January 2025

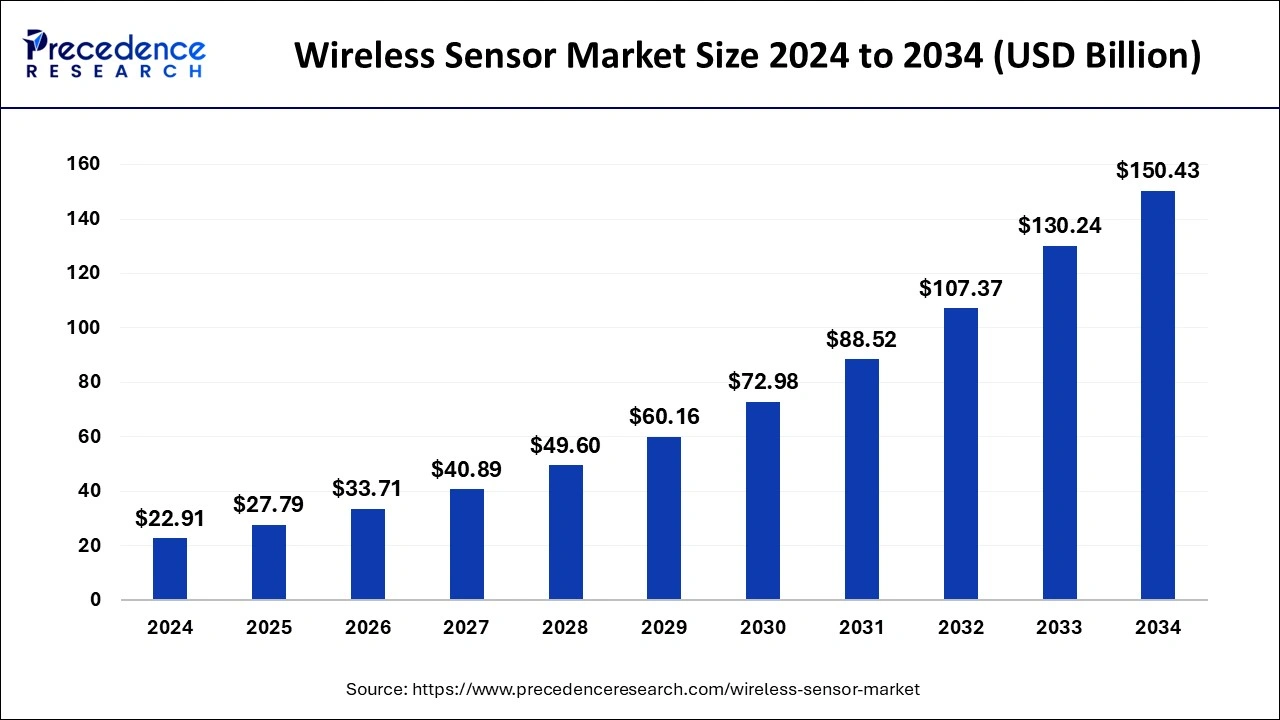

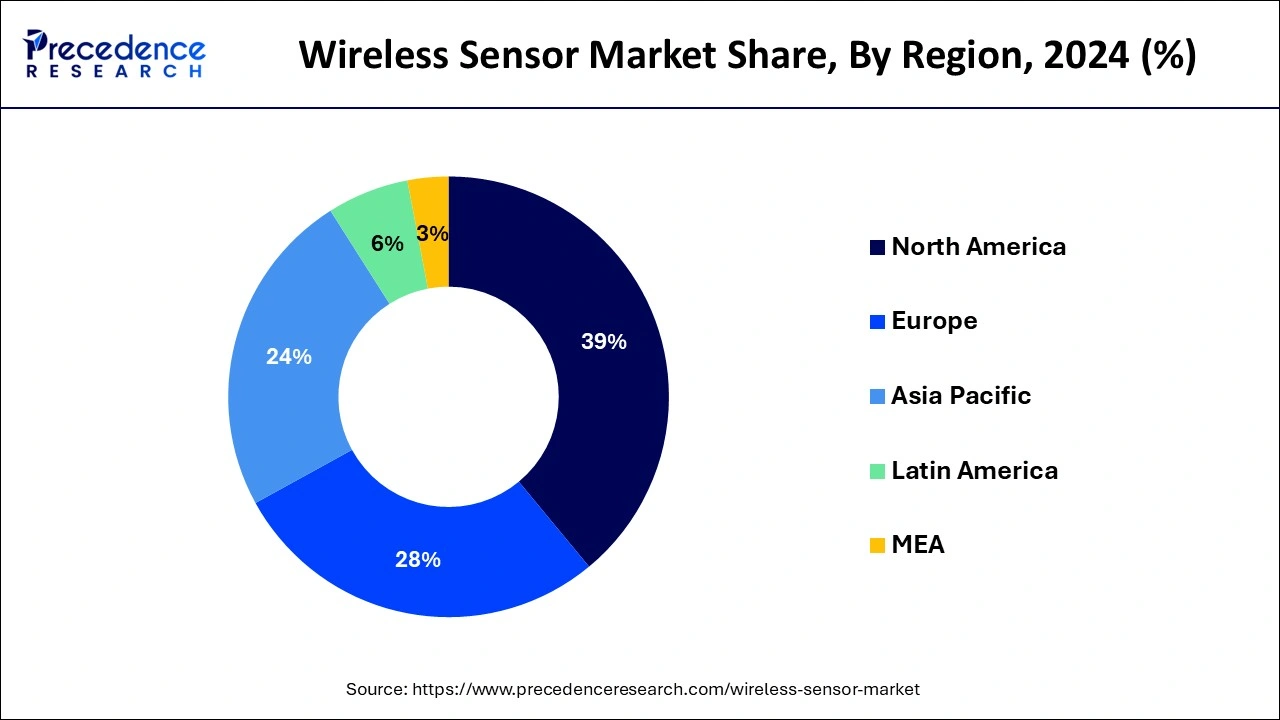

The global wireless sensor market size is accounted at USD 27.79 billion in 2025 and is forecasted to hit around USD 150.43 billion by 2034, representing a CAGR of 20.71% from 2025 to 2034. The North America market size was estimated at USD 8.93 billion in 2024 and is expanding at a CAGR of 20.75% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global wireless sensor market size was calculated at USD 22.91 billion in 2024 and is predicted to increase from USD 27.79 billion in 2025 to approximately USD 150.43 billion by 2034, expanding at a CAGR of 20.71% from 2025 to 2034.

