December 2024

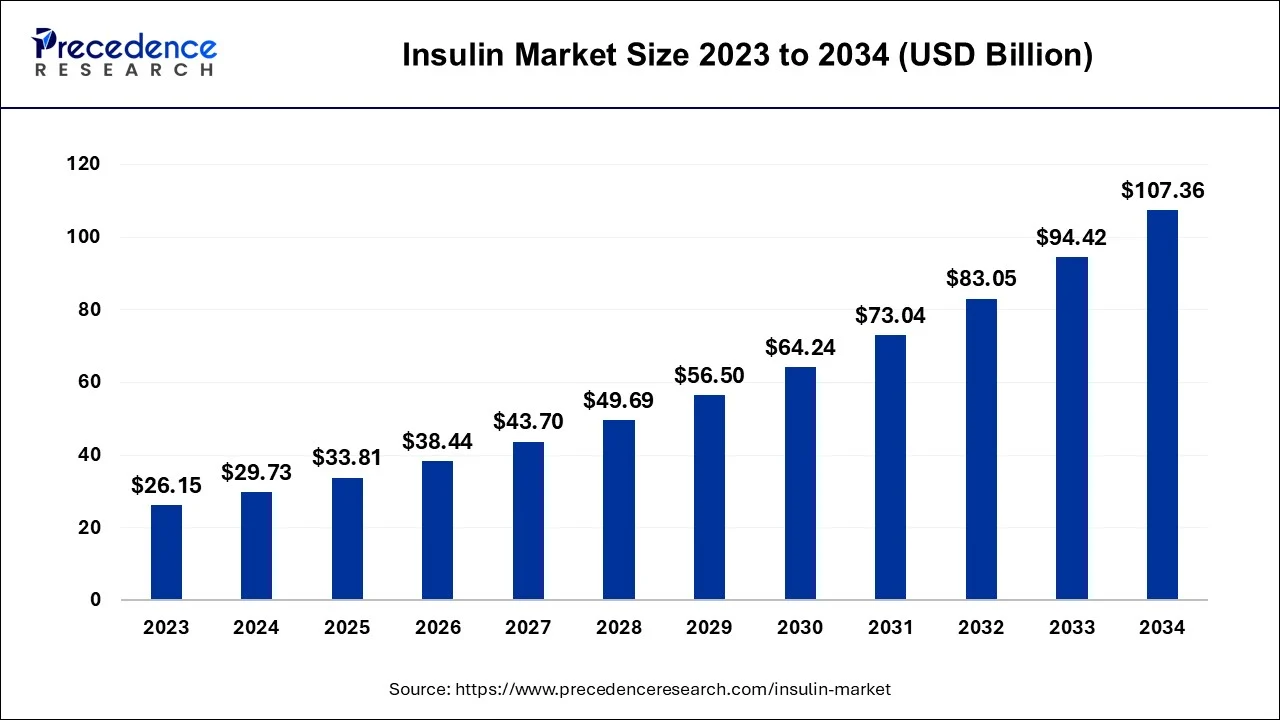

The global insulin market size is estimated at USD 29.73 billion in 2024, grew to USD 33.81 billion in 2025 and is predicted to surpass around USD 107.36 billion by 2034, expanding at a CAGR of 13.70% between 2024 and 2034.

The global insulin market size accounted for USD 29.73 billion in 2024 and is anticipated to reach around USD 107.36 billion by 2034, growing at a CAGR of 13.70% between 2024 and 2034.

