Acetylcysteine Market (By Type: Tablet, Tracheal Drip, Spray; By Application: Pharmaceuticals, Dietary Supplements, Personal Care, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

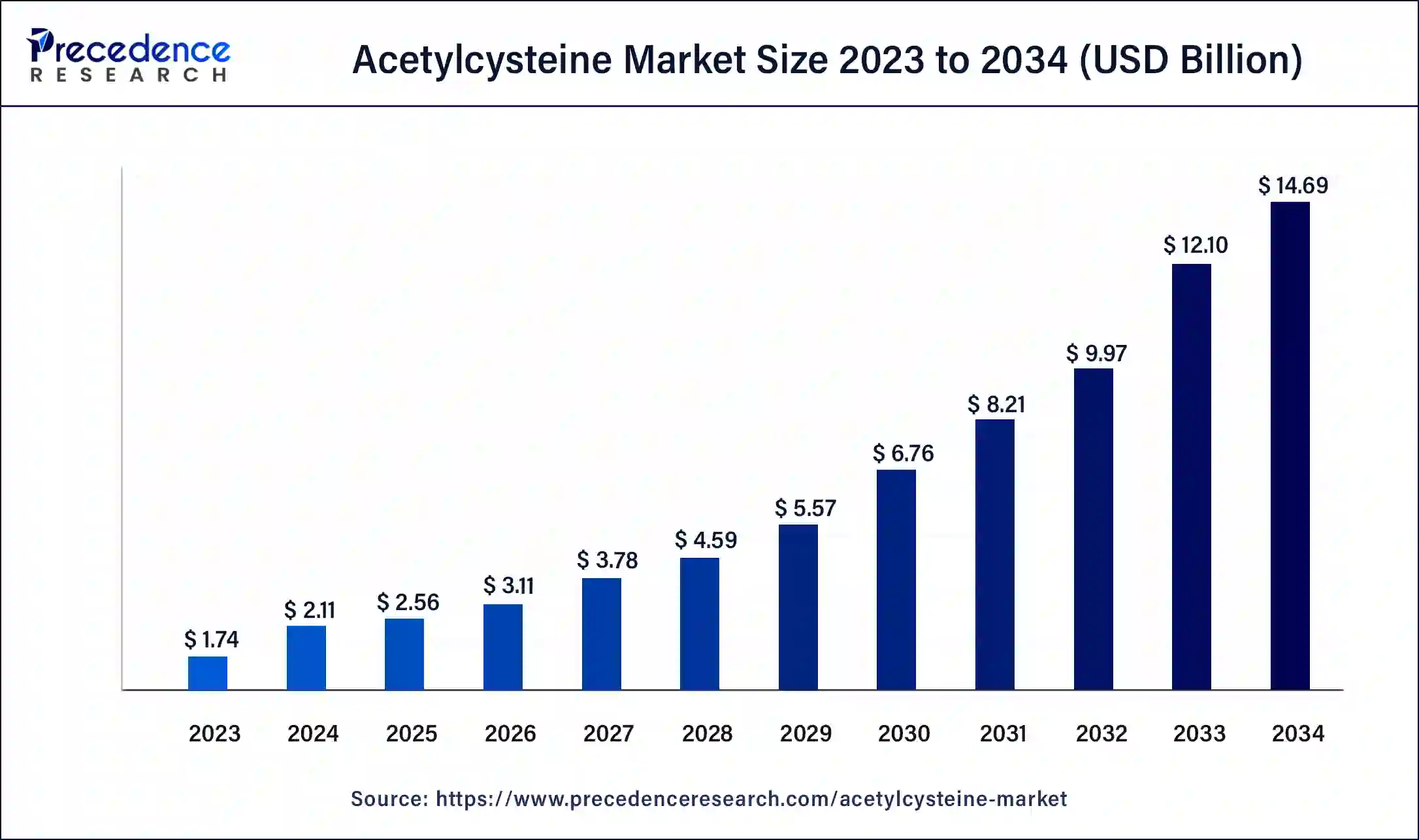

The global acetylcysteine market size was USD 1.74 billion in 2023, accounted for USD 2.11 billion in 2024, and is expected to reach around USD 14.69 billion by 2034, expanding at a CAGR of 21.4% from 2024 to 2034. The North America acetylcysteine market size reached USD 680 million in 2023.