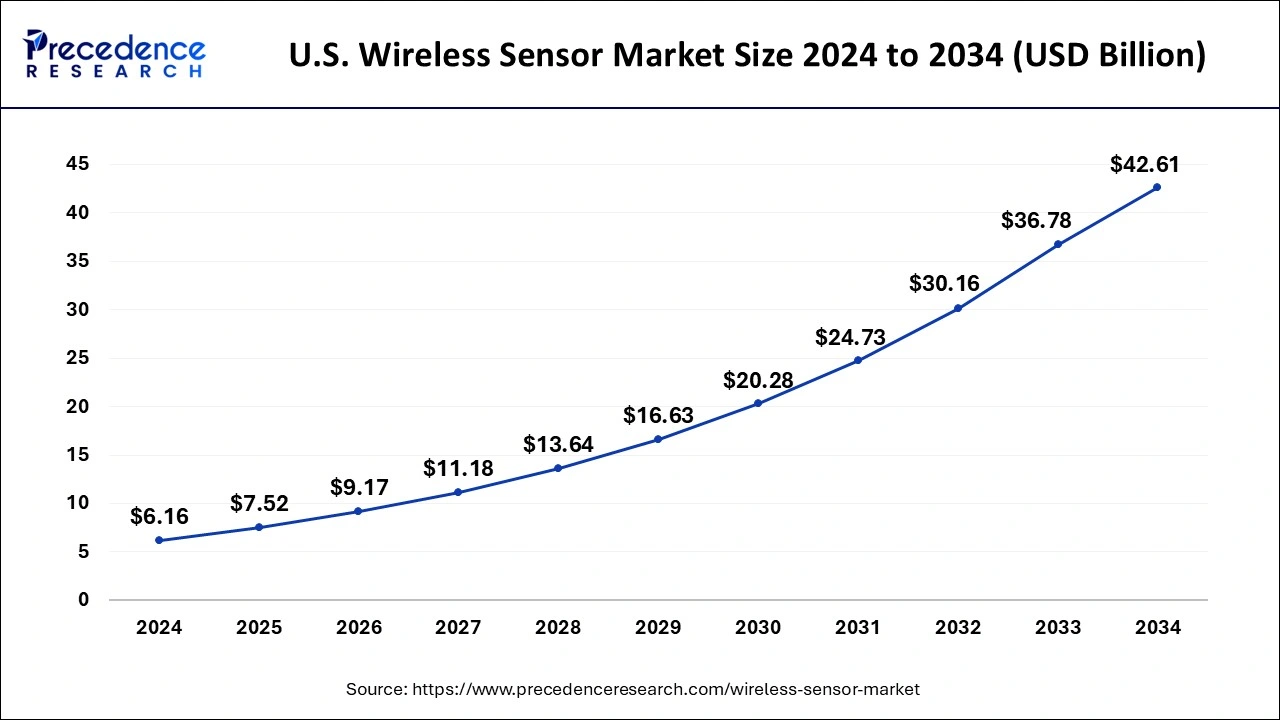

The U.S. wireless sensor market size was evaluated at USD 6.16 billion in 2024 and is projected to be worth around USD 42.61 billion by 2034, growing at a CAGR of 21.34% from 2025 to 2034.

North America has held the largest revenue share 39% in 2024. North America holds a significant share in the wireless sensors market due to a robust technological infrastructure, widespread adoption of IoT applications, and a high degree of industrial automation. The region's early and sustained investments in research and development, coupled with a strong presence of key market players, contribute to its leadership. Additionally, the demand for wireless sensors in diverse sectors such as healthcare, agriculture, and manufacturing, further fuels North America's dominance in this market.

Asia-Pacific is estimated to witness the highest growth. Asia-Pacific commands a significant share of the wireless sensors market due to rapid industrialization, technological advancements, and the proliferation of IoT applications across diverse sectors. Growing demand for smart infrastructure, manufacturing automation, and the deployment of wireless sensors in emerging economies such as China and India contribute to the region's dominance. Additionally, government initiatives promoting digitalization and the adoption of Industry 4.0 technologies further fuel the expansion of the wireless sensor market in the Asia-Pacific region.

Wireless sensors represent compact electronic devices engineered to measure and relay data without the encumbrance of physical connections or wiring. Leveraging technologies such as Wi-Fi, Bluetooth, Zigbee, or cellular networks, these sensors communicate information seamlessly to a central system or other interconnected devices. Their applications span diverse sectors including manufacturing, healthcare, environmental monitoring, and smart home systems.

The distinctive advantage of wireless sensors lies in their capacity to furnish real-time data unburdened by the constraints of traditional wired setups. This adaptability facilitates deployment in unconventional or challenging locations where wired alternatives may be impractical, ensuring comprehensive and dynamic monitoring capabilities. Furthermore, wireless sensor networks offer scalability, enabling the integration of a multitude of sensors to form expansive networks that significantly enhance the efficiency of data collection and analytical processes. Serving as a foundational element within the Internet of Things (IoT), wireless sensors play an indispensable role in propelling automation, refining decision-making processes, and augmenting overall connectivity within the contemporary technological landscape.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 20.71% |

| Market Size in 2025 | USD 27.79 Billion |

| Market Size in 2024 | USD 22.91 Billion |

| Market Size by 2034 | USD 150.43 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type and Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Industry 4.0 adoption and IoT proliferation

The adoption of Industry 4.0 principles, emphasizing the integration of digital technologies into manufacturing processes, significantly surges the demand for wireless sensors. Industry 4.0 relies on real-time data collection, analysis, and communication between machines, enabling intelligent decision-making and process optimization. Wireless sensors play a pivotal role in this transformation, facilitating seamless connectivity and data exchange across the manufacturing ecosystem. Their ability to monitor equipment health, track production parameters, and enable predictive maintenance aligns perfectly with the objectives of Industry 4.0, driving the market demand.

