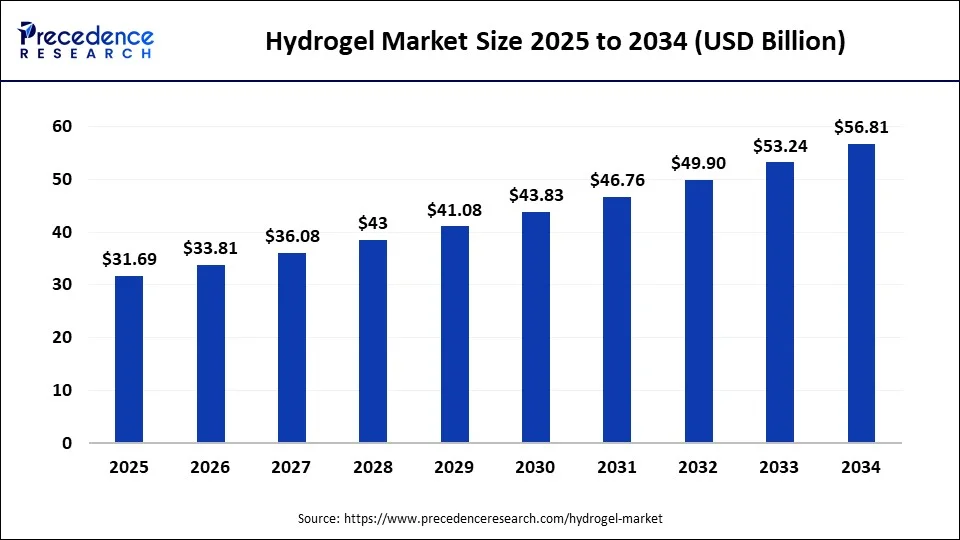

The global hydrogel market size was USD 27.62 billion in 2023, estimated at USD 29.70 billion in 2024 and is anticipated to reach around USD 56.81 billion by 2034, growing at a CAGR of 6.7% from 2024 to 2034.

