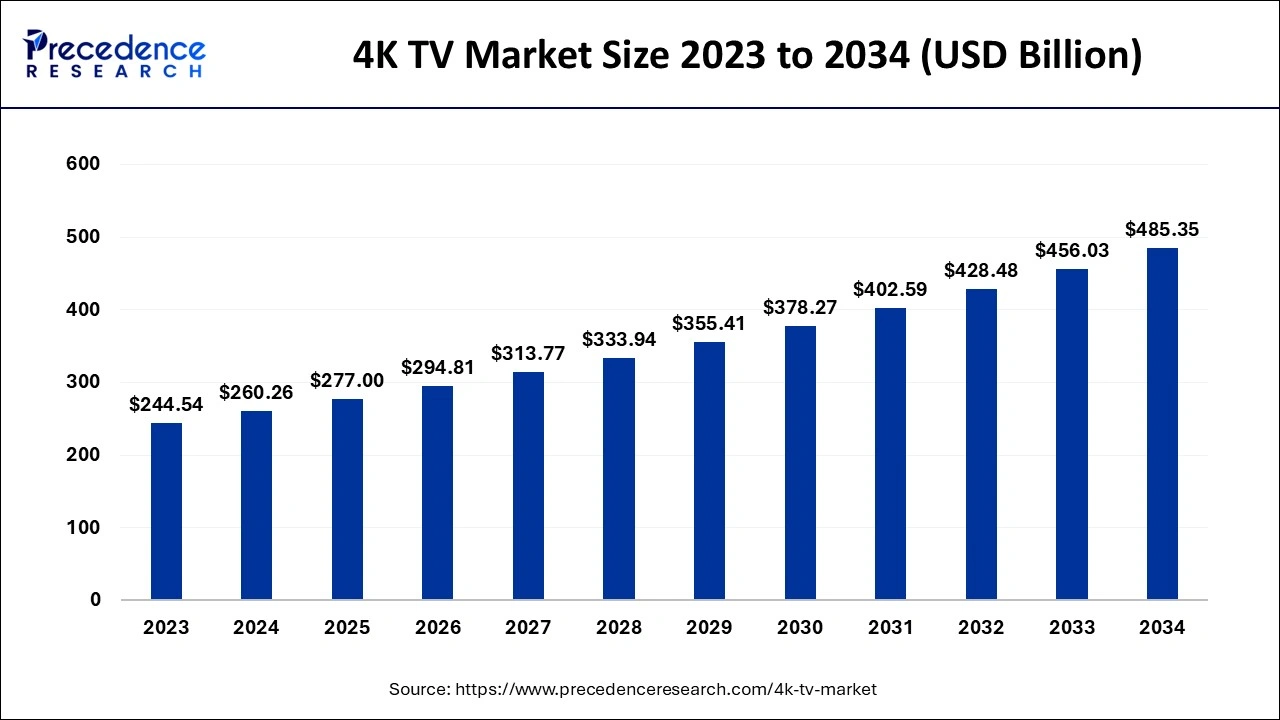

The global 4K TV market size is calculated at USD 260.26 billion in 2024, grew to USD 277.00 billion in 2025 and is projected to reach around USD 485.35 billion by 2034. The market is expanding at a CAGR of 6.43% between 2024 and 2034. The North America 4K TV market size is exhibited at USD 96.30 billion in 2024 and is expected to grow at a CAGR of 6.56% during the forecast year.

The global 4K TV market size accounted for USD 260.26 billion in 2024 and is expected to exceed USD 485.35 billion by 2034, growing at a CAGR of 6.43% from 2024 to 2034. The demand for higher-resolution TVs is driving the growth of the 4K TV market. Additionally, developments of smart TVs with high dynamic range (HDR) and wide color gamut (WCG) are influencing the market. The growing utilization of 4K gaming is projected to enhance demand for 4K TVs in the upcoming period.

