July 2024

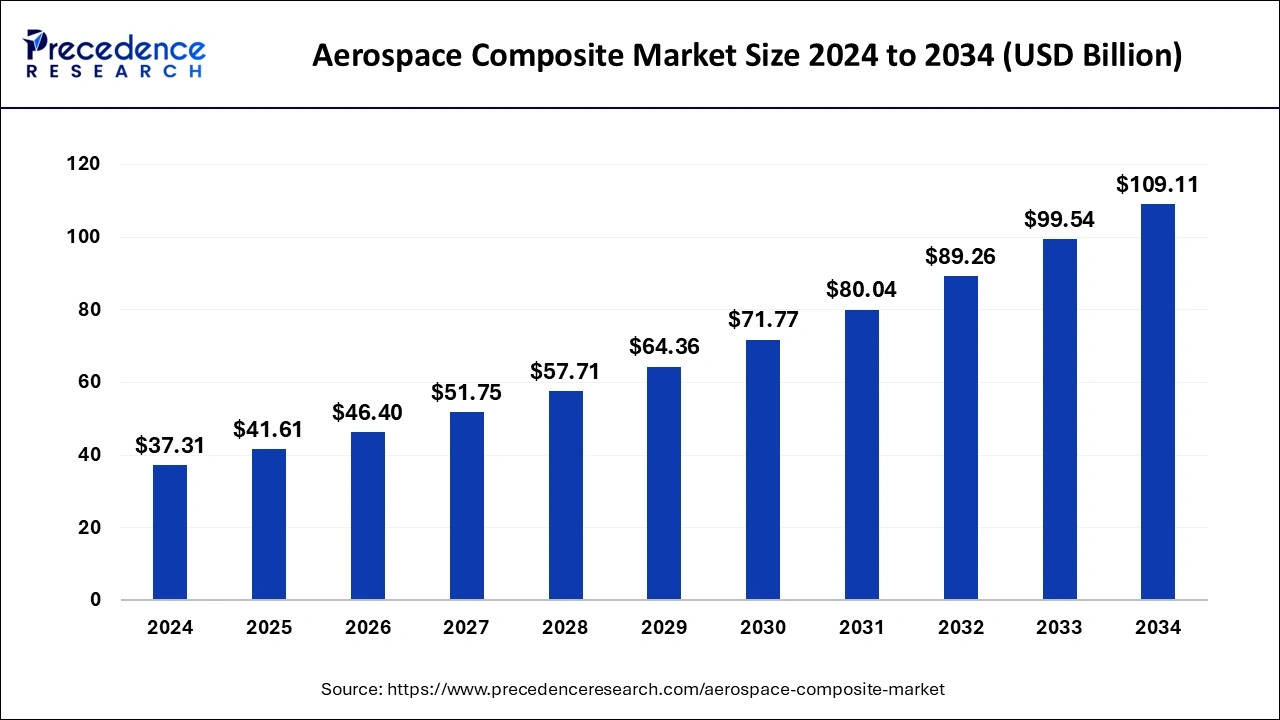

The global aerospace composite market size is calculated at USD 41.61 billion in 2025 and is forecasted to reach around USD 109.11 billion by 2034, accelerating at a CAGR of 11.33% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global aerospace composite market size accounted for USD 37.31 billion in 2024 and is predicted to increase from USD 41.61 billion in 2025 to approximately USD 109.11 billion by 2034, expanding at a CAGR of 11.33% from 2025 to 2034.

Aerospace science is rapidly turning to composite materials due to their high strength, low weight, low electrical conductivity, and durability, which makes them well-suited for aircraft construction. Composites are increasingly becoming popular in the aerospace industry due to their utilization in important structural elements, including fuselage sections, wings, and tail structures. Composites offer an exceptional strength-to-weight ratio, which ensures a reduction in overall weight and upholds structural robustness under harsh conditions.

Composite materials offer several benefits in aircraft applications when compared to traditional materials such as metals. Composite materials are versatile as their physical and mechanical properties can often be customized for application by adjusting the composition of the specific material. Composite uses provide more options for the design geometry of aircraft structures as they are ideal for compound curves and organic shapes, including wheel fairings, engine cowlings, and wing tips.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 11.33% |

| Market Size in 2025 | USD 41.61 Billion |

| Market Size in 2024 | USD 37.31 Billion |

| Market Size by 2034 | USD 109.11 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fiber Type, Manufacturing Process, and Aircraft |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising application of composites in aerospace

The increasing application of composites in aerospace is expected to boost the growth of the aerospace composite market during the forecast period. Composite materials are widely used in aerospace applications, including engine blades, brackets, nacelles, interiors, wide-body wings, single aisle wings, and others. Composites offer versatility, which makes them used for both structural applications and components in almost all aircraft and spacecraft. Components, including fan blades and casing materials, are increasingly constructed from composites owing to their excellent capacity to withstand extreme temperatures while maintaining structural integrity.

The successful application of composites in missiles has substantially increased the development of primary structures for space vehicles. Moreover, factors such as lightweight, high temperature and chemical resistance, high dimensional stability, stiffness, and improved performance made this material popular in various aerospace components and structural applications. Therefore, the use of composites in aerospace enhances engine efficiency and contributes significantly to the reduction of overall aircraft weight.

