July 2024

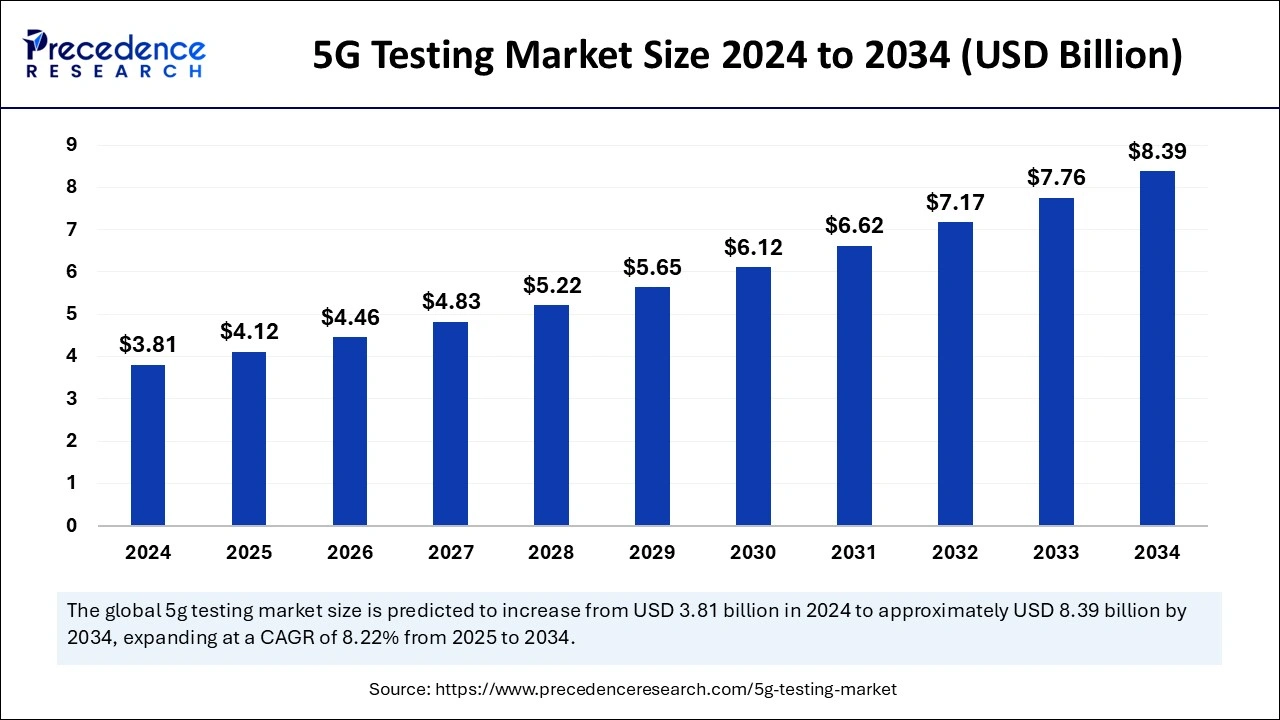

The global 5G testing market size is calculated at USD 4.12 billion in 2025 and is forecasted to reach around USD 8.39 billion by 2034, accelerating at a CAGR of 8.22% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global 5G testing market size was estimated at USD 3.81 billion in 2024 and is predicted to increase from USD 4.12 billion in 2025 to approximately USD 8.39 billion by 2034, expanding at a CAGR of 8.22% from 2025 to 2034. The market growth is attributed to the increasing demand for high-speed, low-latency connectivity and the rapid deployment of 5G networks across key regions.

Artificial Intelligence (AI) drives transformative change by accelerating development in the 5G testing market while improving innovation alongside operational efficiency. The combination of AI solutions automates network testing through technology that analyzes signals and optimizes performance alongside identifying anomalies. Real-time monitoring tools, along with diagnostic features, help focus fast identification and resolution processes for 5G infrastructure challenges. Machine learning algorithms help companies execute predictive analytics, which allows organizations to recognize network problems ahead of time, prevent downtime, and enhance overall system reliability.