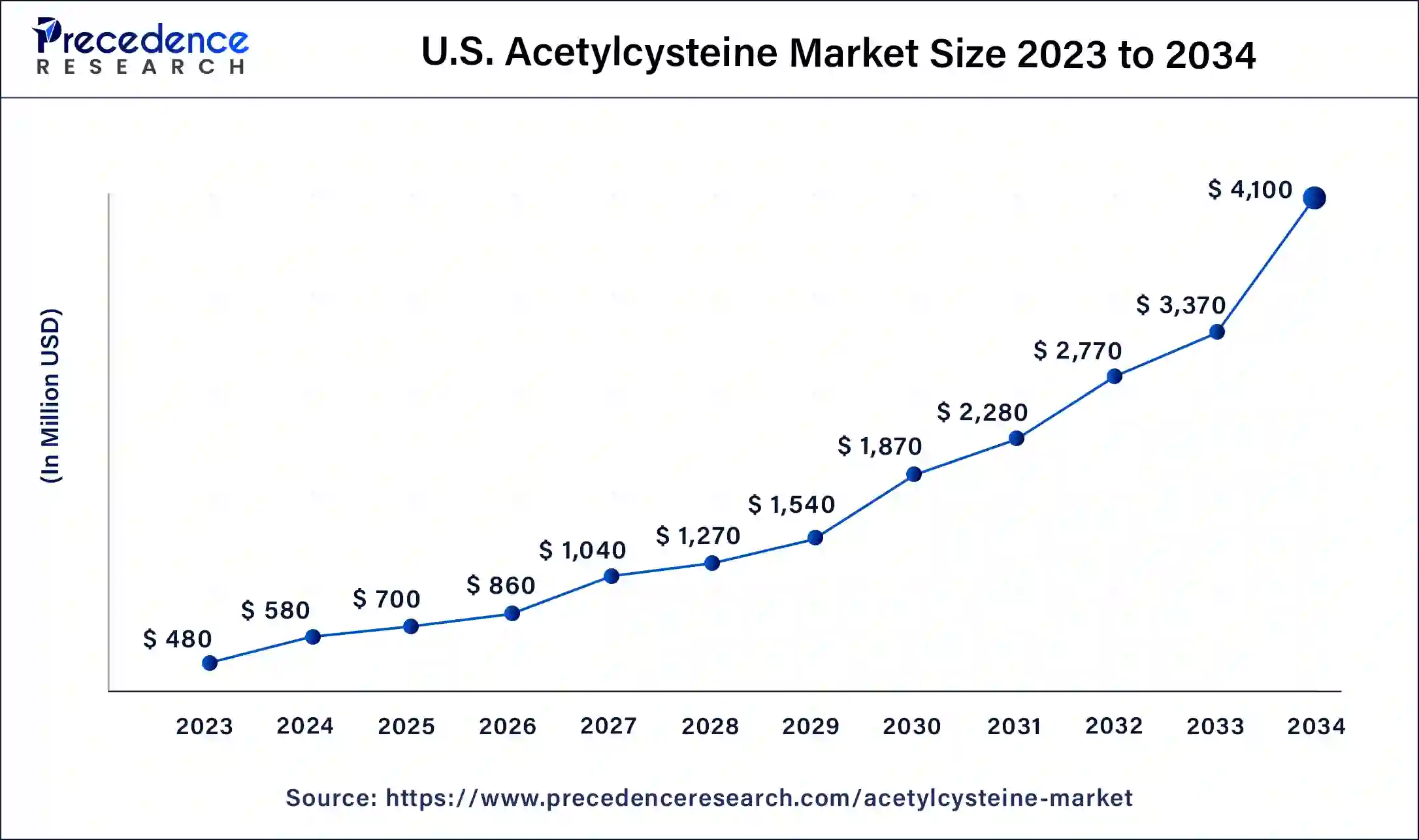

The U.S. acetylcysteine market size was estimated at USD 480.00 million in 2023 and is predicted to be worth around USD 4,100.00 million by 2034, at a CAGR of 21.6% from 2024 to 2034.

