October 2024

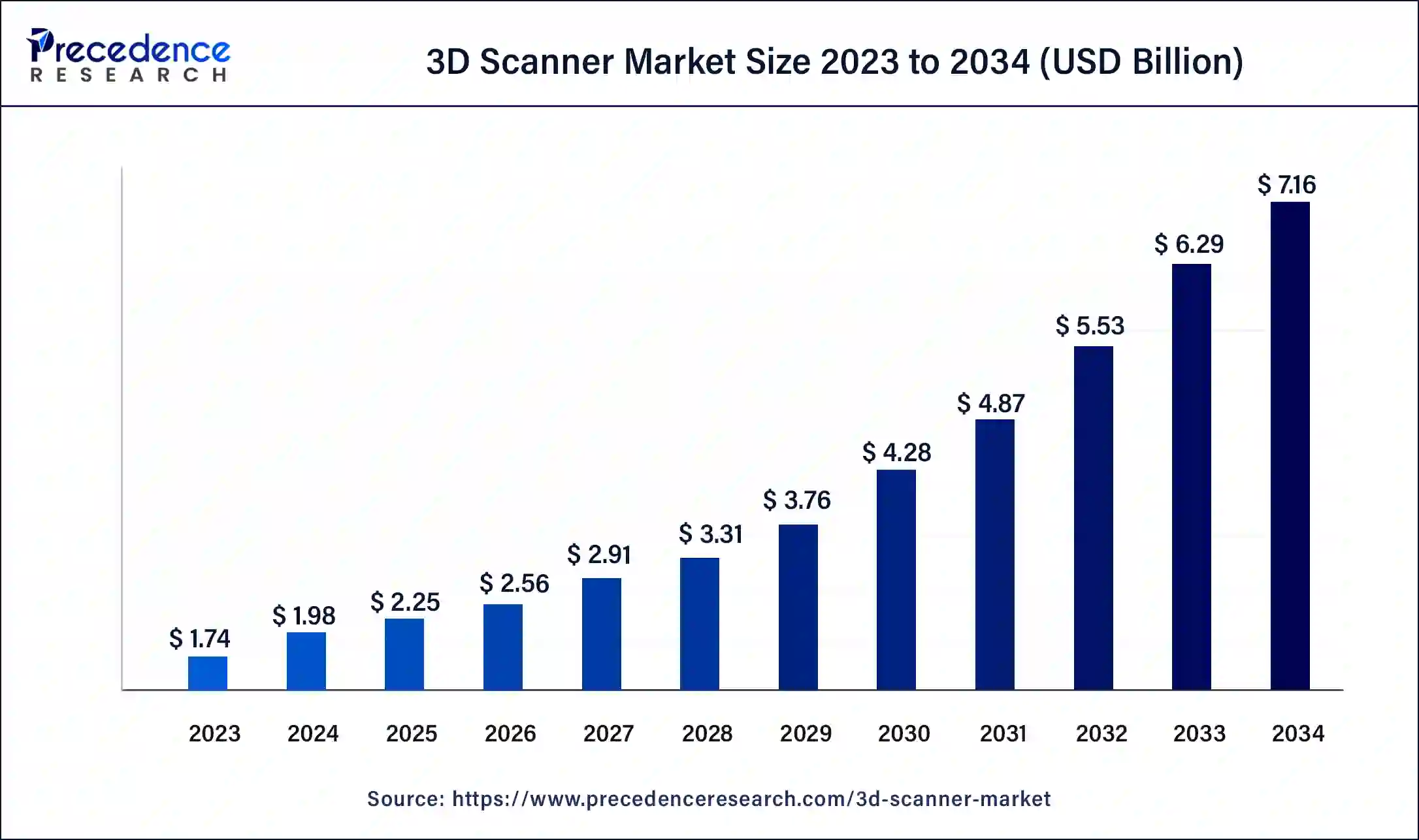

The global 3D scanner market size was USD 1.74 billion in 2023, calculated at USD 1.98 billion in 2024 and is expected to be worth around USD 7.16 billion by 2034. The market is slated to expand at 13.72% CAGR from 2024 to 2034.

