January 2025

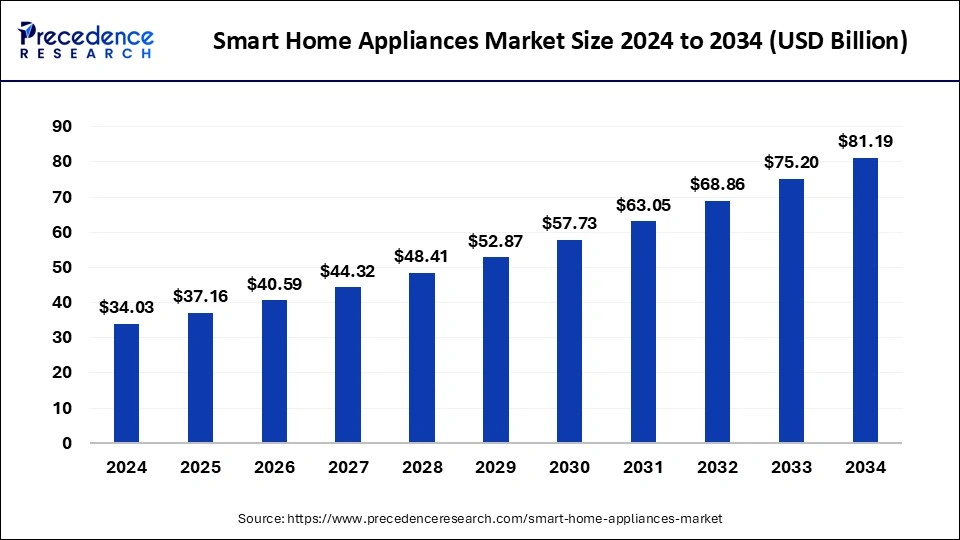

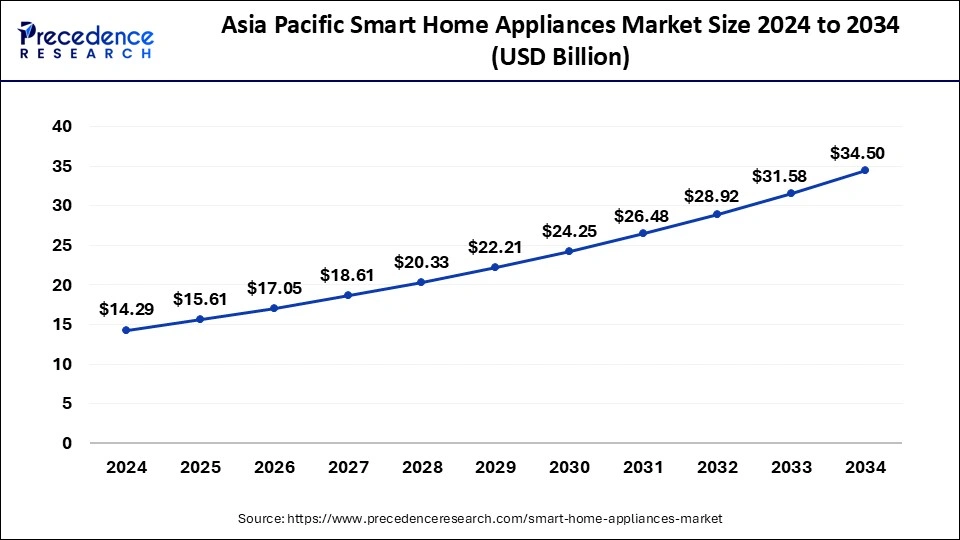

The global smart home appliances market size is calculated at USD 37.16 billion in 2025 and is forecasted to reach around USD 81.19 billion by 2034, accelerating at a CAGR of 9.08% from 2025 to 2034. The Asia Pacific smart home appliances market size surpassed USD 15.61 billion in 2025 and is expanding at a CAGR of 9.21% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global smart home appliances market size was estimated at USD 34.03 billion in 2024 and is predicted to increase from USD 37.16 billion in 2025 to approximately USD 81.19 billion by 2034, expanding at a CAGR of 9.08% from 2025 to 2034. The smart home appliances market is driven by the rising interest in energy-saving appliances.

The Asia Pacific smart home appliances market size was exhibited at USD 14.29 billion in 2024 and is projected to be worth around USD 34.50 billion by 2034, poised to grow at a CAGR of 9.21% from 2025 to 2034.

