November 2024

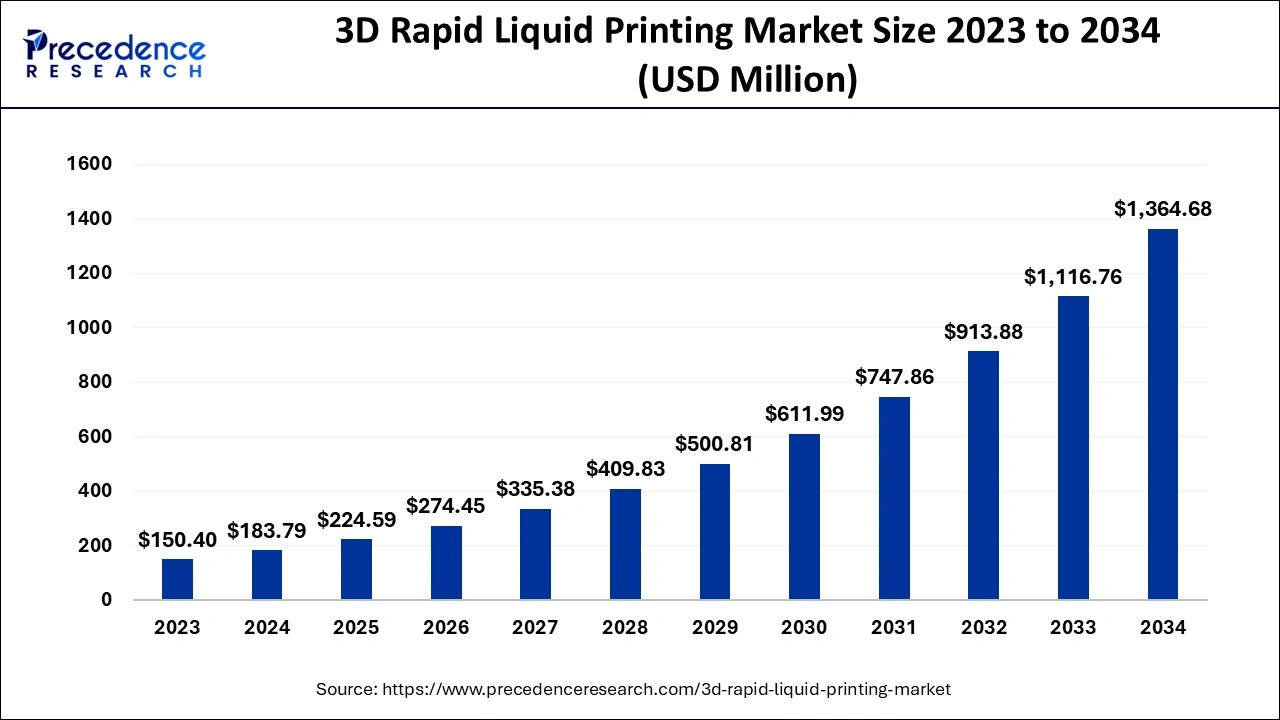

The global 3D rapid liquid printing market size is evaluated at USD 183.79 million in 2024, grew to USD 224.59 million in 2025 and is anticipated to reach around USD 1,364.68 million by 2034. The market is expanding at a healthy CAGR of 22.20% between 2024 and 2034.

The global 3D rapid liquid printing market size is worth around USD 183.79 million in 2024 and is estimated to hit around USD 1,364.68 million by 2034, growing at a double-digit CAGR of 22.20% from 2024 to 2034. The 3D rapid liquid printing market is growing because of improved technology, the need to create products based on customers’ requirements, cheaper solutions, and new materials, as well as applications in the sectors of healthcare, avionics, and the automobile industry.

The emerging technology impacting the 3D rapid liquid printing market is artificial intelligence in the spheres of design, manufacturing, and materials. AI uses these algorithms to improve design careers, and with machine learning, the generation of complex structures and optimum geometry in the shortest time with less scrap is achieved. It also manages or controls the process of printing in order to achieve higher accuracy, uniformity, and quality because of the real-time operational algorithms provided by artificial intelligence. AI breaks down the time and cost of finding and creating new, stronger, or more adaptable materials that broaden the scope of applications for RLP.

The 3D rapid liquid printing market provides the ability to quickly create three-dimensional structures out of fluids such as polymers or hydrogels. Rapid liquid printers build an object by laying down materials successively using technologies like inkjet printing heads to produce. Physical objects from digital designs. Manufacturing industries, healthcare, automotive, and consumer product industries are responsible for areas such as prototype production, tooling, anatomical models, and design validation. The objective of rapid liquid printing is to develop technology that will enable large-scale products to be produced at a fast rate and also to enable the customer to design and put the product into production.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,364.68 Million |

| Market Size in 2024 | USD 183.79 Million |

| Market Size in 2025 | USD 224.59 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 22.20% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Metal component manufacturing growth

Many car makers and aircraft makers are using metal 3D printing in making light alloy brackets, engine clamps, valves, and turbo blades for aircraft engines. They are capable of using ultrahigh-intensity liquid printing techniques to produce metal components that are stronger but have less weight than casting parts.