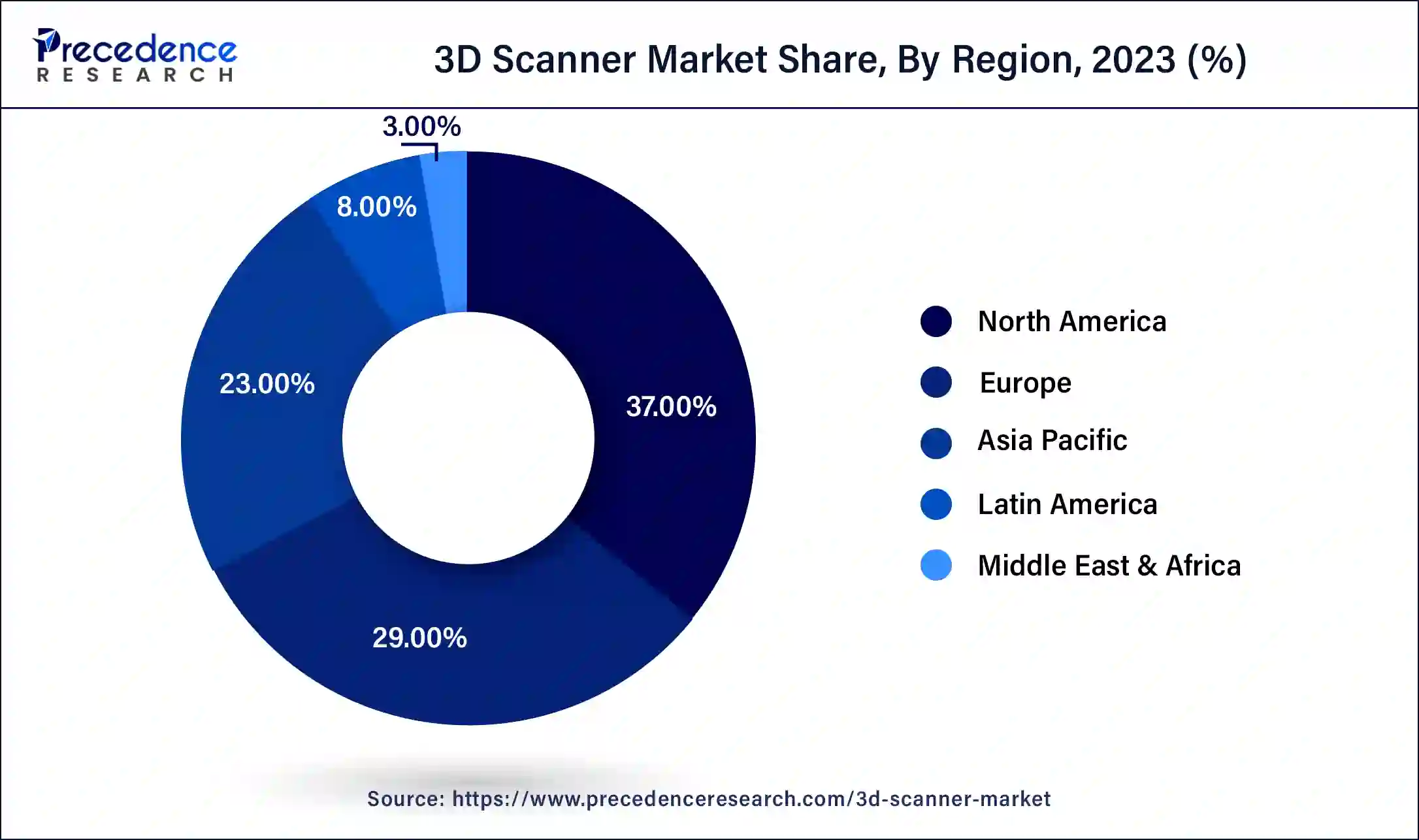

The global 3D scanner market size is projected to be worth around USD 7.16 billion by 2034 from USD 1.98 billion in 2024, at a CAGR of 13.72% from 2024 to 2034. The North America 3D scanner market size reached USD 640 million in 2023. 3D scanning technology is widely adopted in several industries, such as architecture, aerospace, healthcare, media, and automotive sectors, leading to substantial growth in the 3D scanner market.