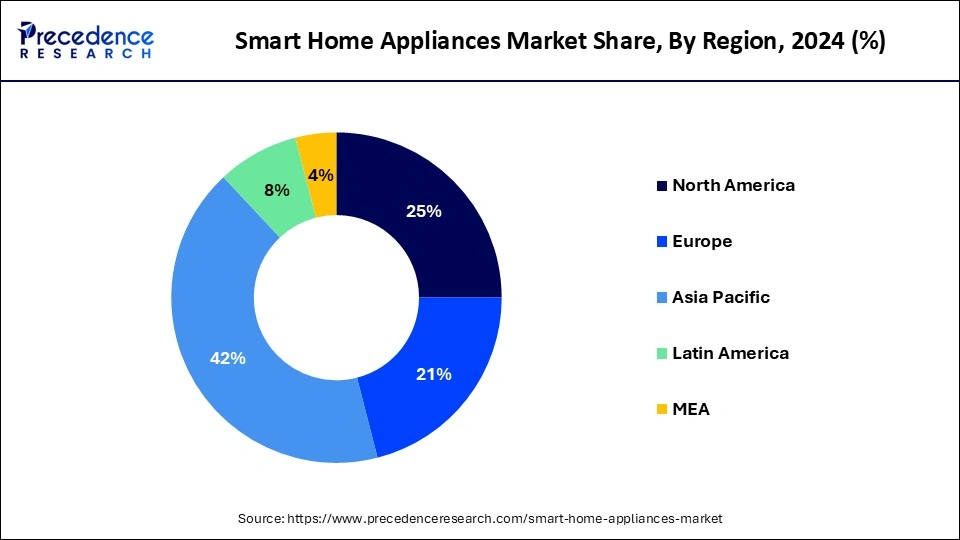

Asia Pacific dominated in the smart home appliances market in 2024. The middle class has expanded due to rapid economic expansion, especially in China, India, and Southeast Asia. For the sake of protection and convenience, this group is becoming increasingly prepared to spend money on smart home technologies. These nations are becoming increasingly urbanized, which has increased demand for space-saving, intelligent, and practical household appliances. Governments offer tax breaks and subsidies to producers and users of smart home products. Additionally, they provide grants and money to research institutes and startups concentrating on innovative technology developments.

North America is expected to grow at the fastest rate in the smart home appliances market during the forecast period. Customers are more prepared to spend money on high-end smart home appliances with cutting-edge features and benefits in North America due to the region's generally better standard of living and disposable income levels. The demand for smart home appliances with time-saving features and remote-control capabilities is driven by changes in lifestyle, such as the rise in dual-income homes and the need for convenience.

The consumer electronics segment that manufactures cutting-edge features, including sensors, automated control systems, and networking capabilities like Wi-Fi and Bluetooth, is known as the "smart home appliances market." These appliances are intended to improve overall performance, energy efficiency, and convenience by integrating with smart home ecosystems.

By enabling remote control and monitoring through smartphone apps or voice assistants, smart appliances provide convenience to their customers. They can save time and effort by automating temperature control, operation scheduling, and alerting users to maintenance requirements. Popular smart home platforms (including Google Home, Amazon Alexa, and Apple HomeKit) are frequently compatible with these appliances, allowing easy integration and control with other linked devices. This connectivity improves the user experience and overall home automation.

| Report Coverage | Details |

| Market Size by 2034 | USD 81.19 Billion |

| Market Size in 2025 | USD 37.16 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.08% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing adoption of home automation systems

Smart home appliances are made to maximize energy use by modifying usage habits in response to human behavior and real-time data. Smart washers can optimize water usage based on load size, smart thermostats can alter occupancy patterns, and smart refrigerators can modify cooling settings during off-peak hours. Because they use less energy overall, these efficiencies minimize energy bills and promote environmental sustainability.

Home automation is becoming increasingly popular as people age and need help with everyday chores and accessibility. For older or differently abled people, smart home appliances with features like voice control and automated routines improve independence and quality of life. This drives the growth of the smart home appliances market.

Advancements in Artificial Intelligence (AI)

AI is a fundamental component of smart homes' networked Internet of Things (IoT) ecosystem. Artificial intelligence (AI) algorithms facilitate smooth communication and coordination between many appliances by managing and analyzing data from sensors and devices. Because of their connectivity, appliances may function intelligently together in situations like this. For instance, a home security system powered by artificial intelligence (AI) can instantly change the lighting and notify the owner of any risks it detects.

High initial cost

Installing and configuring smart home gadgets can incur additional fees in addition to the purchase price. Professional installation could be necessary for some devices, raising the total cost. To incorporate these appliances into their current smart home ecosystem, consumers might also need more hubs or accessories, raising the initial cost even more.

It is still common for consumers to be ignorant of the features and advantages of smart home products. Another critical factor is preferences; some users value price and basic features more than the sophisticated features that smart appliances can offer. This limits the growth for the smart home appliances market.

Integration with IoT

Energy conservation can be facilitated by IoT-enabled appliances, which optimize energy usage by utilizing real-time data and user behavior. By decreasing energy waste, this capability helps consumers' utility bills and promotes environmental sustainability efforts. IoT has many advantages, but there are privacy and data security risks. Strong security measures must be put in place by developers and manufacturers to safeguard user information and stop illegal access to linked devices. This opens an opportunity for the smart home appliances market.

