October 2024

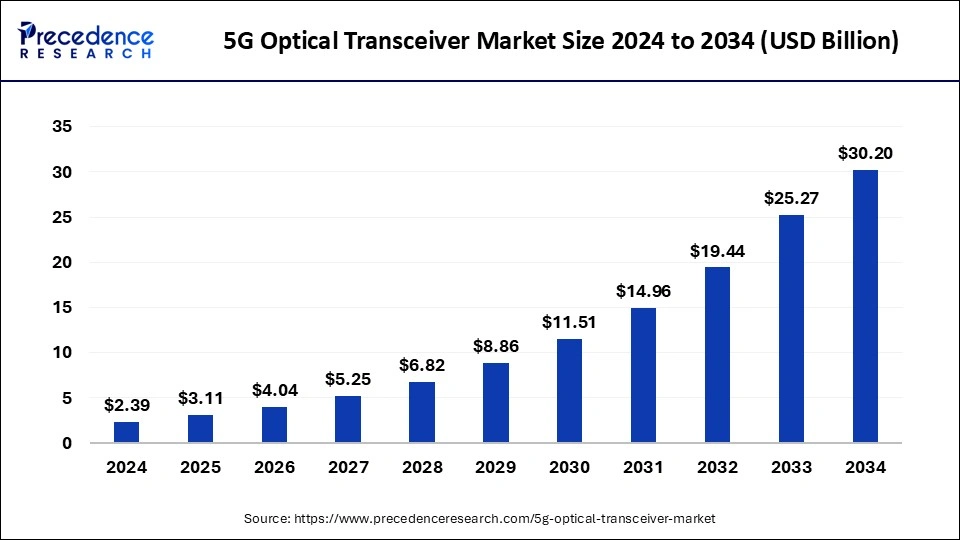

The global 5G optical transceiver market size is calculated at USD 3.11 billion in 2025 and is forecasted to reach around USD 30.20 billion by 2034, accelerating at a CAGR of 28.87% from 2025 to 2034. The North America 5G optical transceiver market size surpassed USD 0.86 billion in 2024 and is expanding at a CAGR of 28.90% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global 5G optical transceiver market size was estimated at USD 2.39 billion in 2024 and is predicted to increase from USD 3.11 billion in 2025 to approximately USD 30.20 billion by 2034, expanding at a CAGR of 28.87% from 2025 to 2034. The growing demand for 5G is expected to drive the deployment of 5G optical transceivers in 5G infrastructure, thereby driving the 5G optical transceiver market.

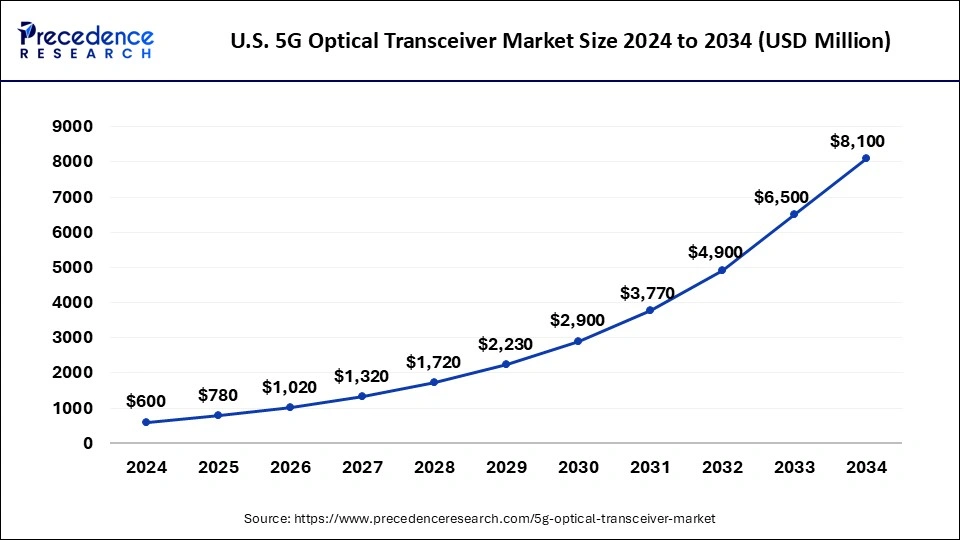

The U.S. 5G optical transceiver market size was exhibited at USD 600 million in 2024 and is projected to be worth around USD 8,100 million by 2034, poised to grow at a CAGR of 29.73% from 2025 to 2034.