Artificial intelligence is significantly transforming the 4K TV market. The integration of AI in TVs is enabling smart content. Consumers are able to have access to their 4K TVs in their smart devices like smartphones and tablets, making it more convenient and easier to handle and operate the streaming. AI integration allows the addition of non-4K content in displays on TVs like it's part of 4K content, making it enjoyable to the consumers and improving consumer experiences. Image and quality upscaling are driving the rapid adoption of AI in TVs.

Technology advancements like ultra-high-definition (UHD) services and content security systems are emerging in the market. The integration of AI is enabling seamless content in the 4K TV market and providing sustainable features, such as energy-saving modes, making them more popular in the industry. With the multiple benefits AI offers, manufacturers are determined to adopt the integrated technologies in 4K TVs extensively.

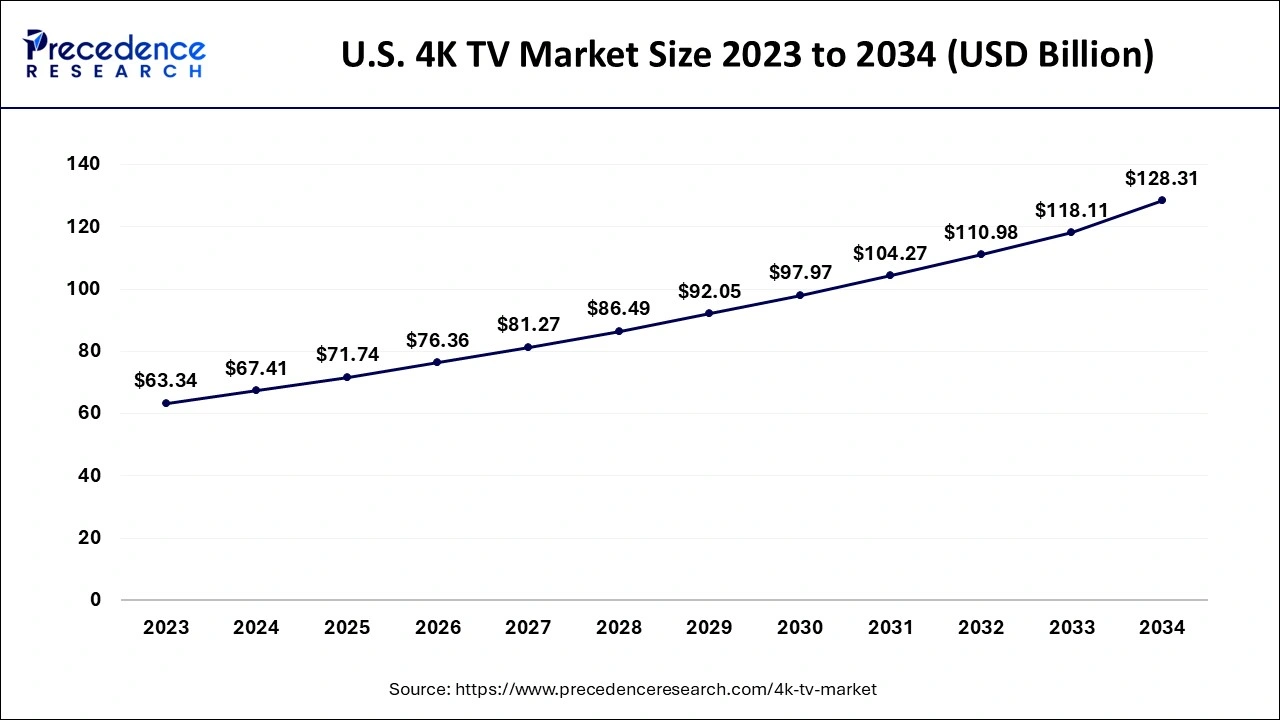

The U.S. 4K TV market size is evaluated at USD 67.41 billion in 2024 and is projected to be worth around USD 128.31 billion by 2034, growing at a CAGR of 6.63% from 2024 to 2034.