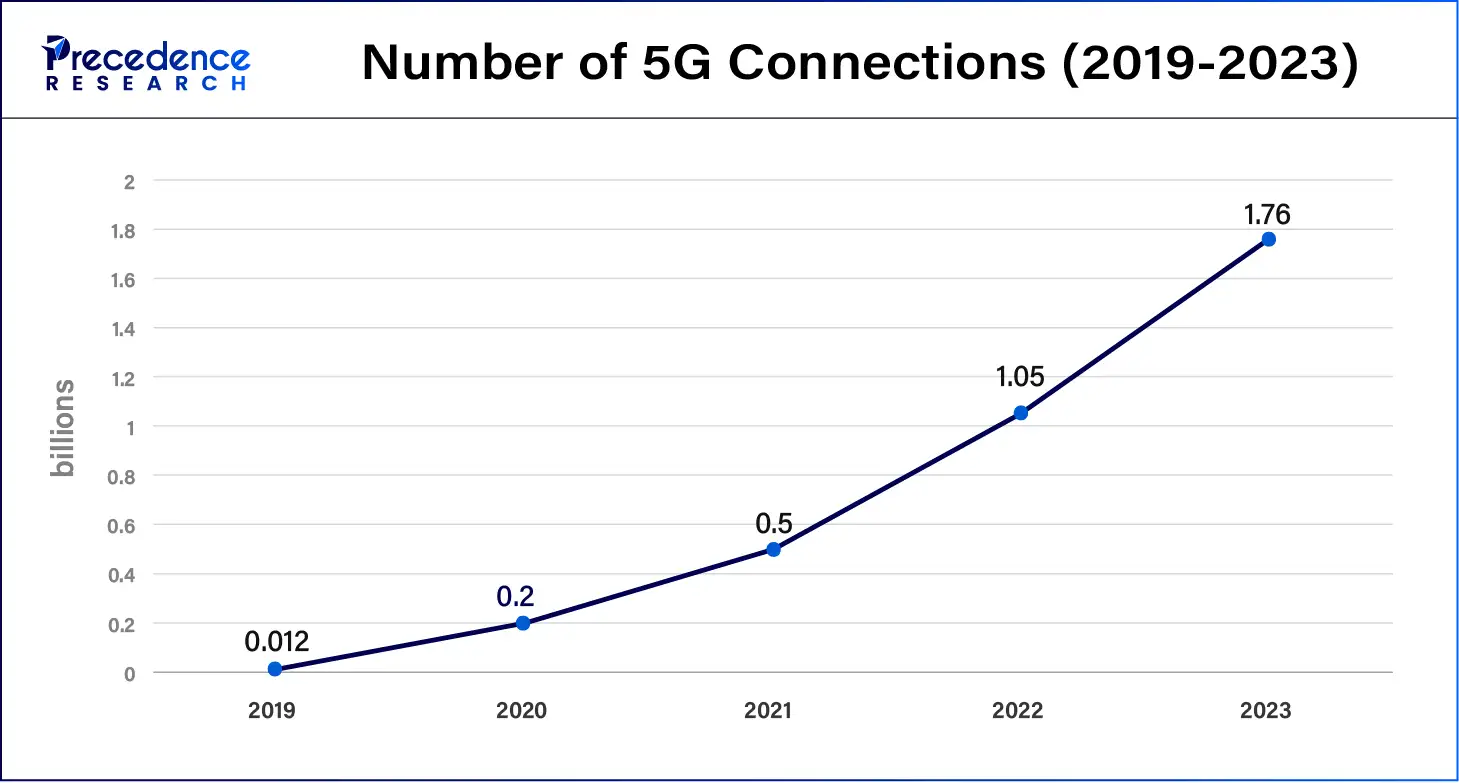

The growing installation of 5G networks around the globe creates tremendous opportunities for 5G testing market expansion. Network infrastructure investments are substantial, as telecom operators need to satisfy the growing requirements for fast connections and short-latency applications with better capacity capabilities. By 2025, international 5G subscriptions are projected to reach 2.8 billion, according to the International Telecommunication Union (ITU).

Telecommunication operators need testing solutions with advanced capabilities to verify performance metrics from network slicing components alongside edge computing elements alongside beamforming technology capabilities. These testing solutions function as hardware and software tools to validate 5G networks against established performance requirements and compliance standards. The fast-paced installation of 5G networks mandates robust assessments of new frequencies together with millimeter-wave bands, which generates a need for purpose-built testing equipment.

| Report Coverage | Details |

| Market Size by 2034 | USD 8.39 Billion |

| Market Size by 2025 | USD 4.12 Billion |

| Market Size in 2024 | USD 3.81 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.22% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, End-user Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Accelerating 5G deployments

Increasing deployment of 5G networks worldwide is anticipated to propel the 5G testing market. In 2024, Europe has the most extensive 5G coverage, with 68% of its population connected, followed by the Americas at 59%, according to predictions from the International Telecommunication Union (ITU). High-income countries lead the global 5G network, as numerous technical technologies deployment is growing. An active partnership between governments and organizations supports these developments through strategic support along with funding resources. In 2023, the UK government launched a £40 million fund to unlock 5G benefits across the country, aiming to drive adoption and innovation.

