blood pressure, glucose levels, and heart rate) and offering real-time insights. Artificial intelligence (AI) and big data analytics are used more often in mobile health apps to provide more precise diagnoses and tailored suggestions. Due to this technology, patients can better comprehend their health data and make wise decisions.

The providers segment is observed to be the fastest growing in the wireless health market during the forecast period. Wireless health solutions assist providers in streamlining their processes, increasing productivity, and cutting expenses. For example, mobile health apps and electronic health records (EHR) allow providers to lower administrative burdens, improve team communication, and automate data collecting. Providers can improve operational performance and patient care by reducing paperwork and facilitating easy access to patient data.

Segments Covered in the Report

By Product

By Component

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

March 2025

January 2025

January 2025