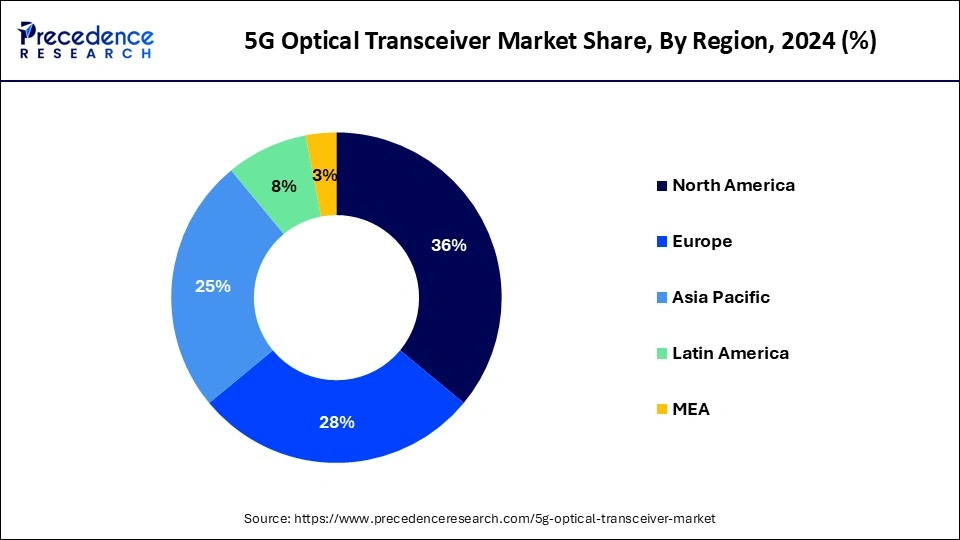

North America registered the largest revenue share of the 5G optical transceiver market in 2024. The demand for 5G infrastructure in the U.S. and Canada is driving regional market growth. Key market players are introducing 5G-compatible optical transceiver portfolios, further fueling this expansion. The increasing deployment of 5G in Canada is rising innovation, development, and investment in 5G infrastructure. The growing adoption and deployment of 5G technology have a positive impact on the regional industry.

Asia Pacific is anticipated to showcase significant growth with the highest CAGR in the 5G optical transceiver market in the upcoming period. The adoption of 5G in the Asia Pacific region is driving innovation, development, and investment. The implementation of 5G is expected to contribute significantly to regional industrial growth. The importance of data center operations is increasing among large enterprises and government agencies in APAC. Several data centers in the region are already operated by cloud service providers (CSPs) and colocation vendors. Telecom vendors like NTT DATA and China Telecom, along with certain global IT service firms, manage most of the data centers in this region.

A 5G optical transceiver is a device that enables high-speed data transmission over 5G wireless networks using optical signals. With the installation of base stations and advancements in 5G technology, there will be a significant rise in the demand for optical devices used in communication networks. Optical transceivers, also known as fiber optic transceivers, are crucial interconnect components that transmit and receive data. They utilize fiber optic technology to convert electrical signals into light and vice versa. The front, backhaul, and midhaul components of 5G infrastructure heavily rely on optical transceivers. The market is expected to grow due to the increasing demand for 5G technology and the deployment of optical transceivers in 5G networks.

| Report Coverage | Details |

| Market Size by 2034 | USD 30.20 Billion |

| Market Size in 2025 | USD 3.11 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 28.87% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Form Factor, Wavelength, Distance, 5G Infrastructure, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growth in cloud computing

Due to the growth of cloud computing and the increasing use of data-intensive applications, there has been a significant expansion in the number of data centers worldwide. Optical transceivers play a critical role in the infrastructure of these data centers by facilitating high-speed data transfer between servers and storage systems.

The rise in demand for Internet of Things (IoT) devices has resulted in a proliferation of connected devices, creating a need for faster and more reliable wireless networks. Optical transceivers are essential components in IoT devices such as sensors, cameras, and smart home appliances, which enable them to communicate with other devices and the cloud.

High initial development costs

The substantial initial installation expenses are a major factor that could hinder the growth of the 5G optical transceiver market. Setting up 5G networks and deploying optical transceivers require significant investments in infrastructure and equipment. The high costs associated with constructing and upgrading network infrastructure, including fiber-optic cables, base stations, and optical transceivers, can pose a significant barrier, particularly for smaller network operators or those operating in economically constrained regions.

The migration of OTNs toward WDM architecture

Optical transport networks (OTNs) are transitioning from SONET technology to wavelength-division multiplexing (WDM) architecture, particularly dense WDM (DWDM). The deployment of DWDM systems by carriers has been highly beneficial. It allows for the transmission of multiple wavelengths over a single fiber, significantly increasing capacity. This advancement enables network operators to reduce the cost associated with deploying multiple network overlays for different services or a single-channel network. These factors are expected to positively impact the 5G optical transceiver market during the forecast period.