Regulatory and standardization challenges

Impede due to regulatory and standardization challenges in global 5G testing market. A lack of global market standards along with regulatory requirements proves to be blockers for business expansion. Market growth faces partial delays, as there exist no universally recognized testing standards or regulatory frameworks for 5G networks. Global deployment of 5G services and testing methods appears complicated as multiple regions choose their specific testing protocols.

Telecom operators, alongside testing solution providers, encounter multiple regulatory environments that make it complex to integrate testing processes throughout different borders. Standards that vary inconsistently between regulatory jurisdictions actively create delays for both robust, widespread testing solutions and market entry expenses and timing. Regions with developing 5G requirements and policies face substantial growth obstacles because of their disjointed regulatory standards.

Rising R&D investments by telecom operators

Rising investment in research and development (R&D) by telecom operators is expected to create immense opportunities for the 5G testing market. Recent increases in telecom operators' research and development investments have created new opportunities for advanced testing solutions. 5G service development and network performance improvement drive telecom operators to spend more money on research and development activities.

Telecom operators invest heavily in 5G testing tools, which creates major opportunities for firms in the 5G testing market to develop innovative solutions for complex testing requirements, including network slicing and edge computing alongside low-latency applications. Next-generation services and emerging technologies create an optimum setting for testing solutions to develop successfully.

The hardware segment held a dominant presence in the 5G testing market in 2024 due to the escalating demand for advanced testing solutions to support the global rollout of 5G networks. The 5G infrastructure deployment required large investments from operators who purchased high-performance network testing devices involving top-quality equipment such as network analyzers and signal generators along with test instruments. The stringent demands of complex 5G networks, which require network slicing millimeter-wave testing and low-latency applications, generated significant market demand for specialized hardware devices.

The service segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034 due to the increasing need for end-to-end testing, network optimization, and consulting services. Service providers within telecom and network operators need generalized solutions that cover all essential areas of 5G assessment, which includes device tests, network performance assessment, and interoperability protocols. Service providers must assume central responsibility to contribute expertise while enhancing network stability and managing safety risks that come with implementing global 5G networks.

The telecom service providers segment accounted for a considerable share of the 5G testing market in 2024. The rollout of 5G networks led to significant demand for testing solutions as these providers strive to ensure network reliability and performance for users. Telecom companies are spending high investments for their network infrastructure enhancements, which fueled strategic investments into advanced testing instruments. The massive online gender disparity calls for telecom providers to extend 5G network access fairly while pushing the development of advanced testing solutions to preserve network reliability and address inclusiveness.

The telecom equipment manufacturers segment is anticipated to grow with the highest CAGR during the studied years. These manufacturers play a critical role in producing the infrastructure required for 5G networks. Due to network slicing-edge computing and advanced antenna advancement, testing equipment requirements have surged. Furthermore, there is faster development as telecom equipment manufacturers work together with telecom operators to introduce next-generation 5G base stations alongside small-cell technologies that need specific performance testing.

North America dominated the global 5G testing market by registering the highest share in 2024 due to the rapid advancements in 5G deployment and substantial investments from telecom operators. U.S. cellular operators Verizon AT&T and T-Mobile are leading the global deployment of 5G technology by growing their infrastructure rapidly. The demand for testing solutions increased to match the progression of the millimeter-wave spectrum and small-cell deployment technology. Moreover, North America's focus on next-generation technologies, ranging from autonomous vehicles to IoT to smart cities, resulted in comprehensive investments in 5G testing tools dedicated to achieving high-speed and low-latency network performance.

Asia Pacific is projected to host the fastest-growing 5G testing market in the coming years. Countries like China, Japan, South Korea, and India are at the forefront of 5G deployments, fueled by government initiatives and increasing consumer demand for high-speed connectivity. A wave of 5G investment by Huawei and ZTE drives significant demand for testing solutions in the market. The regional domination of Asia Pacific's telecom equipment vendors and manufacturers, coupled with growing device and network testing requirements, creates an expanding need for 5G testing solutions.

The 5G subscriber count in China continues to rise rapidly, driven by major advances in network deployment according to the China Academy of Information and Communications Technology (CAICT), which places China in the lead position as the world's largest 5G market.

By Offering

By End-user Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

April 2024

February 2025

April 2025