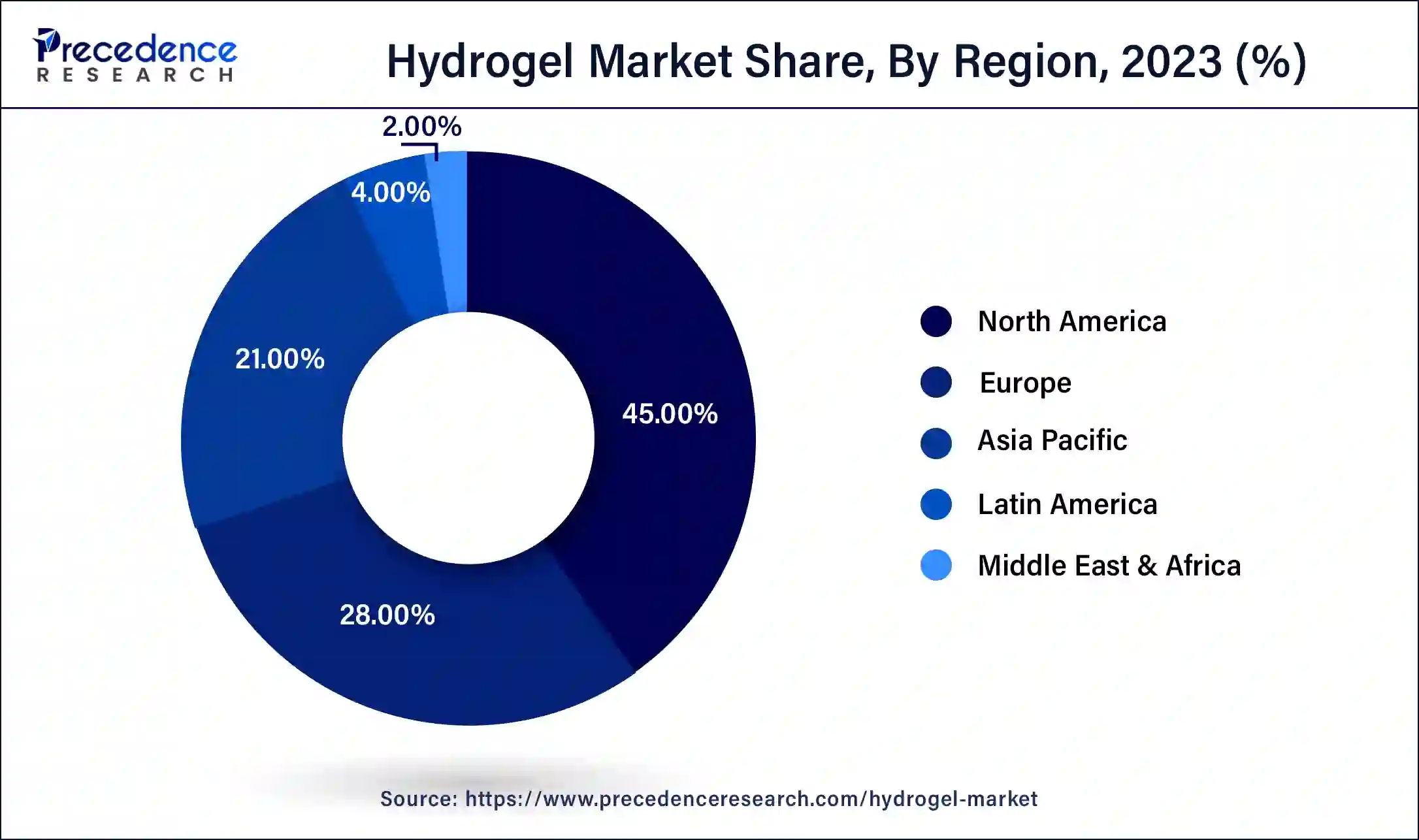

The global hydrogel market size accounted for USD 29.70 billion in 2024 and is predicted to reach around USD 56.81 billion by 2034, expanding at a CAGR of 6.7% from 2024 to 2034. The North America hydrogel market size reached USD 12.43 billion in 2023.