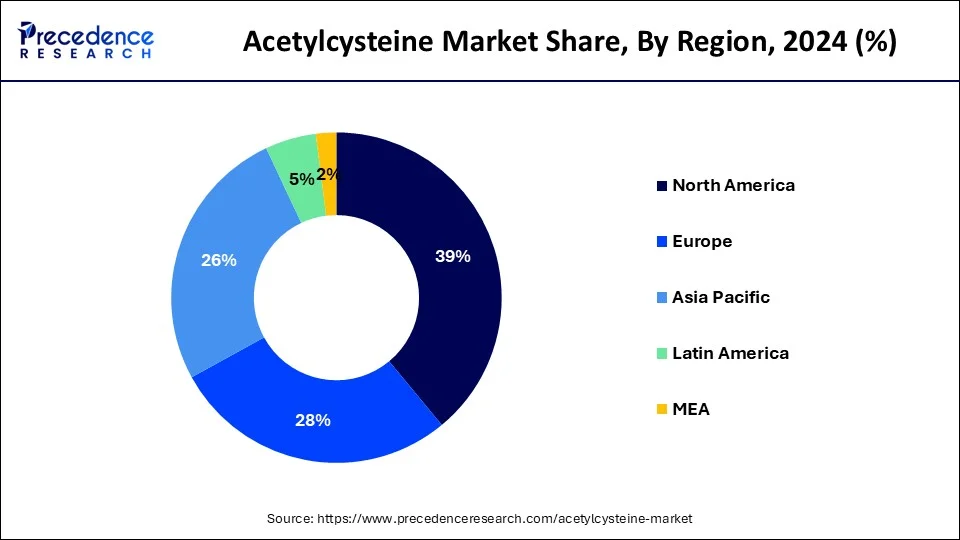

North America emerged as the dominating region in the acetylcysteine market in 2023, capturing the largest market share of 39%. This dominance is due to the increasing prevalence of respiratory conditions in the region. Acetylcysteine, available under various trade names, is widely used for acetaminophen overdose treatment, as both an injectable and oral agent, and as a mucolytic in inhalation form. Moreover, ongoing investigational studies explore its potential applications in liver failure, cancer treatment, and other medical conditions. With heightened awareness and significant investments from key industry players, North America is expected to witness substantial market growth in the forecast period, driven by the expanding therapeutic applications and rising demand for respiratory treatments.

In Europe, the increasing prevalence of chronic obstructive pulmonary disease (COPD) and cystic fibrosis has become a significant driver for the acetylcysteine market. With a robust presence of renowned pharmaceutical companies and research institutions, the region is at the forefront of developing and adopting advanced respiratory treatments, including acetylcysteine-based therapies. This favorable ecosystem fosters innovation and drives market growth as healthcare providers seek effective solutions for managing respiratory conditions.

Asia Pacific is estimated to expand at the fastest CAGR of 22.24% between 2023 and 2034 in the acetylcysteine market. The rising incidence of respiratory diseases, exacerbated by increasing pollution levels and a growing aging population, is driving the demand for respiratory treatments like acetylcysteine. Additionally, the region's improving economic conditions, rising disposable income levels, and expanding healthcare infrastructure contribute to the growing accessibility of respiratory care, further propelling market growth in the Asia-Pacific region.

The acetylcysteine market revolves around the production and distribution of a chemical compound, serving multiple therapeutic purposes in medical practice. Primarily, it is widely recognized for its efficacy in treating paracetamol (acetaminophen) overdoses. By increasing glutathione levels, an essential antioxidant in the body, acetylcysteine helps neutralize the toxic metabolites generated by paracetamol metabolism, thereby preventing liver damage and failure caused by overdose. Beyond its role in managing paracetamol toxicity, acetylcysteine is also utilized as a mucolytic agent in the treatment of various respiratory conditions. In chronic respiratory ailments like pneumonia and bronchitis, acetylcysteine works by reducing the viscosity of thick mucus, thereby facilitating its clearance from the airways and improving breathing.

Furthermore, acetylcysteine can be administered through different routes, including oral ingestion, injection, or inhalation as a mist, depending on the specific medical indication and patient requirements. It is even utilized to treat lactobezoar in newborns, a condition characterized by the accumulation of undigested milk in the stomach. While generally considered safe, acetylcysteine may elicit certain adverse effects, particularly when taken orally, such as nausea, vomiting, and skin irritation.