The high pace of development of metal component production, especially in the automotive and aerospace industries, is one of the key factors driving the rapid growth of the 3D rapid liquid printing market. As 3D printing technology advances and the components used in metals begin to develop, metal additive manufacturing is gradually shifting towards the areas of low-volume production runs and custom component fabrication.

The cost involved in manufacturing printers

The main obstacles to the development of the 3D rapid liquid printing market are excessive expenditures to fabricate the printer and materials compatible with liquid printing. Further, the technologies demand serious research and developmental undertakings in order to obtain increasingly sharper resolutions and enhanced rates of printing. The system also demands advanced apparatus such as optical systems and highly specially designed mechanisms for handling fluids, which calls for a much higher capital investment for RLP-3D.

Growing applications

The 3D rapid liquid printing market can deliver multiple solutions for the aerospace, healthcare, automotive, and consumer electronics industries. Due to its ability to create prototypes and make parts within a short space of time, it is preferable in industries in which the design and manufacturing should be very flexible. Furthermore, medical applications, including custom implants, prosthetics, and tissue engineering, will also find advantages in using RL-3D in terms of the capability of the printer to print with bio-compatible material with incredibly fine details. Future development could be inspired by its application in fashion, architecture, and education sectors, thus providing affordable, eco-friendly solutions with opportunities for customizing products.

The printers segment dominated the global 3D rapid liquid printing market in 2023. The printers are classified into two types, namely, desktop printers and industrial printers. It is divided into design and inspection, printing, and scanning aspects of the software. Industrial 3D printers use CAD to construct 3D objects from liquids such as hot plastic or powder substances, which can be small office-built equipment or large construction-sized printers. The adoption of end-use parts with the help of rapid liquid printers is attributed to this segment’s growth.

The materials segment is expected to witness significant growth in the 3D rapid liquid printing market during the forecast period. Rapid liquid printing (RLP) is one type of additive manufacturing or 3D printing technique that employs inorganic liquids such as polymers and hydrogels. RLP is made of industrial materials, and it can develop goods of high volumes and specifications. Substrate materials, which include plastics, metals, ceramics, and biomaterials, are getting used in additive manufacturing strategies that preserve special features which include strength, flexibility, conductivity, and biocompatibility, thereby enhancing the opportunity for their use in all forms of industry, including aerospace, automotive, energy and medical among others.

The prototyping segment held the largest share of the 3D rapid liquid printing market in 2023. Rapid liquid printing is an experimental 3D printing technique that is used for prototyping and mass customization. Rapid prototyping (RP) is a technique of direct tooling manufacturing process of solid objects from computer-generated models. The physical prototypes can be easily developed using RLP. Rapid prototyping can be described as the set of processes or technology that is employed in the creation of a real part from a three-dimensional model. In rapid prototyping, an engineer and designer can build the final product faster by incorporating several design loops of virtual models and physical prototypes at a minimal cost.

The manufacturing segment is expected to grow at the fastest rate in the 3D rapid liquid printing market over the forecast period. The 3D printing in manufacturing has advantages over the traditional techniques. Advantages of 3D printing or AM include lower waste, increased speed, design versatility, and a variety of materials at lower costs. 3D printing is a manufacturing technique that uses an object’s digital model to build a three-dimensional object layer by layer. Additive manufacturing is revolutionizing manufacturing because it allows the on-demand production of parts and products without expensive tools and molds.

The automotive segment dominated the 3D rapid liquid printing market in 2023. Additive production is revolutionizing automobile manufacturing with the help of easing the generation of lightweight, complicated, and customized design elements, fixing automobile performance, fuel economy, and structure modulation, besides decreasing manufacturing costs and time required for prototyping and spare parts production. The potential for creating components that are both low in weight and high in strength can deliver benefits to various characteristics of vehicles and within the automotive industry by using environmentally friendly and efficient solutions to create vehicles.