High cost of ceramic matrix composites

The high cost associated with composite materials in aerospace is anticipated to hamper the growth of the market. High cost is required for the production of composite materials in the aerospace sector due to the expensive raw materials, including advanced carbon or glass and epoxy resin, which may restrict the expansion of the global aerospace composite market during the forecast period.

Rapid advancements in technology

The rapid advancements in technology are projected to offer a lucrative opportunity for the growth of the aerospace composite market during the forecast period. The continuous technological advancements in components and structural applications in airplanes increase the use of composites instead of conventional materials such as aluminum. In recent years, the significant rise in passenger traffic and the stringent emission regulations led to a surging demand for new-generation aircraft. Manufacturers are developing new aircraft models in the military, commercial, and general aviation sectors, which require efficient engines with improved performance and low-weight material. Additionally, several Governments around the world are promoting the use of lightweight materials to enhance gasoline efficiency, boost plane performance, and reduce gas consumption. Thereby driving the market’s growth.

The carbon fiber segment accounted for the dominating share of the aerospace composite market in 2024. Carbon fiber plays a vital role in the aviation and aerospace sectors due to its special properties, such as high stiffness, high strength, low density, lightweight, high-temperature capability, and moderate pricing compared to glass and aramid fibers. Carbon fiber is one of the most recognized types of fiber reinforcement globally. Carbon fiber can be derived from three polymer precursors: polyacrylonitrile (PAN), pitch, and rayon.

The aramid fiber segment is expected to witness significant growth in the aerospace composite market during the forecast period, owing to the increasing use of lightweight and durable components for aircraft interiors. Aramid-based composites are widely used for components that are subjected to high stress, for instance, the construction of gliders.

The ATL or AFP segment held the largest segment of the aerospace composite market in 2024 and is expected to sustain the position throughout the forecast period. ATP and AFP are advanced manufacturing techniques reshaping the production of composite structures. ATL and AFP have become critical to the aviation and space industries. Automated tape placement (ATP) and automated fiber placement (AFP) are most commonly used in the aerospace industry to manufacture components, including aircraft skins and wing panels. Aerospace designs often involve complex geometries and shapes. The use of ATL and AFP systems allows for intricate patterns, enabling the creation of components with sophisticated designs that would be quite challenging to achieve manually.

In the aerospace composite market, the resin transfer molding segment is expected to grow significantly during the forecast period. The growth of the segment is majorly driven by the growing use of injection molding for producing complex aerospace components.

The commercial aircraft segment accounted for the dominating share of the aerospace composite market in 2024 and is projected to continue its dominance over the forecast period. Commercial aircraft extensively use feature composite materials for the construction of wing structures, which include carbon-fiber-reinforced composites, as they offer high strength and stiffness.

The growth of the segment is also driven by the adoption of composites for fuel efficiency and lower greenhouse gas emissions in aerospace. Aerospace composites are often used for multiple interior components of commercial aircraft, such as panels, partitions, and overhead. Therefore, the use of composites reduces weight and allows for creative design, which results in a comfortable and pleasing experience for passengers.

The business & general aviation segment is expected to witness considerable growth in the aerospace composite market over the forecast period owing to the increasing focus on fuel efficiency. The use of composites in business and general aviation makes them highly impact-resistant, with thermal stability and damage tolerance. The strength, resilience, and lightweight properties allow for the unique demands of aerospace applications. In addition, the imposition of environmental regulations increases the adoption of aerospace composites for emission reductions, pushing for lighter and more efficient designs.

North America held the dominant share of the aerospace composite market in 2024. The region is observed to witness prolific growth during the forecast period. The region's growth is attributed to the presence of prominent aviation market players, rapid advancement in technology, increasing applications for composites, the emergence of 3D printing, rising government investment in the aerospace industry, and growing demand for lightweight material or fuel efficiency in aerospace. Thereby dominating the market in North America.

The U.S. is a leading market in aerospace technology and highly relies on aerospace composites. The country has the largest aerospace industry in the world and is also one of the largest exporters of commercial aircraft. Aerospace composites are widely used in aircraft and spacecraft applications. Aerospace composites offer excessive strength-to-weight ratio and high-quality standards of aerospace composite materials, as well as flexibility in designing, manufacturing, and testing aerospace composite structures. Several market players have adopted marketing strategies such as new product launches, collaborations, and expansions to maintain their market share and gain a competitive edge.

Asia Pacific is observed to expand at a rapid pace during the forecast period. The increasing government investment in the aerospace sector, rising demand for fuel-efficient aircraft engines, and increasing demand for aerospace composites across various applications. Additionally, the adoption of advanced technology and sustainability goals aligns with the benefits offered by aerospace composites, which is expected to propel the demand for the aerospace composite market in the region.

Among all countries, China is one of the largest aerospace composites producers and consumers in the region and is likely to fuel the market’s revenue with its robust growth in domestic aircraft production.

By Fiber Type

By Manufacturing Process

By Aircraft

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

November 2024

February 2025

November 2023