Simultaneously, the proliferation of the Internet of Things (IoT) amplifies the need for wireless sensors across diverse sectors. As IoT continues to expand, connecting an ever-growing number of devices, sensors become essential components in this interconnected landscape. Wireless sensors enable the transmission of data from IoT devices to centralized systems, supporting applications ranging from smart homes and cities to healthcare and agriculture. The synergy between Industry 4.0 and IoT creates a compelling narrative, propelling the demand for wireless sensors as critical enablers of smart, data-driven, and efficient processes across industries.

Security concerns and security concerns

Security concerns pose a significant restraint on the market demand for wireless sensors, creating apprehension among potential users. As these sensors play a crucial role in collecting and transmitting sensitive data, the risk of unauthorized access and cyber threats becomes a primary deterrent. Industries and organizations are cautious about the potential compromise of critical information, leading to a reluctance to adopt wireless sensor technologies. The fear of security breaches not only impacts the confidence of end-users but also hampers regulatory compliance efforts, especially in sectors with stringent data protection requirements.

Concerns over data integrity, confidentiality, and the potential for system vulnerabilities contribute to a hesitancy to invest in wireless sensor solutions. Addressing these security challenges through robust encryption, authentication mechanisms, and continuous advancements in cybersecurity practices is essential to alleviate these concerns and foster greater market acceptance of wireless sensor technologies.

Expansion of smart cities and healthcare innovation

The expansion of smart cities represents a significant opportunity for the wireless sensor market. In smart city initiatives, wireless sensors play a crucial role in urban planning, traffic management, and environmental monitoring. These sensors enable the collection of real-time data, contributing to efficient city services and sustainability efforts. As cities worldwide strive to become more technologically advanced and interconnected, the demand for wireless sensors is set to rise, presenting lucrative opportunities for companies in the market.

In the healthcare sector, innovation driven by wireless sensors opens up new possibilities for remote patient monitoring, telehealth, and improved medical diagnostics. These sensors, when integrated into medical devices, offer precise and timely health data, contributing to personalized and effective patient care. As the healthcare landscape continues to evolve towards more technologically advanced and patient-friendly practices, wireless sensors are positioned as essential components, presenting promising prospects for market growth and development.

In 2023, the biosensors segment held the highest market share of 21% on the basis of the product type. The biosensors segment in the wireless sensors market involves devices that detect biological responses and convert them into measurable signals. These sensors find application in healthcare, environmental monitoring, and food safety. Trends in biosensors include the integration of nanotechnology for enhanced sensitivity, the rise of wearable biosensors for continuous health monitoring, and the development of point-of-care biosensors for rapid and decentralized testing. With increasing focus on personalized medicine and advancements in biotechnology, the biosensors segment is poised for growth in various industries due to its versatile and precise detection capabilities.

The level sensors segment is anticipated to witness the highest growth at a significant CAGR of 24.5% during the projected period. The level sensors segment in the wireless sensor market involves devices that measure the level of liquids or solids in containers. These sensors play a crucial role in industries like manufacturing, oil and gas, and water management.

A notable trend in this segment is the increasing adoption of non-contact level sensors, utilizing technologies like ultrasonic and radar, which offer higher accuracy and reliability. As industries prioritize automation and efficiency, the demand for advanced level sensors is expected to continue growing, driving innovation and expanding applications across diverse sectors.

According to the industry vertical, the consumer electronics segment has held a 24% revenue share in 2023. The consumer electronics segment in the wireless sensors market refers to the integration of sensors into everyday devices, enhancing functionality and user experience. In this vertical, wireless sensor are increasingly embedded in smartphones, smartwatches, and other gadgets. Current trends include the incorporation of sensors for health monitoring in wearables, improved gesture recognition in gaming consoles, and enhanced environmental sensors in smartphones.

The consumer electronics sector continues to drive innovation, demanding smaller, more energy-efficient sensors to support the development of smart and interconnected devices for everyday use.

The agriculture segment is anticipated to witness the highest growth over the projected period. In the wireless sensors market's agriculture segment, sensors are employed for precision farming, monitoring soil conditions, crop health, and environmental factors. This technology allows farmers to make data-driven decisions, optimizing resource usage and improving overall agricultural efficiency. Trends in this segment include the integration of wireless sensors in irrigation systems, the use of drones equipped with sensors for aerial monitoring, and the development of smart farming applications that leverage real-time data to enhance crop yield and sustainability in modern agriculture practices.

By Product Type

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

August 2024

November 2024