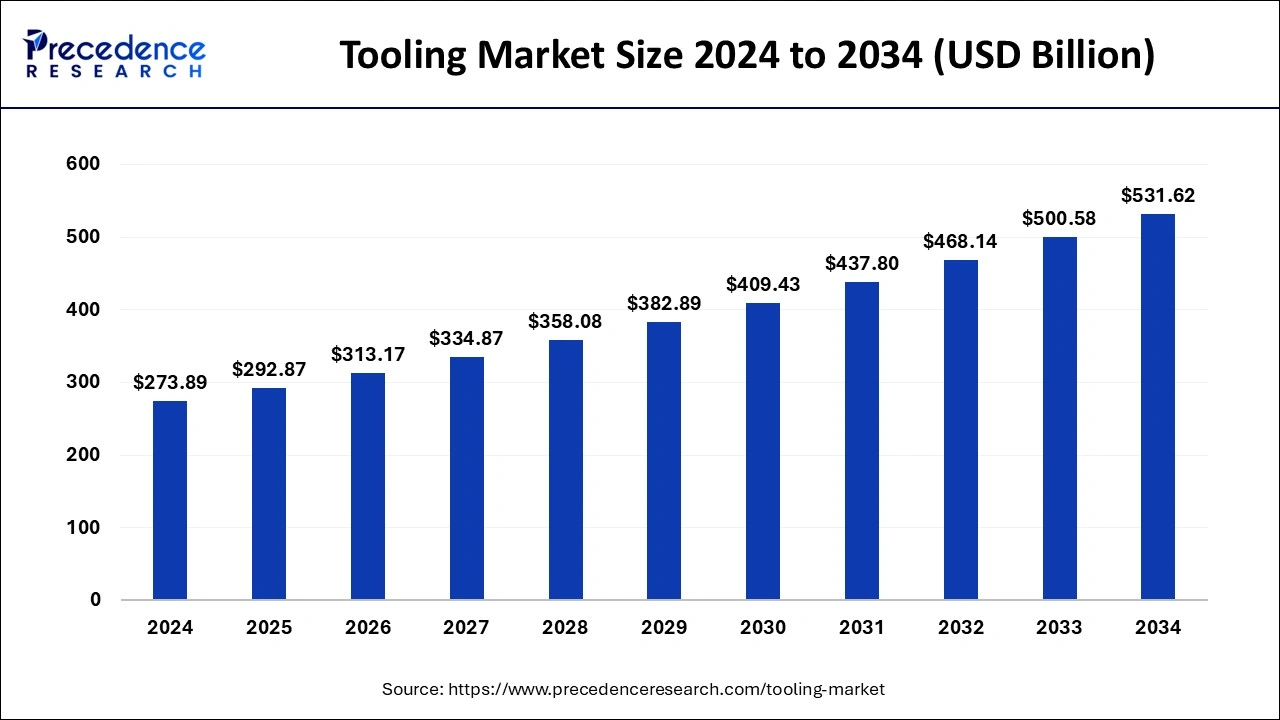

The global tooling market size is calculated at USD 292.87 billion in 2025 and is forecasted to reach around USD 531.62 billion by 2034, accelerating at a CAGR of 6.86% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global tooling market size was estimated at USD 273.89 billion in 2024 and is predicted to increase from USD 292.87 billion in 2025 to approximately USD 531.62 billion by 2034, expanding at a CAGR of 6.86% from 2025 to 2034. Rising demand for technologically advanced tooling machines and equipment is driving the growth of the tooling market.

Tooling is one of the important parts of the manufacturing and industrial process. It is an essential part of producing high-quality parts as per requirements. The machine tools include fixtures, drills and brochures, press tools, dies, jigs, gauges, patterns, and molds. The tool manufacturing process has positively influenced the precision and efficiency of producing parts. The sizes and shapes of tooling depend on the industrial process's requirements. The increasing user application of tooling in industries such as construction, mechanical and automotive, and aerospace are driving the growth of the tooling market.

The rising use of tooling in diverse industrial applications such as manufacturing, automotive, chemical, aerospace and defense, construction and mining, and others contribute to the tooling market growth. The increasing investment in the development of industries and the surging investment by the major market players in the different industries due to rising global demand is driving the expansion of the market.

Rising concern about sustainable practices, technologically emerging industries, rising automation, and ongoing research on the development of tooling machines are accelerating the growth of the tooling market.

The integration of modern technological innovations in tooling, such as artificial intelligence, Internet of Things (IoT), machine learning, robotics, etc., is further propelling the market's growth.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.86% |

| Market Size in 2025 | USD 292.87 Billion |

| Market Size by 2034 | USD 531.62 Billion |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Material Type, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising industrialization

The rising industrialization and manufacturing industries are contributing significantly to the tooling market's growth. Tooling involves the use of molds, patterns, jigs, cutting tools, and fixtures to shape and form the parts. Different types and sizes of tools are used in different industries per the requirements. Tooling plays a significant role in the mass production of goods; it can lower operational costs by speeding up the production process and saving time. Accurate tooling is essential for the manufacturing of high-quality products. In the manufacturing industries, engineering, precision, and tooling work simultaneously.

