January 2025

Adeno Associated Virus Vector Manufacturing Market (By Scale of Operations: Clinical, Preclinical, Commercial; By Method: In Vivo, In Vitro; By Application: Vaccine, Cell Therapy, Gene Therapy; By Therapeutic Area: Genetic Disorders, Infectious Diseases, Neurological Disorders, Hematological Diseases, Ophthalmic Disorders) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

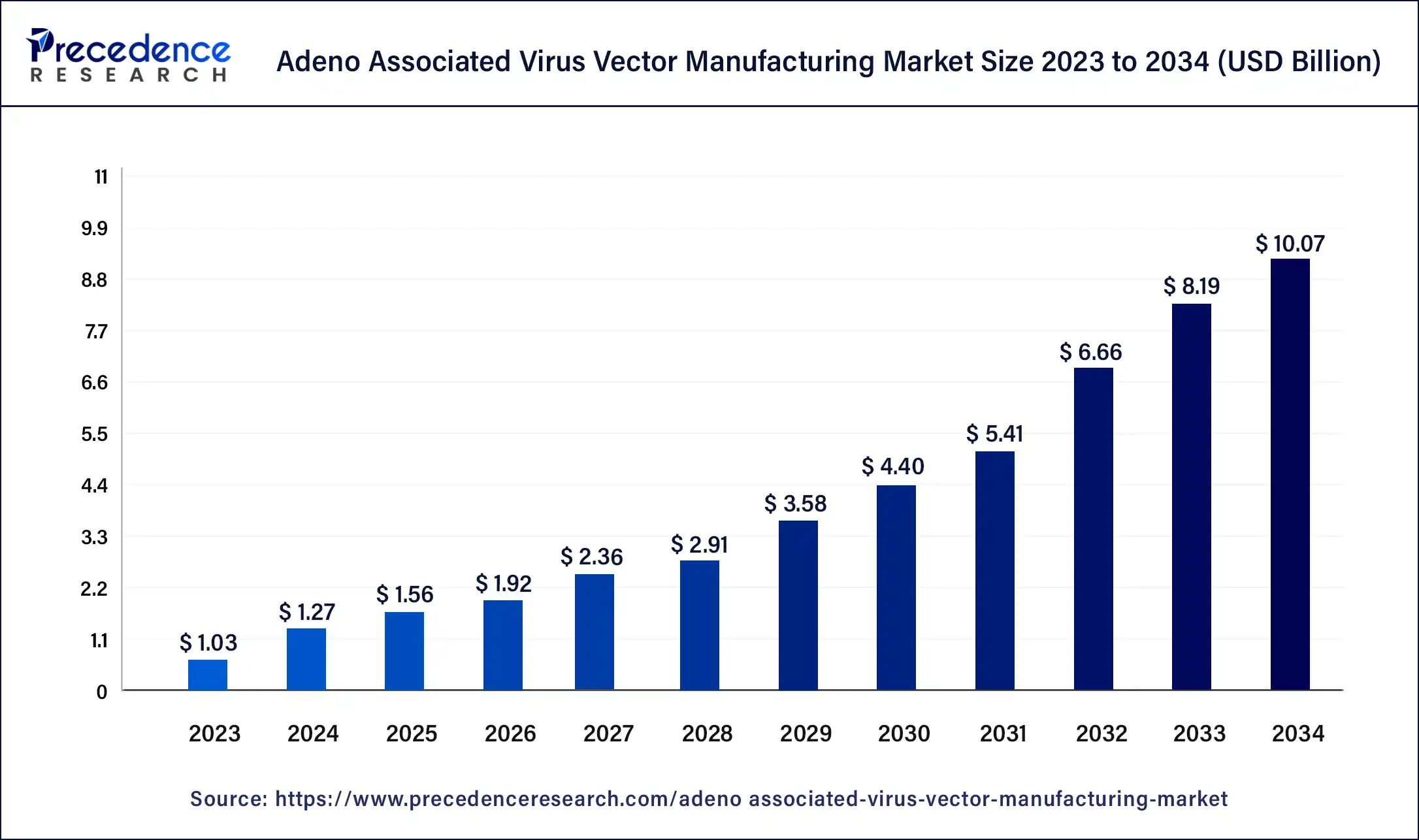

The global adeno associated virus vector manufacturing market size was USD 1.03 billion in 2023, calculated at USD 1.27 billion in 2024, and is expected to reach around USD 10.07 billion by 2034. The market is expanding at a solid CAGR of 23% over the forecast period 2024 to 2034.