New product launches

New product launches meet the growing consumer demand for innovative and advanced technology in their homes, offering convenience, efficiency, and enhanced user experiences. Launching new products allows companies to differentiate themselves from competitors, showcasing unique features and cutting-edge technologies that attract tech-savvy consumers. As the adoption of smart home technology increases, new product launches cater to early adopters and tech enthusiasts, driving market growth and expanding the customer base. Many consumers look to upgrade their existing home systems with the latest smart appliances, creating a continuous demand for the newest products on the market.

The smart washing machines segment dominated in the smart home appliances market in 2024. Smartphone apps help owners of contemporary smart washing machines remotely operate and monitor them, thanks to their Wi-Fi and Bluetooth capabilities. Voice control and automation are also made possible by these machines' smooth integration with other smart home ecosystems and devices, including Google Assistant, Apple HomeKit, and Amazon Alexa.

Urban populations are more tech-savvy than ever and want connected, efficient, and convenient smart appliances. The need for smart washing machines is fueled by the growing number of smart homes adopted in urban areas. Advanced cleaning technologies such as steam cleaning, allergen removal, and high-temperature washes are prominent in smart washing machines, catering to the growing consumer demand for health and hygiene.

There is a strong market demand for smart washing machines due to their practical benefits, with consumers willing to invest in appliances that offer time-saving and efficiency-enhancing features. Leading appliance brands have focused heavily on developing and marketing smart washing machines, increasing their availability and consumer awareness, and driving segment growth.

The smart air purifiers segment is observed to be the fastest growing in the smart home appliances market during the forecast period. Artificial Intelligence (AI) and Internet of Things (IoT) technology are now features of smart air purifiers. Due to these developments, the devices can now automatically alter their operation to provide adequate air purification based on real-time air quality monitoring. Smart sensors that identify allergies, pollutants, and other airborne particles are a feature of modern air purifiers. Connecting to household Wi-Fi networks makes it possible for smartphones and smart home ecosystems like Apple HomeKit, Google Assistant, and Amazon Alexa to be used for remote control and monitoring.

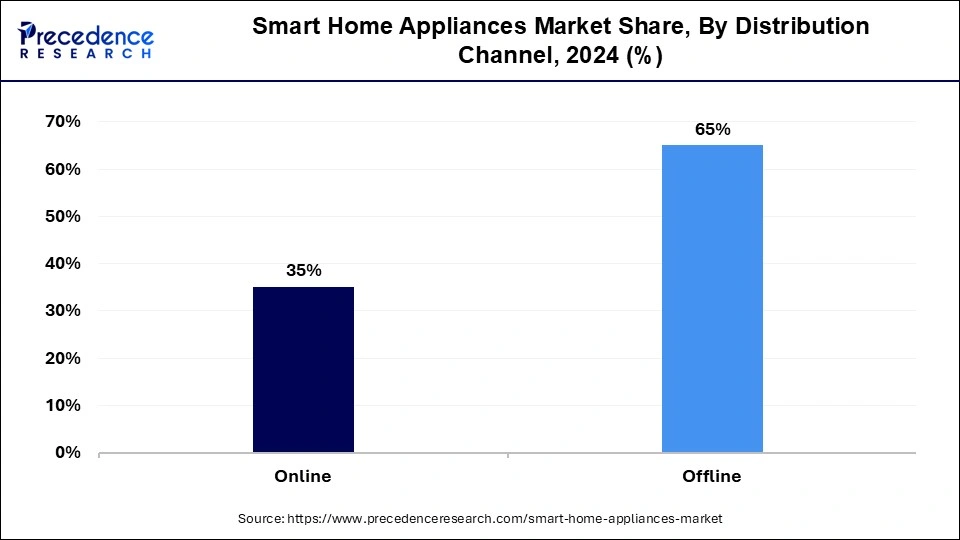

The offline segment dominated in the smart home appliances market in 2024. Consumers appreciate being able to view, feel, and operate smart home gadgets before making a purchase. This tactile feeling guarantees the functionality and quality of the product. Instead of waiting for their goods to arrive from online retailers, shoppers may take their products home right away. Brick-and-mortar establishments frequently have established reputations that foster customer confidence. Many consumers would rather purchase pricey goods, such as smart home appliances, from reputable merchants.

The online segment is observed to be the fastest growing in the smart home appliances market during the forecast period. Increased access to online shopping platforms has been made possible by the global expansion in internet usage. The number of individuals who can now use the Internet has significantly increased, especially in developing countries. This has increased the potential client base for online sales of smart home products. Customers can now buy smart home equipment online more quickly because of the significant infrastructure investments made by major e-commerce platforms like Amazon, Alibaba, and local businesses. These marketplaces provide a large selection of goods, affordable prices, and practical delivery choices.

By Product

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

February 2025

February 2024