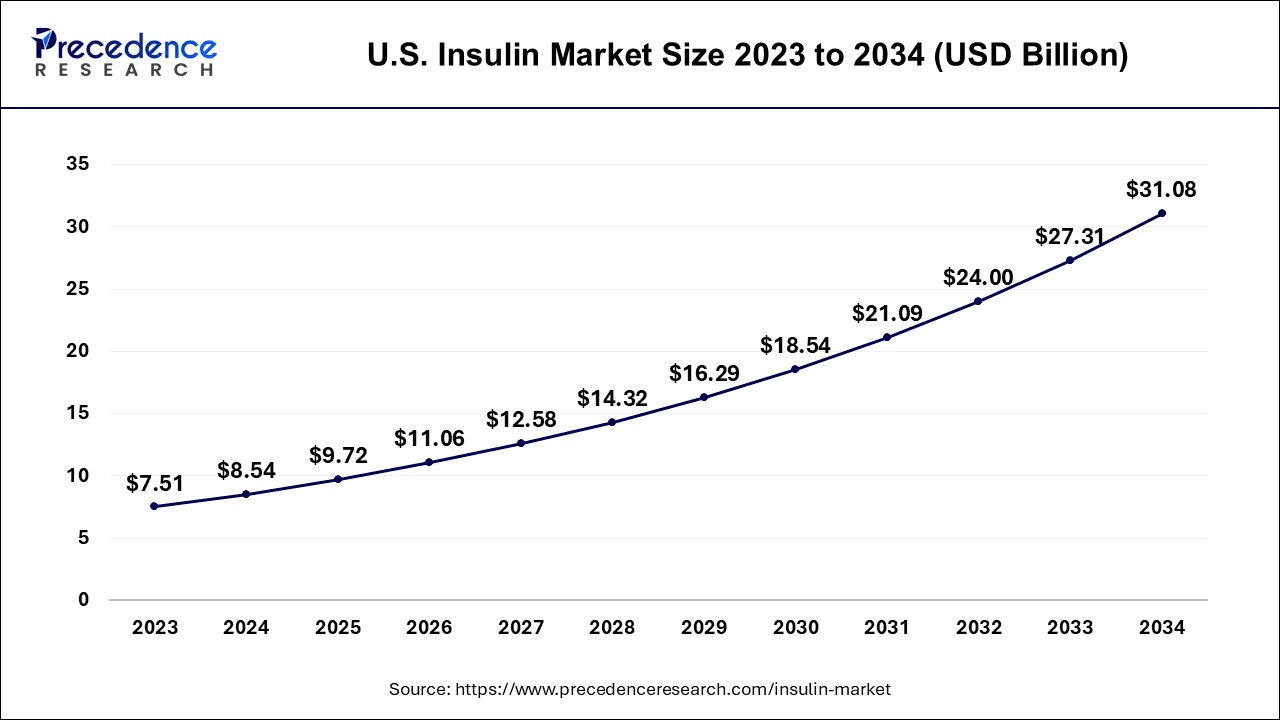

The U.S. insulin market size is estiated at USD 8.54 billion in 2024 and is expected to be worth around USD 31.08 billion by 2034, growing at a CAGR of 13.79% from 2024 to 2034.

