January 2025

The global zero waste packaging market size is estimated at USD 316.89 billion in 2025 and is predicted to reach around USD 724.30 billion by 2034, accelerating at a CAGR of 9.62% from 2025 to 2034. The Asia Pacific zero waste packaging market size surpassed USD 148.94 billion in 2025 and is expanding at a CAGR of 9.73% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global zero waste packaging market size was estimated for USD 289.08 billion in 2024 and is anticipated to reach around USD 724.30 billion by 2034, growing at a CAGR of 9.62% from 2025 to 2034.

AI serves in a highly productive role that is essential zero waste packaging. AI-driven automated recycling systems can effectively identify and sort as well as process recyclable materials by directing them into separate bins while identifying contaminants. Intelligent packaging powered by sensors and RFID tags will become smart enough to record every step that a product undertakes from the point of production to consumption; thus, it will provide pertinent information for making informed decisions in the retail sector. This artificial intelligence is key to meeting sustainable goals and developing sustainable packaging solutions, such as optimum material and design identification (the streamlining process) for waste reduction. AI-powered analytics can also improve supply chain efficiency while automating processes to deliver products on time and maintain quality. In a nutshell, it advocates that, with the help of AI, we can easily envision a different way of addressing the problems associated with packaging waste and having them safely adopted for sustainability and the greening of the industry.

The Asia Pacific zero waste packaging market size was estimated at USD 135.87 billion in 2024 and is anticipated to be surpass around USD 344.04 billion by 2034, rising at a CAGR of 9.73% from 2025 to 2034.

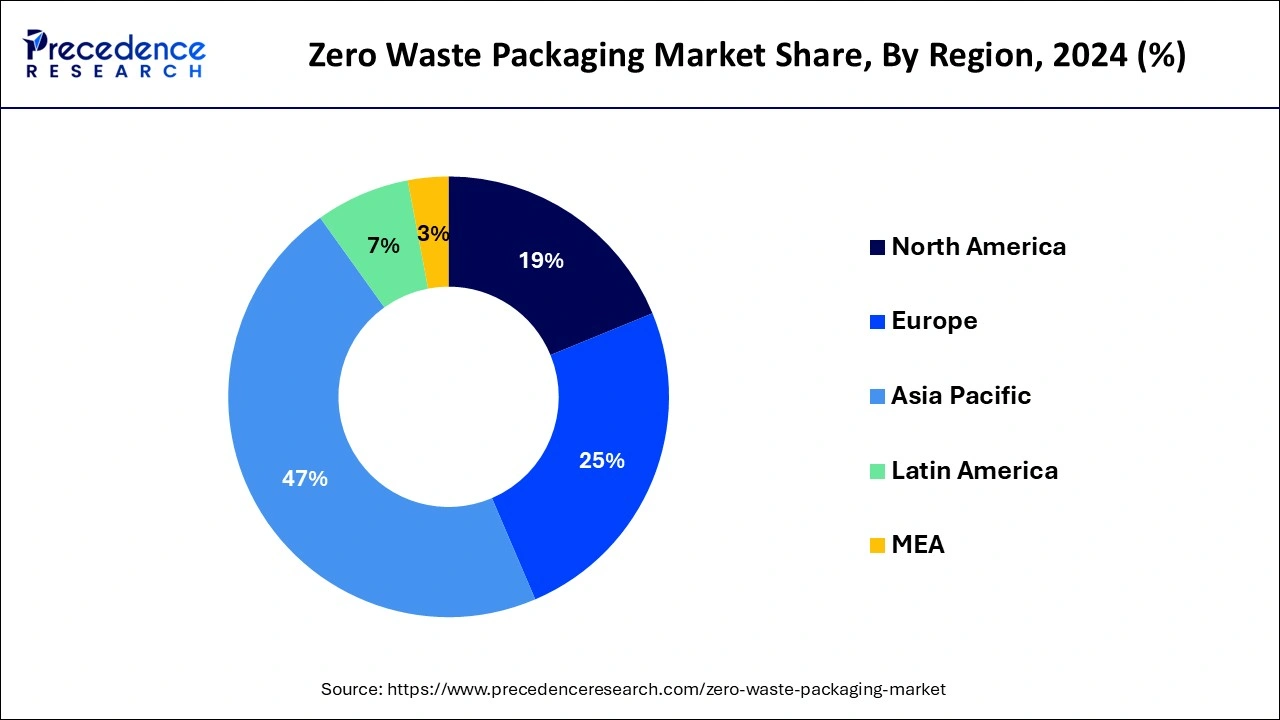

Asia Pacific dominated the global zero waste packaging market with the largest market share of 47% in 2024. As countries in this region focus on reducing waste, enhancing recycling rates, and promoting environmental sustainability, the zero-waste packaging market is evolving rapidly. Governments across APAC are implementing bans and regulations on single-use plastics. For instance, countries like India, Thailand, and Indonesia have set stringent plastic waste management policies, which are encouraging businesses to explore alternatives such as paper, glass, metal, and biodegradable materials for packaging. As e-commerce businesses look for sustainable packaging options for shipping, there is an increasing trend toward zero-waste packaging, such as biodegradable, recyclable, or reusable materials.