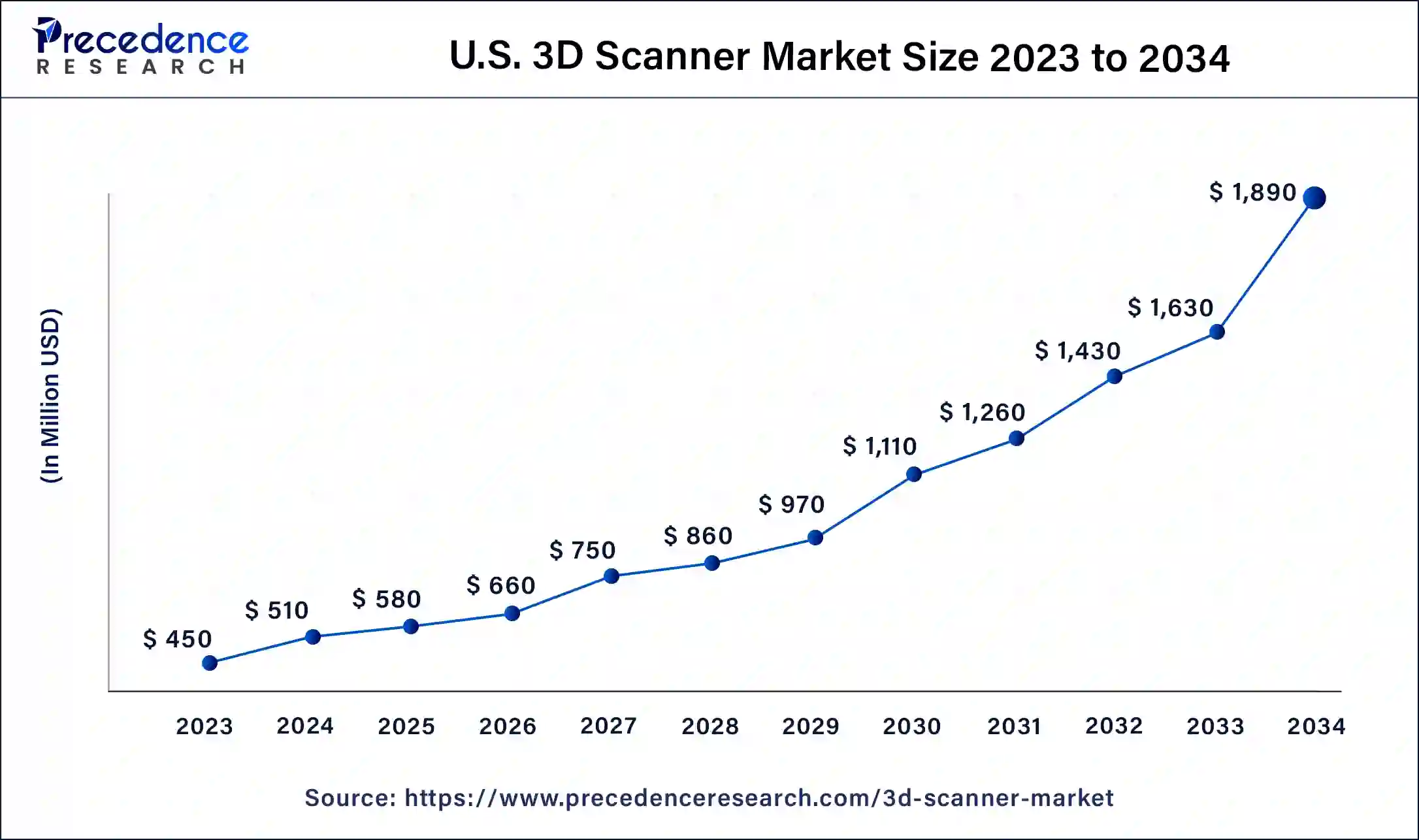

The U.S. 3D scanner market size was exhibited at USD 450 million in 2023 and is projected to be worth around USD 1,890 million by 2034, poised to grow at a CAGR of 13.72% from 2024 to 2034.

North America dominated the 3D scanner market in 2023 due to the presence of several of the world’s largest companies in the aviation, military, healthcare, and media sectors operating from the region. The booming animation and media industry in the region has spurred tremendous demand and interest in 3D scanning technology. The 3D printing market is also robust in the region, further driving demand in the 3D scanner space.

Asia Pacific is expected to see the fastest growth in the 3D scanner market over the forecast period. Widespread industrialization in the region has led to increasing demand for product development, manufacturing, and distribution. There is an increasing demand for state-of-the-art product lifecycle management systems that are widely integrating the use of 3D scanning technology. Increased research and development spending in the region has also led to the adoption of newer technologies like 3D scanning to enhance productivity.