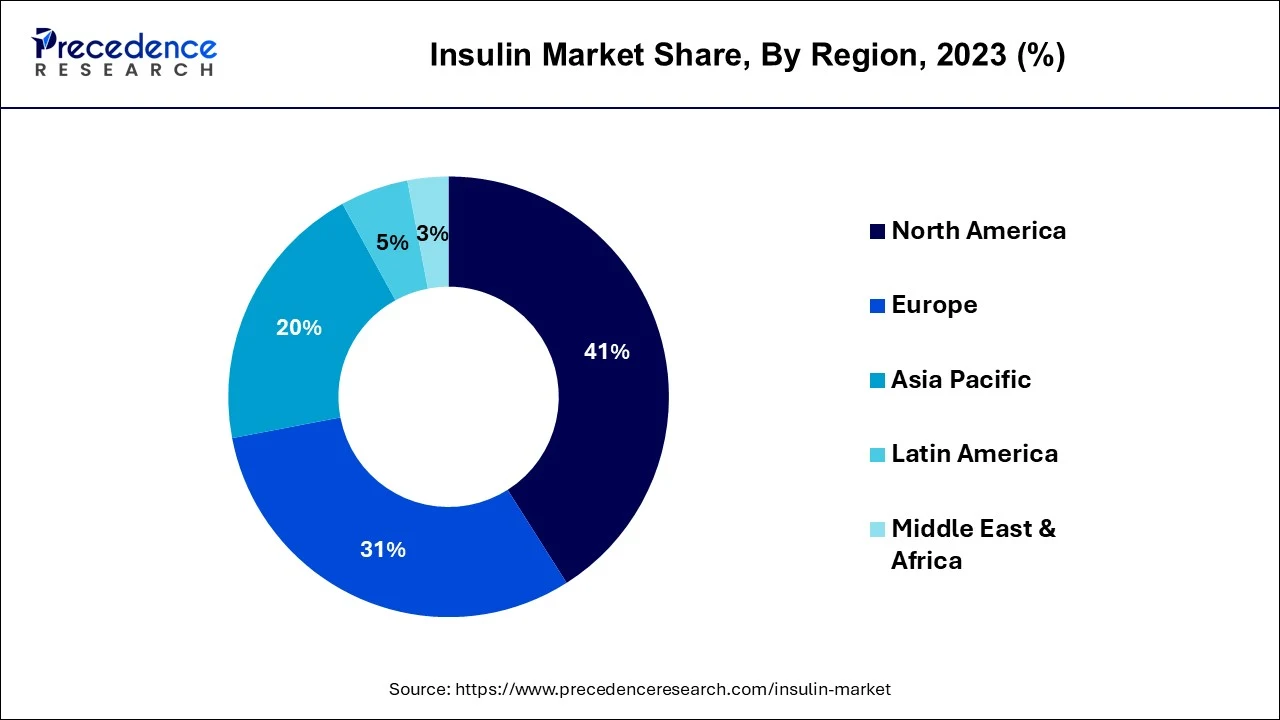

North America has held largest revenue share of 41% in 2023. The North American insulin market is characterized by a robust demand for diabetes management solutions. Insulin, a life-saving hormone for individuals with diabetes, is witnessing a trend towards advanced delivery mechanisms such as insulin pens and pumps. Moreover, there is a growing preference for long-acting and ultra-rapid-acting insulin analogs, emphasizing improved convenience and efficacy. The region is also witnessing a rising focus on personalized insulin therapies, with an emphasis on precision medicine approaches.

Asia Pacific is estimated to observe the fastest expansion. In Asia Pacific, the insulin market is defined by its rapidly expanding diabetic population. This trend has led to a surge in demand for affordable and accessible insulin products. Biosimilar insulins have gained traction, aiming to provide cost-effective alternatives. Additionally, Asia Pacific is witnessing a shift towards telemedicine and digital solutions for diabetes management, enabling better patient care and access to insulin therapies in remote and underserved areas. Regulatory reforms and increasing awareness about diabetes care are further shaping the insulin market in this region.

In Europe, the insulin market is marked by a growing emphasis on personalized medicine and innovative delivery systems. The region's healthcare systems support a wide range of insulin options, including biosimilars and cutting-edge therapies. Stricter regulations on insulin pricing and accessibility continue to shape the market landscape while promoting affordability and quality care.

The insulin market plays a vital role in the pharmaceutical sector by producing and supplying insulin, a hormone essential for managing diabetes. It comprises diverse insulin types, such as fast-acting, long-acting, and intermediate-acting formulations. Key factors propelling this market are the escalating global diabetes prevalence and the expanding elderly population. These demographics drive insulin demand, making it a pivotal component of healthcare.

With various insulin delivery innovations and the development of biosimilar products, the market continues to evolve, but it also faces challenges in ensuring equitable access to insulin and navigating regulatory complexities. This process helps maintain the body's blood sugar balance, preventing it from reaching dangerous levels. Insulin deficiency, often associated with conditions like diabetes, can lead to high blood sugar and various health complications, necessitating external insulin supplementation for management.

| Report Coverage | Details |

| Growth Rate from 2024 to 2024 | CAGR of 13.70% |

| Market Size in 2024 | USD 29.73 Billion |

| Market Size by 2034 | USD 107.36 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising diabetes prevalence and innovative insulin delivery

The relentless surge in diabetes prevalence serves as a potent force propelling the insulin market to unprecedented heights. With changing lifestyles, poor dietary choices, and increasing rates of obesity, diabetes has become a global health crisis. As more people require insulin to control their blood sugar levels, the demand for this life-saving hormone has reached new levels. This trend is not limited to developed regions; emerging economies are also grappling with rising diabetes cases, creating a vast global market. The insulin market responds to this demand by continually expanding production and research to meet the varied needs of diabetes patients.

The insulin market witnesses a surge in demand due to continuous innovations in insulin delivery methods. Smart insulin pens, wearable insulin pumps, and advanced monitoring systems are transforming how patients manage their diabetes. These innovations enhance the convenience, precision, and overall patient experience of insulin therapy, leading to increased market demand. Moreover, these modern delivery solutions address longstanding challenges related to patient adherence and insulin dosing accuracy.