Moreover, although rare, instances of non-immune anaphylaxis have been reported following acetylcysteine administration. Hence, acetylcysteine remains a vital therapeutic agent in clinical practice, offering a multifaceted approach to addressing paracetamol overdoses and managing respiratory ailments characterized by excessive mucus production.

Acetylcysteine Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 21.4% |

| Global Market Size in 2023 | USD 1.74 Billion |

| Global Market Size in 2024 | USD 2.11 Billion |

| Global Market Size by 2034 | USD 14.69 Billion |

| U.S. Market Size in 2023 | USD 480 Million |

| U.S. Market Size by 2034 | USD 4,100 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Therapeutic agent in managing various respiratory conditions

Acetylcysteine stands out as a vital therapeutic agent in managing various respiratory conditions owing to its mucolytic and antioxidant properties. As the incidence of pulmonary diseases continues to rise globally, acetylcysteine's role in alleviating symptoms and improving outcomes becomes increasingly significant. In respiratory ailments such as chronic obstructive pulmonary disease (COPD), cystic fibrosis (CF), and tracheal drip, acetylcysteine plays a crucial role in mitigating symptoms and improving respiratory function. These conditions are characterized by the accumulation of thick, viscous mucus in the airways, leading to breathing difficulties and increased susceptibility to infections. Acetylcysteine's mucolytic action facilitates the breakdown of thick mucus, making it easier to expel from the airways.

By loosening mucus, acetylcysteine helps to alleviate coughing, chest congestion, and breathing difficulties, thereby improving the overall quality of life for patients with respiratory diseases. Moreover, acetylcysteine's antioxidant properties play a pivotal role in reducing inflammation and oxidative stress in the lungs. Inflammatory pathways and oxidative stress are key drivers of pulmonary diseases, exacerbating tissue damage and impairing respiratory function. By replenishing glutathione levels and combating oxidative stress, acetylcysteine helps to mitigate inflammation and protect lung tissue from damage. COPD, in particular, poses a significant health burden globally, affecting millions of individuals and ranking among the leading causes of death.

Acetylcysteine therapy offers a promising approach in managing COPD symptoms and slowing disease progression by targeting inflammation and oxidative stress, the underlying mechanisms contributing to COPD pathogenesis. Hence, acetylcysteine emerges as a valuable therapeutic intervention in the treatment of inflammatory pulmonary diseases. Its dual action as a mucolytic and antioxidant agent makes it a cornerstone in managing respiratory conditions, offering relief from symptoms and improving lung function, thereby enhancing the quality of life for patients battling pulmonary ailments. As the prevalence of these conditions continues to rise, the demand for acetylcysteine-based treatments is expected to escalate, driving the growth of the acetylcysteine market in the future.

High cost of treatment

The high cost of treatment presents a significant challenge and is expected to restrain the growth of the acetylcysteine market during the forecast period. Acetylcysteine, while being a highly effective medication for various respiratory conditions, can be costly for patients, especially those without adequate insurance coverage or access to healthcare services. The expense associated with acetylcysteine treatment includes not only the cost of the medication itself but also additional expenses such as medical consultations, diagnostic tests, and hospitalization in severe cases. For individuals with chronic respiratory conditions requiring long-term acetylcysteine therapy, the cumulative costs can be substantial, posing a financial burden on patients and their families.

Furthermore, the high cost of acetylcysteine treatment may limit access to care for underserved populations and those in low-resource settings, exacerbating disparities in healthcare access and outcomes. Patients may forego or delay treatment due to financial constraints, leading to worsening symptoms, disease progression, and diminished quality of life.

Moreover, healthcare systems and providers may face challenges in reimbursing the cost of acetylcysteine therapy, particularly in settings where healthcare budgets are constrained, reimbursement policies are restrictive, or insurance coverage is inadequate. Addressing the issue of high treatment costs requires collaborative efforts from stakeholders across the healthcare ecosystem, including pharmaceutical companies, policymakers, payers, healthcare providers, and patient advocacy groups.

Strategies to mitigate the financial burden of acetylcysteine treatment may include negotiating lower drug prices, expanding insurance coverage, implementing cost-sharing programs, and promoting the use of generic alternatives where available. Therefore, while acetylcysteine represents a valuable therapeutic option for respiratory conditions, its high cost of treatment poses a significant barrier to access and affordability for patients. Efforts to address these cost-related challenges are essential to ensure equitable access to acetylcysteine therapy and improve health outcomes for individuals with respiratory ailments.