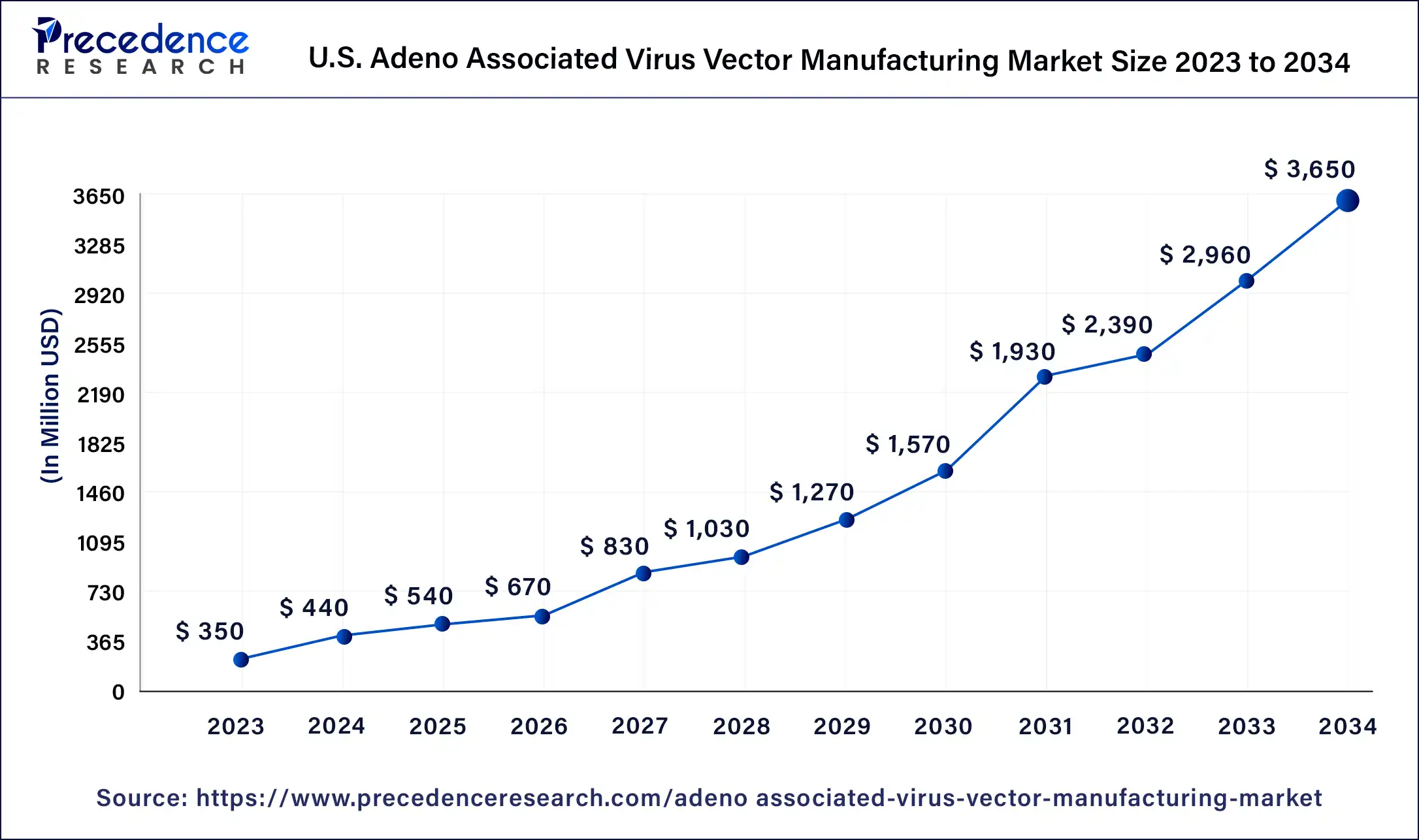

The U.S. adeno associated virus vector manufacturing market size was estimated at USD 8.31 million in 2023 and is predicted to be worth around USD 50.22 million by 2034, at a CAGR of 17.8% from 2024 to 2034.