The convergence of technology and healthcare is making insulin therapy more accessible and manageable, resulting in a heightened demand for insulin products. The insulin market, driven by these innovative delivery methods, is at the forefront of providing patients with effective and convenient tools for diabetes management.

Patient adherence, affordability and accessibility

Patient adherence, or the consistent and proper use of prescribed insulin regimens, remains a significant challenge within the insulin market. Non-adherence to treatment plans can lead to inadequate glycemic control, complications, and increased healthcare costs. Patients may skip doses, use insulin improperly, or discontinue treatment due to factors like injection discomfort or fear of hypoglycemia. Addressing patient education, support, and reducing barriers to adherence is crucial to enhancing treatment effectiveness and overall market demand.

The affordability of insulin is a pressing concern that restrains market demand. The rising costs of insulin production and pricing disparities between different regions can limit access for patients, particularly those without adequate insurance coverage. Many individuals face financial burdens when purchasing insulin, leading to medication rationing, suboptimal diabetes control, and adverse health outcomes. Affordable insulin alternatives, such as biosimilars and government initiatives, are essential to alleviate these affordability challenges and ensure equitable access to this life-saving medication.

Moreover, limited access to insulin is a critical constraint affecting market demand, particularly in low-income regions and underserved communities. Access to healthcare facilities, diagnostic tools, and insulin delivery options can be limited, hindering timely and appropriate diabetes management. Expanding healthcare infrastructure, increasing insulin affordability, and fostering telemedicine and remote healthcare services are strategies that can address accessibility issues, enhancing market demand while improving the quality of care for people with diabetes.

Biosimilar production and telemedicine integration

The surge in biosimilar insulin production significantly boosts the demand for insulin in the market. Biosimilar insulins offer cost-effective alternatives to branded counterparts, making diabetes management more affordable and accessible. As healthcare systems and patients seek to control the rising costs of diabetes treatment, biosimilars address these concerns while maintaining quality and efficacy. This cost-efficiency drives patient adoption, supporting market growth. Furthermore, biosimilar production diversifies insulin options, providing a broader range of choices for healthcare providers and patients, thereby expanding the insulin market.

The integration of telemedicine into diabetes care is reshaping the insulin market. Telemedicine enhances patient care by enabling remote consultations and monitoring. It promotes adherence to insulin regimens and provides real-time support for patients. By incorporating telehealth solutions, the market expands its reach to underserved areas, making diabetes management more convenient and accessible.

Telemedicine complements insulin treatment by offering patient education, data-driven diabetes management, and regular follow-ups, ultimately improving patient outcomes. This integration not only improves patient care but also fuels market demand as it meets the evolving needs of both patients and healthcare providers in the dynamic healthcare landscape.

According to the product, the long-acting insulin segment has held a 48% revenue share in 2023. Long-acting insulin, also known as basal insulin, provides a slow, steady release of insulin over an extended period. This type of insulin helps maintain consistent blood sugar levels between meals and overnight. In the insulin market, there is a growing interest in more convenient, once-daily, and ultra-long-acting formulations to simplify diabetes management and enhance patient compliance.

The rapid-acting insulin segment is anticipated to expand at a significant CAGR of 21.4% during the projected period. A rapid-acting insulin is a type of insulin designed for quick absorption into the bloodstream. It is typically administered just before or after meals to manage post-meal blood sugar spikes. Current trends in the insulin market indicate a rising demand for faster-acting formulations, facilitating better glycemic control for individuals with diabetes.