Expanding application of acetylcysteine

Future opportunity in the acetylcysteine market lies in expanding its application beyond respiratory conditions to other therapeutic areas. While acetylcysteine is primarily known for its mucolytic and antioxidant properties in treating respiratory disorders like chronic obstructive pulmonary disease (COPD) and cystic fibrosis, emerging research suggests its potential efficacy in diverse medical fields. Acetylcysteine's antioxidant properties make it a promising candidate for addressing oxidative stress-related conditions such as liver diseases, acetaminophen overdose, and neurodegenerative disorders like Alzheimer's disease and Parkinson's disease.

Studies have shown that acetylcysteine can mitigate oxidative damage and inflammation, offering potential therapeutic benefits in these conditions. Furthermore, acetylcysteine's mucolytic action could extend its utility to diseases characterized by excessive mucus production or mucosal inflammation, such as certain gastrointestinal disorders and sinusitis. Expanding research and clinical trials exploring acetylcysteine's efficacy and safety profile across various therapeutic domains could uncover new indications and treatment modalities, unlocking untapped market opportunities.

Additionally, strategic partnerships between pharmaceutical companies, academic institutions, and research organizations can facilitate the development of innovative formulations, dosage forms, and delivery systems to optimize acetylcysteine's therapeutic potential and enhance patient outcomes across a broader spectrum of diseases. Thus, diversifying acetylcysteine's applications beyond respiratory disorders represents a promising avenue for future growth in the acetylcysteine market.

The tablets segment held the highest market share of 57% in 2023. Tablets are the primary form of N-Acetylcysteine (NAC) consumption in the global acetylcysteine market, and this trend is expected to persist over the forecast period. The increasing demand for NAC tablets is primarily driven by the rising cases of acetaminophen intoxication and the growing utilization of NAC in the healthcare sector. With the surge in acetaminophen usage and the corresponding rise in paracetamol overdose incidents, the demand for NAC tablets for the treatment of acetaminophen overdose is experiencing a significant rise. This trend underscores the critical role that NAC tablets play in addressing acetaminophen-related health concerns and is expected to drive market growth in the coming years.

The spray segment is anticipated to witness rapid growth at a significant CAGR of 21.25% during the projected period in the acetylcysteine market. Spray formulations of acetylcysteine offer convenient administration and are particularly favored for respiratory conditions such as chronic obstructive pulmonary disease (COPD) and cystic fibrosis. Patients find spray formulations easier to use, especially for inhalation therapy, making them a preferred choice in the management of respiratory ailments. Additionally, advancements in spray technology have led to improved drug delivery mechanisms, enhancing the efficacy of acetylcysteine sprays. As a result, the spray type segment is experiencing robust growth and is expected to continue expanding in the global market.

The pharmaceutical segment has held 31% market share in the acetylcysteine market for the year 2023. Acetylcysteine holds a crucial role in the pharmaceutical market, primarily for treating respiratory ailments like COPD, cystic fibrosis, and bronchitis. As a potent mucolytic agent, it effectively reduces the viscosity of mucus, facilitating its expulsion from the lungs. This mechanism aids in relieving congestion and improving respiratory function in patients suffering from chronic lung conditions. Due to its therapeutic benefits and proven efficacy, acetylcysteine remains a cornerstone treatment option in respiratory medicine. Its widespread usage underscores its significance in pharmaceutical formulations aimed at alleviating symptoms and improving the quality of life for individuals with respiratory disorders.

The dietary supplement segment is anticipated to witness significant growth of 22% over the projected period. Acetylcysteine serves as a dietary supplement renowned for its liver-supporting properties and detoxification capabilities. Its purported antioxidant attributes make it a valuable component in promoting liver health by safeguarding hepatic tissues against toxicity and harmful substances. By replenishing glutathione levels, acetylcysteine aids in neutralizing free radicals and reducing oxidative stress within the liver, thereby mitigating potential damage caused by toxins and environmental pollutants. As a result, acetylcysteine supplementation is often advocated as a supportive measure to enhance liver function and overall detoxification processes, offering individuals a natural means to bolster their liver health and fortify their body against oxidative damage.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client