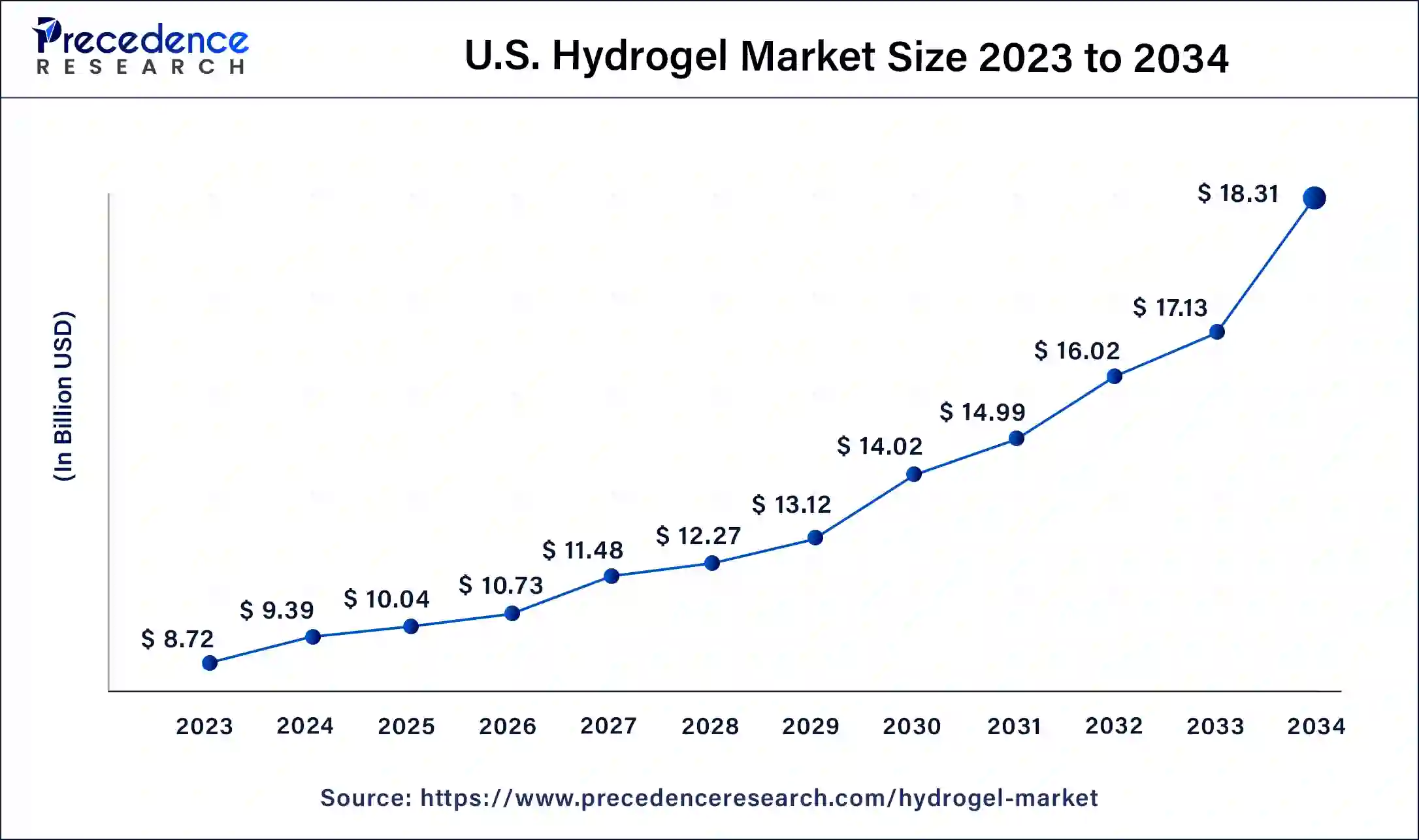

The U.S. hydrogel market size was estimated at USD 8.72 billion in 2023 and is predicted to be worth around USD 18.31 billion by 2034, at a CAGR of 6.9% from 2024 to 2034.

North America dominated the hydrogel market in 2023. This is attributed to the increased demand for hydrogels in biotechnology, tissue engineering, agriculture, medicine, and other fields. Due to rising demand for personal care, hygiene, and health care items such as baby diapers, sanitary pads, and paper towels in the developed countries in the North America region have seen substantial growth in the market.

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. Due to increased per capita income and growing population, the Asia-Pacific region has experienced tremendous growth. The emerging nations of Asia-Pacific region are likely to drive the hydrogel market forward throughout the forecast period due to rising disposable income and technological advancements.

Hydrogel is a three-dimensional network structure composed of cross-linked water-soluble polymers that can be natural or synthetic. It has a moisture-retaining capacity and thus can absorb a large amount of water or biological fluids. Biocompatibility, porosity, flexibility, and water-holding capacity make it ideal for medical applications. Biocompatible hydrogel adapts well to living tissues, providing no external harm to the internal body or skin. It allows clinicians to pursue biodegradable solutions for the medical interventions of drugs in the patient’s body as the hydrogels used get degraded enzymatically. Hydrogel dressings are ideal for wound healing and can absorb the fluids coming out through the wounds due to their water-holding capacity.

Hydrogel finds application in the agriculture, biomedical, food, and cosmetics industry. It is widely used in medical devices, personal care products, and water treatment. In tissue engineering, it is used to regenerate tissues. The researchers can perform diverse cell culturing projects inside the laboratories.

During the projection period, the global hydrogel market is likely to see profitable prospects as a result of variables such as hydrogel’s capacity to minimize environmental contamination and provide sustainability. During the projection period, the global hydrogel market will be fueled by wide applicability of hydrogels in different industries. Furthermore, the hydrogel is employed in the pharmaceutical business to extend the shelf life of drugs. The evaporative cooling hydrogel packaging, which improves the physical stability of existing medicinal goods, is becoming more common in the pharmaceutical business. This is one of the main drivers of the global hydrogel market.