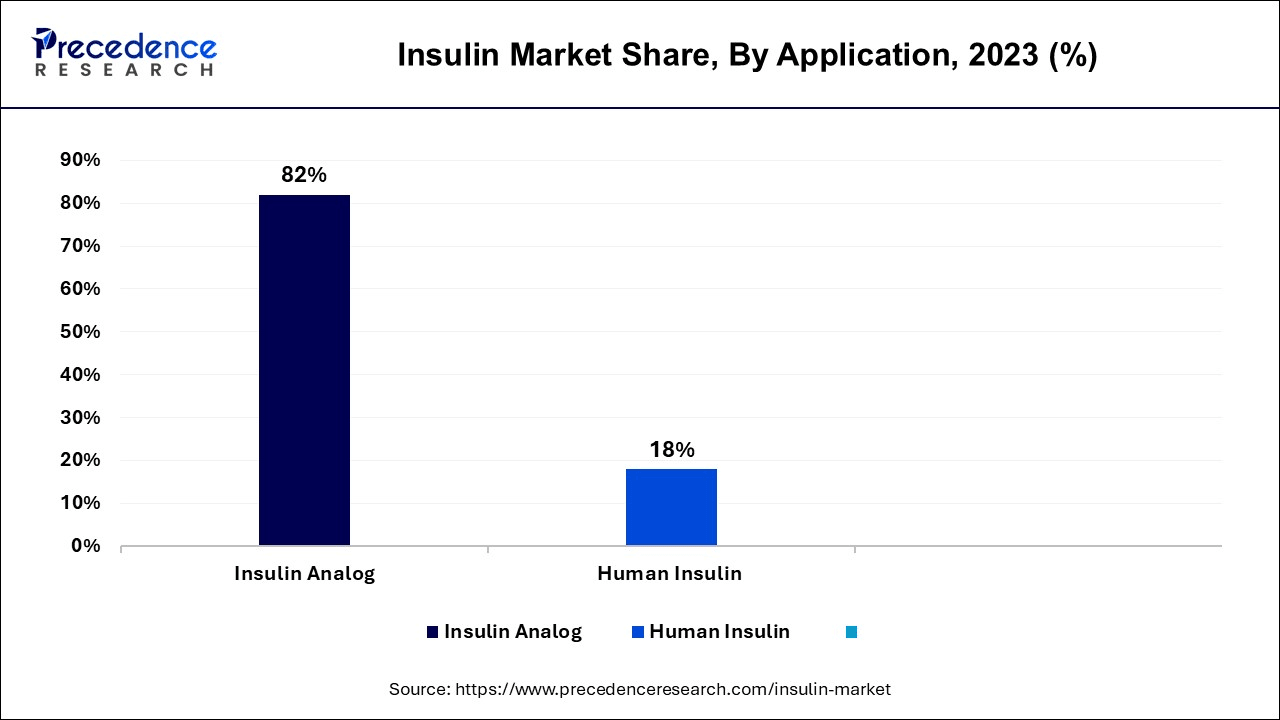

Based on the application, the insulin analog segment held the largest market share of 82% in 2023. Insulin analog is a synthetic form of insulin engineered to have specific properties tailored for individual patient needs. In the insulin market, there's a growing trend towards personalized diabetes management. Insulin analogs offer greater flexibility in dosing and are becoming increasingly popular for their ability to mimic natural insulin release. This trend reflects the pursuit of improved glycemic control and enhanced quality of life for diabetes patients.

On the other hand, the human Insulin segment is projected to grow at the fastest rate over the projected period. Human insulin, a biologically derived hormone, is a cornerstone in diabetes management. It is a replica of the insulin naturally produced by the human body. In the insulin market, the trend is shifting towards the adoption of recombinant DNA technology to produce human insulin, enhancing its availability and affordability. This technological advancement aligns with the demand for more cost-effective and accessible insulin treatments, particularly in developing regions.