Zero waste packaging is hailed as a fresh industrial revolution. It guarantees that items will be packaged in a way that produces no waste. This is mostly accomplished through the use, recycling, and reuse of trash. Waste created by packing materials is an issue everywhere in the globe. As a result of being buried in landfills or thrown in the ocean, a sizable amount of the garbage also affects aquatic life and forms massive islands of rubbish. As a result, strict environmental rules have been developed. For instance, in 2020, the Singapore government launched a collaborative project called The Singapore Packaging Agreement (SPA). A joint initiative between the government of Singapore, NGOs and the packaging industry, to diminish packaging waste.

An agreement is optional in order to provide the sector freedom in implementing affordable waste reduction strategies. The requirement for zero waste retailers is being met by these growing concerns, which essentially encourage consumers to bring their own packing materials, including bags and containers, among others, to transport their purchases from the stores. Throughout the forecast period, these factors are projected to support the zero-waste packaging market's expansion.

The zero-waste packaging market is predicted to increase significantly as a result of the strict regulatory environment, the worldwide environmental crisis, and other factors. Over 200 million tonnes of plastic are being produced each year and landfilled. Furthermore, because it produces a significant amount of harmful gas waste during industrial burning, only a few number of recycling methods guarantee a totally clean-riddance. Furthermore, single-use plastics are prohibited in a large number of nations worldwide. The food and beverage businesses are quite concerned about this. Major businesses in the beverage industry claim that single-use plastic replacements are not currently practical or financially viable. Players in the zero-waste packaging industry should expect to benefit from significant innovation possibilities as a consequence of the critical need and need to address an enduring issue. Fast moving consumer goods (FMCG) corporations have partnered with businesses like Dabur India Ltd., which uses zero-waste packaging techniques to deliver products to customers using minimum packaging and collect the residual waste for reuse and recycling. This procedure increases the profitability for zero-waste packaging producers while raising environmental issues with regard to trash management throughout the world.

The expensive cost of zero waste packaging materials, however, could serve as a market restraint. Though currently more expensive than plastic garbage, zero waste materials don't require extra costs like financing to clean the waste. For instance, according to estimates from the World Economic Forum, waste from plastic packaging causes an annual loss of $80 to $120 billion. Additionally, the quickly growing food and beverage sector and rising e-commerce sales are some of the reasons that are anticipated to create a number of potential opportunities for the market in the years to come.

Waste created by packing materials is an issue everywhere in the globe. As a result of being buried in landfills or thrown in the ocean, a sizable amount of the garbage also affects aquatic life and forms massive islands of rubbish. As a result, strict environmental rules have been developed.

With the expansion of the consumer goods business, both marked and unmarked product consumption has multiplied, which in turn has raised the demand for sustainable packaging techniques. In an effort to use fewer raw materials, efforts include improving production methods, reducing the size and thickness of the actual packaging produced, eliminating unnecessary packaging, etc.

| Report Coverage | Details |

| Market Size in 2025 | USD 316.89 Billion |

| Market Size by 2034 | USD 724.30 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.62% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Application, Distribution Channel and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The compostable goods segment contributed the highest market share of 76% in 2024. This is largely due to increased knowledge and worries about the importance of waste among the worldwide population that might have negative impacts on the environment.

As a result, consumers are increasingly looking for compostable goods as a reliable substitute for other disposable items when disposing of garbage. Since they are seen as a necessary alternative to other disposable items, compostable products have been more in demand for waste disposal. Additionally, the end-use industry's food and beverage sector is predicted to see the highest CAGR of 9.44% throughout the projection period.

Due to the rising demand for recycled and biodegradable packaging options, the offline sector dominated the worldwide zero waste packaging market. To reduce the usage of plastic, the retail firms are working with the suppliers of zero waste packaging solutions, which is anticipated to fuel the sector development over the forecast period. For instance, Virgin Megastore, a global network of entertainment retail stores, works with Avani Eco in November 2019. Virgin Megastore began utilizing customized Avani Bio's cassava bags in place of plastic bags at their UAE stores. The bags are entirely biodegradable since they are constructed of vegetable oil, organic polymers, and cassava starch. Another significant growth driver for the offline category in the next years will be the spike in consumer demand for eco-friendly packaging options.

The food and beverage sector held highest revenue share in 2024. The need for food and beverage packaging is mostly being driven by convenience foods because of its mobility, extended shelf lives, and simple manufacture. Convenience food is becoming in demand as a result of consumers' hectic lifestyles and the aging population. Innovative packaging and cutting-edge technologies have increased the range of easily available food alternatives, including packed, frozen, chilled, etc. Product safety and sustainability are the primary concerns of the majority of package manufacturers. Consumer goods corporations are increasingly packaging food, which has changed consumers' preferences for convenient foods. A lot of chemical suppliers are also shifting to more environmentally friendly solutions by using less plastic in packaging.

Geographically speaking, North America has accumulated the greatest market share due to the enormous volume of surgeries performed there on the region's vast population of elderly patients. The surgical sutures market has benefited greatly from the region's availability of cutting-edge medical facilities and equipment.

By Material Type

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025