Tooling accuracy enhances the consistency and quality of the final products. Injection molding is one of the prominent tooling methods in the manufacturing industry, and many identical products are produced in less variation and in less time. Additionally, advancements in technology like CNC machining that revolutionize tooling are also boosting the growth of the tooling market.

Fluctuating cost of raw materials

The unpredictable fluctuations in the availability and pricing of essential raw materials, including steel, iron, aluminum, and copper, have significantly impacted the tooling market. The resulting instability in raw material costs has directly contributed to disrupted pricing within the tooling industry. This, in turn, has imposed constraints on the growth and development of the overall tooling market. As a result, manufacturers and businesses reliant on these materials have faced challenges in managing production costs and adapting to the volatile market conditions, ultimately impacting their ability to expand and innovate.

Technological advancements in tooling

The integration of smart technologies in manufacturing tooling is driving the opportunity to grow the tooling market. The traditional manufacturing tooling technologies include hones, lathes, drill presses, screw machines, broaching machines, milling tools, hobby machines, etc. The technological evolution in tooling is enhancing the speed and accuracy and reducing the operational cost of the production process.

There are some of the technologies that revolutionized machine tooling such as laser cutters, laser welding machines, CNC machines, CNC milling machines, plasma cutting machines, automated lathes, 3 in 1 machine, fabrication software, metrology software, machine tool technology data management, high-precision grinding machines, advanced Swiss turning technology, work holding module technology, hybrid machine tools, and tools for rough and finish boring. Thus, adopting these technologies is driving precision in industrial processes that boost the growth of the tooling market.

The dies and molds segment dominated the market with the largest share in 2024. The tooling consists of dies, molds, jigs, forging, fixtures, gauges, and machines. Tools such as dies and molds are the most used equipment and machines in industrial applications like automotive, consumer goods, and aerospace. Dies and molds are used in the mass production of components with more accuracy and consistency. It is used in the manufacturing and designing specialized tools and is highly preferred by manufacturers for high-quality production processes.

The stainless steel segment dominated the tooling market in 2024. The increased adoption of stainless-steel tools in manufacturing and industrial applications is due to their corrosion-resistant properties. Stainless steel offers high strength, durability, and corrosion resistance properties. It contains nickel, chromium, and molybdenum as alloying agents. Stainless steel tooling is used in the food and beverages industry, consumer goods manufacturing units, healthcare equipment, and others. It has great machinability, wear resistance, and hardenability properties used in sharp cutting edges and molds, allowing accurate and consistent outputs.

The automotive segment held the largest share of the tooling market in 2024. The segment is expected to sustain its position during the forecast period. The segment's growth is owing to the rising population and ever-expanding demand for the automobile for ease of life while maintaining lifestyle demand and requirements, positively influencing the demand for the automotive industry. Tooling is one of the most important parts of the automotive industry; it is used in various applications, such as body panels, engine parts, precision molds for composites, and plastic materials. Tooling in the automotive industry refers to the engineering and designing of tools in the manufacturing process. Rapid tooling speeds up the manufacturing process, offers flexibility in operations and helps save money. The rising automation in the operational process is driving the adoption of tooling in the automotive industry.

Europe led the tooling market with the largest market share in 2024. The growth of the market in the region is increasing due to the rising industrial development. The rising investment by public and private organizations for the development of industries like automotive, consumer goods, construction, electronics, aerospace, and others is driving the demand for tooling equipment for operational workflow. The supportive environmental conditions and government regularities are collectively contributing to the growth of the tooling market in the region.

North America is expected to witness the fastest CAGR during the forecast period. The tooling market is expecting substantial growth in the regional market due to the strong presence of the industrial infrastructure, and the ongoing investments in industries like automotive, aerospace, defense, and construction are further driving the demand for tooling equipment. The integration of modern technologies like artificial intelligence, IoT, and others is driving the growth of the region's market.

The U.S. is majorly responsible for the growth of the tooling market in the North American region. The U.S. leads in various sectors in which different tools are needed. These sectors include automotive, construction, aerospace, and mechanical. The country also has various key players that keep on developing new and advanced tools while incorporating advanced technologies.

Asia Pacific is observed to grow at a notable rate during the forecast period in the tooling market. The cost of production, including labor and raw materials, is relatively lower in many Asia Pacific countries compared to Western countries. This cost advantage attracts multinational companies to set up manufacturing plants in the region, further increasing the demand for tooling. The local tooling industry in the Asia Pacific region is developing rapidly, with many companies investing in modern manufacturing techniques and technologies. This development enhances the capability and competitiveness of local tooling providers.

By Product Type

By Material Type

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client