The 25G transceiver segment dominated the 5G optical transceiver market in 2024. As the number of 5G macro base stations increases, the demand for 25G optical transceivers is expected to rise, driving the segment’s growth over the forecast period. 25G transceivers are ideal for 5G front-haul connections, which utilize direct fiber connections due to their network construction efficiency. These transceivers employ wavelength division multiplexing (WDM) technology to combine multiple wavelengths into a single fiber.

The 400G transceiver segment is expected to grow significantly in the 5G optical transceiver market over the forecast period. The IEEE approved a 400G standard in 2017, prompting equipment manufacturers to develop cost-effective technology. The demand for data-intensive services has accelerated the development of 400G technology. These 400G transceivers are prepared for future upgrades to 800G and offer significantly higher speeds than 100G and 200G. Despite the high initial investment, the capability of 400G technology to upgrade to 800G is expected to drive segment growth throughout the projected period.

The SFP56 form factor segment dominated the 5G optical transceiver market in 2024. This can be linked to Optical transceivers with the SFP56 form factor, which are widely used in 5G infrastructure due to their compatibility with both 50G and 25G connections. They are favored for their high-speed connectivity, reliable performance, and superior quality. In response to the growing demand for SFP56 in 5G applications, leading market players are introducing new product portfolios.

The QSFP28 segment is anticipated to grow significantly during the 5G optical transceiver market in the forecast period. This is due to Video streaming and gaming on 5G networks demanding low latency. QSFP28 optical transceivers, with their compact form factors, reduce cable and space costs by lowering all expenses. The segment's growth is driven by its high data rate compatibility, low latency, and cost-effectiveness.

The 1310 nm band segment dominated the 5G optical transceiver market in 2024. The properties of the 1310nm band are driving the growth of this segment. These connections link the core network with the cell site, which is essential for transporting large volumes of data. The 1310nm wavelength optical transceivers are primarily used in 5G infrastructure for high-speed backhaul connections.

The 850 nm band segment is estimated to grow significantly in the 5G optical transceiver market over the forecast period. 5G infrastructure employs 850nm band optical transceivers to connect small cells or in-building distributed antenna systems. These transceivers use multimode fiber optic cables for short-distance connectivity and provide better bandwidth and lower costs. Their affordability and availability make 850nm transceivers suitable for 5G infrastructure, driving the growth of this segment.

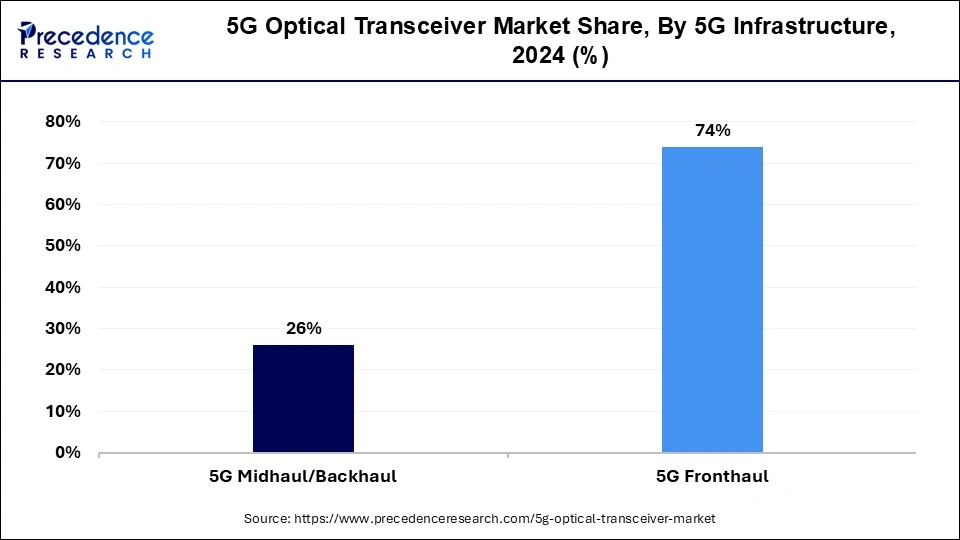

The 5G fronthaul segment dominated the 5G optical transceiver market in 2024. These transceivers offer high data rates, low latency, and cost-effectiveness, making them an ideal choice for supporting 5G infrastructure. 5G networks have been commercialized and adopted worldwide, with millions of 5G base stations already deployed globally. To meet the demand for these base stations, network operators have turned to optical transceivers.

The 5G midhaul/backhaul segment is projected to show substantial growth in the 5G optical transceiver market during the projected period. The compatibility of optical transceivers with 5G network infrastructure drives their adoption in the 5G midhaul and backhaul segments. 5G midhaul and backhaul are supported through the metro access, core, and convergence layers, commonly utilizing 50G/100G transceivers. Additionally, these transceivers trigger high-speed data transmission for applications such as video streaming, virtual reality, and augmented reality.

By Type

By Form Factor

By Wavelength

By Distance

By 5G Infrastructure

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

July 2024