The 3D scanner market in China has experienced significant growth due to its utilization in reverse engineering, civil surveying, architecture, and urban topography. Rapid automation and demand for infrastructure are spurring demand for the technology. China is also one of the largest automobile manufacturers in the world, driving demand in the market.

3D scanning is the process of analyzing objects, environments, or people in the real world and collecting three-dimensional data. 3D scanning takes measurements of contoured surfaces to acquire size and dimensions to create point cloud data. This 3D data is then used to construct digital three-dimensional models, including details like shape, textures, color, etc. 3D scanning can be done through different technologies like laser triangulation, photogrammetry, computerized tomography, and LiDAR.

Laser triangulation 3D scanning technology uses laser beams on surfaces and measures the deflection of the beams. Structured light 3D scanning projects structured patterns of light (like grids) on the scanned object and measures details about a surface’s shape by looking at the pattern deformation. More sophisticated 3D scanning, like photogrammetry, reconstructs two-dimensional objects in 3D using computational geometrical algorithms.

Photogrammetric scanning is usually used for large objects or environments. Computerized tomography, colloquially known as CT scanning, is widely used in the medical sector to generate images of human anatomy. CT scans take a series of 2D images of various parts of the scanned person with X-rays and later superimpose these images on each other to generate a 3D model. Each type of 3D scanning technology has its advantages, disadvantages, and cost-effectiveness.

The 3D scanner market helps industries collect useful information for a variety of applications, such as motion capture, augmented reality, gesture, industrial design, product lifecycle management, and orthotics, to name a few. This data can then be converted to 3D computer-aided design (CAD) models or other compatible software based on what the data will be used for. What kind of 3D scanning technology is used depends entirely on the industry and end-use.

Some technologies are ideal for short-range scanning, while others are built for medium- or long-range scanning, which is useful in scanning larger environments or objects like ships and buildings. 3D scanning technology also plays a vital role in maintaining digital copies of real-world machines for predictive maintenance, simulation, and optimization.

How artificial Intelligence is transforming the 3D scanner market

Artificial intelligence is making waves across several industries and the 3D scanning market is also one of them. AI is being used in the 3D scanning sector to automate data processing, enhance geometric reconstruction, object detection and more. One of the most time consuming aspects of 3D scanning continues to be data processing. Machine learning algorithms are being deployed to improve the speed and accuracy of processing the large amount of data generated by high-resolution images captured during scans.

AI-powered solutions such as the development of radiance fields are improving real-time visualizations. AI-powered technologies such as deep learning are being used in neural radiance fields to reconstruct three-dimensional scenes from two-dimensional images. Artificial intelligence is also helping integrate professional workflows.

| Report Coverage | Details |

| Market Size by 2034 | USD 7.16 Billion |

| Market Size in 2023 | USD 1.74 Billion |

| Market Size in 2024 | USD 1.98 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 13.72% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Range, Component, Type, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise of 3D printing

The use of 3D printing has skyrocketed in the past decade. 3D printing often needs sophisticated 3D scanning and software to create digital copies of objects, which are then modified according to specific industry needs. 3D printing not only has widespread industrial applications but has also seeped into small and medium-scale fabrication setups. 3D printing is heavily utilized in additive manufacturing, where products are created layer-by-layer using 3D scanner data and relevant software.

3D scanning and printing have also significantly improved product lifecycle management. Product lifecycle management is helping manufacturers develop new products faster and at a lower cost than before. 3D scanning is instrumental in the concept and design stage, development stage, and even production and launch stages of a product’s lifecycle.

The aerospace industry is also a huge driver in the 3D scanner market. The technology is being used to provide a more complete view of aircraft and the components developed for them. Manufacturers use these digital models to correct errors and even reverse engineer legacy parts to create new ones.

Animation, media, and augmented reality ventures

3D scanning is now a staple in the media and entertainment industry, and it is in high demand in movie production and game development. Game developers and animators use 3D scanning to reproduce real-world objects and environments to construct detailed virtual scenes. 3D scanners are also being used to create detailed models of actors' bodies and faces. This data is used to build realistic digital characters for movies and video games and to run motion-capture systems.

Healthcare sector demand

The medical sector increasingly requires different scanning technologies like X-rays, CT, MRI, and ultrasound to study anatomy and aid in diagnosis and disease monitoring. The rising incidence of chronic diseases and cancers has spurred demand in the medical scanning space. These scans are useful in providing information to healthcare providers about the internal organs of a patient. Previous information gaps are now being closed with the use of 3D scanning technologies.