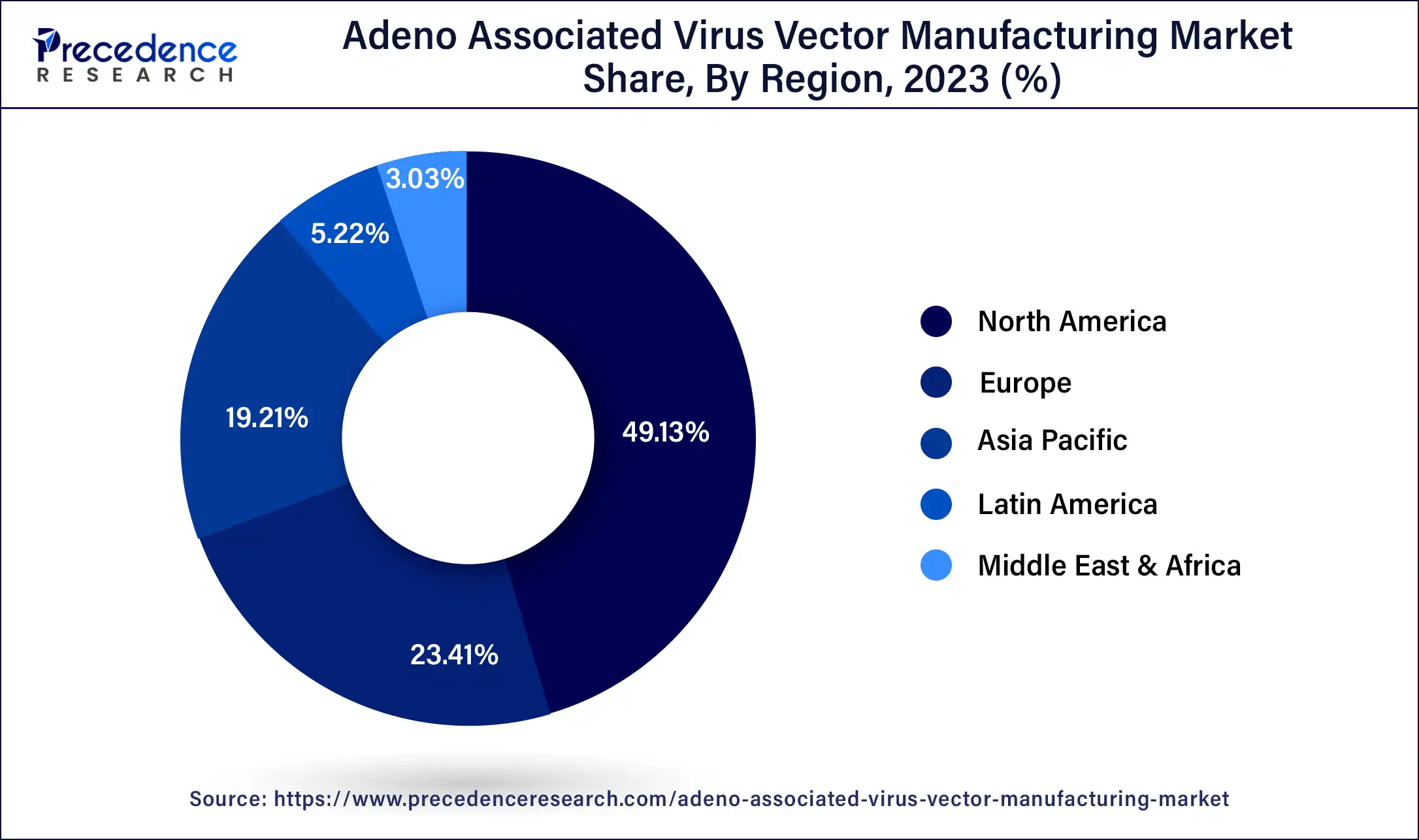

North America accounted for the largest share during the projection period. North America has a vibrant ecosystem of collaborations and partnerships among academic institutions, research organizations, and biopharmaceutical companies. These collaborations facilitate knowledge exchange, technology transfer, and resource access, accelerating adeno-associated virus (AAV) vector development and manufacturing. Such collaborations and partnerships have significantly advanced North America's AAV vector manufacturing market.