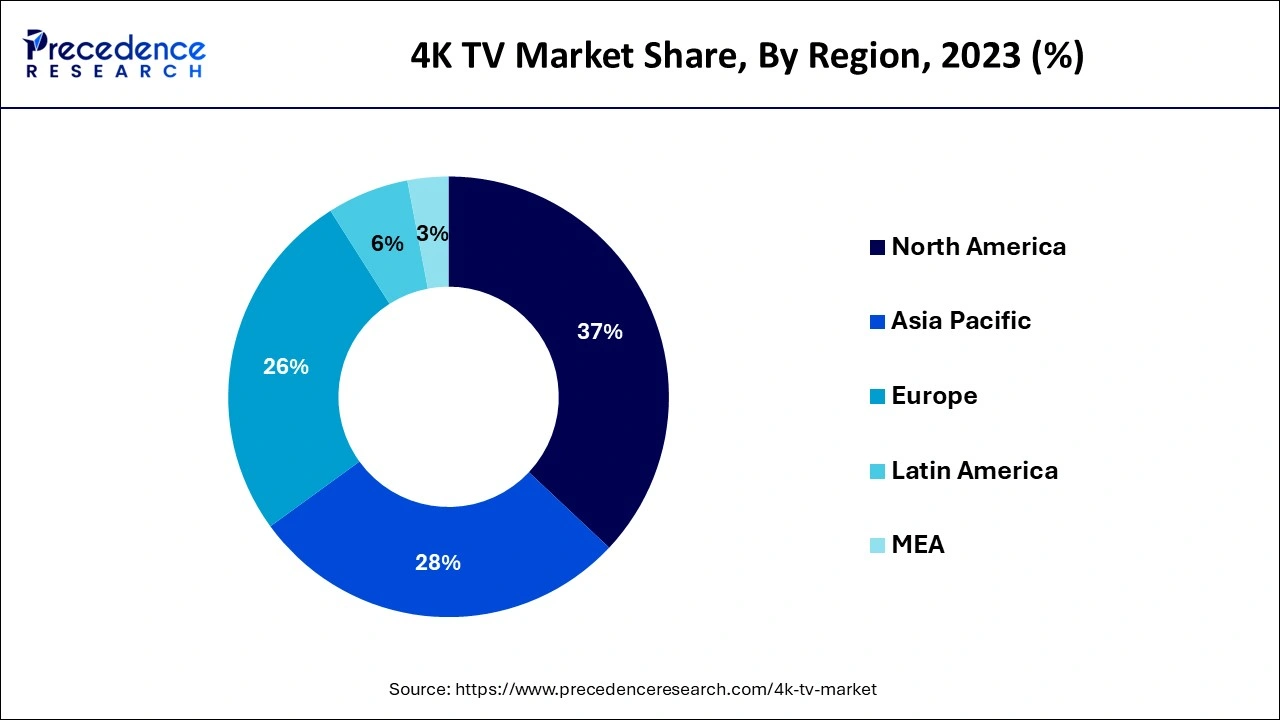

North America held the largest market share of 37% in 2023. The presence of established major TV manufacturing companies drives the market in North America. The region is well known for technology advancements, with countries like the United States and Canada investing in the research & developments that are encouraging cutting-edge developments in TV technology. Increasing disposable income allows consumers to spend on luxuries and premium options.

The United States leads the North American 4K TV market with a large consumer base. Also, well-established retail and online networks in the country are providing easy access and availability to consumers. Collaboration of the United States with several other nations is continuously encouraging innovation & development in manufacturing industries. Moreover, the government initiatives are helping to boost the United States market.

Asia Pacific is expected to witness significant growth in the 4K TV market during the forecast period. A large consumer base helps expand the adoption of 4K TVs in Asia Pacific. The large population of the region is the key factor driving the market. The adoption of digitalization has increased in Asia due to increased disposable income among the middle-class population. Countries like China, India, Indonesia, and Japan have witnessed significant growth in the demand for smart TVs.

India is leading the Asia Pacific’s 4K TV market with a huge consumer base. The increasing government investments in infrastructure developments and transportation are supporting nations' markets. Rising productions of TVs from local to large-scale manufacturers are enabling easy access and affordable choices for the country's consumers.