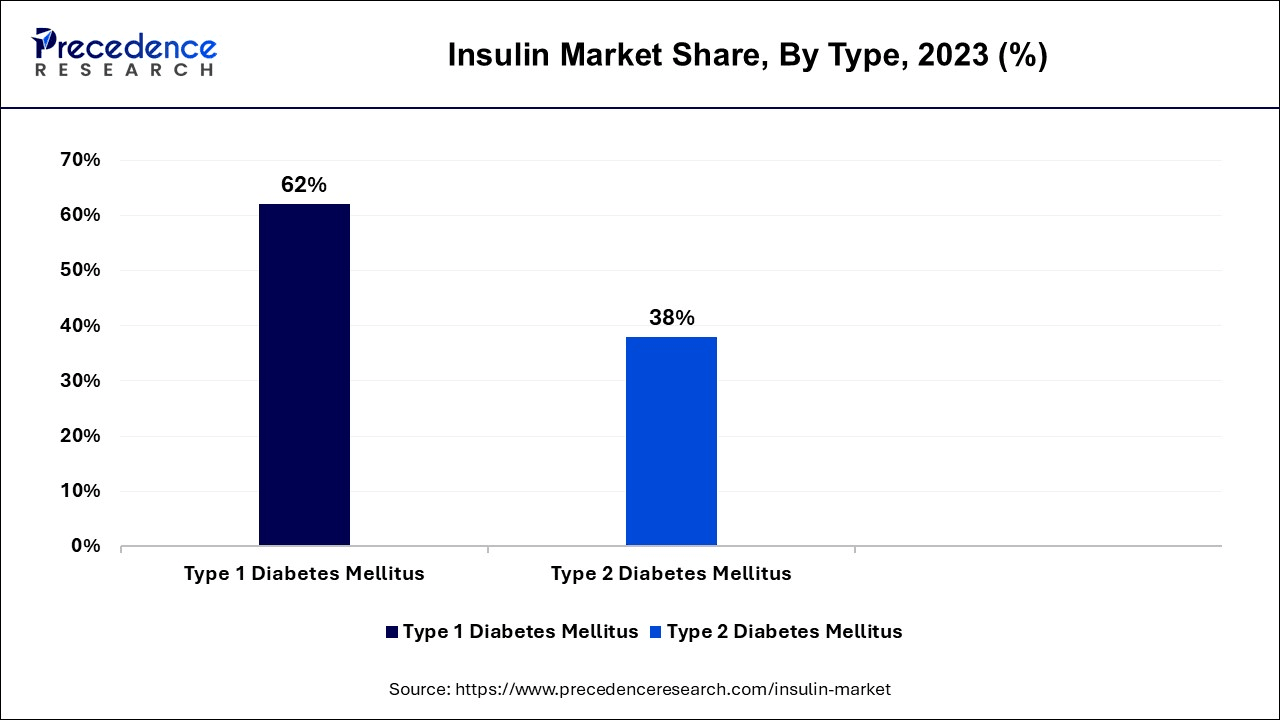

In 2023, the Type 1 diabetes mellitus segment had the highest market share of 62% based on the type. In the insulin market, Type 1 diabetes mellitus requires a continuous and dependable supply of insulin. Recent trends in this segment focus on the development of advanced delivery systems like insulin pumps and smart insulin pens. There is also a growing emphasis on enhancing the insulin's stability and duration of action. Personalized insulin regimens and telemedicine solutions are gaining traction to better manage insulin dosages and monitor glucose levels in this segment.

The type 2 diabetes mellitus segment is anticipated to expand at the fastest rate over the projected period. Type 2 diabetes mellitus in the Insulin market is witnessing an upsurge in demand, primarily due to the increasing prevalence of this form of diabetes. Current trends include the development of long-acting insulins, convenient pre-filled insulin pens, and more user-friendly injection devices. The market is moving towards more patient-centric approaches, focusing on self-management, education, and combination therapies to address the multifaceted nature of Type 2 diabetes.

Based on the distribution channel, the hospitals segment is anticipated to hold the largest market share of 76% in 2022. Hospitals play a pivotal role in the Insulin market by serving as a key distribution channel for this life-saving medication. Insulin, used to manage diabetes, is primarily dispensed in hospital settings for inpatients and individuals requiring immediate medical attention. Recent trends indicate a shift towards digitalization in hospitals, with electronic health records and automated medication dispensing systems streamlining the distribution process. Additionally, hospitals are increasingly emphasizing patient education on insulin administration and management, further enhancing patient care and outcomes.

On the other hand, the retail pharmacies segment is projected to grow at the fastest rate over the projected period. Retail pharmacies, both brick-and-mortar and online, are essential in ensuring convenient access to insulin for patients managing diabetes. These pharmacies provide insulin products for outpatient use, offering a wide range of insulin formulations and injection devices.

Current trends in the insulin market within retail pharmacies include expanded accessibility through online platforms, home delivery services, and the introduction of biosimilar insulins to address cost concerns. Patient-centric care models and personalized insulin management support are also on the rise, enhancing the overall patient experience in these settings.

Segments Covered in the Report

By Product

By Application

By Type

By Distribution Channel

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

August 2024

January 2025

August 2024