The hydrogel is also employed in the curing and treatment process. In usual healing processes, a wound dressing comprised of hydrogel gives moisture to the wound and aids in the repair of the epidermis, removal of extra dead tissue, and proliferation. Moreover, greater awareness of hydrogel formulations has prompted product focused research and development companies to develop new hydrogel products, and applications are projected to drive the global hydrogel market growth during the forecast period. The demand for hydrogels is expected to rise due to rising demand for ecofriendly goods to address issues such as environmental issues, sustainability, and biodegradability.

| Report Coverage | Details |

| Market Size in 2023 | USD 27.62 Billion |

| Market Size in 2024 | USD 29.70 Billion |

| Market Size by 2034 | USD 56.81 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.7% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Raw Material, Form, Product, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Increasing Adoption of Biomaterials

The expansion of the hydrogel market is mainly due to the increasing use of biomaterials as controlled drug delivery systems to safely administer the respective drugs for medical treatment purposes. This targeted release of therapeutic agents inside the patient’s body improves the drug efficacy and reduces side effects. Drug delivery systems, such as biologically active agents, carriers, polymers, and polymer-drug formulations, are useful in ensuring focused clinical trials and success.

Another significant driver is the use of hydrogels in tissue engineering technology that aims to discover living tissues, cells, or organs with improved functionality and repair damaged ones. Different types of wound dressings, such as pH, temperature, pressure, and glucose-sensitive, can effectively monitor the wound and suggest precise treatments. The rise in the aging population and chronic diseases that require regular attention and efficiency in treatments are also boosting the need for hydrogel products. The agriculture and horticulture sectors demand the supply of hydrogels to optimize their traditional farming methods with better crop yield, soil retention, and nutrient delivery to the crops.

Availability of Alternatives and High Cost

The availability of alternatives, such as synthetic polymers, can hinder the growth of the market. Moreover, the high cost associated with the production of hydrogel using high-quality materials and sophisticated manufacturing processes acts as a restraining factor.

3D Printing of Hydrogels

A 3D printing technology is emerging with the application of 3D printed hydrogels composed of natural and synthetic components, such as alginate, degradable polyurethane, and agarose, to offer artificial tubular structures for nerve regeneration. Bone and tissue damage caused by any infection or inflammation can be repaired with the help of 3D-printed hydrogels due to their properties of healing wounds, fighting infections, and treating tumors. 3D-printed structures of hydrogels are stronger and tougher than cartilage, with mechanical strength to retain the human body structure and maintain its 3D forms.

The synthetic hydrogels segment dominated the hydrogel market in 2023. The synthetic hydrogels have a long service life, a high ability to absorb water, and high gel strength. The synthetic polymers, on the other hand, usually have well defined structures that may be altered to give degradability. The market for synthetic hydrogels is likely to be driven by the aforementioned factors.

The natural hydrogels segment is fastest growing segment of the hydrogel market in 2023. The hyaluronic acid, collagen, fibrin, Matrigel, and natural hydrogens including alginate, chitosan, and skill fibers are all examples of the natural hydrogels. As components of the extracellular matrix in reality, they remain the most physiological hydrogels. The natural hydrogels have wide applications in the diverse sectors.

The polyacrylate segment held the largest share of the market in 2023 and is likely to expand rapidly in the near future. The ability of polyacrylate hydrogel to absorb a large amount of water makes it suitable for applications such as contact lenses, wound dressings, and diapers. Rising demand from the pharmaceutical industry is expected to contribute to segmental growth.

In 2023, the semi crystalline hydrogels segment dominated the hydrogel market. The hydrogel polymers that are superabsorbent are known as semi crystalline hydrogels. As a result, semi crystalline hydrogels have become popular in the wound dressing business for ulcers and surgical wounds.

The amorphous hydrogels segment, on the other hand, is predicted to develop at the quickest rate in the future years. The amorphous hydrogels are glycerin and water-based compounds that are generally used to hydrate wounds. These dressings aid in wound healing by keeping the site wet, encouraging regeneration and tissue formation, and facilitating oxidative exfoliation.

In 2023, the films & matrices segment dominated the hydrogel market. The hydrogel films serve as membranes or coatings in physiologically interfaced devices. The drug administration, wound healing, anti-adhesive membranes, cell culture, and soft tissue rebuilding are some of the biomedical applications for hydrogel films.

The hydrogel sheets segment, on the other hand, is predicted to develop at the quickest rate in the future years. The hydrogel sheets are prescribed for the treatment of minimally draining partial and full-thickness wounds such as deep wounds, dermal ulcers, pressure ulcers, skin tears, minor burns, infected wounds, radiation dermatitis, donor sites, and wounds with slough or necrosis, as a primary dressing product.

Segments Covered in the Report

By Raw Material Type

By Composition

By Form

By Product

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client