The U.S. Food and Drug Administration (FDA) has guidelines and regulations for developing, manufacturing, and approving gene therapies. These provide a clear pathway for companies to bring AAV vector-based gene therapies to market. This regulatory clarity has fostered innovation and investment, positively impacting the AAV vector manufacturing market.

Europe is expected to witness substantial growth in the Adeno-associated virus (AAV) vector manufacturing market Numerous renowned academic and research institutions drive the European market to the forefront of gene therapy research. These institutions conduct extensive research on Adeno-associated virus (AAV) vectors, including their design, optimization, and manufacturing methods. The findings of this research are often translated into commercial manufacturing processes, which further fuel the growth of the AAV vector manufacturing market in the region.

Asia-Pacific is expected to be the fastest-growing region in the Adeno-associated virus (AAV) vector manufacturing market It is owing to the increasing investments in advancements in biotechnology and favorable government initiatives to promote gene therapies. Many leading biopharmaceutical companies and research institutions in India have invested in advanced facilities for Adeno-associated virus (AAV) vector production, which has contributed to the growth of the AAV vector manufacturing market. For instance, Reliance Life Sciences Pvt. Ltd approved a pioneering technology by the Indian Institute of Technology in Kanpur to revolutionize the gene therapy sector, especially for various genetic eye disorders.

Latin America is expected to witness steady growth in the Adeno-associated virus (AAV) vector manufacturing market

This region is driven by increasing awareness about gene therapies, growing demand for advanced healthcare solutions, and improving healthcare infrastructure. Particularly Brazil has a well-established biopharmaceutical industry with state-of-the-art infrastructure for research, development, and manufacturing of gene therapies, including Adeno-associated virus (AAV) vectors.

The Middle East & Africa region is expected to witness moderate growth in the Adeno-associated virus (AAV) vector manufacturing market

This region is navigated by increased investments in healthcare infrastructure and growing demand for advanced treatment options. The expanding adoption of gene therapies for treating genetic diseases, favorable government initiatives, and rising collaborations between international pharmaceutical companies and local research institutions are driving the growth of the Adeno-associated virus (AAV) vector manufacturing market in the Middle East & Africa.

Market Overview

A non-enveloped virus, termed as Adeno-associated virus (AAV) devised to deliver DNA to target cells with utmost significance, especially in clinical-trials experiments using therapeutic strategies, even to generate recombinant AAV fragments in the absence of viral genes and which contains DNA interest considered as safe strategies for gene therapies for diverse therapeutic applications.

In February 2022, SIRION Biotech and the Centre for Genomic Regulation partnered to create a novel adeno-associated virus vector for type 1 and type 2 diabetic gene therapy to target the specific pancreatic cells. This approach has got more clarity, efficiency and is even safe to use.

The increasing investments in research and development activities related to Adeno-associated virus (AAV) vector manufacturing, including vector design, production optimization, and characterization, are contributing to the growth of the AAV vector manufacturing market. These investments aim to improve the safety, efficacy, and scalability of AAV vector production, which is expected to boost the demand for AAV vectors in gene therapy applications.

Regulatory agencies, such as the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) have been providing increasing support and guidance for developing and commercializing gene therapies that use AAV vectors. This favorable regulatory environment has facilitated the approval and commercialization of various AAV-based gene therapies, further influencing the growth of the AAV vector manufacturing market.

| Report Coverage | Details |

| Market Size in 2023 | USD 1.03 Billion |

| Market Size in 2024 | USD 1.27 Billion |

| Market Size by 2034 | USD 10.07 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 23% |

| Largest Market | North America |

| Fastest-Growing Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Scale of Operations, By Method, By Application, and By Therapeutic Area |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for gene therapies

Adeno-associated virus (AAV) vectors are widely used in gene therapy, a rapidly growing medical field. The increasing prevalence of genetic diseases, such as genetic disorders, rare diseases, and certain types of cancers, drives the demand for gene therapies that utilize AAV vectors for gene delivery. The development of CRISPR-Cas9 has made it easier to precisely edit genes, increasing the potential for successful gene therapies. This is a significant growth factor for the AAV vector manufacturing market.