The global 4K TV market has witnessed significant growth in recent years due to rising consumer demands for high-quality visual TVs. Government and private organizations' investments are enabling manufacturers to adopt and integrate smart technologies to improve displays like OLED, QLED, and SUHD. These technologies have enhanced imaging and color quality and have improved the consumer experience of 4K TVs, leading to further increased attraction. Growing market competition has led to reduced costs for smart and larger TVs, making them affordable and more preferred by consumers.

Brands are spectacularly collaborating to improve brand reputation and sales by building market strategies and promotion efforts. These partnerships are helping to create smart features for TVs and enhancing further innovations and developments along with increasing economic profits. Ongoing collaboration between manufacturers in the 4K TV market is leading to migration with advanced technologies.

| Report Coverage | Details |

| Market Size by 2034 | USD 485.35 Billion |

| Market Size in 2024 | USD 260.26 Billion |

| Market Size in 2025 | USD 277.00 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.43% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Screen Size, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Consumer demands for 4K contents

The market has witnessed significant growth due to increased consumer demands for the 4K TV market services, such as TV shows, on streaming services like Netflix, Disney+, and Amazon Prime. The manufacturers have made it easy for consumers to access streaming services with 4K content. Additionally, the growing adoption of digitalization, like smartphones, tablets, and laptops, is further making access to 4K content easy for consumers.

Consumers' growing preference for watching sports and live events on 4K displays is driving demands for the advanced 4K TV market. Rising demand for 4K gaming content, like PlayStations, is fueling the expansion. With continuously rising demand for high picture quality, upgraded features, and growing premium choices, the market is transforming to success.

High upfront cost

As compared to the HDTVs, 4K TVs are quite expensive. Additional features of HDR, WCG, OLED, and QLED are further increasing the cost of the 4K TVs. Premium brands have high prices, making them unaffordable for the middle-class population. High prices give consumers limited access to the 4K TV market content. Additionally, the availability of smart devices like smartphones, laptops, and tablets helps consumers double-check their decision before buying expensive 4K TVs.

Commercial users

Commercial users like advertisers, retailers, hotels, restaurants, and resorts are holding potential future opportunities for the 4K TV market. Retailers and advertisers have increased their preference for 4K TVs for digital advertisements for more visual influence and impact on consumers. Hotels, resorts, and restaurants are highly adopting 4K TVs to improve their reputations and visual attractions for customers. Such commercial users have witnessed great tourism and local experiences due to the adoption of the 4K TVs.

Moreover, the growing adoption of 4K TVs in academies and training sectors for better learning, remote working or training, and engaging attention are fueling the 4K TV market expansion. The healthcare sector is also seeking a role in the market growth, as the utilization of 4K TVs for high-resolution medical imaging and patient education & understanding has increased. Commercial users like stadiums and corporate sectors are adopting TVs for video conferences and offering consumer experiences with large-screen displays.

The 52 to 65 inches segment dominated the 4K TV market in 2023, as the market has witnessed consumers upgrading the smaller screen sizes to larger sizes of 4K TVs. The 52 to 62-inch screen size of 4K TVs provides an optimal viewing experience for consumers. These TVs are convenient and comfortable for the living rooms. Improved panel technology like OLED and QLED productions is emerging in the segment growth. Additionally, advancements in color gamut technology and high dynamic range are improving consumer experience with the 52- to 62-inch screen size 4K TVs. Manufacturers' innovations are the promotion of their brands, as highlighted products are further driving consumer attraction toward the segment. Additionally, growing online sales and partnerships between manufacturers and retailers are enhancing audience engagement.

The greater than 65 inches segment is anticipated to grow at the fastest rate in the 4K TV market during the forecast period. Improved panel technology like SUHD (super ultra-high definition) is improving the quality of the 4K TVs. This technology enables manufacturers to produce a large range of products. The segment is further rising due to increasing consumer preferences for luxury and premium TVs. With consumers willing to spend on premium products, companies are focusing on wide marketing, leading to attracting consumers.

By Screen Size

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client