Since 2016, 3D scanning and printing technology applications in the medical and biotechnology sectors have grown substantially. The technology is used in bioprinting and creating implants for custom-fit orthotics, prosthetic devices, back braces, dental implants, and more. Compared to traditional methods, 3D scanning is less invasive for the patient while improving the quality of data collected. This allows clinicians to make more accurate diagnoses and, in turn, provide better treatment.

High costs of 3D scanning technology

While 3D scanning provides a number of benefits in various industries and applications, the high initial cost of obtaining the technology remains a significant barrier to truly widespread adoption. Operating 3D scanners also requires a certain amount of training (depending on the technology) and requires businesses to hire trained professionals or pay for training existing employees to operate the machinery.

The cost of 3D scanning technology also ends up prohibitive for small and medium enterprises. As a result, many small-scale businesses usually avoid going for 3D scanning solutions, instead opting for alternate, inexpensive products. These factors restrict growth in the 3D scanner market.

Integration with emerging technologies

Integrating 3D scanning technologies with emerging technologies like machine learning and the Internet of Things will enhance their capabilities. AI-powered algorithms are already in use in some industries to automate data processing and create volumetric point clouds quicker and more accurately. IoT sensors can also be integrated into existing 3D scanning systems for use in smart packaging in industries such as fast-moving consumer goods, fashion, and the automotive sector.

IoT integration with CAD data also has applications in taking body or room measurements in the fashion and furniture retail sectors. 3D scanning also has the potential to improve the performance of autonomous vehicles and unmanned aircraft by enhancing obstacle detection systems. As 3D scanning technology gets more compact, handheld versions will greatly decrease the setup and use time, making them more accessible for small and medium-scale industries.

The structured light scanners segment dominated the global 3D scanner market in 2023. Advancements in structured light 3D scanners have led them to become more affordable. This has led to their adoption in archeology and small-scale industries.

The laser scanner segment is expected to grow at the fastest rate in the 3D scanner market over the forecast period. Laser scanners are popular over other products in the market for several reasons. These scanners are able to capture detailed geometries even on surfaces with shiny or dark finishes. Laser scanners are less sensitive to ambient light conditions and changing light. Developments in laser scanner technology have led to their adoption in several industries, depending on the objects to be scanned. They are also increasingly available in compact, handheld configurations.

The short range segment held the largest share of the 3D scanner market in 2023. The low cost of these device and their compact nature make them versatile and easy to use for a variety of applications such as product design and material inspection. These scanners are also generally considered safe for scanning animals or people.

The medium range segment is expected to grow at the fastest rate in the 3D scanner market over the forecast period. Medium-range scanners are being widely adopted in civil engineering, architecture, and industrial manufacturing. These scanners are cheaper compared to their long-range counterparts and have versatile uses.

The 3D scanner market is bifurcated into software, hardware, and services by component. In 2023, the hardware segment accounted for the largest share of the market globally. This dominance can be attributed to the increasing demand for components for 3D scanners in response to growing awareness and technological advancements for imaging and printing applications.

The 3D scanner market can be categorized by type into fixed coordinate measuring machine (CMM)-based, tripod-mounted, portable CMM-based, and desktop scanners. In 2023, the fixed CMM-based segment dominated the global market. These 3D scanners capture the entire object from various angles at a stationary location, which is driving the demand for this type of scanner.

The 3D scanner market is generally bifurcated into virtual simulation, quality control and inspection, reverse engineering, and others. In 2023, the quality control & inspection segment held the largest share of the market. This growth is attributed to the increasing awareness about advanced medical treatment and the need to capture large volumes of 3D data for analysis.

The automotive segment held the largest share of the 3D scanner market in 2023. The sector's widespread adoption of 3D scanning in automotive design, manufacturing, plant inspection, and material processing has led to its dominance in the market. The ease of use and versatility of 3D scanning have been crucial in its adoption for scanning and analyzing smaller components in the automotive sector.

The healthcare segment is expected to grow rapidly in the 3D scanner market in the upcoming years. Advances in 3D scanning technology and imaging have numerous applications in the healthcare sector to provide better analysis and a more accurate representation of patient anatomy. The technology is non-invasive, and needs no contact with the body, making it more hygienic and patient-friendly. 3D scanning also has the advantages of reduced cost and time taken for results to be obtained compared to conventional scanning methods.

Segments Covered in the Report

By Product

By Range

By Component

By Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024