Growing interest from biopharmaceutical companies

Biopharmaceutical companies have shown a growing interest in developing gene therapies that utilize Adeno-associated virus (AAV) vectors as a delivery platform. Many pharmaceutical companies have entered partnerships, collaborations, and licensing agreements with AAV vector manufacturers to secure a reliable supply of vectors for their gene therapy programs. Emerging technologies such as transient transfection, helper virus-free systems, and scalable production platforms are being developed to enhance AAV vector manufacturers which can provide cutting-edge manufacturing solutions. This increasing interest from biopharmaceutical companies is driving the growth of the AAV vector manufacturing market.

The commercial segment is expected to dominate the global market during the forecast period. There has been a significant expansion of clinical trials for gene therapies that utilize Adeno-associated virus (AAV) as vectors. As more gene therapies progress through preclinical and clinical development stages, the demand for AAV manufacturing services has increased. The commercial segment has been at the forefront of providing contract manufacturing services to support the growing number of gene therapy clinical trials, resulting in a higher revenue share.

The clinical segment is the fastest growing segment of the global market

The expansion of gene therapy pipelines by pharmaceutical and biotechnology companies and academic research institutions creates a higher demand for Adeno-associated virus (AAV) vectors for preclinical and clinical studies. The growing number of gene therapy programs in various stages of development is driving the need for reliable and scalable AAV vector manufacturing, thereby contributing to the growth of the AAV vector manufacturing market.

The in vivo segment dominates the adeno associated virus vector manufacturing market; the segment is predicted to continue to its growth during the forecast period.

Adeno-associated virus (AAV)-based gene therapies have demonstrated promising clinical results in treating various diseases, including genetic disorders, ocular diseases, and muscular dystrophy. The success of these therapies has driven increased demand for AAV vectors for in vivo applications. Advances in AAV vector manufacturing technologies, such as scalable production platforms, improved vector design, and optimized production processes, have enabled more efficient and cost-effective manufacturing of AAV vectors for in vivo gene therapy applications. This has contributed to the dominance of the in vivo segment in the AAV vector manufacturing market.