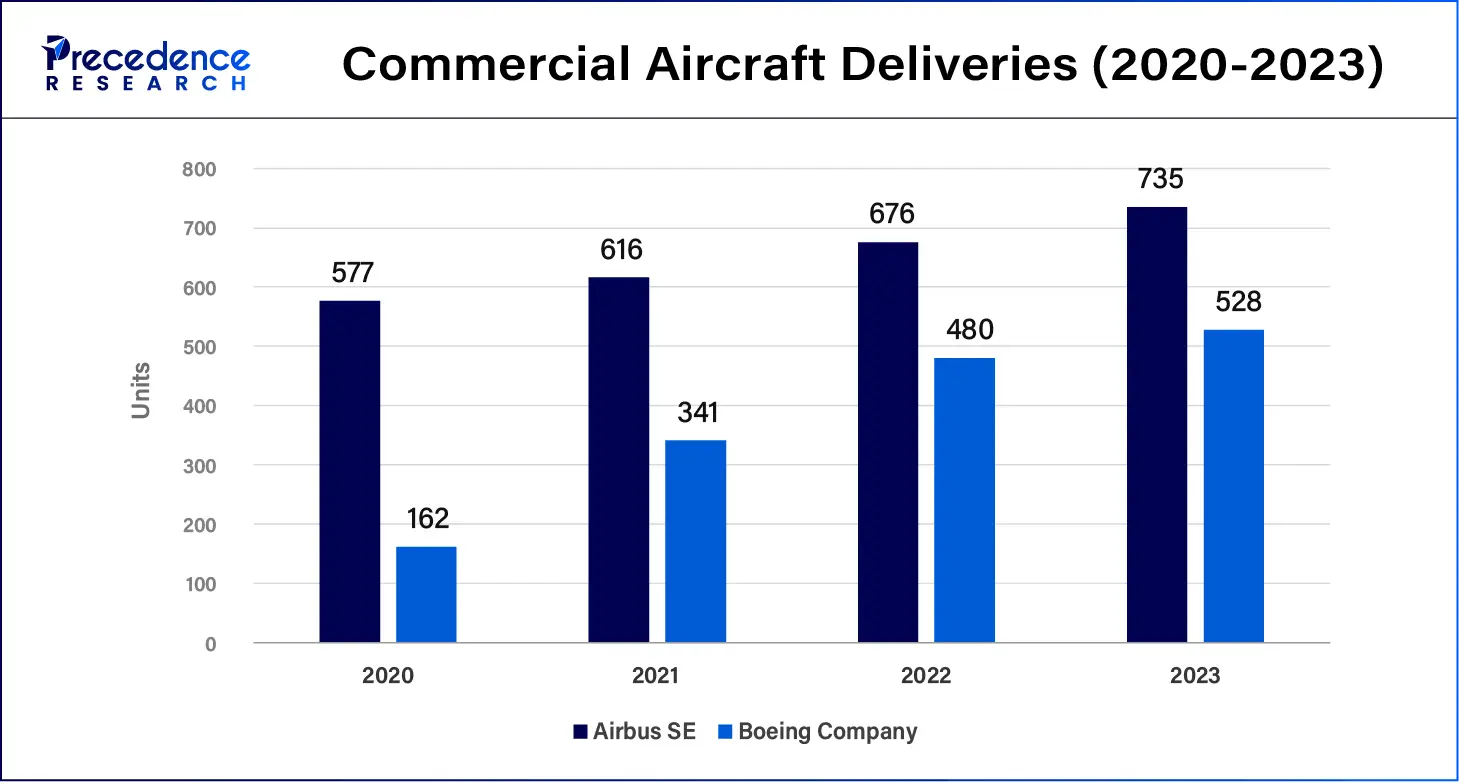

The aerospace & defense segment is anticipated to grow significantly in the 3D rapid liquid printing market during the forecast period. 3D printing certainly makes prototypes and has end-use applications in the aerospace and aviation sectors. Components built using additive manufacturing can be stronger and lighter than the components built using mechanical manufacturing techniques. The driving force behind the aerospace 3D printing market is continually changing as the aerospace industry demands new products that can be produced both quickly and cheaply for commercial, military, space, and UAV applications. The ability to utilize 3D printing to create lightweight and high geometric density parts with optimized structures affects the aircraft production process, especially the aircraft parts of commercial, business, and special purpose aviation, including helicopters.

North America led the global 3D rapid liquid printing market in 2023. The rapid growth in the aerospace & defense industry in the North American region and the availability of key printing material manufacturers are the factors for the growth of the rapid liquid printing market. The region has been on the front line for research, development, and marketing of additive production. The research businesses were active in developing additive manufacturing techniques, which include RLP in aerospace, automobile, and healthcare fields, due to the availability of leading technology solutions providers and high technology take-up rates in the verticals of aerospace, automobile, and healthcare. The emphasis is placed on research and development activities, together with technological enhancements in the region.

Asia Pacific is anticipated to grow notably in the 3D rapid liquid printing market during the forecast period. Because of a higher demand for 3D printing technologies in the automotive, aerospace and defense, healthcare industries, and other industries due to rapid industrialization in this region, there has been increased investment in advanced manufacturing technologies and the increasing demand for complex and innovative products. In advanced manufacturing technologies, there is a growing demand for customized and innovative products. Current technological giants, including China, Japan, and South Korea, are among the most technologically developed nations in the region.

By Component

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

November 2024

February 2025

April 2025