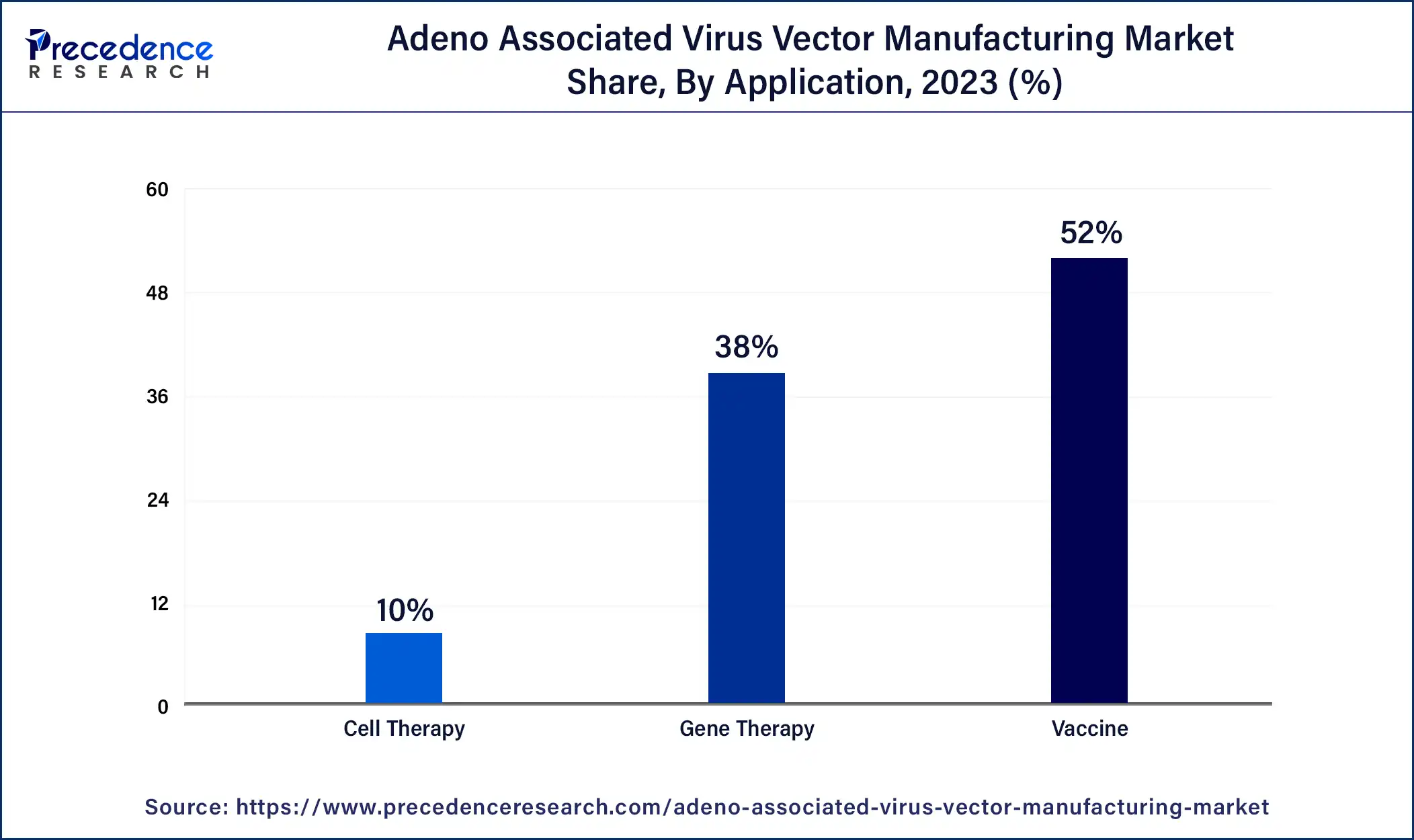

The vaccines segment has the largest share in the adeno associated virus vector manufacturing market

Vaccines are crucial in preventing and controlling infectious diseases, and their development has been a priority for healthcare systems worldwide. In vaccine development, Adeno-associated virus (AAV) vectors deliver antigen genes or other immunomodulatory genes to trigger an immune response against specific pathogens. The ongoing demand for new vaccines and the need to improve existing ones have contributed to the significant share of AAV vector manufacturing dedicated to vaccines.

Gene therapy is the fastest-growing segment during the projected period

The field of gene therapy, including adeno-associated virus (AAV) vector manufacturing, has attracted significant investments from both private and public sectors. The growing interest in gene therapy as a promising approach for treating various diseases, including infectious diseases, has increased investment in AAV vector-based vaccines. This investment has further fueled the growth of the vaccines segment in the AAV vector manufacturing market.

Neurological disorders held the highest share of revenue in the adeno associated virus vector manufacturing market throughout the estimated period

Adeno-associated virus (AAV) vectors are used to deliver therapeutic genes into target cells in the body, and they have been extensively studied for their potential in treating various neurological disorders. Due to the high prevalence and significant impact of neurological disorders on patients' quality of life, AAV vector manufacturing for gene therapy targeting these conditions may have a relatively higher market share than other therapeutic areas. However, it's important to note that the market share for AAV vector manufacturing can vary depending on multiple factors, including the stage of clinical development, regulatory approvals, and market demand for different gene therapies targeting various diseases.

The genetic disorders segment is expected to increase its growth during the projection period

In India, with a vast population of 8 billion, the majority are troubled with genetic disorders such as sickle cell anemia and thalassemia. For example, the highest prevalence of sickle cell disease is over 20 million of patients. The market for gene therapies targeting genetic disorders is expanding rapidly, driven by the high unmet medical need in this area and the potential of Adeno-associated virus (AAV)-based gene therapies to provide long-term therapeutic benefits. As the clinical development of AAV-based gene therapies progresses, the demand for AAV vectors for manufacturing is expected to grow further as companies seek to scale up their production to meet market demand.

Recent Developments

Segments Covered in the Report:

By Scale of Operations

By Method

By Application

By Therapeutic Area

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

December 2024